Hong Kong's Chinese Stock Market Sees Sharp Increase Amidst Trade Deal Optimism

Table of Contents

Factors Driving the Stock Market Surge in Hong Kong

Several interconnected factors have fueled the recent surge in Hong Kong's Chinese stock market. Positive developments in US-China trade negotiations, increased foreign investment, and stronger-than-expected economic data from mainland China all play significant roles.

Positive Trade Deal Negotiations

Positive developments in the ongoing US-China trade negotiations have significantly boosted investor confidence. The prospect of reduced tariffs and eased trade tensions has injected a much-needed dose of optimism into the market.

- Specific Agreements: Recent reports suggest progress on key issues, including intellectual property protection and agricultural purchases. While specifics remain confidential, the overall positive sentiment is palpable.

- Impact on Specific Sectors: Reduced tariffs are expected to benefit several Chinese sectors heavily represented on the Hong Kong stock exchange, including technology, manufacturing, and consumer goods. This has led to a significant increase in trading volume and share prices.

- Expert Opinions: "The positive momentum in trade talks is undeniably driving the market," says Jane Li, a leading financial analyst at HSBC. "Investors are anticipating a more stable and predictable trading environment, leading to increased investment."

Increased Foreign Investment in Hong Kong

The inflow of foreign capital into Hong Kong's market is another crucial driver of the recent price increase. Several international investment firms are increasing their holdings in Chinese companies listed in Hong Kong, injecting significant liquidity into the market.

- Investment Growth: Data shows a substantial increase in foreign investment in the past quarter, with figures exceeding previous years' averages.

- Key Investors: Several prominent US and European investment funds have publicly announced increased allocations to Hong Kong-listed Chinese stocks.

- Reasons for Increased Interest: The combination of relatively attractive valuations, strong growth prospects for Chinese companies, and the potential benefits of a US-China trade deal has attracted significant foreign interest.

Stronger-than-Expected Economic Data from China

Robust economic indicators from mainland China are further bolstering investor sentiment and driving demand for Chinese stocks listed in Hong Kong. Stronger-than-anticipated growth figures across various sectors signal a healthy and expanding Chinese economy.

- Key Economic Indicators: Recent data points to significant growth in key areas, including GDP growth, industrial production, and retail sales, all exceeding market expectations.

- Impact on Investor Sentiment: This positive economic outlook reinforces the belief that Chinese companies will continue to perform well, boosting demand for their shares listed on the Hong Kong Stock Exchange.

- (Insert Chart/Graph Here): A visual representation of key economic indicators would significantly enhance this section.

Sectors Performing Best in Hong Kong's Market

While the entire market has seen gains, certain sectors are significantly outperforming others.

Technology Stocks

Technology companies listed in Hong Kong, especially those with strong ties to mainland China, have experienced exceptional gains.

- Specific Companies: [Insert examples of specific companies and their percentage gains]. These companies are benefiting from increased domestic demand and growing global competitiveness.

- Contributing Factors: Government support for technological innovation, strong R&D investment, and a rapidly expanding domestic market are major contributing factors.

Consumer Goods and Retail

The consumer goods and retail sector is also performing exceptionally well, fueled by increased consumer spending and economic growth in China.

- Impact of Increased Spending: Stronger consumer confidence and rising disposable incomes are driving sales growth for numerous companies in this sector.

- High-Performing Companies: [Insert examples of specific companies demonstrating strong growth].

Financial Services

Financial institutions listed on the Hong Kong Stock Exchange are also benefiting from the positive market environment.

- Growth Drivers: Increased trading activity, rising interest rates, and robust economic growth are contributing to the strong performance of this sector.

- Market Data: [Insert data on market capitalization and trading volume to support the claim].

Risks and Potential Challenges Ahead

While the current outlook is positive, investors should remain aware of potential risks and challenges.

Trade Deal Uncertainty

Despite recent progress, significant uncertainty remains surrounding the US-China trade deal. Potential setbacks or unresolved issues could significantly impact market performance.

- Potential Setbacks: The possibility of renewed trade tensions or disagreements on key issues could negatively affect investor sentiment.

- Impact on Investor Confidence: Any indication of a breakdown in negotiations could lead to a sharp market correction.

Geopolitical Risks

Broader geopolitical factors could also pose risks to the Hong Kong market.

- Geopolitical Instability: Global economic downturns or political instability could negatively impact investor confidence and lead to market volatility.

- Influence on Market Trends: These unpredictable factors can significantly influence the current positive market trends.

Market Volatility

It's crucial to remember that stock markets are inherently volatile. The current surge could be followed by periods of correction or decline.

- Historical Data: Historical data shows that even prolonged periods of growth are typically punctuated by periods of market correction.

Conclusion

The recent surge in Hong Kong's Chinese stock market is driven by a confluence of factors, primarily positive trade deal optimism, increased foreign investment, and strong economic data from mainland China. While several sectors are experiencing significant growth, investors must remain aware of potential risks associated with trade deal uncertainty, geopolitical factors, and inherent market volatility. To make informed investment decisions, monitor Hong Kong's Chinese stock market closely, stay updated on the latest trends in Hong Kong's investment landscape, and conduct thorough research and analysis before committing capital. Learn more about investing in the Hong Kong Chinese stock market and navigate this dynamic environment strategically.

Featured Posts

-

Canadas Economic Outlook The Urgent Need For Fiscal Responsibility Under The Liberals

Apr 24, 2025

Canadas Economic Outlook The Urgent Need For Fiscal Responsibility Under The Liberals

Apr 24, 2025 -

Ja Morant Faces Nba Probe Following Latest Incident

Apr 24, 2025

Ja Morant Faces Nba Probe Following Latest Incident

Apr 24, 2025 -

Instagram Launches Rival Video Editor To Attract Tik Tok Creators

Apr 24, 2025

Instagram Launches Rival Video Editor To Attract Tik Tok Creators

Apr 24, 2025 -

Los Angeles Wildfires And The Perils Of Disaster Betting

Apr 24, 2025

Los Angeles Wildfires And The Perils Of Disaster Betting

Apr 24, 2025 -

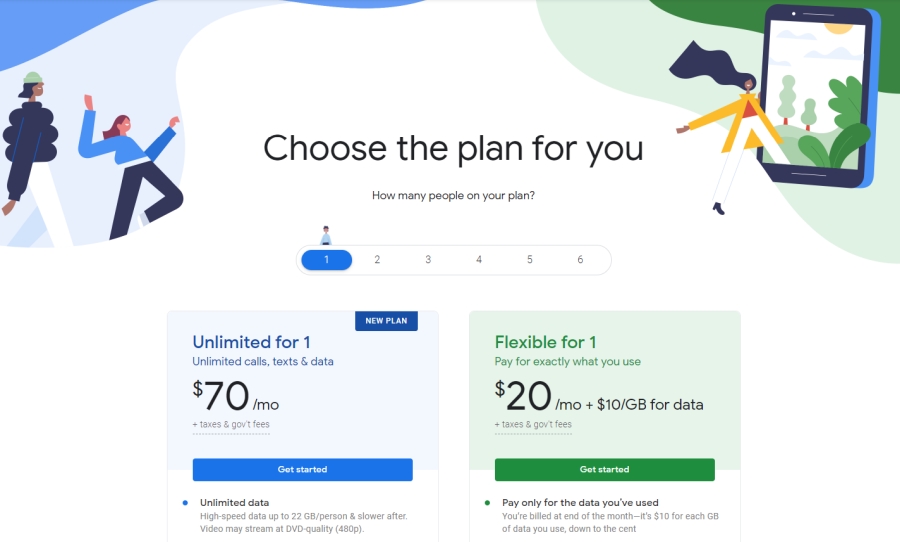

Google Fis 35 Unlimited Plan Is It Right For You

Apr 24, 2025

Google Fis 35 Unlimited Plan Is It Right For You

Apr 24, 2025