How Ind AS 117 Is Revolutionizing The Indian Insurance Landscape

Table of Contents

Ind AS 117, also known as Insurance Contracts, is a crucial accounting standard aligning Indian Generally Accepted Accounting Principles (GAAP) with International Financial Reporting Standards (IFRS 17). It represents a major shift from previous accounting practices, promising enhanced transparency and comparability within the Indian insurance market. This move towards global accounting standards aims to improve investor confidence and facilitate better cross-border comparisons.

Key Changes Introduced by Ind AS 117

Ind AS 117 introduces several fundamental changes impacting how insurance companies account for their contracts and liabilities.

Impact on Revenue Recognition

Ind AS 117 significantly alters revenue recognition principles. The previous methods often resulted in inconsistent revenue reporting across insurers. Under Ind AS 117:

- Contractual Service Margin: Revenue is recognized based on the "contractual service margin," representing the insurer's expected profit over the life of the insurance contract. This differs from previous practices where revenue might be recognized upfront or linearly.

- Timing of Revenue Recognition: Revenue is now recognized over the period the insurer provides insurance coverage, reflecting the ongoing service provided to the policyholder. This results in a smoother recognition of revenue compared to the previous methods.

- Impact on Financial Statements: The change in revenue recognition affects the insurer's income statement, balance sheet, and cash flow statement, leading to more accurate reflection of financial performance over time. This shift necessitates a more robust and granular approach to financial modeling and forecasting. (Keywords: Ind AS 117 Revenue Recognition, Insurance Contract Revenue, IFRS 17 Impact on India)

Treatment of Insurance Liabilities

The measurement and reporting of insurance liabilities are fundamentally changed under Ind AS 117. This includes:

- Fulfillment Cash Flows: Liabilities are now measured based on the estimated "fulfillment cash flows," representing the expected future cash outflows associated with fulfilling the insurance contract. This involves a more sophisticated approach to assessing future claims.

- Risk-Adjusted Discount Rates: The calculation of present values considers risk-adjusted discount rates, reflecting the uncertainty inherent in estimating future cash flows. This provides a more realistic valuation of insurance liabilities.

- Impact on Solvency Ratios: The revised liability measurement significantly impacts solvency ratios, requiring insurers to maintain higher capital reserves to absorb potential future claims. The implications for regulatory capital requirements are significant. (Keywords: Ind AS 117 Liabilities, Insurance Liability Measurement, Solvency II implications)

Enhanced Financial Reporting and Transparency

Ind AS 117 considerably improves the quality and comparability of financial reporting for insurance companies. This leads to:

- Improved Disclosure Requirements: The standard mandates detailed disclosures about insurance contracts, liabilities, and the methods used to measure them. This enhanced transparency fosters greater understanding by stakeholders.

- Better Understanding of Insurer Performance: The more accurate and consistent reporting enables investors and analysts to better assess the financial performance and health of insurance companies.

- Increased Investor Confidence: The improved transparency and comparability ultimately lead to increased confidence in the Indian insurance market, attracting both domestic and international investment. (Keywords: Ind AS 117 Reporting, Insurance Financial Reporting, Transparency in Indian Insurance)

Challenges in Implementing Ind AS 117

The transition to Ind AS 117 presents considerable challenges for Indian insurers:

- System Upgrades: Existing IT systems often need significant upgrades to handle the complexities of the new accounting requirements.

- Data Collection: Gathering the necessary data for accurate liability measurement and revenue recognition can be resource-intensive and challenging.

- Staff Training: Insurers need to invest in training their staff on the intricacies of Ind AS 117 to ensure accurate implementation.

- Potential Impact on Operational Efficiency: The initial stages of implementation might disrupt operational efficiency, requiring careful planning and resource allocation. (Keywords: Ind AS 117 Implementation Challenges, IFRS 17 Implementation in India)

Impact on Various Stakeholders

The adoption of Ind AS 117 has far-reaching consequences across the insurance ecosystem.

Insurers

Ind AS 117 necessitates changes in insurers' financial reporting processes, risk management strategies, and capital planning. It pushes insurers to embrace a more sophisticated approach to actuarial modeling and risk assessment.

Investors

The improved quality and comparability of financial information empower investors to make more informed decisions. The increased transparency reduces information asymmetry and promotes a more efficient allocation of capital within the market.

Regulators

Regulators play a crucial role in monitoring the implementation of Ind AS 117, ensuring compliance and maintaining the stability of the insurance sector. Their oversight is vital for a smooth transition and consistent application of the standard.

Policyholders

While the direct impact on policyholders might be less immediate, Ind AS 117 indirectly influences pricing strategies and potentially the overall financial health of insurers, ultimately impacting the long-term sustainability of insurance products.

Conclusion

Ind AS 117 represents a significant overhaul of accounting practices within the Indian insurance industry. The key changes, including revised revenue recognition, a more sophisticated treatment of insurance liabilities, and enhanced reporting requirements, are driving greater transparency and comparability. While implementation presents challenges, the long-term benefits—improved risk management, increased investor confidence, and a more robust and stable insurance sector—are substantial. Understanding and effectively implementing Ind AS 117 is crucial for success in the evolving Indian insurance market. Contact us today to learn how we can help your organization navigate this transition. (Keywords: Ind AS 117, Ind AS 117 Compliance, Ind AS 117 Implementation)

Featured Posts

-

Detski Festival Potochinja Edinstveno Iskustvo Za Detsa

May 14, 2025

Detski Festival Potochinja Edinstveno Iskustvo Za Detsa

May 14, 2025 -

Premier League Star On Arsenals Radar According To Ornstein

May 14, 2025

Premier League Star On Arsenals Radar According To Ornstein

May 14, 2025 -

Chiusure Stradali Lombardia Giro Di Milano Sanremo 2025

May 14, 2025

Chiusure Stradali Lombardia Giro Di Milano Sanremo 2025

May 14, 2025 -

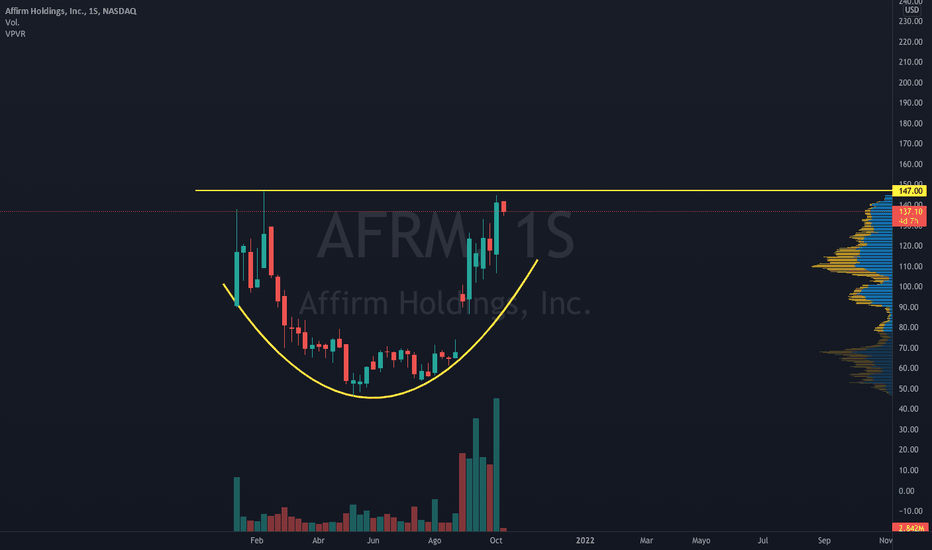

Trump Tariffs Did They Kill The Fintech Ipo Market The Affirm Afrm Example

May 14, 2025

Trump Tariffs Did They Kill The Fintech Ipo Market The Affirm Afrm Example

May 14, 2025 -

The Rise Of Cross National Artists In Eurovision

May 14, 2025

The Rise Of Cross National Artists In Eurovision

May 14, 2025