GOP Tax Plan: Does It Really Cut The Deficit? A Mathematical Look

Table of Contents

The GOP Tax Plan's Core Provisions and Projected Economic Impact

The 2017 Tax Cuts and Jobs Act significantly altered the US tax code. Key provisions included a reduction in the corporate tax rate from 35% to 21%, changes to individual income tax brackets, and adjustments to deductions and credits. Proponents argued these cuts would stimulate economic growth through several mechanisms:

- Increased Investment: Lower corporate taxes were predicted to encourage businesses to invest more, leading to job creation and higher productivity.

- Stimulated Economic Activity: Increased investment and consumer spending, fueled by tax cuts, would boost overall economic activity.

- Improved Labor Market Participation: Tax cuts, proponents argued, would incentivize individuals to work more, increasing the tax base.

Official projections, largely based on dynamic scoring models, predicted significant economic growth, leading to higher tax revenues that would offset the revenue loss from the tax cuts, ultimately reducing the deficit. These models incorporated assumptions about increased investment, productivity gains, and changes in labor supply.

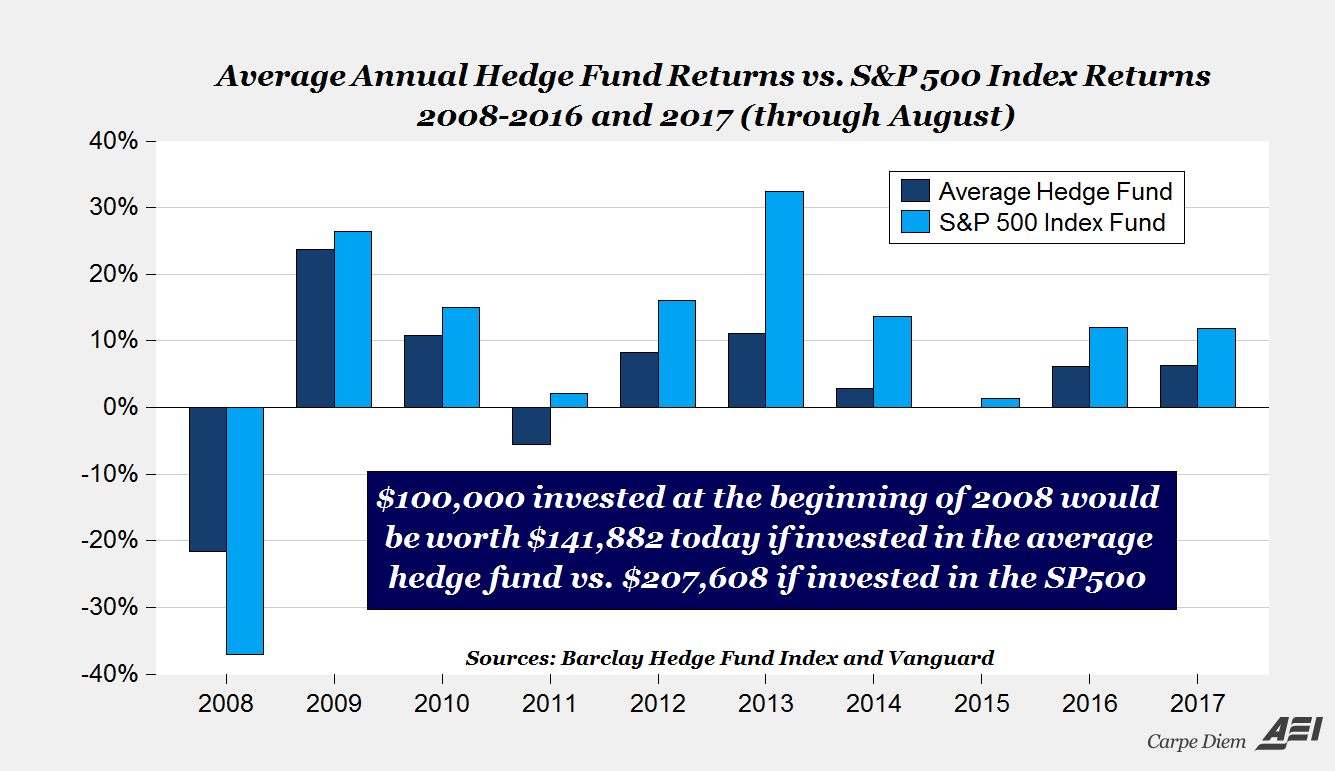

Analyzing the Actual Data: Deficit Trends Post-Tax Cut

The years following the implementation of the GOP tax plan revealed a different picture. Actual deficit figures showed a marked increase, contradicting the projected deficit reduction.

[Insert Graph/Chart Here: A clear visualization comparing projected deficit vs. actual deficit from 2017 onwards. Clearly label axes and data sources.]

Key findings from analyzing the post-tax-cut data include:

- Increased National Debt: The national debt grew significantly faster than projected under the GOP tax plan. This increase highlights a substantial discrepancy between the promised deficit reduction and the actual fiscal outcome.

- Changes in Tax Revenue Compared to Projections: Tax revenues increased, but not nearly enough to offset the revenue loss from the tax cuts, as projected by proponents of the plan. This suggests that the economic growth stimulated by the tax cuts was not as robust as anticipated.

- Impact on Specific Sectors of the Economy: The impact varied across different sectors. While some sectors experienced growth, others showed minimal or negative changes, indicating uneven distribution of the economic benefits.

Economic Modeling and its Limitations in Predicting the GOP Tax Plan's Impact

The projections of the GOP tax plan's impact heavily relied on economic modeling. Various models, incorporating different assumptions and methodologies, were employed to forecast the economic effects of the tax cuts. However, economic modeling inherently suffers from limitations:

- Unpredictable External Factors: Global economic shocks, unforeseen crises (like the COVID-19 pandemic), and changes in international trade significantly impact economic outcomes and were not fully accounted for in initial projections.

- Difficulties in Accurately Predicting Behavioral Changes: Precisely predicting consumer spending, business investment, and labor market responses to tax cuts is challenging. Behavioral responses often deviate from initial model assumptions.

- Political and Social Influences: Political decisions and social factors significantly influence economic outcomes and are difficult to quantify within economic models.

Long-Term Fiscal Implications of the GOP Tax Plan

The increased deficit resulting from the GOP tax plan has significant long-term fiscal implications. The sustained growth of the national debt raises concerns about:

- Potential for Future Tax Increases: To address the growing national debt, future administrations may need to implement significant tax increases to maintain fiscal solvency.

- Impact on Social Security and Other Government Programs: Increased debt burdens could necessitate cuts in social security, Medicare, and other crucial government programs.

- Credit Rating and International Standing: The rising national debt could negatively affect the US credit rating and its international standing, potentially increasing borrowing costs.

Conclusion

The GOP tax plan's impact on the deficit reveals a significant gap between projections and reality. While proponents predicted deficit reduction driven by robust economic growth, the actual data shows a considerable increase in the national debt. This discrepancy highlights the inherent limitations of economic modeling in accurately predicting complex economic phenomena, particularly the behavioral responses to large-scale tax cuts. Further research is needed to fully understand the long-term consequences of the GOP tax plan on the national deficit. Continue to follow credible economic analysis and engage in informed discussions about the GOP Tax Plan Deficit to ensure responsible fiscal policy. Understanding the complexities of the GOP Tax Plan Deficit is crucial for informed civic engagement and responsible governance.

Featured Posts

-

Testez Vos Connaissances Sur La Loire Atlantique Quiz Histoire Gastronomie And Culture

May 21, 2025

Testez Vos Connaissances Sur La Loire Atlantique Quiz Histoire Gastronomie And Culture

May 21, 2025 -

Addressing Lack Of Funds Practical Steps For Financial Improvement

May 21, 2025

Addressing Lack Of Funds Practical Steps For Financial Improvement

May 21, 2025 -

D Wave Quantum Inc Qbts Stock Plunge Understanding Mondays Crash

May 21, 2025

D Wave Quantum Inc Qbts Stock Plunge Understanding Mondays Crash

May 21, 2025 -

Oh Jun Sung Triumphs In Wtt Star Contender Chennai

May 21, 2025

Oh Jun Sung Triumphs In Wtt Star Contender Chennai

May 21, 2025 -

De Essentie Van Nederlands Bankieren Tikkie En Meer

May 21, 2025

De Essentie Van Nederlands Bankieren Tikkie En Meer

May 21, 2025

Latest Posts

-

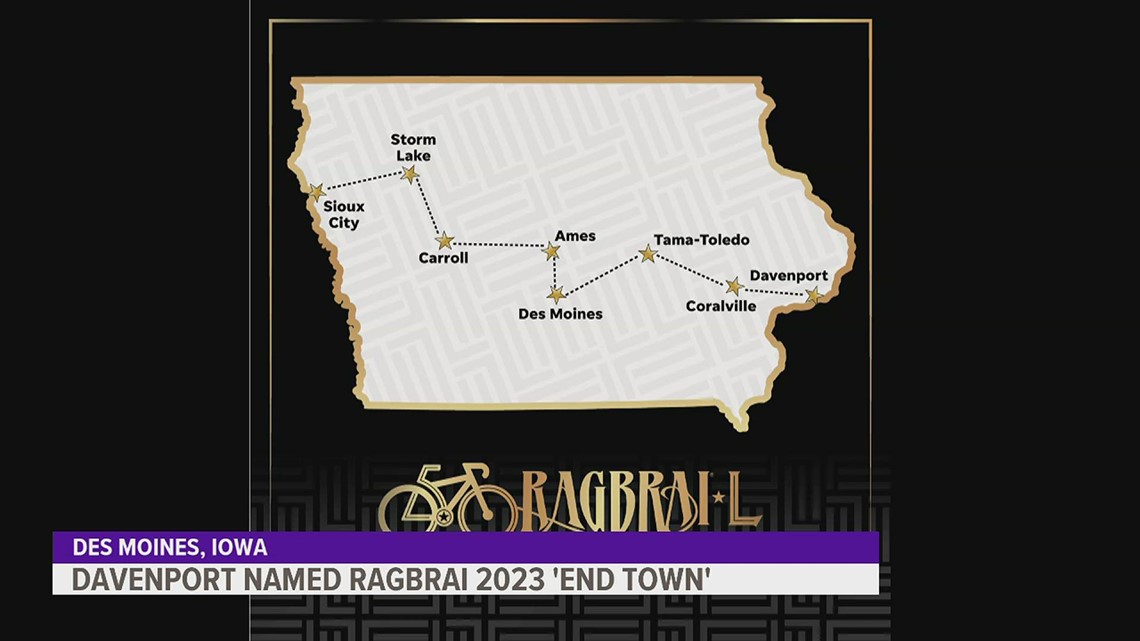

Scott Savilles Biking Journey From Ragbrai To Daily Commutes

May 21, 2025

Scott Savilles Biking Journey From Ragbrai To Daily Commutes

May 21, 2025 -

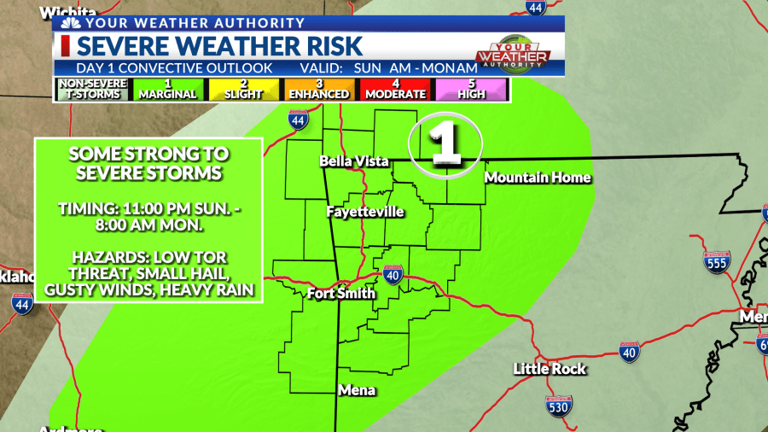

Increased Storm Risk Overnight Severe Weather Possible Monday

May 21, 2025

Increased Storm Risk Overnight Severe Weather Possible Monday

May 21, 2025 -

Planning Your Day For Breezy And Mild Temperatures

May 21, 2025

Planning Your Day For Breezy And Mild Temperatures

May 21, 2025 -

Boosting Resilience Strategies For Mental Wellbeing

May 21, 2025

Boosting Resilience Strategies For Mental Wellbeing

May 21, 2025 -

Kcrg Tv 9s Coverage Of The Minnesota Twins 10 Games To Air

May 21, 2025

Kcrg Tv 9s Coverage Of The Minnesota Twins 10 Games To Air

May 21, 2025