How Climate Risk Affects Your Creditworthiness For A Home Purchase

Table of Contents

Increased Insurance Premiums and Difficulty Obtaining Coverage

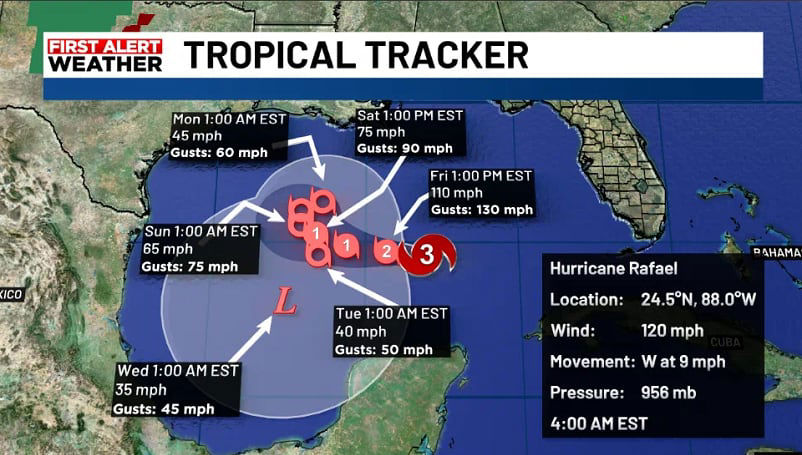

The increasing frequency and severity of extreme weather events like floods, wildfires, and hurricanes are dramatically increasing insurance premiums in high-risk areas. This, in turn, can significantly impact your creditworthiness.

Rising premiums due to climate-related damage:

- Examples of specific climate events impacting premiums: Hurricane Ida in Louisiana resulted in massive insurance claims, leading to increased premiums for homeowners across the state. Similarly, the devastating California wildfires have caused a surge in homeowners insurance costs in affected regions. The increasing number of severe hailstorms across the Midwest is also driving up insurance rates.

- Potential for insurers to deny coverage in high-risk zones: Many insurance companies are now refusing to renew policies or offer new coverage in areas deemed high-risk due to climate change. This leaves homeowners in these areas vulnerable and without crucial protection.

- Impact on credit scores due to late or missed payments: Higher insurance premiums can strain household budgets, making it challenging to afford monthly payments. Late or missed payments, whether for insurance or other bills, can negatively affect your credit score, making it harder to secure a mortgage or other loans in the future.

Impact on Loan Approval:

Mortgage lenders often require proof of adequate homeowner's insurance as a condition for loan approval. Difficulty obtaining sufficient coverage, or facing drastically increased premiums, can directly impact your ability to secure a mortgage. Lenders may even deny your application altogether if they perceive the climate risk as too high. This highlights the crucial link between climate risk, insurance, and your creditworthiness.

Property Value Depreciation due to Climate Change

Properties located in areas prone to climate-related disasters, such as coastal regions vulnerable to flooding or areas at high risk of wildfires, are experiencing significant value depreciation.

Decreased property values in high-risk zones:

- Examples of property values declining: Homes in floodplains are consistently showing lower resale values compared to similar properties in safer locations. Similarly, properties near wildfire-prone forests have seen substantial value decreases after recent fires, reflecting both the immediate damage and the long-term risk.

- Impact on homeowner equity: Decreased property values directly reduce homeowner equity, potentially impacting your ability to leverage your home's value for refinancing or securing loans. This decrease in equity can significantly limit your financial options.

- Impact on ability to refinance or secure other loans: Reduced equity makes it more challenging to refinance your mortgage at a lower interest rate or obtain other loans using your home as collateral. This can restrict your financial flexibility and increase your overall financial burden.

The impact of climate-related disclosures on property values:

Mandatory climate-related disclosures, increasingly common in many jurisdictions, require sellers to reveal information about their property's climate risks. While meant to inform buyers, these disclosures can also negatively influence market values, particularly for properties located in high-risk zones. This added transparency further impacts buyer interest and property value.

Government Regulations and Climate-Related Policies

Government regulations and climate-related policies are also playing a crucial role in shaping the landscape of homeownership and mortgage lending.

Floodplain regulations and building codes:

- Examples of regulations impacting construction and renovation: Stricter building codes in flood-prone areas often mandate elevated foundations, flood-resistant materials, and other costly upgrades. These regulations increase construction and renovation costs, potentially affecting property values and lending decisions.

- Influence on lending decisions: Lenders often consider the compliance of properties with relevant building codes and regulations before approving a mortgage. Non-compliance can lead to loan denial or higher interest rates.

Government financial incentives and programs:

Several governments are implementing financial incentives and programs aimed at mitigating climate risks and promoting sustainable homeownership. These programs can influence lending decisions by providing incentives for homeowners to invest in climate-resilient upgrades or to purchase properties in less climate-vulnerable areas. However, the availability and accessibility of these programs vary greatly by location.

Assessing Your Own Climate Risk and Mitigation Strategies

Proactively assessing your property's climate risk and implementing mitigation strategies is crucial to protect your creditworthiness and financial future.

Understanding your location's climate risk:

- Resources for assessing climate risk at a specific address: Many online tools and resources are available to help you determine your property's vulnerability to various climate-related threats. FEMA's flood maps and the NOAA's climate data are excellent starting points.

- Proactive measures to protect property value: Investing in flood mitigation measures like sump pumps and backflow valves, or implementing wildfire prevention strategies such as clearing brush around your property, can significantly reduce your risk and protect your property's value.

Strategies for reducing climate risk:

- Comprehensive insurance: Securing comprehensive insurance coverage, potentially including flood insurance and supplemental wind or wildfire coverage, is essential to protect yourself from financial losses due to climate-related events.

- Home improvements: Investing in climate-resilient home improvements, such as replacing windows with energy-efficient options or upgrading your roof to withstand high winds, can reduce your long-term costs and protect your property's value.

Conclusion

Climate risk is no longer a peripheral concern; it's a significant factor impacting your creditworthiness and ability to purchase a home. Understanding the potential impacts of increased insurance premiums, property value depreciation, and government regulations is crucial in navigating the home-buying process. By proactively assessing your property's climate risk and implementing mitigation strategies, you can protect your financial future and improve your chances of securing a mortgage. Don't underestimate the importance of understanding how climate risk affects your creditworthiness; take the necessary steps today to protect your investment. Learn more about mitigating climate risk and securing your financial future!

Featured Posts

-

Femicide A Growing Crisis And Its Underlying Factors

May 21, 2025

Femicide A Growing Crisis And Its Underlying Factors

May 21, 2025 -

Madrid Open Sabalenka And Zverev Progress To Next Round

May 21, 2025

Madrid Open Sabalenka And Zverev Progress To Next Round

May 21, 2025 -

Councillors Wifes Jail Sentence Statement On Migrant Hotel Remarks

May 21, 2025

Councillors Wifes Jail Sentence Statement On Migrant Hotel Remarks

May 21, 2025 -

Wtt Star Contender Chennai India Fields Unprecedented 19 Player Team

May 21, 2025

Wtt Star Contender Chennai India Fields Unprecedented 19 Player Team

May 21, 2025 -

Are American Workers Ready For The Reshoring Of Manufacturing Jobs

May 21, 2025

Are American Workers Ready For The Reshoring Of Manufacturing Jobs

May 21, 2025

Latest Posts

-

Wintry Mix Of Rain And Snow Impacts And Precautions

May 21, 2025

Wintry Mix Of Rain And Snow Impacts And Precautions

May 21, 2025 -

When Will Drier Weather Arrive A Look At The Forecasts

May 21, 2025

When Will Drier Weather Arrive A Look At The Forecasts

May 21, 2025 -

Driving In A Wintry Mix Of Rain And Snow Safety Tips

May 21, 2025

Driving In A Wintry Mix Of Rain And Snow Safety Tips

May 21, 2025 -

Drier Weather Ahead How To Stay Safe And Prepared

May 21, 2025

Drier Weather Ahead How To Stay Safe And Prepared

May 21, 2025 -

Preparing For Drier Weather Tips And Advice

May 21, 2025

Preparing For Drier Weather Tips And Advice

May 21, 2025