Guaranteed Approval Tribal Loans: Direct Lenders For Bad Credit

Table of Contents

Understanding Guaranteed Approval Tribal Loans

Tribal loans are short-term loans offered by lenders who are affiliated with Native American tribes. These lenders often operate under different regulatory frameworks than traditional banks, which can sometimes lead to more flexible lending criteria. The term "guaranteed approval" is often used in marketing materials, but it's important to manage expectations. While tribal lenders may have higher approval rates for those with bad credit compared to traditional banks, no loan is truly "guaranteed." Approval depends on meeting certain eligibility requirements.

Tribal lenders differ from traditional lenders in several key ways:

- Often higher approval rates for bad credit: Tribal lenders often focus on income verification rather than solely relying on credit scores.

- May offer faster processing times: The application and approval process can be quicker than with traditional banks.

- May have different regulatory frameworks: This can mean different rules and regulations regarding interest rates and loan terms.

- Potentially higher interest rates compared to conventional loans: Because of the higher risk associated with lending to borrowers with bad credit, interest rates on tribal loans can be significantly higher.

Finding Reputable Direct Lenders for Tribal Loans

Choosing a reputable direct lender is paramount when considering a tribal loan. Predatory lending practices are unfortunately prevalent in the short-term loan industry. Therefore, thorough research is crucial before applying. Here’s how to identify legitimate direct lenders:

- Research lenders thoroughly before applying: Check their online presence, looking for contact information, physical addresses (if applicable), and detailed information about their loan products.

- Read online reviews and testimonials: Look for reviews on independent review sites to gauge other borrowers' experiences.

- Verify licensing and registration: Ensure the lender is properly licensed and registered to operate in your state. Contact your state's banking or financial regulatory agency if you have doubts.

- Beware of lenders promising guaranteed approval without proper due diligence: Legitimate lenders will perform a credit check and assess your ability to repay before approving a loan.

Eligibility Criteria for Tribal Loans with Bad Credit

While the eligibility requirements may vary between lenders, some general criteria typically apply:

- Minimum age requirement: Usually 18 years or older.

- Proof of income and regular employment: Lenders need to verify that you have a consistent income source to repay the loan.

- Active bank account: Funds will be deposited and withdrawn from your bank account.

- US residency: Most tribal lenders require borrowers to be US residents.

Tribal lenders often assess creditworthiness differently than traditional banks. They may place less emphasis on credit scores and more on your ability to repay the loan based on your income and employment history. This is where a steady job and verifiable income become vital.

Interest Rates and Loan Terms for Tribal Loans

Interest rates for tribal loans are influenced by several factors:

- Credit score: While not the sole determinant, a lower credit score will likely result in a higher interest rate.

- Loan amount: Larger loan amounts often come with higher interest rates.

- Repayment term: Shorter repayment terms generally lead to higher interest rates.

It’s crucial to compare the APR (Annual Percentage Rate) across different lenders. While tribal loan interest rates might seem high compared to traditional loans, they could be lower than payday loans or other high-cost short-term borrowing options. Always carefully review the loan terms, including the repayment schedule, any potential fees (origination fees, late payment fees), and the total amount you'll repay.

Responsible Borrowing and Managing Tribal Loans

Taking out a loan, regardless of the type, requires responsible borrowing practices. Avoid debt traps by:

- Budgeting tips for loan repayment: Create a detailed budget that includes your loan repayment as a priority expense.

- Exploring debt consolidation options: If you have multiple debts, consider consolidating them into a single loan with a lower interest rate.

- Contacting a credit counselor: If you're struggling to manage your finances, seek professional help from a credit counselor. They can offer advice and support.

- Understanding your rights as a borrower: Familiarize yourself with the laws and regulations protecting borrowers in your state.

Conclusion

Guaranteed approval tribal loans can be a viable option for individuals with bad credit seeking financial assistance. However, it's crucial to choose a reputable direct lender, understand the terms and conditions, and borrow responsibly. Thorough research and careful planning are essential to avoid potential pitfalls and ensure a positive borrowing experience. Remember to always compare offers from several lenders before making a decision.

Need a loan with bad credit? Explore the options available with guaranteed approval tribal loans from reputable direct lenders today! Begin your search responsibly and secure the financial help you need.

Featured Posts

-

Bu Yazin En Bueyuek Transferi Avrupa Da Ingiliz Devi Isi Bitiriyor

May 28, 2025

Bu Yazin En Bueyuek Transferi Avrupa Da Ingiliz Devi Isi Bitiriyor

May 28, 2025 -

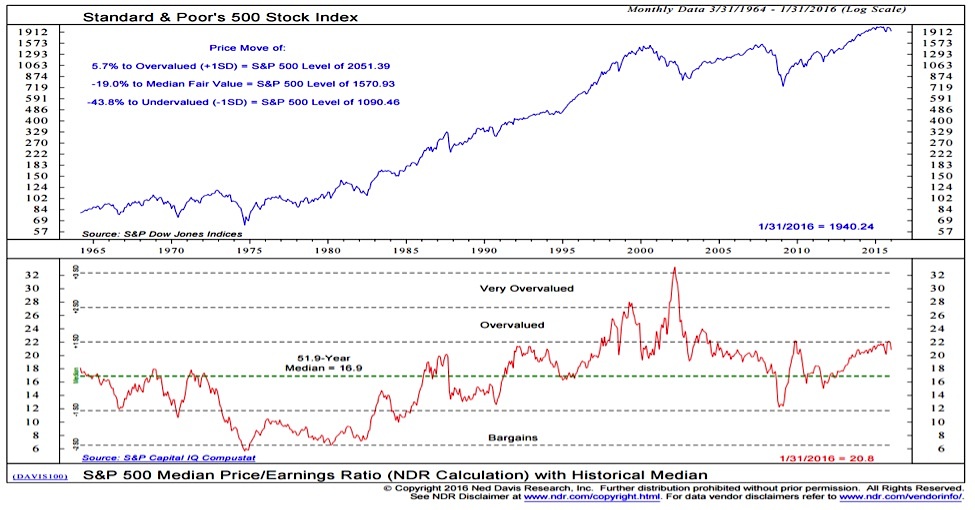

Addressing Investor Concerns Bof As View On Elevated Stock Market Valuations

May 28, 2025

Addressing Investor Concerns Bof As View On Elevated Stock Market Valuations

May 28, 2025 -

Nl West Standings Update Padres Dodgers Lead Burnes Injury Concerns

May 28, 2025

Nl West Standings Update Padres Dodgers Lead Burnes Injury Concerns

May 28, 2025 -

Office365 Security Breach Millions Stolen From Executive Accounts

May 28, 2025

Office365 Security Breach Millions Stolen From Executive Accounts

May 28, 2025 -

The Alejandro Garnacho Transfer Saga Chelseas Bid And Uniteds Decision

May 28, 2025

The Alejandro Garnacho Transfer Saga Chelseas Bid And Uniteds Decision

May 28, 2025

Latest Posts

-

Savvato 5 4 Olokliromenos Odigos Tileoptikon Programmaton

May 30, 2025

Savvato 5 4 Olokliromenos Odigos Tileoptikon Programmaton

May 30, 2025 -

Ti Na Deite Stin Tileorasi To Savvato 5 Aprilioy

May 30, 2025

Ti Na Deite Stin Tileorasi To Savvato 5 Aprilioy

May 30, 2025 -

Odigos Tiletheasis Gia To Savvato 5 4

May 30, 2025

Odigos Tiletheasis Gia To Savvato 5 4

May 30, 2025 -

Tileoptiko Programma Savvatoy 5 Aprilioy

May 30, 2025

Tileoptiko Programma Savvatoy 5 Aprilioy

May 30, 2025 -

To Tileoptiko Programma Tis Kyriakis 11 Maioy

May 30, 2025

To Tileoptiko Programma Tis Kyriakis 11 Maioy

May 30, 2025