Grim Retail Sales: Bank Of Canada Rate Cuts On The Horizon?

Table of Contents

Analyzing the Recent Retail Sales Decline

The most recent retail sales data paints a concerning picture. A significant percentage decline in Canadian retail sales signals a substantial slump in consumer spending. This retail sales slump isn't isolated to a single sector; instead, it reflects a broader weakening in consumer demand across various categories. Key indicators suggest a concerning trend.

-

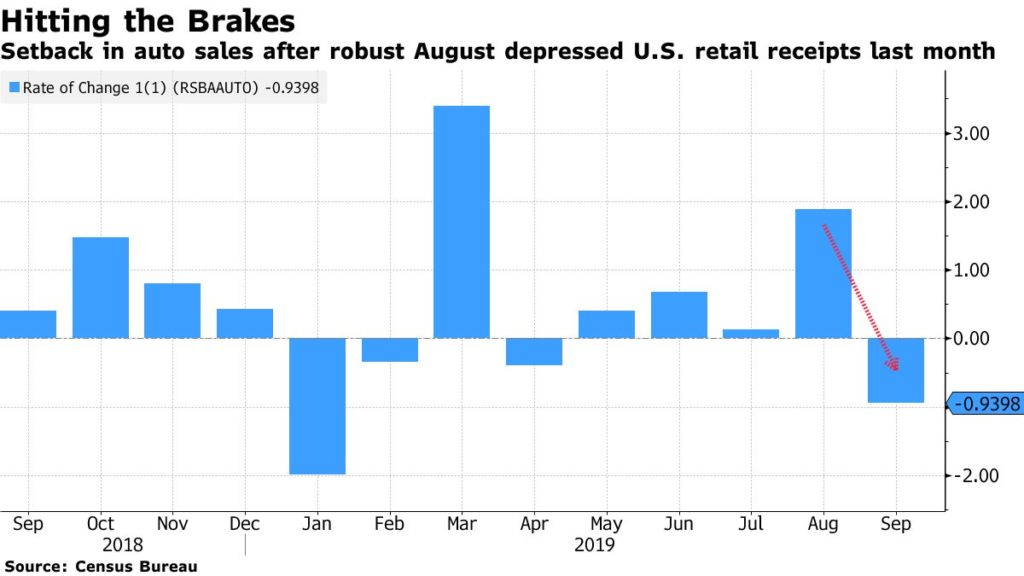

Breakdown by Sector: The decline isn't uniform. While the automotive sector has seen a particularly sharp drop, other areas like clothing, electronics, and furniture also experienced significant setbacks. This widespread weakness points towards a deeper underlying economic issue than simple seasonal adjustments.

-

Year-over-Year Comparison: Comparing the current figures to those from the previous year reveals a more dramatic picture of the consumer spending decline. Even after adjusting for seasonal variations, the drop remains substantial, indicating a worrying trend rather than a temporary blip.

-

Geographical Variations: The impact of the Canadian retail sales downturn isn't consistent across the country. While some provinces show a more pronounced decrease, others exhibit a milder decline, highlighting regional economic disparities that require tailored policy responses.

Factors Contributing to Weak Retail Sales

Several intertwined factors contribute to this weak retail sales performance. The current economic climate is characterized by a perfect storm of challenges that are directly impacting consumer behavior and spending.

-

High Inflation's Grip: Soaring inflation has significantly eroded consumer purchasing power. Rising prices for essential goods and services leave less disposable income for discretionary spending, contributing heavily to the retail sales slump.

-

Rising Interest Rates: The Bank of Canada's previous interest rate hikes, while intended to curb inflation, have inadvertently increased borrowing costs. This makes larger purchases like homes and vehicles less accessible, further dampening consumer demand and impacting Canadian retail sales.

-

Eroded Consumer Confidence: Economic uncertainty and persistent inflation have eroded consumer confidence. Hesitancy to spend is a direct consequence of this anxiety, leading to a further contraction in retail sales.

-

Cooling Housing Market: The cooling housing market is also having a ripple effect. Decreased home values and tighter lending conditions impact consumer wealth and confidence, reducing spending on both necessities and discretionary items.

The Bank of Canada's Response: Potential Rate Cuts

Given the grim retail sales data, the Bank of Canada is likely to re-evaluate its monetary policy. The current situation may necessitate a shift towards stimulating economic growth, potentially involving interest rate cuts.

-

Inflation Targeting Mandate: While the Bank of Canada's primary mandate is inflation control, the significant slowdown in retail sales and the potential for a broader economic downturn might necessitate prioritizing economic growth even at the risk of slightly higher inflation in the short term.

-

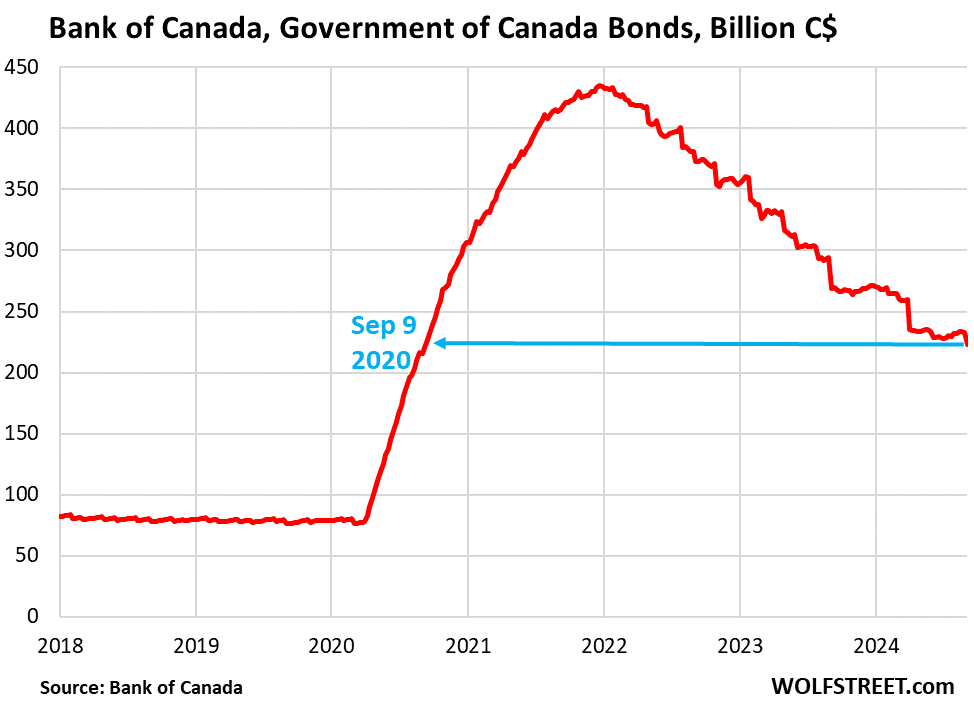

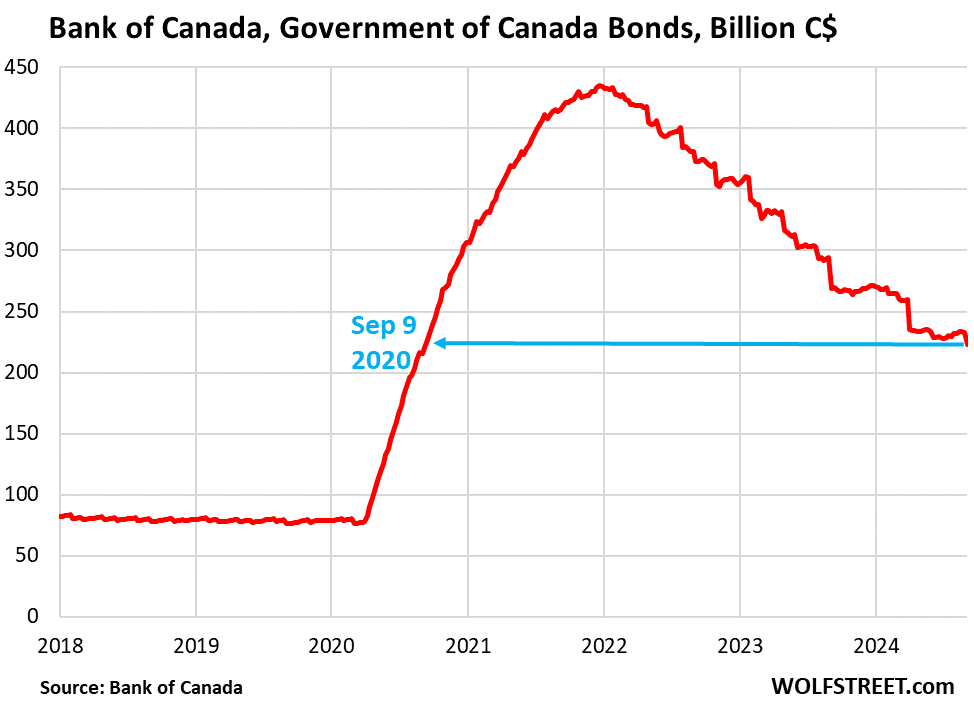

Precedents for Rate Cuts: The Bank of Canada has implemented rate cuts in the past during periods of economic weakness. Historical precedents suggest that a similar response is likely given the severity of the current retail sales slump.

-

Timeline for Rate Cuts: The precise timing of any potential rate cuts remains uncertain. However, the severity of the consumer spending decline and the overall economic climate suggest that a decision may be imminent, potentially within the next few months.

-

Implications of Rate Cuts: While rate cuts could stimulate economic activity and boost consumer spending, they also carry the risk of further fueling inflation if not managed carefully. The Bank of Canada will need to carefully balance these competing concerns.

Alternative Economic Scenarios and Their Impact

Several economic scenarios could unfold, each impacting retail sales and the Bank of Canada's decisions differently.

-

Scenario: Mild Recession: A mild recession would likely exacerbate the current retail sales slump, leading to a more aggressive approach to rate cuts by the Bank of Canada. Further measures, including quantitative easing, might also be considered.

-

Scenario: Gradual Economic Recovery: If the economy shows signs of a gradual recovery, the need for immediate and significant rate cuts might lessen. The Bank of Canada could opt for a more measured approach, monitoring key economic indicators closely.

-

Role of Fiscal Policy: Government fiscal policy will play a crucial role. Targeted government spending or tax cuts could help mitigate the economic downturn and support consumer spending, potentially reducing the need for drastic interest rate cuts.

Conclusion: Grim Retail Sales and the Outlook for Bank of Canada Rate Cuts

The grim retail sales figures paint a concerning picture of the Canadian economy. The significant decline in consumer spending, driven by inflation, rising interest rates, and decreased consumer confidence, strongly suggests that the Bank of Canada is likely to consider interest rate cuts to stimulate economic activity. While the timing and magnitude of any cuts remain uncertain, the current economic climate points towards a shift in monetary policy. Staying informed about future economic developments and the Bank of Canada's decisions is vital. To stay updated on the latest news regarding grim retail sales and their impact on interest rates, revisit our site regularly and subscribe to our newsletter for timely updates.

Featured Posts

-

Orioles Broadcasters Jinx Broken 160 Game Hit Streak Ends

Apr 28, 2025

Orioles Broadcasters Jinx Broken 160 Game Hit Streak Ends

Apr 28, 2025 -

Red Sox Breakout Candidate Is This The Year For Players Name

Apr 28, 2025

Red Sox Breakout Candidate Is This The Year For Players Name

Apr 28, 2025 -

A Heartwarming Goodbye Espn Honors Cassidy Hubbarth

Apr 28, 2025

A Heartwarming Goodbye Espn Honors Cassidy Hubbarth

Apr 28, 2025 -

Zyart Qayd Eam Shrtt Abwzby Wtfqdh Ladae Almnawbyn Fy Abwzby

Apr 28, 2025

Zyart Qayd Eam Shrtt Abwzby Wtfqdh Ladae Almnawbyn Fy Abwzby

Apr 28, 2025 -

Economists Predict Rate Cuts Following Weak Retail Sales Data

Apr 28, 2025

Economists Predict Rate Cuts Following Weak Retail Sales Data

Apr 28, 2025