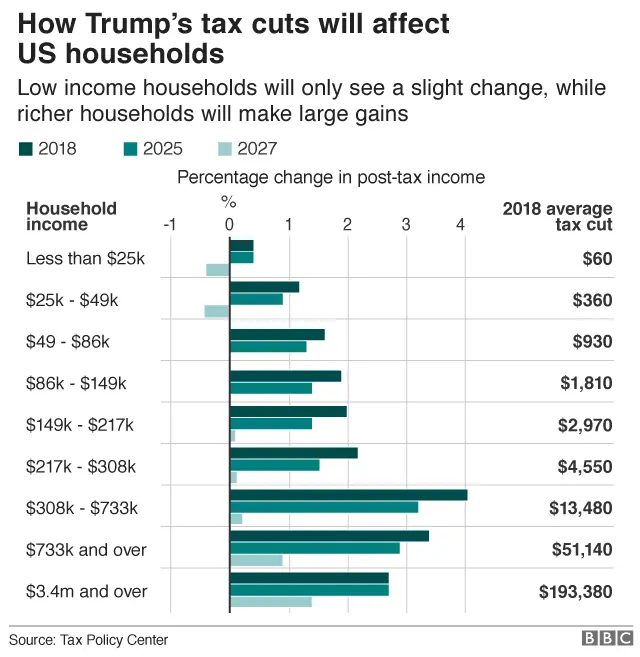

House Passes Trump Tax Bill: Key Changes And Impacts

Table of Contents

Individual Tax Rate Changes

The Trump Tax Bill significantly altered individual income tax rates and brackets. The act reduced the number of individual income tax brackets, resulting in lower marginal tax rates for many. Understanding these changes in tax brackets is key to assessing your personal tax liability.

- New tax brackets and corresponding rates: The bill lowered the seven existing individual income tax brackets to just four, simplifying the tax code. The exact rates varied based on filing status (single, married filing jointly, etc.). The aim was to provide tax cuts and stimulate the economy.

- Impact on middle-class families: While many middle-class families experienced some tax relief due to the lowered tax rates, the impact varied greatly depending on individual circumstances, deductions, and credits. The increased standard deduction benefited some middle-class families more than the rate reductions.

- Impact on high-income earners: High-income earners generally benefited the most from the lower top tax rates, though some high-income individuals may have seen their overall tax liability increase due to changes in itemized deductions.

- Potential increase or decrease in tax liability: For some, the tax liability decreased considerably; for others, the changes were negligible, and in some cases, they resulted in a slight increase, depending on the individual's specific financial situation. The changes to itemized deductions played a significant role in this variability.

Corporate Tax Rate Reduction

A cornerstone of the Trump Tax Bill was the drastic reduction in the corporate tax rate. This cut aimed to boost business investment, spur job creation, and enhance overall economic growth. This corporate tax reform significantly altered the business tax landscape.

- The new corporate tax rate: The bill slashed the corporate tax rate from 35% to 21%, a substantial decrease. This represented one of the most significant changes in the legislation.

- Potential impact on corporate profits and investment: Proponents argued that the lower rate would lead to increased corporate profits, prompting more investment in businesses and equipment.

- Predicted effects on job growth and the economy: It was predicted that this increased investment would translate to job creation and overall economic expansion. However, critics argued that the tax cuts would primarily benefit shareholders and CEOs.

- Concerns about potential loopholes and tax avoidance: There were concerns that the lower corporate tax rate could lead to increased tax avoidance and the exploitation of loopholes, minimizing the actual revenue increase for the government.

Changes to Itemized Deductions

The Trump Tax Bill made significant adjustments to itemized deductions, significantly impacting taxpayers' tax liability. Understanding these changes regarding itemized deductions and the standard deduction is essential.

- Increased standard deduction amounts: The standard deduction was substantially increased, making itemized deductions less appealing for many taxpayers. This simplified the tax filing process for a significant portion of the population.

- Limitations on SALT deductions: Perhaps the most controversial change was the limitation on the deduction for state and local taxes (SALT). This cap disproportionately affected taxpayers in high-tax states, leading to increased tax burdens for many residents.

- Impact on homeowners and taxpayers in high-tax states: Homeowners and taxpayers in high-tax states, particularly those who previously itemized, experienced the most significant negative impact due to the SALT deduction cap.

- Analysis of who will benefit and who will be negatively affected: The changes favored taxpayers who utilized the standard deduction, while those who itemized, particularly in high-tax states, faced increased tax burdens.

Changes to the Child Tax Credit

The Child Tax Credit also underwent modifications under the Trump Tax Bill, impacting families with children. These changes to family tax benefits altered the amount and eligibility criteria.

- New credit amount: The maximum amount of the Child Tax Credit was increased.

- Changes to eligibility: Eligibility requirements were slightly altered, potentially expanding the pool of families benefiting from the credit.

- Impact on families with children: Families with children generally saw an increase in tax relief through this expanded credit.

Long-Term Impacts and Economic Projections

Predicting the long-term effects of the Trump Tax Bill on the US economy is complex and involves varying expert opinions and forecasts. The long-term economic growth impacts are still being debated.

- Projected impact on the national debt: Critics argued that the substantial tax cuts would lead to a significant increase in the national debt.

- Potential effects on inflation: Concerns arose about potential inflationary pressures due to the increased spending power resulting from the tax cuts.

- Predictions regarding economic growth: Proponents predicted that the tax cuts would stimulate economic growth, generating increased tax revenue despite the lower tax rates.

- Discussions about the distribution of tax benefits: Disagreements persisted regarding the fairness of the tax cuts’ distribution, with many feeling the benefits disproportionately favored high-income earners and corporations.

Conclusion

The Trump Tax Bill, passed by the House, represents a major overhaul of the US tax code. This article has explored some of the most significant changes, including reductions in individual and corporate tax rates, modifications to itemized deductions, and adjustments to the Child Tax Credit. The long-term economic impacts remain to be seen, but the bill is expected to have profound effects on American households and businesses.

Call to Action: Understanding the implications of the Trump Tax Bill is crucial for taxpayers and businesses. Stay informed about further developments and consult with a tax professional to navigate these significant changes in the tax law. Learn more about the specific impacts of the Trump Tax Bill, Tax Cuts and Jobs Act, and tax reform on your personal finances.

Featured Posts

-

How To Secure Bbc Big Weekend 2025 Tickets At Sefton Park

May 24, 2025

How To Secure Bbc Big Weekend 2025 Tickets At Sefton Park

May 24, 2025 -

Conchita Wurst And Jj To Perform Together At Esc 2025 Eurovision Village

May 24, 2025

Conchita Wurst And Jj To Perform Together At Esc 2025 Eurovision Village

May 24, 2025 -

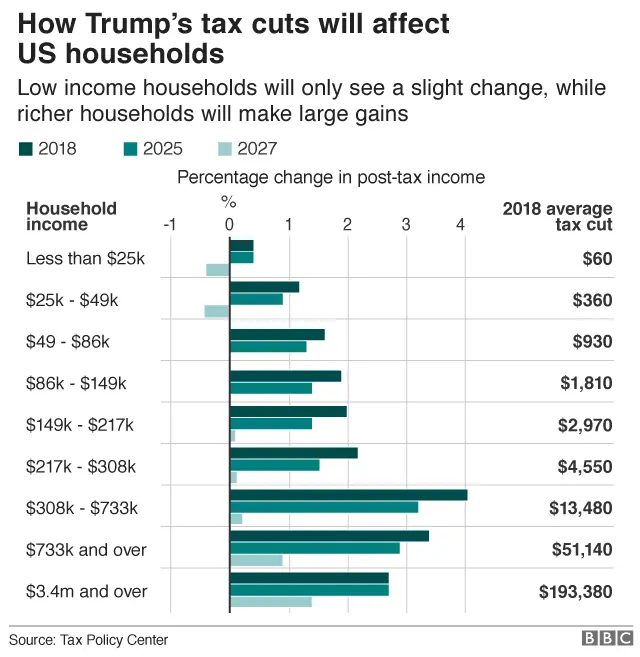

Positive Horoscope Outlook 5 Zodiac Signs On April 14 2025

May 24, 2025

Positive Horoscope Outlook 5 Zodiac Signs On April 14 2025

May 24, 2025 -

Apple Stock Investment Analyzing A 254 Price Target

May 24, 2025

Apple Stock Investment Analyzing A 254 Price Target

May 24, 2025 -

Demna At Gucci Analyzing The Impact Of The New Creative Director

May 24, 2025

Demna At Gucci Analyzing The Impact Of The New Creative Director

May 24, 2025

Latest Posts

-

Jonathan Groffs Just In Time A Night Of Support From Broadway Friends

May 24, 2025

Jonathan Groffs Just In Time A Night Of Support From Broadway Friends

May 24, 2025 -

Broadways Just In Time Star Studded Opening Night For Jonathan Groff

May 24, 2025

Broadways Just In Time Star Studded Opening Night For Jonathan Groff

May 24, 2025 -

Jonathan Groffs Just In Time Photos From The Opening Night Celebration

May 24, 2025

Jonathan Groffs Just In Time Photos From The Opening Night Celebration

May 24, 2025 -

Jonathan Groffs Just In Time Broadway Debut Lea Michele Daniel Radcliffe And More Celebrate

May 24, 2025

Jonathan Groffs Just In Time Broadway Debut Lea Michele Daniel Radcliffe And More Celebrate

May 24, 2025 -

Is Jonathan Groffs Just In Time Performance Tony Worthy

May 24, 2025

Is Jonathan Groffs Just In Time Performance Tony Worthy

May 24, 2025