Golden Cross Bitcoin: Historical Data And Future Price Expectations

Table of Contents

Understanding the Bitcoin Golden Cross

The Bitcoin Golden Cross is a powerful visual representation of a potential bullish trend reversal in technical analysis.

Definition: Deciphering the Crossover

A Golden Cross occurs when the shorter-term 50-day moving average crosses above the longer-term 200-day moving average. This crossover signifies a shift in momentum, suggesting that buying pressure is outweighing selling pressure.

Significance: Why it Matters for Bitcoin Investors

This crossover is considered bullish because it indicates a potential change in the long-term trend. After a prolonged period of bearish sentiment (where the 50-day MA is below the 200-day MA), a Golden Cross suggests that the price is likely to experience an upward trend. This doesn't guarantee a price surge, but historically, it's been associated with periods of increased bullish activity.

Limitations: The Golden Cross Isn't a Crystal Ball

It's crucial to understand the limitations of using the Golden Cross as a standalone predictor. The Golden Cross is a lagging indicator; it confirms a trend that has already started. It does not predict the magnitude or duration of the price increase. Other market forces can significantly influence price action, regardless of the Golden Cross signal.

- Visual representation of a Golden Cross chart: [Insert a chart here visually depicting a Golden Cross].

- Explanation of moving averages (50-day and 200-day): The 50-day moving average represents short-term price trends, while the 200-day moving average reflects long-term trends.

- Mention other technical indicators used in conjunction with the Golden Cross: RSI (Relative Strength Index), MACD (Moving Average Convergence Divergence), and volume analysis can provide additional context and confirmation.

Historical Analysis of Bitcoin Golden Crosses

Examining past Golden Cross events in Bitcoin's history is crucial for gauging the indicator's reliability.

Past Occurrences: A Look Back at Bitcoin's History

Several Golden Cross events have occurred in Bitcoin's history. Identifying these events, along with the market conditions leading up to them, provides valuable insights.

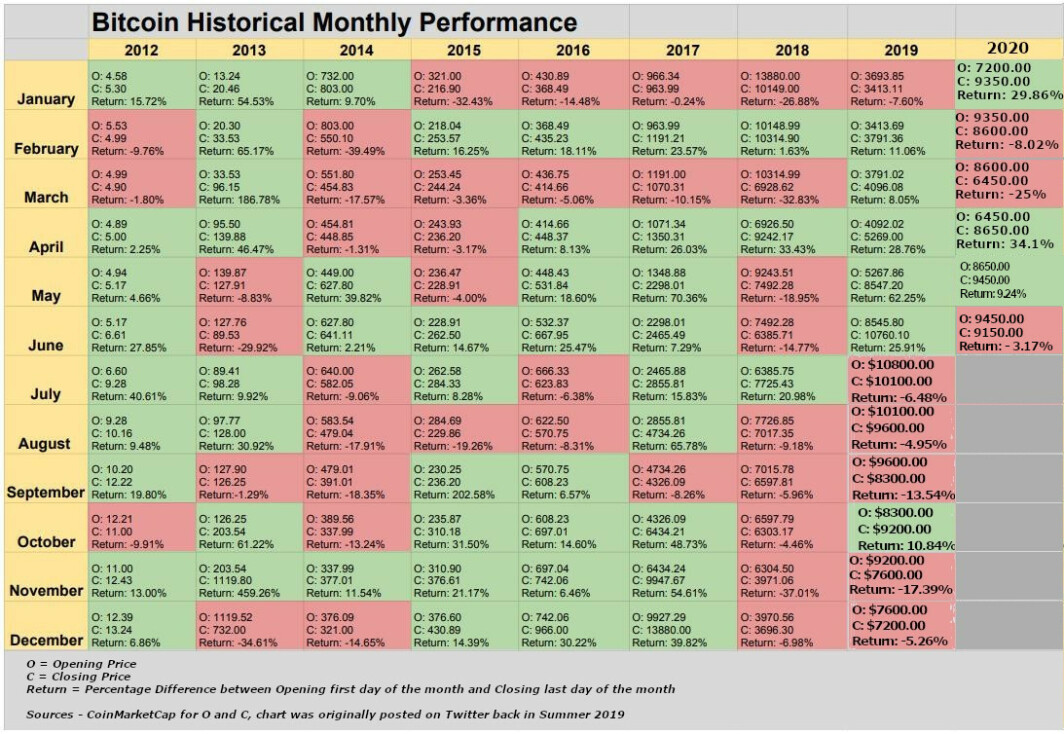

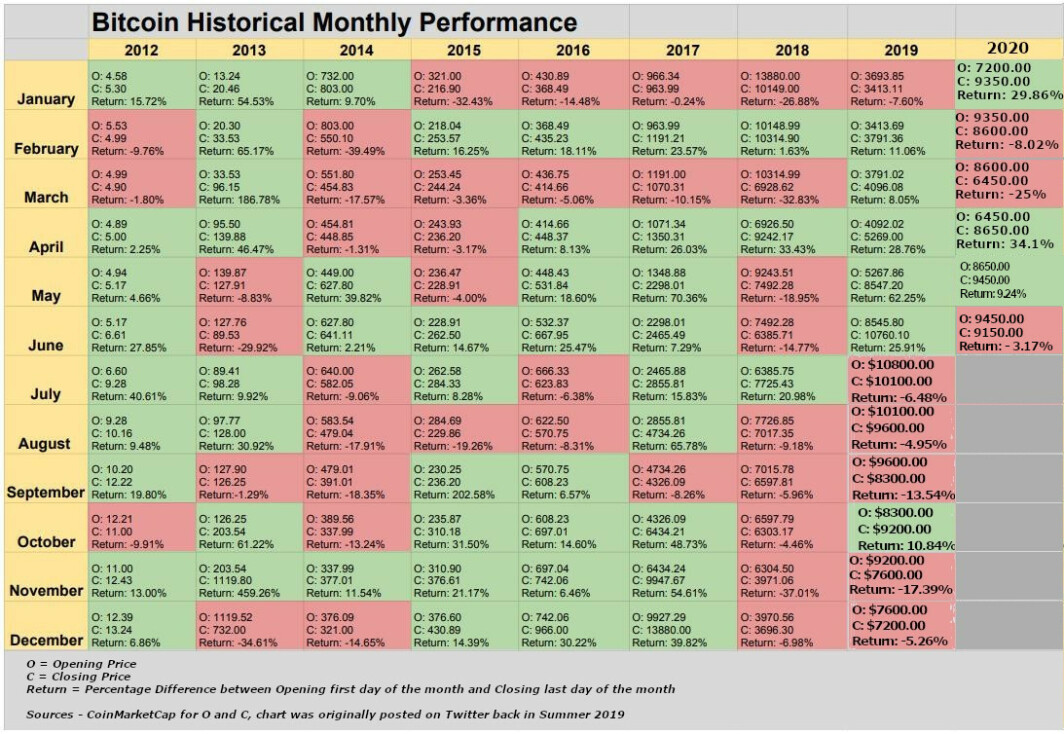

Price Performance Post-Crossover: Analyzing the Results

Following a Golden Cross, Bitcoin's price performance has varied. While not all Golden Crosses have resulted in significant price increases, many have been followed by periods of sustained bullish momentum. However, the duration and magnitude of these price movements have differed considerably.

Data Sources: Where to Find Reliable Bitcoin Data

Reliable sources for historical Bitcoin price data include CoinMarketCap, CoinGecko, and TradingView. These platforms provide comprehensive historical price charts and allow for detailed analysis.

- Specific dates of past Golden Cross events: [List specific dates and brief descriptions].

- Percentage price increase/decrease following each event: [Provide data on percentage changes].

- Duration of bullish trends after each Golden Cross: [Describe the length of upward price movements].

- Charts illustrating historical performance: [Include charts visually representing price movements after past Golden Cross events].

Factors Influencing Bitcoin Price After a Golden Cross

While the Golden Cross provides a technical signal, various other factors influence Bitcoin's price after its occurrence.

Market Sentiment: The Power of Investor Psychology

Investor sentiment plays a critical role. Positive news, widespread adoption, and overall market optimism can amplify the impact of a Golden Cross, leading to a more pronounced price surge. Conversely, negative news or fear can dampen the effect.

Regulatory Changes: Government Influence on BTC

Government regulations and policies significantly impact Bitcoin's price. Positive regulatory developments can boost investor confidence, while stricter regulations can lead to price drops.

Adoption Rate: Growing Use Drives Value

The increasing adoption of Bitcoin by businesses, institutions, and individuals fuels demand and price appreciation. Wider adoption typically correlates with higher prices.

Macroeconomic Factors: The Global Economy's Impact

Global macroeconomic factors, such as inflation, interest rates, and economic growth, can influence investor appetite for Bitcoin, impacting its price.

- Examples of positive and negative market sentiment: [Cite examples of news events impacting sentiment].

- Specific regulatory changes and their effects: [Discuss specific regulatory examples and their influence].

- Statistics on Bitcoin adoption growth: [Include data showing growth trends].

- Examples of macroeconomic events impacting Bitcoin: [Discuss macroeconomic events and their impact on BTC price].

Predicting Future Bitcoin Price Based on the Golden Cross

Predicting the future price of Bitcoin based solely on the Golden Cross is impossible.

Probabilistic Approach: Understanding the Uncertainties

Predictions are inherently probabilistic. While historical data provides insights, it does not guarantee future performance.

Scenario Analysis: Exploring Possibilities

Based on past performance and current market conditions, several scenarios are possible. A strong Golden Cross could lead to a substantial price increase, while a weaker one might only produce a modest rally or even fail to materialize into any significant change.

Disclaimer: This is Not Financial Advice

This analysis is for informational purposes only and should not be considered financial advice. Investing in Bitcoin involves significant risk, and you could lose money.

- Potential price targets based on historical data: [Provide potential price targets based on past performance – but emphasize uncertainty].

- Factors that could lead to a stronger or weaker rally: [Discuss factors that could impact the strength of a potential rally].

- Risk assessment associated with investing in Bitcoin: [Clearly highlight the risks involved in Bitcoin investment].

Conclusion

The Bitcoin Golden Cross, while a potentially bullish signal, is just one piece of the puzzle. Historical analysis shows that while a Golden Cross often precedes periods of upward price movement, the magnitude and duration of these movements are unpredictable. Numerous other factors, from market sentiment and regulatory changes to adoption rates and macroeconomic conditions, significantly impact Bitcoin's price. Understanding the interplay of these factors is crucial for informed decision-making.

Call to Action: While a Golden Cross Bitcoin signal can be helpful, thorough research and a diversified investment strategy are crucial. Learn more about utilizing the Golden Cross Bitcoin signal effectively by exploring [link to further resources or analysis]. Understand the risks involved before making any investment decisions related to the Golden Cross Bitcoin. Remember that Bitcoin price prediction remains complex, and relying on a single indicator like the Golden Cross is insufficient for robust investment strategies.

Featured Posts

-

Lotto And Lotto Plus Results Wednesday April 2 2025

May 08, 2025

Lotto And Lotto Plus Results Wednesday April 2 2025

May 08, 2025 -

Saglik Bakanligi Personel Alimi 37 000 Kisi Icin Basvuru Kilavuzu Ve Tarihler

May 08, 2025

Saglik Bakanligi Personel Alimi 37 000 Kisi Icin Basvuru Kilavuzu Ve Tarihler

May 08, 2025 -

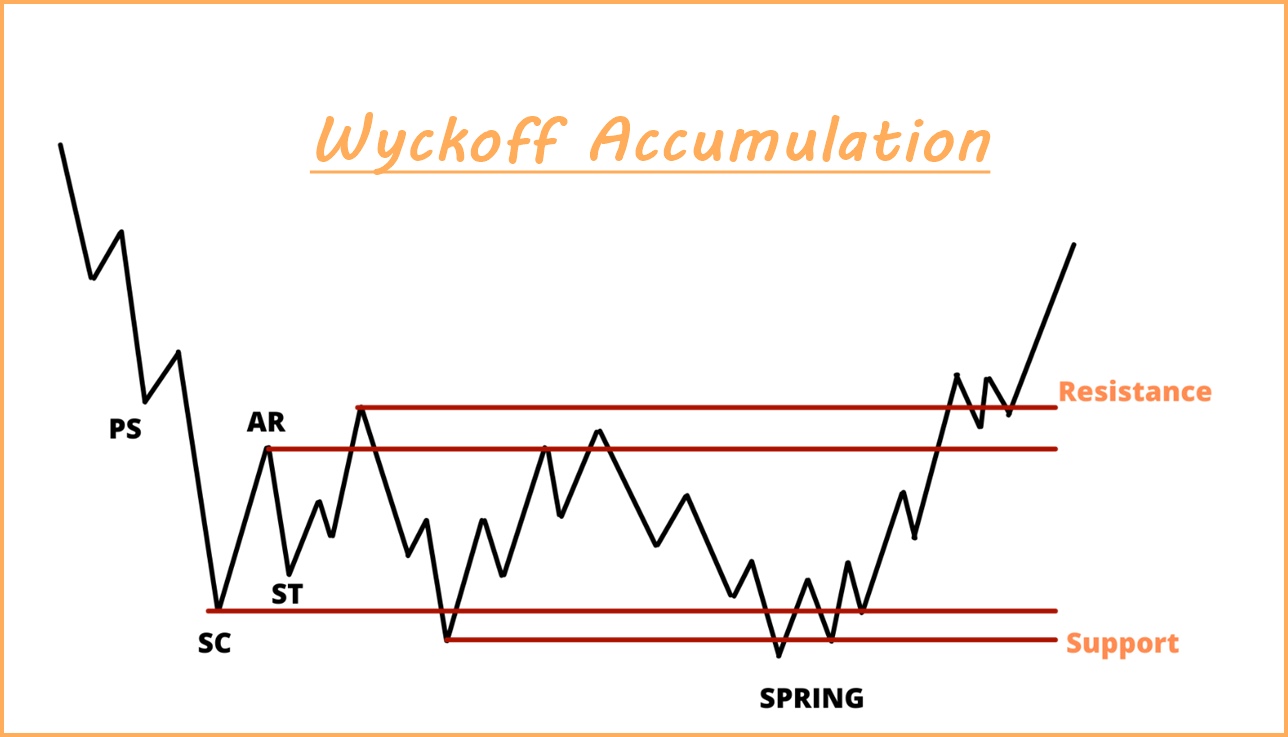

Ethereum Nears 2 700 Wyckoff Accumulation Analysis

May 08, 2025

Ethereum Nears 2 700 Wyckoff Accumulation Analysis

May 08, 2025 -

Analiza E Ndeshkimit Si Psg Fitoi Ne Pjesen E Dyte

May 08, 2025

Analiza E Ndeshkimit Si Psg Fitoi Ne Pjesen E Dyte

May 08, 2025 -

Py Ays Ayl Ke Pysh Nzr Lahwr Myn Askwlwn Ke Awqat Kar Myn Tbdyly

May 08, 2025

Py Ays Ayl Ke Pysh Nzr Lahwr Myn Askwlwn Ke Awqat Kar Myn Tbdyly

May 08, 2025