Trump Tariffs: Did They Kill The Fintech IPO Market? The Affirm (AFRM) Example

Table of Contents

The Fintech IPO Boom and Bust Leading Up to the Tariffs

The period leading up to the implementation of Trump tariffs witnessed a surge in Fintech IPOs. High valuations were commonplace, fueled by investor enthusiasm for innovative financial technology companies. This boom was characterized by:

- Successful Fintech IPOs (Pre-Tariffs): Examples include Square (SQ), Stripe (private but highly valued), and PayPal (PYPL) – already established players who benefited from the strong market conditions.

- Factors Contributing to the Boom: Technological advancements, increasing adoption of digital financial services, and substantial venture capital investment all contributed to a positive and optimistic outlook for the sector.

However, this exuberance began to wane in late 2018. Increased market volatility and growing economic uncertainty, foreshadowing the full impact of the trade war, started to dampen investor enthusiasm.

- Shift in Investor Sentiment: Concerns about global economic growth and the potential for a prolonged trade war led to a more cautious approach to investment, particularly in riskier sectors like Fintech.

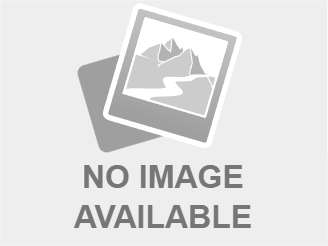

The Impact of Trump Tariffs on the US Economy and Investor Confidence

The Trump administration's tariffs, intended to protect American industries, created significant uncertainty and impacted various sectors of the US economy. The consequences included:

- Economic Consequences:

- Increased consumer prices due to higher import costs.

- Supply chain disruptions, leading to production delays and shortages.

- Decreased business investment due to uncertainty and higher costs.

- Impact on Investor Confidence: The tariffs fueled concerns about future economic growth and profitability, dampening investor confidence and risk appetite. This macroeconomic environment naturally impacted IPOs, especially within the inherently riskier tech sector, making investors more selective and demanding.

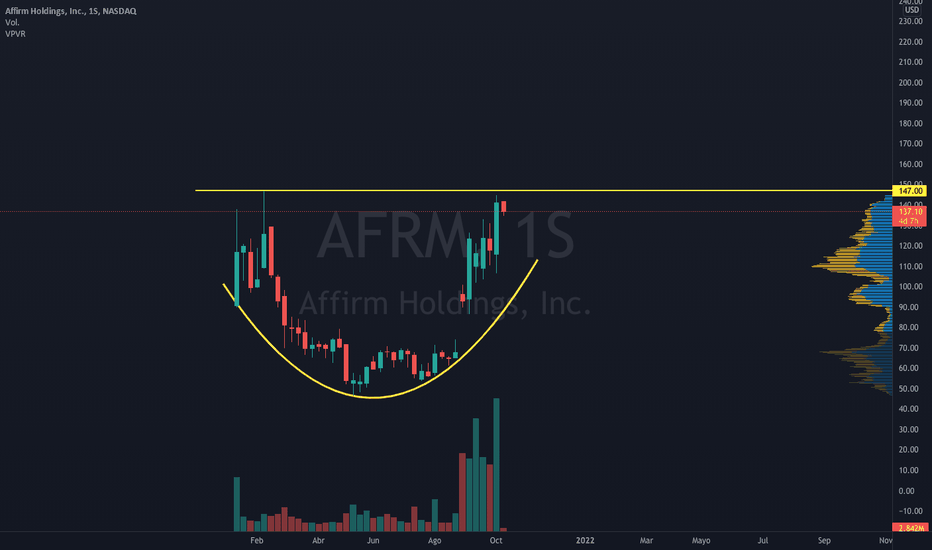

Affirm (AFRM)'s IPO in the Context of Trade Tensions

Affirm, a buy now, pay later (BNPL) fintech company, went public in January 2021, well after the escalation of the trade war. Analyzing its IPO in the context of the preceding trade tensions reveals several points:

- Affirm's IPO Details: The company's IPO occurred amidst ongoing economic uncertainty, though the initial market reaction was positive. However, its performance following the IPO needs to be analyzed in relation to the lingering impact of the tariffs and other macroeconomic factors.

- Factors Influencing Affirm's Post-IPO Performance: While the tariffs may have indirectly contributed to a more cautious market environment, other factors significantly impacted Affirm's stock price. These included overall market conditions, the company's own financial performance, investor sentiment towards the BNPL sector, and increasing competition.

Alternative Explanations for the Fintech IPO Slowdown

It's crucial to acknowledge that the slowdown in the Fintech IPO market wasn't solely attributable to Trump tariffs. Several other factors played a role:

- Alternative Explanations:

- Changes in interest rates impacting valuations and investment decisions.

- Overall market corrections independent of trade policy.

- Increased regulatory scrutiny of the Fintech sector. These factors likely interacted with, and potentially exacerbated, the effects of the tariffs, creating a more challenging environment for Fintech IPOs.

Conclusion

While definitively proving a direct causal link between Trump tariffs and the slowdown in the Fintech IPO market requires further research, this analysis of Affirm (AFRM)'s IPO offers valuable insight. The interplay between macroeconomic factors, such as the tariffs, and investor sentiment is complex. The indirect impact of trade policies on market dynamics is undeniable. While other factors undeniably contributed to the slowdown, the uncertainty created by the Trump tariffs likely played a role in shaping investor behavior and affecting the timing and success of Fintech IPOs. Further research into the impact of Trump tariffs and other macroeconomic factors on the Fintech IPO market is essential for investors and entrepreneurs alike. Understanding the complexities of the relationship between trade policy and the success of Fintech IPOs is crucial for navigating future market conditions.

Featured Posts

-

Yevrobachennya 2025 Opera V Sauni Ochikuvannya Ta Prognozi

May 14, 2025

Yevrobachennya 2025 Opera V Sauni Ochikuvannya Ta Prognozi

May 14, 2025 -

Trafico De Armas En Republica Dominicana Un Corredor Clave Hacia Haiti

May 14, 2025

Trafico De Armas En Republica Dominicana Un Corredor Clave Hacia Haiti

May 14, 2025 -

The Judd Sisters Unveiling Family History In A New Docuseries

May 14, 2025

The Judd Sisters Unveiling Family History In A New Docuseries

May 14, 2025 -

Ipo Slowdown The Role Of Tariffs And Global Uncertainty

May 14, 2025

Ipo Slowdown The Role Of Tariffs And Global Uncertainty

May 14, 2025 -

Mission Impossible Dead Reckoning Tom Cruises High Altitude Stunt Revealed

May 14, 2025

Mission Impossible Dead Reckoning Tom Cruises High Altitude Stunt Revealed

May 14, 2025