HMRC Child Benefit: Understanding And Responding To Official Communications

Table of Contents

Identifying Genuine HMRC Communications

It's vital to ensure any communication you receive is genuinely from HMRC to protect yourself from scams. Here's how to identify authentic HMRC correspondence:

Recognizing Official Letters and Emails

- Letterhead: Genuine HMRC letters will always feature the official HMRC letterhead, including the crown emblem and contact details.

- Email Address: Official emails will come from an address ending in "@gov.uk". Be wary of similar-looking addresses.

- Contact Details: The letter or email will include clear contact details, enabling you to verify its authenticity through independent means.

- Unique Reference Number: Every official communication will contain a unique reference number specific to your case.

- Secure Online Links: Legitimate HMRC emails will only contain links to secure websites (https://www.gov.uk/). Never click on suspicious links.

- Avoid Phishing Scams: HMRC will never ask for your full banking details, passwords, or PINs via email or text. Report suspicious emails immediately.

Verifying Communication Through HMRC Online Services

Your HMRC online account provides the ultimate verification tool.

- Access Your Account: Log in to your HMRC online account at gov.uk. Here, you can view all official communications and check their authenticity.

- Suspected Fraud: If you suspect a communication is fraudulent, do not respond to it. Report it immediately to HMRC through the appropriate channels.

- Direct Verification: If unsure, contact HMRC directly using their official contact details (found on their website) to verify the letter or email.

Understanding Common HMRC Child Benefit Correspondence

HMRC sends various communications regarding your Child Benefit. Understanding their purpose is key to maintaining your payments.

Annual Statements and Updates

- Purpose: These statements summarize your Child Benefit payments for the tax year, detailing the amounts received and periods covered.

- Information to Look For: Check payment amounts, dates, and any changes to your entitlement.

- Action Required: Usually, no action is required unless there are discrepancies you need to report.

Requests for Information and Verification

- Why HMRC Asks: HMRC may request information if your circumstances have changed (e.g., change of address, new child, change in income).

- Importance of Prompt Response: Delayed responses can lead to delays or suspension of your payments. Respond promptly and accurately.

- Providing Documentation: Submit requested documents securely, either online through your HMRC account or by post using recorded delivery.

Notifications of Changes to Your Child Benefit Payments

- Types of Changes: You may receive notifications about increased payments, reduced payments, or cessation of payments.

- Reasons for Changes: Changes might result from your child reaching a certain age, a change in your household income, or other relevant circumstances.

- Disagreement with a Change: If you disagree with a change, contact HMRC immediately to discuss the matter and provide any necessary evidence.

Responding to HMRC Child Benefit Communications

Responding promptly and accurately to HMRC communications is crucial. Here's how:

Online Responses via HMRC Online Services

- Step-by-Step: Log into your HMRC online account. Navigate to the relevant communication. Follow the on-screen instructions to provide the required information.

- Benefits of Online Response: Online responses are faster, more secure, and provide confirmation of receipt.

Responding by Post

- Completing Forms: Fill out any paper forms accurately and completely.

- Proof of Postage: Keep proof of postage (e.g., a certificate of posting) as evidence of your response.

- Postal Address: Send your response to the address specified on the HMRC communication.

Contacting HMRC Directly if You Need Help

- Contact Methods: HMRC offers various contact methods including phone, online forms, and webchat. Find these details on the gov.uk website.

- When to Contact: Contact HMRC if you have questions, need clarification, or are facing difficulties responding to their communications.

Conclusion

Successfully navigating HMRC Child Benefit communications is crucial for maintaining your entitlement. By understanding how to identify genuine correspondence, interpreting the information provided and responding appropriately, you can avoid potential delays or disruptions to your payments. Remember to always verify the authenticity of any communication and promptly respond to any requests for information. If you are unsure about anything, do not hesitate to contact HMRC directly for clarification regarding your Child Benefit. Proactive engagement with your HMRC Child Benefit communications ensures a smooth and hassle-free experience. Take control of your Child Benefit today!

Featured Posts

-

College Boom Towns Go Bust Enrollment Decline And Economic Fallout

May 20, 2025

College Boom Towns Go Bust Enrollment Decline And Economic Fallout

May 20, 2025 -

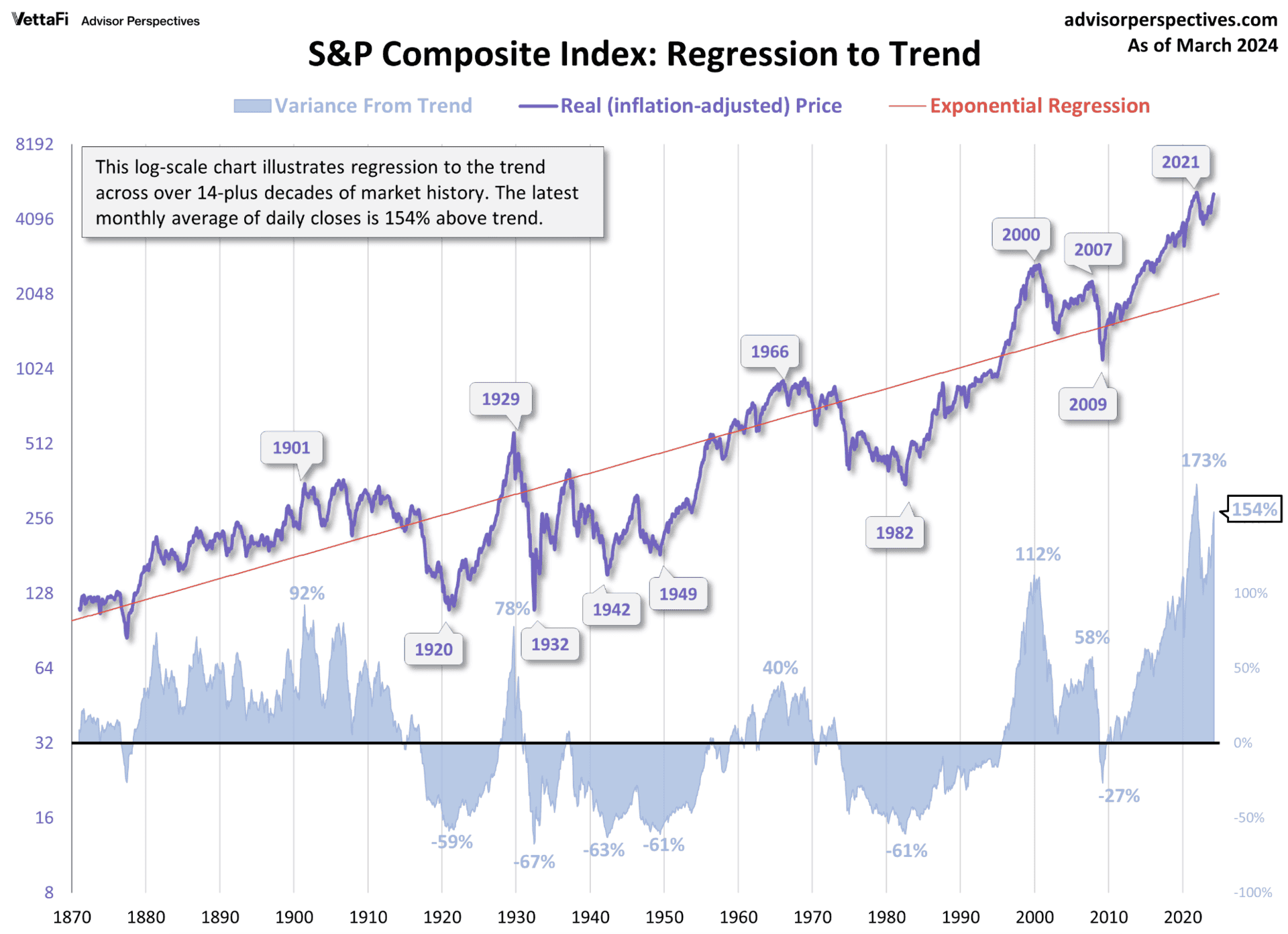

Should Investors Worry About Elevated Stock Market Valuations Bof As View

May 20, 2025

Should Investors Worry About Elevated Stock Market Valuations Bof As View

May 20, 2025 -

Cin Gp Soku Hamilton Ve Leclerc In Diskalifiye Karari

May 20, 2025

Cin Gp Soku Hamilton Ve Leclerc In Diskalifiye Karari

May 20, 2025 -

Sabalenka And Zverev Advance Madrid Open Update

May 20, 2025

Sabalenka And Zverev Advance Madrid Open Update

May 20, 2025 -

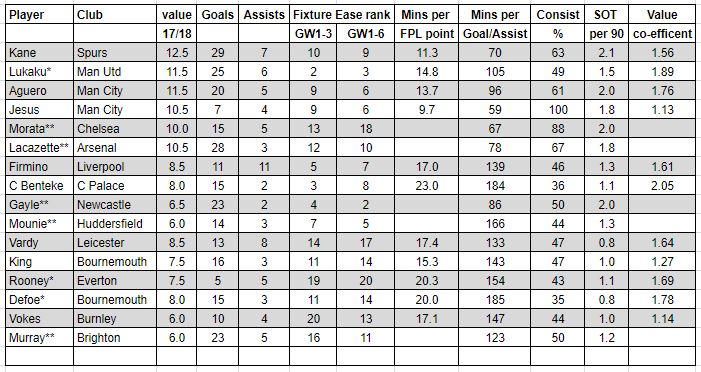

Manchester Uniteds Pursuit Of Premier League Forward Newcastles Interest Complicates Transfer

May 20, 2025

Manchester Uniteds Pursuit Of Premier League Forward Newcastles Interest Complicates Transfer

May 20, 2025

Latest Posts

-

Kolme Muutosta Huuhkajien Avauskokoonpanoon Kaellman Sivussa

May 20, 2025

Kolme Muutosta Huuhkajien Avauskokoonpanoon Kaellman Sivussa

May 20, 2025 -

Huuhkajat Avauskokoonpanoon Kolme Muutosta Kaellman Penkille

May 20, 2025

Huuhkajat Avauskokoonpanoon Kolme Muutosta Kaellman Penkille

May 20, 2025 -

Jalkapallo Kaellman Ja Hoskonen Eroavat Puolalaisseurasta

May 20, 2025

Jalkapallo Kaellman Ja Hoskonen Eroavat Puolalaisseurasta

May 20, 2025 -

Huuhkajat Kaksikko Kaellman Ja Hoskonen Palaavat Kotiin

May 20, 2025

Huuhkajat Kaksikko Kaellman Ja Hoskonen Palaavat Kotiin

May 20, 2025 -

Kaellman Ja Hoskonen Loppu Puolassa Mitae Seuraavaksi

May 20, 2025

Kaellman Ja Hoskonen Loppu Puolassa Mitae Seuraavaksi

May 20, 2025