How Net Asset Value (NAV) Affects Your Amundi Dow Jones Industrial Average UCITS ETF Investment

Table of Contents

What is Net Asset Value (NAV) and How is it Calculated for the Amundi DJIA UCITS ETF?

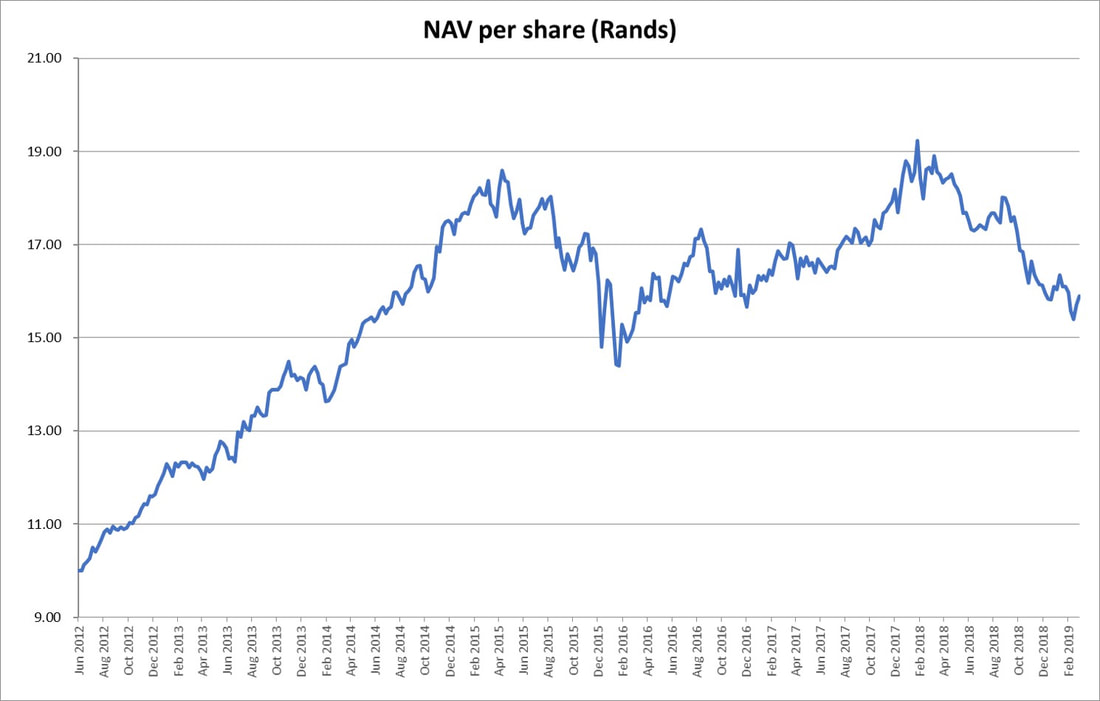

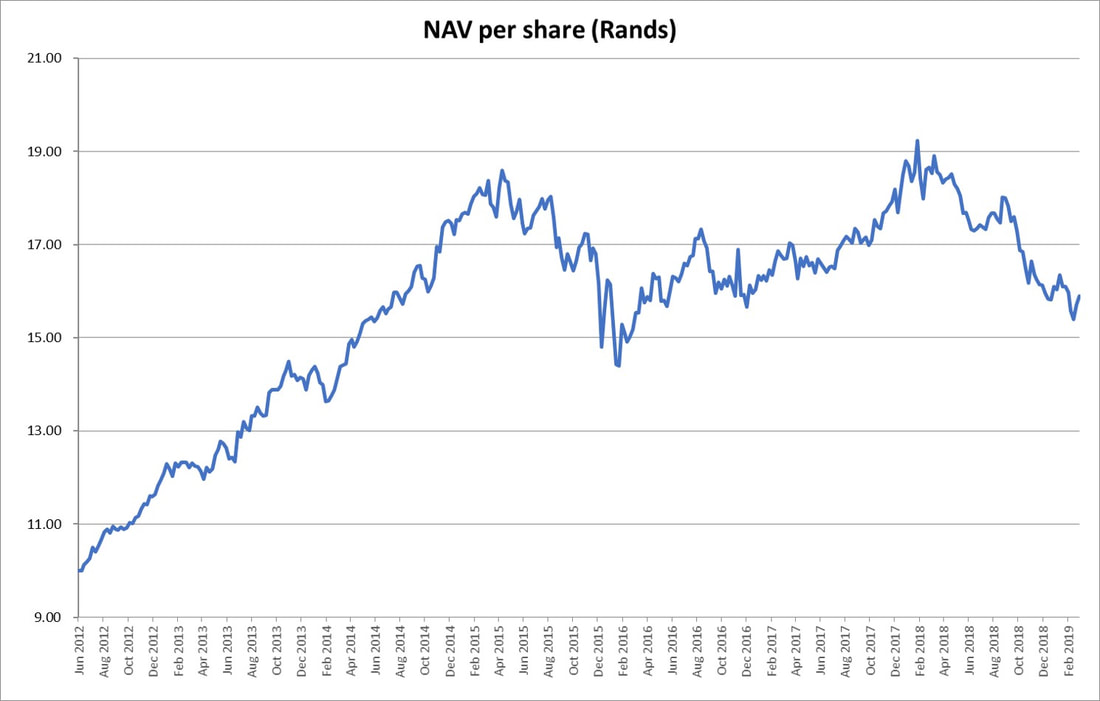

Net Asset Value (NAV) represents the total value of an ETF's underlying assets, minus its liabilities, divided by the number of outstanding shares. In simpler terms, it's the net worth of the ETF per share. For the Amundi Dow Jones Industrial Average UCITS ETF, this calculation is directly linked to the performance of the 30 constituent companies of the Dow Jones Industrial Average (DJIA). The ETF aims to track the DJIA's performance, so its NAV reflects the aggregate value of these 30 blue-chip stocks.

The NAV of the Amundi DJIA UCITS ETF is calculated daily, typically at the close of the market. This daily calculation ensures that the fund's value accurately reflects the current market prices of the underlying assets.

- Definition of NAV: The net asset value per share of an ETF.

- Components of NAV calculation for this specific ETF: The market value of the 30 DJIA components, less any liabilities (like management fees).

- How market fluctuations impact daily NAV: Positive market movements in the DJIA generally increase the ETF's NAV, while negative movements decrease it.

- Where to find the daily NAV for this ETF: You can typically find the daily NAV on the Amundi website, major financial news websites (like Yahoo Finance or Google Finance), and your brokerage account statement.

How NAV Fluctuations Affect Your Investment in the Amundi DJIA UCITS ETF

Changes in the Net Asset Value (NAV) directly impact the value of your investment. While the ETF's share price generally tracks its NAV closely, there might be a slight difference, known as tracking error. This error can stem from various factors, including transaction costs and the ETF's management fees.

Several factors influence NAV changes:

-

Market movements of DJIA components: Positive or negative performance in the underlying DJIA stocks will directly affect the ETF's NAV. A bull market typically leads to NAV increases, while a bear market leads to decreases.

-

Dividends: When the companies within the DJIA pay dividends, the ETF receives these dividends, which usually increase the NAV.

-

Expenses: Management fees and other operational expenses reduce the NAV over time.

-

Impact of bull and bear markets on NAV: Bull markets generally increase NAV, while bear markets decrease it.

-

Relationship between NAV and ETF share price (explain tracking difference and why they might not be identical): While ideally they're very close, minor differences (tracking error) can arise due to trading costs and other factors.

-

Influence of dividends on NAV: Dividends received by the ETF from underlying companies increase the NAV.

-

Effect of management fees on NAV: Management fees slightly decrease the NAV over time.

Using NAV to Make Informed Investment Decisions with the Amundi DJIA UCITS ETF

Monitoring the Net Asset Value (NAV) is essential for tracking your investment's performance. By regularly checking the NAV, you can see the growth or decline of your investment over time. This data, however, shouldn't be the sole basis for investment decisions.

- Strategies for monitoring NAV changes: Check the NAV daily, weekly, or monthly depending on your investment strategy. Many brokerage platforms provide easy access to this information.

- Benchmarking against similar ETFs using NAV: Compare the NAV performance of the Amundi DJIA UCITS ETF to similar ETFs tracking the DJIA to assess its relative performance.

- Timing investment strategies based on NAV trends (caution against short-term trading based solely on NAV): While NAV trends can inform investment strategies, avoid short-term trading decisions based solely on minor NAV fluctuations. A long-term perspective is crucial.

- Importance of considering broader investment strategy alongside NAV analysis: NAV is a vital piece of information, but it should be considered alongside your overall financial goals and risk tolerance.

Conclusion

Understanding Net Asset Value is crucial for successfully investing in the Amundi Dow Jones Industrial Average UCITS ETF. Regularly monitoring NAV fluctuations allows you to track your investment's progress and make more informed decisions. However, remember to consider NAV within a broader investment strategy tailored to your risk tolerance and long-term financial objectives. Don't rely solely on short-term NAV movements. Instead, focus on the long-term potential of the underlying DJIA companies. To learn more about Net Asset Value and optimize your ETF investment strategy, explore resources available on the Amundi website and consult with a financial advisor. Regularly reviewing your investment's Net Asset Value will help ensure your portfolio aligns with your financial goals.

Featured Posts

-

Planned M62 Westbound Closure Manchester To Warrington Resurfacing

May 25, 2025

Planned M62 Westbound Closure Manchester To Warrington Resurfacing

May 25, 2025 -

Svadby Na Kharkovschine 600 Brakov Za Mesyats Tendentsii I Statistika

May 25, 2025

Svadby Na Kharkovschine 600 Brakov Za Mesyats Tendentsii I Statistika

May 25, 2025 -

10 Let Posle Pobedy Na Evrovidenii Gde Seychas Pobediteli

May 25, 2025

10 Let Posle Pobedy Na Evrovidenii Gde Seychas Pobediteli

May 25, 2025 -

Moje Doswiadczenia Z Porsche Cayenne Gts Coupe Warto Kupic

May 25, 2025

Moje Doswiadczenia Z Porsche Cayenne Gts Coupe Warto Kupic

May 25, 2025 -

Dissidents Chinois En France Face A La Repression De Pekin

May 25, 2025

Dissidents Chinois En France Face A La Repression De Pekin

May 25, 2025

Latest Posts

-

Fedor Lavrov Pavel I Trillery I Lyubov K Ostrym Oschuscheniyam

May 25, 2025

Fedor Lavrov Pavel I Trillery I Lyubov K Ostrym Oschuscheniyam

May 25, 2025 -

K 100 Letiyu Innokentiya Smoktunovskogo Film Menya Vela Kakaya To Sila

May 25, 2025

K 100 Letiyu Innokentiya Smoktunovskogo Film Menya Vela Kakaya To Sila

May 25, 2025 -

Euronext Amsterdam Stocks Surge 8 After Trump Tariff Pause

May 25, 2025

Euronext Amsterdam Stocks Surge 8 After Trump Tariff Pause

May 25, 2025 -

Gryozy Lyubvi Ili Ilicha V Trude Analiz Syuzheta I Personazhey

May 25, 2025

Gryozy Lyubvi Ili Ilicha V Trude Analiz Syuzheta I Personazhey

May 25, 2025 -

Lyudi Lyubyat Schekotat Nervy Fedor Lavrov O Pavle I Trillerakh I Refleksii

May 25, 2025

Lyudi Lyubyat Schekotat Nervy Fedor Lavrov O Pavle I Trillerakh I Refleksii

May 25, 2025