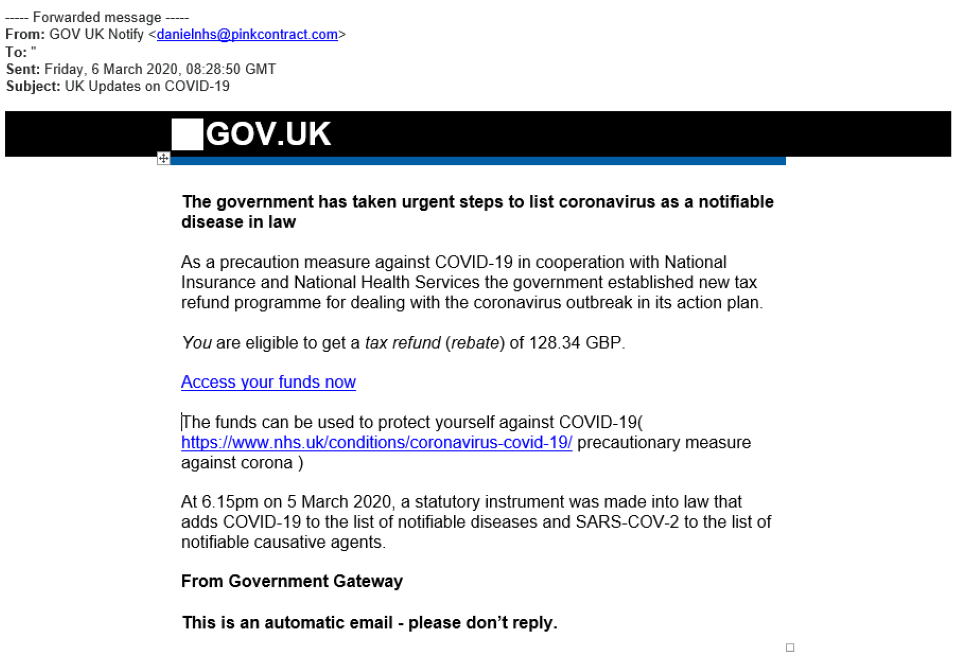

HMRC Refunds: Could Millions Be Entitled To Money Back?

Table of Contents

Common Reasons for HMRC Refunds

Several factors can lead to overpayments and subsequently, HMRC refunds. Let's delve into the most frequent scenarios.

Overpaid Tax

Many people overpay tax unknowingly. This often happens due to:

- Incorrect Tax Code: Your tax code determines how much income tax is deducted from your salary. An incorrect code can lead to excessive deductions.

- Double Tax Payments: Accidental duplicate payments, perhaps due to a processing error or submitting payments twice, can result in overpayment.

- Claiming Too Little Relief: Failing to claim tax reliefs you're entitled to, such as those for marriage or childcare costs, will result in a higher tax bill than necessary.

Each of these scenarios can lead to a significant overpayment, resulting in a substantial HMRC tax refund.

Unclaimed Tax Reliefs

Numerous tax reliefs exist that many people overlook. These include:

- Marriage Allowance: This allows higher-earning spouses to transfer some of their personal allowance to their lower-earning partner, reducing their overall tax bill.

- Gift Aid: If you donate to a registered charity, you can claim Gift Aid, increasing the value of your donation.

- Working From Home Expenses: If you work from home for your employer, you might be able to claim tax relief on certain expenses, such as utility bills and internet costs.

- Childcare Costs: Tax relief is available for childcare costs, potentially reducing your tax liability.

Familiarizing yourself with these reliefs and claiming those you're entitled to could unlock a considerable HMRC repayment.

Pension Contributions

Errors or under-reporting of pension contributions are another common reason for HMRC refunds. This can stem from:

- Incorrect Contribution Amounts: Reporting incorrect amounts of pension contributions made.

- Missing Contributions: Failing to report all pension contributions.

- Errors in Forms: Inaccuracies in the completion of self-assessment forms relating to pension contributions.

Accurate record-keeping of pension contributions is crucial. Failing to do so accurately can result in significant unclaimed tax relief and an HMRC refund.

How to Check if You're Entitled to an HMRC Refund

There are several ways to determine if you have an HMRC refund waiting for you.

Using the HMRC Website

The HMRC website offers a user-friendly portal to access your tax records.

- Log in using your Government Gateway credentials.

- Navigate to your tax account.

- Review your tax returns and payments for any potential overpayments.

Remember to have your Government Gateway details, National Insurance number, and other relevant information readily available.

Contacting HMRC Directly

You can contact HMRC directly by phone or post if you have questions or require assistance.

- Phone: Find the relevant HMRC helpline number on their website.

- Post: Use the appropriate address to write to HMRC.

Be prepared to provide necessary details and expect potential waiting times.

Using a Tax Advisor

For complex tax situations, a tax advisor can provide invaluable assistance.

- Tax advisors possess the expertise to identify potential overpayments and navigate the claims process efficiently.

- They can save you time and ensure accuracy in your claim.

- However, professional services usually come with a fee.

The HMRC Refund Claim Process

Claiming your HMRC refund involves several steps.

Gathering Necessary Documentation

Accurate record-keeping is paramount. You'll need documents such as:

- Payslips

- P60s (end-of-year tax statements)

- Bank statements (showing payments made)

Ensure all information is accurate and complete to avoid delays.

Submitting Your Claim

You can typically submit your claim online through your HMRC online account or via post using the appropriate form.

- Online: The simplest and fastest method.

- Post: Use the relevant HMRC form and send it by post. [Link to HMRC forms (if available)]

Follow the instructions carefully to avoid rejection.

Timescales and Next Steps

HMRC typically processes refunds within several weeks, but this can vary.

- After submitting, monitor your online account for updates.

- If your claim is rejected, contact HMRC to understand the reasons.

- If there are delays, contact HMRC for an update.

Don't Miss Out on Your HMRC Refund

Millions of pounds in unclaimed HMRC refunds exist, and you could be entitled to a significant tax refund, HMRC repayment, or even get your money back. Several reasons exist for overpaying tax, from incorrect tax codes to unclaimed reliefs. This guide has shown you how to check your eligibility, using the HMRC website, contacting HMRC directly, or employing a tax advisor. The process of claiming your HMRC refund involves gathering necessary documentation and submitting your claim online or by post. Don't delay – check your eligibility for an HMRC refund today and reclaim what's rightfully yours!

Featured Posts

-

Hmrc Child Benefit Understanding And Responding To Official Communications

May 20, 2025

Hmrc Child Benefit Understanding And Responding To Official Communications

May 20, 2025 -

Circulation Restreinte Le Boulevard Fhb Ex Vge Interdit Aux 2 Et 3 Roues A Partir Du 15 Avril

May 20, 2025

Circulation Restreinte Le Boulevard Fhb Ex Vge Interdit Aux 2 Et 3 Roues A Partir Du 15 Avril

May 20, 2025 -

Investigation Into Toxic Chemical Persistence Following Ohio Train Derailment

May 20, 2025

Investigation Into Toxic Chemical Persistence Following Ohio Train Derailment

May 20, 2025 -

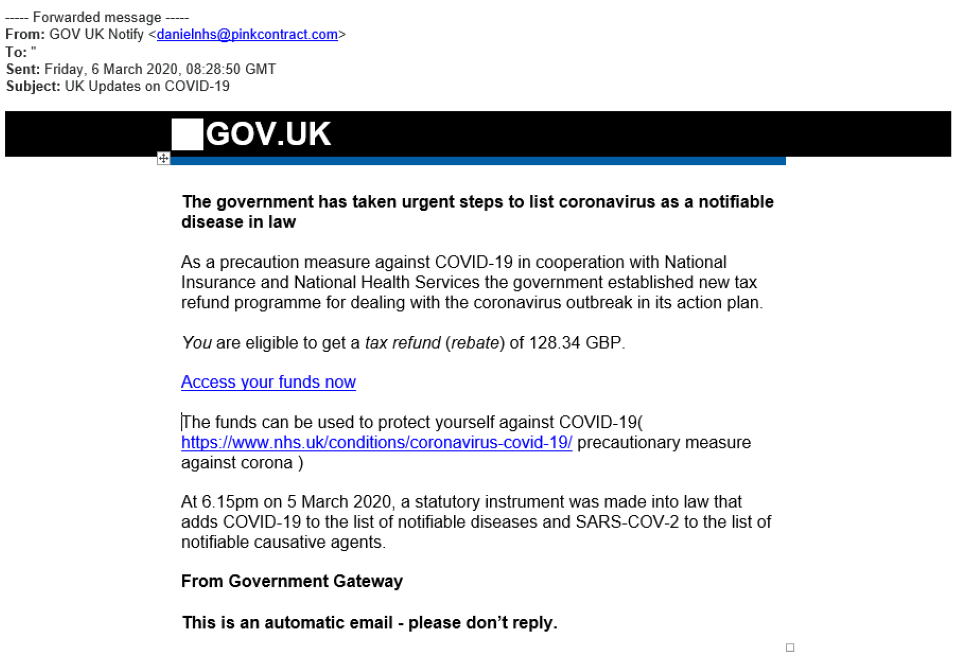

Cassidy Hutchinsons Memoir Key Jan 6 Witness To Share Her Story This Fall

May 20, 2025

Cassidy Hutchinsons Memoir Key Jan 6 Witness To Share Her Story This Fall

May 20, 2025 -

The Typhon Missile System Enhancing Philippine Defense Capabilities Against China

May 20, 2025

The Typhon Missile System Enhancing Philippine Defense Capabilities Against China

May 20, 2025

Latest Posts

-

Investigation Into Washington County Breeder Following 49 Dog Removal

May 20, 2025

Investigation Into Washington County Breeder Following 49 Dog Removal

May 20, 2025 -

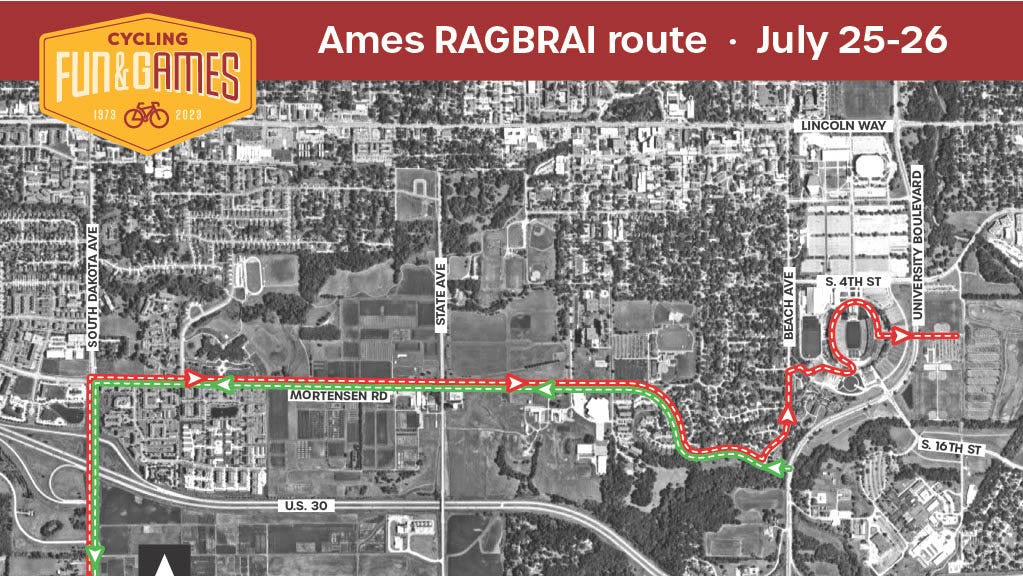

A Cyclists Dedication Scott Savilles Ragbrai And Commute Experiences

May 20, 2025

A Cyclists Dedication Scott Savilles Ragbrai And Commute Experiences

May 20, 2025 -

The Power Of Resilience Protecting Your Mental Health

May 20, 2025

The Power Of Resilience Protecting Your Mental Health

May 20, 2025 -

From Ragbrai To Daily Rides Scott Savilles Passion For Cycling

May 20, 2025

From Ragbrai To Daily Rides Scott Savilles Passion For Cycling

May 20, 2025 -

Mental Health Resilience Strategies For A Stronger You

May 20, 2025

Mental Health Resilience Strategies For A Stronger You

May 20, 2025