High Stock Market Valuations: A BofA Analyst's Rationale For Calm

Table of Contents

BofA's Rationale: Why High Valuations Aren't Necessarily a Cause for Alarm

BofA's analysts argue that several factors mitigate the risks typically associated with high stock market valuations. Their analysis suggests a more complex picture than simply looking at price-to-earnings ratios in isolation. Let's examine their key arguments.

Strong Corporate Earnings and Profitability

BofA's analysis points to robust corporate earnings and profitability as a key supporting factor. Despite economic headwinds, many sectors are demonstrating impressive resilience.

- Examples of strong performance: The technology sector, particularly companies involved in cloud computing and artificial intelligence, continue to show significant earnings growth. Similarly, certain segments of the healthcare and consumer staples industries are demonstrating consistent profitability.

- Data points supporting robust profitability: Earnings Per Share (EPS) growth for many S&P 500 companies has exceeded expectations in recent quarters, indicating strong underlying fundamentals. Profit margins, while potentially facing pressure from inflation, remain relatively healthy in many sectors.

- Resilience despite economic headwinds: The strength of corporate earnings demonstrates a capacity to withstand various economic challenges, suggesting a degree of underlying strength within the economy. This resilience counters the narrative that high valuations are solely based on speculation.

- Keyword integration: The sustained strength in corporate earnings and profitability provides a counterpoint to concerns about high stock market valuations.

Low Interest Rates and Continued Monetary Support

Low interest rates play a significant role in supporting stock valuations and investor behavior. The historically low interest rate environment, although potentially changing, has encouraged investment in equities as a relatively more attractive alternative to fixed-income securities.

- Role of central bank policies: Central banks' actions, while shifting toward a less accommodative stance, have historically kept interest rates low, influencing the cost of capital and thus affecting corporate investment decisions and investor sentiment.

- Effect of low borrowing costs on corporate investment: Low borrowing costs enable companies to invest more readily in expansion and research & development, potentially further boosting earnings and long-term growth, offsetting concerns stemming from high stock market valuations.

- Potential future monetary policy changes and their implications: While interest rates are rising, the trajectory and pace of these increases remain uncertain, impacting the future valuation of stocks. A more gradual increase could still support elevated stock prices.

- Keyword integration: The prevailing environment of low interest rates, though evolving, remains a significant factor impacting investor behavior and supporting high stock market valuations.

Technological Innovation and Long-Term Growth Potential

BofA highlights the transformative impact of technological advancements on long-term economic growth. This dynamic is viewed as a crucial factor justifying, at least in part, the current high stock market valuations.

- Key technological sectors driving growth: Artificial intelligence, cloud computing, biotechnology, and renewable energy are cited as key sectors poised for significant future growth.

- Potential for disruptive innovation: The potential for disruptive technologies to reshape industries and create entirely new markets contributes to the long-term growth outlook.

- Long-term implications for stock market valuations: This perspective suggests that current valuations might be justified by the anticipated long-term growth trajectory driven by technological innovation, offering a rationale for the current high stock market valuations.

- Keyword integration: Technological innovation is seen as a key driver of future growth, potentially justifying the current high stock market valuations.

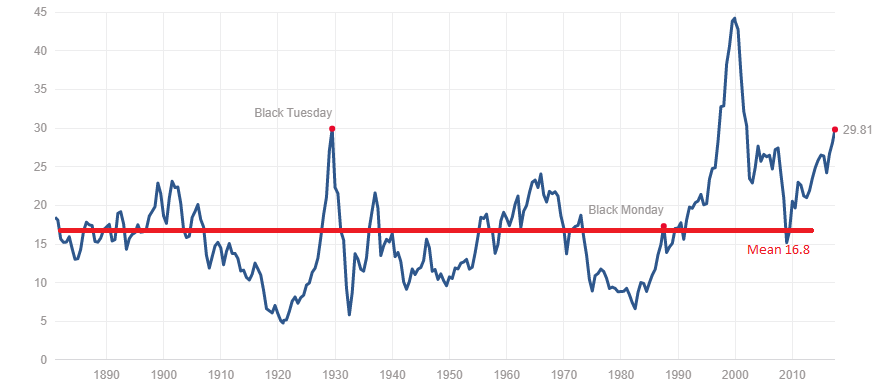

Addressing Valuation Metrics: A Balanced Perspective

While acknowledging the high P/E ratios and other valuation metrics that might suggest overvaluation, BofA emphasizes the need for a balanced perspective. Simply relying on single valuation metrics can be misleading.

- Considering factors beyond traditional valuation metrics: Factors like growth potential, technological disruption, and the impact of monetary policy need to be incorporated into a comprehensive valuation analysis.

- Alternative valuation approaches used by BofA: BofA likely utilizes more sophisticated valuation models that incorporate forward-looking estimates of earnings and cash flows, adjusting for the unique characteristics of individual companies and sectors.

- Limitations of relying solely on single valuation metrics: A single metric like the P/E ratio can be deceptive without considering other vital factors such as revenue growth, debt levels, and market share.

- Keyword integration: Understanding stock valuation requires a holistic approach, looking beyond simple P/E ratios and incorporating other significant metrics for a balanced perspective on high stock market valuations.

Navigating High Stock Market Valuations: A Path Forward

BofA's analysis suggests that while high stock market valuations are a valid consideration, they shouldn't automatically trigger alarm. Strong corporate earnings, low interest rates (though changing), and technological innovation contribute to a more nuanced picture. The key takeaway is the importance of considering the broader economic context and long-term growth prospects. Adopting a balanced approach to investing, considering multiple perspectives and factors beyond simple valuation metrics, is crucial.

Understanding the nuances of high stock market valuations is crucial for informed investment decisions. Stay informed and consult with financial professionals to navigate these market dynamics effectively.

Featured Posts

-

Pne Group Adds Two Wind Farms Boosting Renewable Energy Capacity

Apr 27, 2025

Pne Group Adds Two Wind Farms Boosting Renewable Energy Capacity

Apr 27, 2025 -

Ariana Grandes Transformation A Look At Hair Tattoos And The Value Of Professional Expertise

Apr 27, 2025

Ariana Grandes Transformation A Look At Hair Tattoos And The Value Of Professional Expertise

Apr 27, 2025 -

2025 Nfl Season Justin Herbert And The Chargers Play In Brazil

Apr 27, 2025

2025 Nfl Season Justin Herbert And The Chargers Play In Brazil

Apr 27, 2025 -

Ariana Grande Lovenote Fragrance Set Online Shopping Guide And Price Check

Apr 27, 2025

Ariana Grande Lovenote Fragrance Set Online Shopping Guide And Price Check

Apr 27, 2025 -

Ackmans Trade War Prediction Time Favors Us Hurts China

Apr 27, 2025

Ackmans Trade War Prediction Time Favors Us Hurts China

Apr 27, 2025

Latest Posts

-

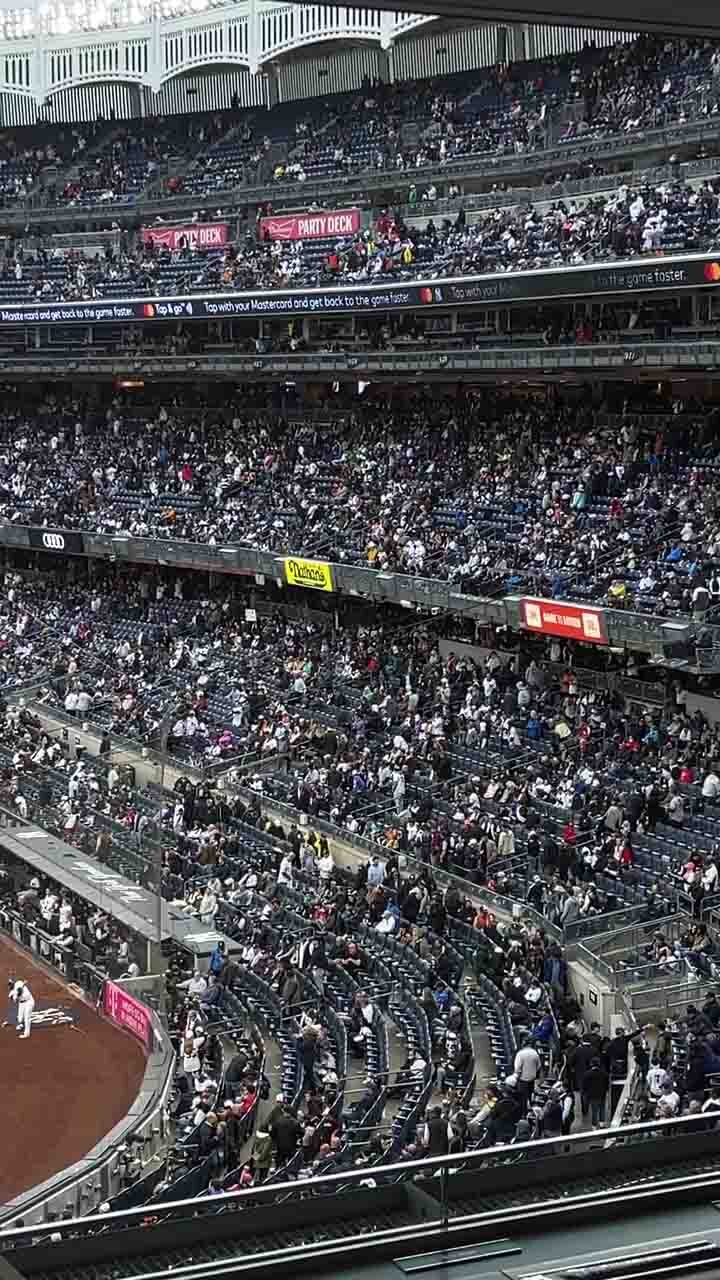

Blue Jays Vs Yankees Live Stream March 7 2025 Watch Mlb Spring Training Free

Apr 28, 2025

Blue Jays Vs Yankees Live Stream March 7 2025 Watch Mlb Spring Training Free

Apr 28, 2025 -

Winning Performance Judge And Goldschmidt Lead Yankees To Victory

Apr 28, 2025

Winning Performance Judge And Goldschmidt Lead Yankees To Victory

Apr 28, 2025 -

Yankees Series Win Hinges On Judge And Goldschmidts Performances

Apr 28, 2025

Yankees Series Win Hinges On Judge And Goldschmidts Performances

Apr 28, 2025 -

Aaron Judge And Paul Goldschmidt The Yankees Winning Formula

Apr 28, 2025

Aaron Judge And Paul Goldschmidt The Yankees Winning Formula

Apr 28, 2025 -

Late Game Heroics From Judge And Goldschmidt Salvage Yankees Series

Apr 28, 2025

Late Game Heroics From Judge And Goldschmidt Salvage Yankees Series

Apr 28, 2025