HKMA's US Dollar Intervention: Implications For The Hong Kong Dollar

Table of Contents

The Hong Kong Dollar's Peg and the HKMA's Role

The HKMA plays a pivotal role in maintaining the HKD's peg to the USD, a system known as a currency board arrangement or linked exchange rate system. This means the HKD is effectively backed by US dollar reserves held by the HKMA. This arrangement ensures a stable exchange rate, fostering international trade and investment.

- Narrow Trading Band: The HKD is allowed to fluctuate within a narrow band of 7.75 to 7.85 HKD per USD. Deviations outside this range trigger HKMA intervention.

- Economic Significance: The peg provides price stability, attracting foreign investment and facilitating international trade for Hong Kong's export-oriented economy. It reduces exchange rate risk for businesses and consumers.

- Monetary Policy Implications: The currency board arrangement limits the HKMA's ability to independently control interest rates, as these are largely determined by US interest rates. This aspect presents both opportunities and challenges.

Mechanisms of HKMA Intervention

The HKMA uses several mechanisms to intervene in the foreign exchange market and maintain the HKD's peg. These interventions are designed to counteract pressure on the HKD/USD exchange rate.

- Buying and Selling USD: When the HKD weakens toward the upper limit of the band (7.85 HKD/USD), the HKMA buys HKD and sells USD to increase demand for the HKD. Conversely, when the HKD strengthens towards the lower limit (7.75 HKD/USD), it sells HKD and buys USD.

- Aggregate Balance: The Aggregate Balance, a key indicator of liquidity in the banking system, reflects the scale of HKMA intervention. Changes in the Aggregate Balance signify adjustments in the money supply to maintain the peg.

- Monetary Operations: The HKMA employs a range of monetary operations, such as repo transactions and reverse repo transactions, to manage liquidity and influence interest rates, supporting its foreign exchange interventions.

Factors Triggering HKMA Intervention

Several factors can trigger HKMA intervention in the foreign exchange market. These often involve significant shifts in capital flows or external economic shocks.

- Speculative Attacks: Sudden and large-scale movements in the foreign exchange market, driven by speculation about the HKD's peg, can necessitate intervention to maintain the exchange rate within the acceptable band.

- Capital Flows: Significant inflows or outflows of capital can exert pressure on the HKD, requiring HKMA intervention to counter these movements and stabilize the currency.

- External Economic Shocks: Changes in US interest rates, global economic crises, or other external economic shocks can influence the HKD/USD exchange rate and trigger HKMA intervention. For instance, a rise in US interest rates can attract capital outflows from Hong Kong, weakening the HKD.

Implications for the Hong Kong Dollar and Economy

HKMA interventions have both short-term and long-term implications for the Hong Kong dollar and the broader economy.

- Short-Term Effects: Interventions can stabilize the HKD/USD exchange rate in the short term, mitigating the impact of speculative attacks or sudden capital flows.

- Long-Term Effects: The peg fosters stability, attracting foreign investment and supporting economic growth over the long term. However, it also limits the HKMA's ability to use monetary policy to address domestic economic challenges such as inflation or deflation independently.

- Impact on Businesses and Investors: The stability provided by the peg reduces exchange rate risk for businesses operating in Hong Kong, making it easier to plan and invest. However, interest rate adjustments driven by US monetary policy can impact borrowing costs.

Transparency and Accountability of HKMA Interventions

The HKMA maintains a relatively high level of transparency regarding its intervention strategies, regularly publishing data on its foreign exchange transactions and the Aggregate Balance.

- Data Publication: The HKMA publishes regular reports and press releases detailing its monetary policy actions, including its interventions in the foreign exchange market.

- Accountability: While the HKMA operates with considerable autonomy, it is ultimately accountable to the Hong Kong government and the public for its actions.

- Criticisms and Concerns: Some critics argue that the currency board arrangement and the resulting limitations on monetary policy flexibility might hinder Hong Kong's response to specific economic challenges.

Conclusion: The Future of HKMA's US Dollar Intervention and its Impact on the Hong Kong Dollar

HKMA's US dollar intervention is a critical component of Hong Kong's monetary policy, playing a vital role in maintaining the stability of the HKD and supporting the economy. Understanding the mechanisms, triggers, and implications of these interventions is essential for navigating the complexities of Hong Kong's financial landscape. The peg remains a cornerstone of Hong Kong's economic strength, attracting investment and fostering trade. However, the interconnectedness of global markets means continued vigilance and adaptability will be crucial for the HKMA to manage future challenges effectively. Stay informed about the latest developments in HKMA's US dollar intervention strategies to better understand their implications for the Hong Kong dollar and the Hong Kong economy. For up-to-date information, visit the official HKMA website.

Featured Posts

-

Temperature Plummets In Bengal Weather Update And Forecast

May 05, 2025

Temperature Plummets In Bengal Weather Update And Forecast

May 05, 2025 -

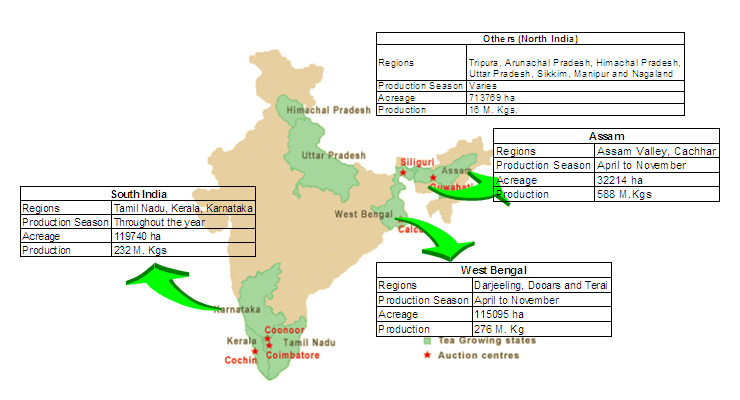

Darjeeling Tea Production Growing Concerns

May 05, 2025

Darjeeling Tea Production Growing Concerns

May 05, 2025 -

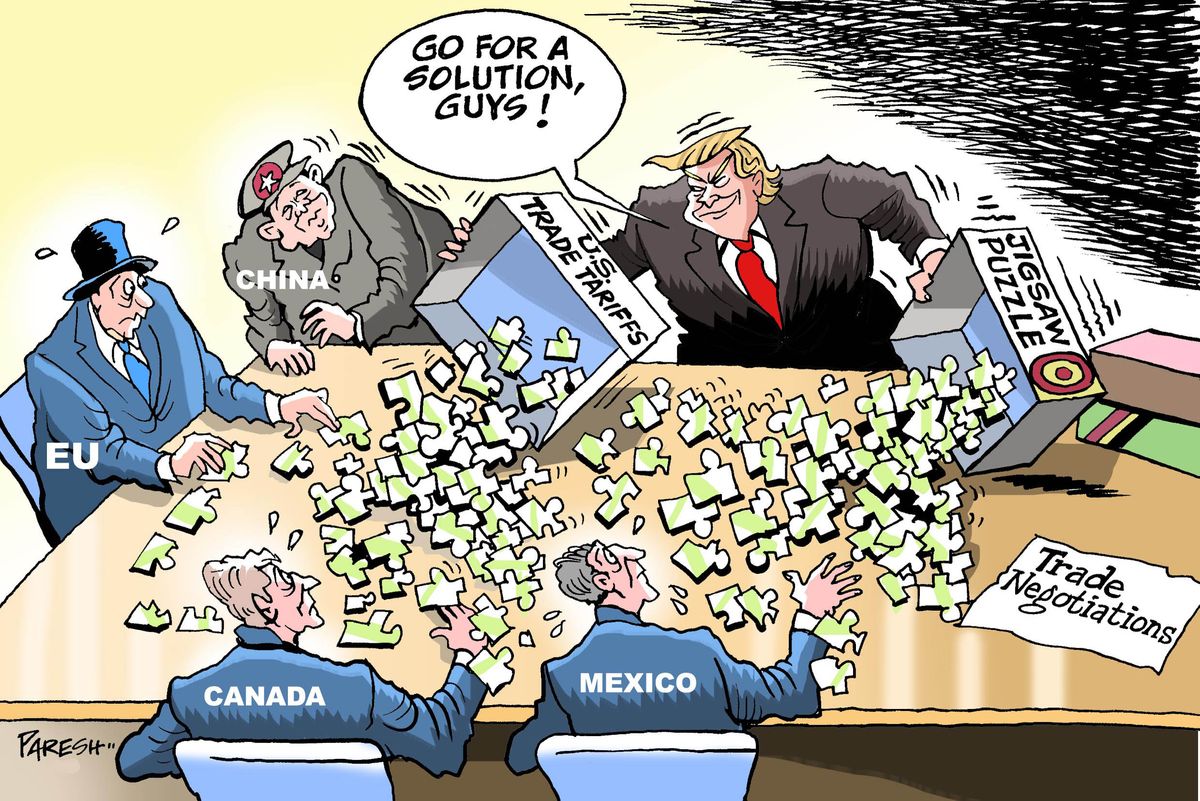

Aritzias Response To Trump Tariffs No Planned Price Increases

May 05, 2025

Aritzias Response To Trump Tariffs No Planned Price Increases

May 05, 2025 -

Seventh Wonder A Fleetwood Mac Tribute Show In Perth Mandurah And Albany

May 05, 2025

Seventh Wonder A Fleetwood Mac Tribute Show In Perth Mandurah And Albany

May 05, 2025 -

Virginia Derbys Location Confirmed Stones Announcement At Colonial Downs

May 05, 2025

Virginia Derbys Location Confirmed Stones Announcement At Colonial Downs

May 05, 2025

Latest Posts

-

Bradley Cooper And Leonardo Di Caprio Gigi Hadids Dating Dilemma

May 05, 2025

Bradley Cooper And Leonardo Di Caprio Gigi Hadids Dating Dilemma

May 05, 2025 -

Oni Byli Kak Bratya No Istoriya Razryva Druzhby Kupera I Di Kaprio

May 05, 2025

Oni Byli Kak Bratya No Istoriya Razryva Druzhby Kupera I Di Kaprio

May 05, 2025 -

Druzhba Kupera I Di Kaprio Pravda O Prichinakh Ikh Razlada

May 05, 2025

Druzhba Kupera I Di Kaprio Pravda O Prichinakh Ikh Razlada

May 05, 2025 -

Razrushennaya Druzhba Istoriya Konflikta Mezhdu Kuperom I Di Kaprio

May 05, 2025

Razrushennaya Druzhba Istoriya Konflikta Mezhdu Kuperom I Di Kaprio

May 05, 2025 -

Raskol Druzhby Pochemu Kuper I Di Kaprio Perestali Obschatsya

May 05, 2025

Raskol Druzhby Pochemu Kuper I Di Kaprio Perestali Obschatsya

May 05, 2025