High Stock Market Valuations: Why BofA Believes Investors Shouldn't Panic

Table of Contents

BofA's Rationale: Understanding the Underlying Factors

BofA's argument against immediate panic selling rests on several key pillars. They contend that current high stock market valuations are not solely indicative of an impending market downturn, but rather a reflection of several complex economic factors.

Strong Corporate Earnings and Profitability

Robust corporate earnings are a significant factor underpinning BofA's optimistic outlook. Many companies are exceeding expectations, demonstrating resilience and strong profitability despite economic uncertainties. This strong performance provides a solid foundation for current valuations.

- Technology sector: The technology sector continues to exceed earnings expectations, driven by innovation and sustained demand for tech products and services. Recent reports from companies like [insert example company and source] showcase significant growth.

- Consumer staples: Despite inflationary pressures, consumer staples companies are demonstrating remarkable resilience, highlighting the enduring demand for essential goods and services. [Insert example company and source] are prime examples of this trend.

Low Interest Rates and Monetary Policy

Low interest rates play a crucial role in supporting asset prices, including stock valuations. The current monetary policy, while shifting, continues to provide a supportive environment for investment.

- Quantitative easing (QE): Past instances of QE have injected significant liquidity into the market, contributing to higher asset prices. While QE programs may be tapering, their lingering effects are still felt.

- Future interest rate hikes: While future interest rate hikes are anticipated, their impact on stock valuations remains a subject of ongoing analysis. BofA's assessments suggest that the impact might be gradual and manageable.

Long-Term Growth Potential

BofA maintains a positive outlook on long-term economic growth prospects. Several factors contribute to this optimistic view.

- Technological innovation: Ongoing technological advancements across various sectors are expected to drive significant growth and efficiency gains in the coming years.

- Emerging market opportunities: Emerging markets present substantial growth potential, offering diversification and opportunities for significant returns over the long term.

Addressing the Concerns of High Valuations

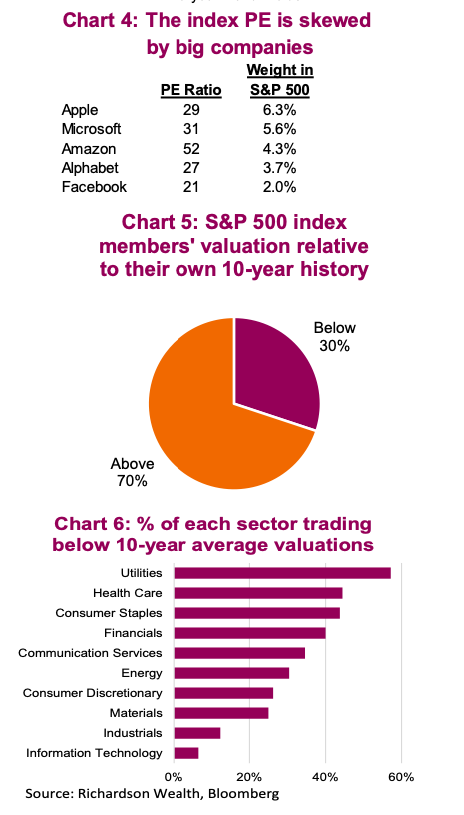

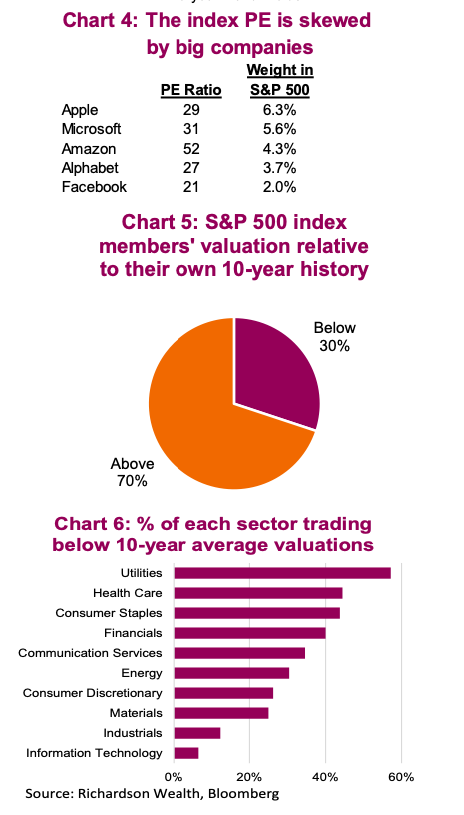

While acknowledging the validity of concerns surrounding high price-to-earnings ratios (P/E) and other valuation metrics, BofA emphasizes the importance of considering the broader context.

Historical Context and Comparisons

High stock market valuations are not unprecedented. History reveals periods of similarly high valuations that did not immediately result in market crashes.

- Dot-com bubble: Comparing current valuations to the dot-com bubble era reveals significant differences in underlying economic fundamentals and technological advancements.

- Previous economic expansions: Analyzing previous periods of economic expansion and high valuations can provide valuable insights into the current market dynamics.

Diversification and Risk Management

BofA strongly emphasizes the importance of diversification and a well-defined investment strategy as key elements in mitigating risks associated with high valuations.

- Diversification across asset classes: Spreading investments across various asset classes, such as stocks, bonds, and real estate, can help reduce overall portfolio volatility.

- Long-term investment horizon: Maintaining a long-term investment horizon allows investors to ride out short-term market fluctuations and benefit from the potential for long-term growth.

BofA's Investment Recommendations (without providing specific financial advice)

BofA suggests investors adopt a measured and strategic approach to navigate the current market environment. This doesn't involve specific stock picks but rather focuses on sound investment principles.

- Focus on companies with strong fundamentals: Prioritize companies with robust balance sheets, consistent earnings growth, and sustainable business models.

- Consider value investing strategies: Value investing, which focuses on identifying undervalued companies, can offer attractive opportunities in a market with high valuations.

- Rebalance portfolios periodically: Regular portfolio rebalancing helps maintain a desired asset allocation and can mitigate risks associated with market fluctuations.

Conclusion: Navigating High Stock Market Valuations with Confidence

BofA's perspective is clear: while high stock market valuations are a legitimate concern, they don't automatically signal an impending crash. Strong corporate earnings, low interest rates, and significant long-term growth potential all contribute to a more nuanced view. By understanding these factors, employing sound diversification strategies, and maintaining a long-term perspective, investors can effectively manage their high stock market valuation concerns. Conduct further research, consult with a qualified financial advisor, and develop a robust investment strategy tailored to your individual risk tolerance and financial goals to effectively assess your high stock market valuation strategy and navigate this market with confidence.

Featured Posts

-

Hair Trimmers Used In Attempted Jailbreak Louisiana Inmates Escape Plan

May 25, 2025

Hair Trimmers Used In Attempted Jailbreak Louisiana Inmates Escape Plan

May 25, 2025 -

Tariffs And The Fed Jerome Powells Concerns About Economic Stability

May 25, 2025

Tariffs And The Fed Jerome Powells Concerns About Economic Stability

May 25, 2025 -

Understanding And Monitoring The Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025

Understanding And Monitoring The Nav Of The Amundi Dow Jones Industrial Average Ucits Etf

May 25, 2025 -

Actress Mia Farrow Seeks Trumps Imprisonment Following Venezuelan Deportation Controversy

May 25, 2025

Actress Mia Farrow Seeks Trumps Imprisonment Following Venezuelan Deportation Controversy

May 25, 2025 -

Amundi Dow Jones Industrial Average Ucits Etf Dist A Guide To Net Asset Value

May 25, 2025

Amundi Dow Jones Industrial Average Ucits Etf Dist A Guide To Net Asset Value

May 25, 2025

Latest Posts

-

The Imaginative Landscapes Of Kazuo Ishiguro Memory Forgetting And Narrative

May 25, 2025

The Imaginative Landscapes Of Kazuo Ishiguro Memory Forgetting And Narrative

May 25, 2025 -

Remembering And Forgetting The Role Of Memory In Kazuo Ishiguros Fiction

May 25, 2025

Remembering And Forgetting The Role Of Memory In Kazuo Ishiguros Fiction

May 25, 2025 -

Roland Whites Imagine The Academy Of Armando Bbc 1 Review Funny Business

May 25, 2025

Roland Whites Imagine The Academy Of Armando Bbc 1 Review Funny Business

May 25, 2025 -

Kazuo Ishiguros Novels A Study Of Memory Forgetting And The Power Of Imagination

May 25, 2025

Kazuo Ishiguros Novels A Study Of Memory Forgetting And The Power Of Imagination

May 25, 2025 -

Young Oxfordshire Racer To Compete At Goodwood Inspired By F1 Icon

May 25, 2025

Young Oxfordshire Racer To Compete At Goodwood Inspired By F1 Icon

May 25, 2025