High-Yield Dividend Investing: Simplicity For Success

Table of Contents

Understanding High-Yield Dividend Stocks

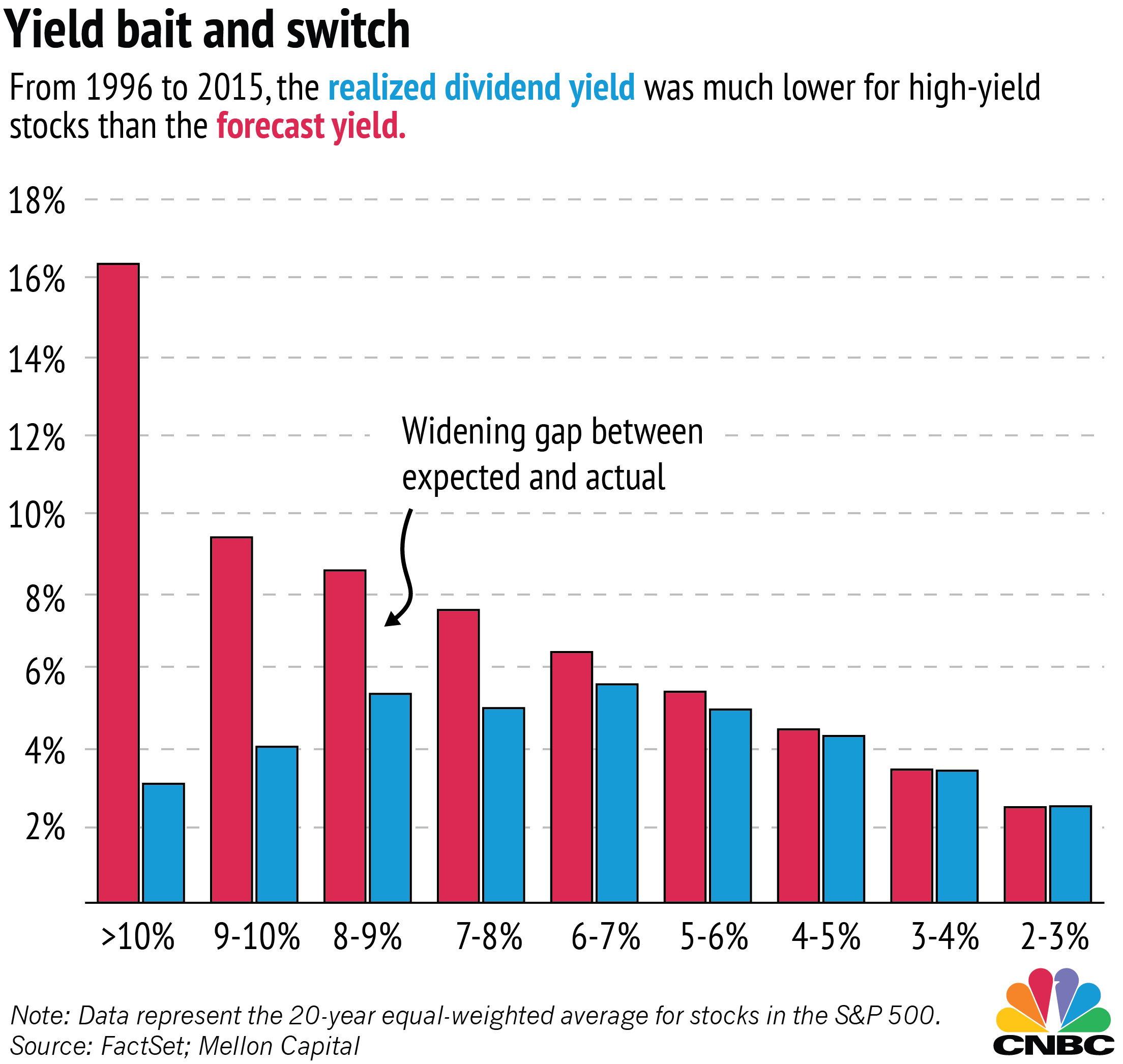

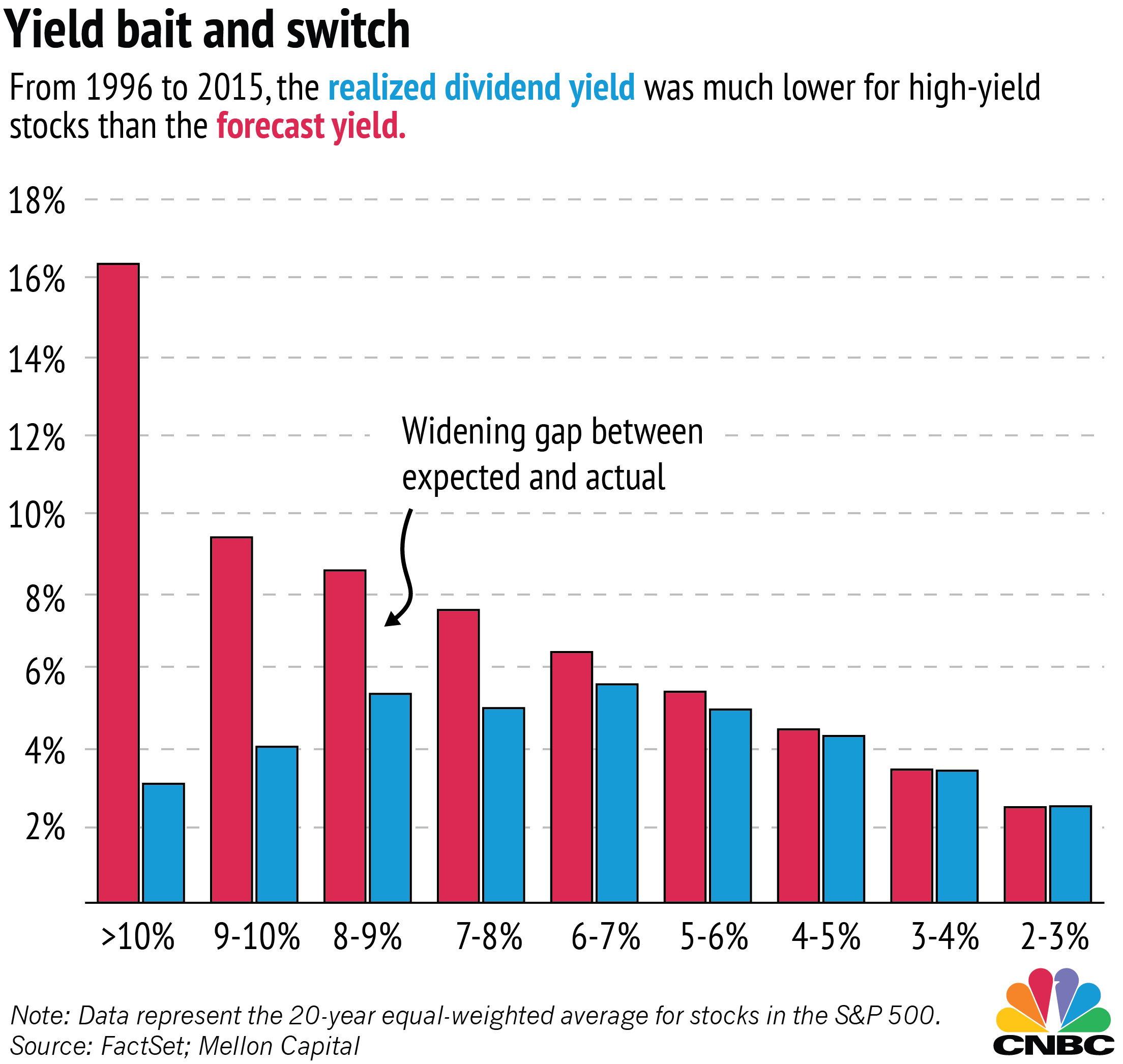

Before diving into the specifics of high-yield dividend investing, it's crucial to grasp the fundamentals. Dividend yield represents the annual dividend per share relative to the stock's price, expressed as a percentage. It's calculated by dividing the annual dividend per share by the current market price per share. Understanding the difference between dividend yield and the dividend payout ratio is vital. While dividend yield shows the return on investment based on the current share price, the dividend payout ratio indicates the percentage of a company's earnings paid out as dividends. A high payout ratio might signal a generous dividend but could also imply reduced potential for future growth or increased risk of dividend cuts.

High-yield dividend stocks, while offering attractive income potential, also carry inherent risks. These include:

- Higher risk of dividend cuts: Companies struggling financially might reduce or eliminate dividends to preserve capital.

- Lower capital appreciation: Companies that distribute a large portion of their earnings as dividends may have less capital for reinvestment and growth, potentially limiting share price appreciation.

Therefore, thorough due diligence is paramount.

- Fundamental analysis is key: Examine a company's financial statements, including its balance sheet, income statement, and cash flow statement.

- Assess financial health and stability: Consider factors like debt-to-equity ratio, free cash flow, and earnings per share (EPS) to gauge the company's ability to sustain dividend payments.

- Diversification is crucial: Spread your investments across various sectors and companies to mitigate risk. Don't put all your eggs in one basket!

Identifying Reliable High-Yield Dividend Investments

Finding promising high-yield dividend stocks requires a strategic approach. Leverage the power of screening tools and financial websites to filter stocks based on dividend yield, payout ratio, and other relevant metrics. Remember, however, that these tools are just starting points. Deep dives into individual company financials are essential.

- Analyze dividend history: Look for a consistent history of dividend payments, indicating the company's commitment to returning value to shareholders.

- Focus on established companies: Companies with a long track record of dividend payments generally offer greater stability and reliability.

- Check analyst ratings and forecasts: Review industry research and analyst opinions to gain insights into the company's future prospects and dividend sustainability. Scrutinize their reasoning behind ratings to inform your own decisions.

Remember, the goal is to identify companies with strong fundamentals and a sustainable dividend policy, not just the highest yield. A high yield without underlying strength is a red flag.

Building a Diversified High-Yield Dividend Portfolio

Diversification is the cornerstone of sound investment strategy. A well-diversified portfolio reduces risk by spreading investments across different sectors, market capitalizations, and geographies. This approach minimizes the impact of poor performance in any single investment.

- Dollar-cost averaging: Invest a fixed amount at regular intervals, regardless of market fluctuations. This strategy mitigates the risk of investing a lump sum at a market peak.

- Dividend reinvestment: Reinvest your dividend payments to buy more shares, accelerating your portfolio's growth through the power of compounding.

- Regular portfolio review and rebalancing: Periodically assess your portfolio's performance and adjust your holdings to maintain your desired asset allocation. Market conditions change, and your portfolio needs to adapt.

Managing Your High-Yield Dividend Investments

Successful high-yield dividend investing is not a "set it and forget it" endeavor. Consistent monitoring and proactive management are vital.

- Track dividend payments and capital gains: Monitor your investment performance closely to track your income stream and capital appreciation.

- Adapt to market changes: Economic conditions and market trends will impact your investments. Be prepared to adjust your portfolio strategy accordingly. This may involve selling underperforming assets and buying into others exhibiting better growth potential.

- Set realistic goals: Establish clear financial goals and a suitable investment timeline to guide your decisions and maintain focus. Short-term needs versus long-term growth must be considered.

- Stay informed: Keep abreast of market trends, economic news, and any developments affecting your chosen companies.

Consider seeking guidance from a qualified financial advisor for personalized advice tailored to your specific circumstances and risk tolerance.

Start Your Journey to Success with High-Yield Dividend Investing

Building a successful high-yield dividend investing portfolio requires careful research, thoughtful diversification, and consistent monitoring. By understanding the fundamentals, identifying reliable investments, and managing your portfolio effectively, you can unlock the potential for long-term financial growth and a steady stream of passive income. Remember, this isn't a get-rich-quick scheme; it's a long-term strategy requiring patience and discipline. Start building your high dividend yield investing portfolio today! Explore resources like [link to a reputable brokerage account or financial planning tool] to get started on your path to financial freedom through investing in high-yield dividends.

Featured Posts

-

Jennifer Aniston Gate Crash Man Charged With Stalking And Vandalism

May 10, 2025

Jennifer Aniston Gate Crash Man Charged With Stalking And Vandalism

May 10, 2025 -

The Surprising Ways Apple Helps Google Thrive

May 10, 2025

The Surprising Ways Apple Helps Google Thrive

May 10, 2025 -

Britannian Kuninkaallinen Perimysjaerjestys Uusi Lista Ja Selitys

May 10, 2025

Britannian Kuninkaallinen Perimysjaerjestys Uusi Lista Ja Selitys

May 10, 2025 -

Palantir Stock Outlook A Pre May 5th Investment Analysis

May 10, 2025

Palantir Stock Outlook A Pre May 5th Investment Analysis

May 10, 2025 -

Nyt Spelling Bee April 1 2025 Pangram And Solution Guide

May 10, 2025

Nyt Spelling Bee April 1 2025 Pangram And Solution Guide

May 10, 2025