High Down Payments: A Major Barrier To Homeownership In Canada

Table of Contents

The Rising Cost of Housing and its Impact on Down Payments

The escalating prices of homes across Canada, particularly in major urban centers like Toronto, Vancouver, and Montreal, are a primary driver of the high down payment problem. This dramatic price increase directly translates into significantly higher required down payments, making homeownership increasingly unattainable for many.

-

Statistics on average home prices in various Canadian cities: Statistics Canada reports show a considerable year-over-year increase in average home prices across major Canadian cities. For example, the average home price in Toronto has consistently surpassed $1 million in recent years, while Vancouver continues to see similarly high numbers. These figures drastically inflate the required down payment.

-

Comparison of down payment percentages required for different property types: The down payment percentage required also varies depending on the purchase price and whether the mortgage is insured or uninsured. For homes priced under $500,000, the minimum down payment is 5%, while homes priced between $500,000 and $1 million require a 5% down payment on the first $500,000 and 10% on the portion above. For homes exceeding $1 million, the down payment requirement increases further.

-

Analysis of the impact of interest rates on affordability: Rising interest rates exacerbate the affordability crisis. Higher interest rates increase monthly mortgage payments, making it even more challenging for buyers to afford a home, even with a substantial down payment. This further highlights the difficulties associated with securing homeownership in Canada's current market.

The Minimum Down Payment Requirements and Their Implications

Canadian lenders require minimum down payments based on the purchase price of the property. These requirements significantly impact affordability, particularly for first-time homebuyers. Understanding the differences between insured and uninsured mortgages is crucial.

-

Explanation of CMHC insurance and its impact on down payment requirements: The Canada Mortgage and Housing Corporation (CMHC) insures mortgages with down payments below 20%, allowing lenders to offer mortgages to buyers with smaller down payments. However, CMHC insurance premiums add to the overall cost of the mortgage.

-

Illustrative examples showing the difference in down payment amounts for different home prices: A $500,000 home requires a minimum down payment of $25,000 (5%), whereas a $1,000,000 home needs a down payment of $100,000 (10% of the portion above $500,000, plus 5% of the first $500,000). This stark difference underscores the financial barrier for many.

-

Discussion of the challenges faced by first-time homebuyers with limited savings: First-time homebuyers often face the most significant challenges, as they typically have limited savings and may lack access to the financial resources needed to meet the high down payment requirements.

Saving for a High Down Payment: The Challenges and Strategies

Saving for a substantial down payment requires discipline, planning, and often significant lifestyle adjustments. Many aspiring homeowners find this a major hurdle.

-

Tips on creating a realistic savings plan: Creating a realistic budget, tracking expenses, and identifying areas where spending can be reduced are critical first steps. Setting achievable savings goals and regularly monitoring progress is essential.

-

Advice on exploring high-interest savings accounts or other investment vehicles: Exploring high-yield savings accounts, Tax-Free Savings Accounts (TFSAs), or Registered Retirement Savings Plans (RRSPs) can accelerate savings growth. However, it's crucial to understand the associated risks and rewards of each investment option.

-

Discussion of the importance of financial literacy and responsible budgeting: Improving financial literacy through workshops, online resources, or financial advisors can equip individuals with the tools and knowledge needed to manage their finances effectively and save for a down payment.

Alternative Financing Options and Government Initiatives

While saving a large down payment remains the ideal scenario, several alternative financing options and government initiatives can help potential homebuyers overcome the hurdle of high down payments.

-

Information on government grants and subsidies for first-time homebuyers: Various federal and provincial programs offer grants and subsidies to assist first-time homebuyers. Researching and understanding eligibility criteria for these programs is crucial.

-

Details on programs offering assistance with down payments: Some programs provide assistance with a portion of the down payment, effectively reducing the financial burden on homebuyers.

-

Discussion of alternative financing options such as shared equity mortgages: Shared equity mortgages allow buyers to purchase a home with a smaller down payment, sharing ownership with a lender or other investor.

Conclusion

The high cost of housing in Canada and the significant down payments required pose a substantial barrier to homeownership for many. While saving for a large down payment presents a considerable challenge, there are strategies and resources available to help prospective buyers navigate this hurdle. Understanding the minimum down payment requirements, employing effective savings strategies, and exploring alternative financing options are crucial steps. By staying informed and proactively planning, Canadians can increase their chances of achieving their dream of homeownership despite the challenges of high down payments. Start planning your strategy today and overcome the hurdle of high down payments to achieve your Canadian homeownership dream.

Featured Posts

-

Living Legends Of Aviation Honors Firefighters And Other Heroes

May 09, 2025

Living Legends Of Aviation Honors Firefighters And Other Heroes

May 09, 2025 -

Palantir Technologies Stock Investment Analysis And Future Outlook

May 09, 2025

Palantir Technologies Stock Investment Analysis And Future Outlook

May 09, 2025 -

Wynne Evans Illness A Health Update And Potential Showbiz Comeback

May 09, 2025

Wynne Evans Illness A Health Update And Potential Showbiz Comeback

May 09, 2025 -

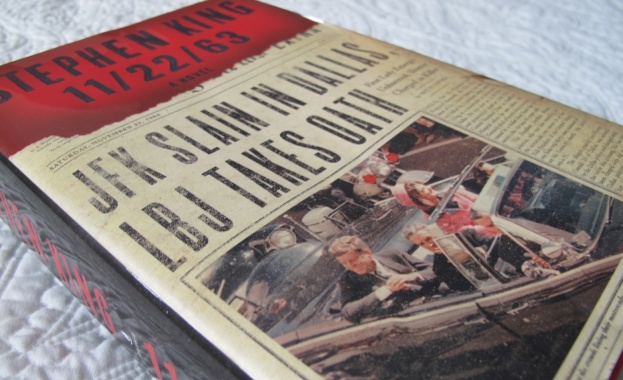

Netflix Rimeyk Na Kultov Roman Na Stivn King

May 09, 2025

Netflix Rimeyk Na Kultov Roman Na Stivn King

May 09, 2025 -

Stiven King Mask I Tramp Poplichniki Putina Analiz Zayavi

May 09, 2025

Stiven King Mask I Tramp Poplichniki Putina Analiz Zayavi

May 09, 2025