Euronext Amsterdam Stocks Surge 8% After Trump Tariff Pause

Table of Contents

The Impact of the Tariff Pause on Euronext Amsterdam Stocks

The temporary pause primarily impacted tariffs targeting specific European goods, including certain manufactured products and technological components. These tariffs, implemented during the Trump administration, had previously created considerable uncertainty and hampered trade between Europe and the United States. The subsequent lifting, even temporarily, resulted in a significant positive reaction within the Euronext Amsterdam market.

- Key Sectors Affected: The technology and manufacturing sectors experienced the most substantial gains, reflecting their sensitivity to trade policies.

- Percentage Increase: Several key indices on Euronext Amsterdam saw double-digit percentage increases in the days following the tariff pause announcement. Specific company stock prices also saw substantial gains, with some exceeding 15%.

- Market Reaction: The immediate market reaction was characterized by increased trading volume and a surge in buying activity, indicating strong investor confidence in a more positive trade environment.

The relationship between the tariff pause and investor sentiment is clearly positive. The lifting of these trade barriers signaled a potential easing of trade tensions and reduced uncertainty, thereby boosting investor confidence and leading to the observed market surge. However, uncertainty remains surrounding the permanence of this tariff pause, and any potential future reinstatement could significantly impact the market.

Analyzing the Long-Term Implications for Euronext Amsterdam

While the immediate impact is positive, the long-term implications for Euronext Amsterdam require careful consideration. The potential for sustained growth in the affected sectors is significant, provided the positive trade momentum continues. However, several factors could influence the future performance of the market.

- Potential Risks and Challenges: Geopolitical instability, fluctuations in the global economy, and the potential re-implementation of tariffs all represent significant risks. Furthermore, the competitive landscape within Europe and globally needs careful consideration.

- Geopolitical Implications: The development underscores the intricate relationship between trade policy, investor sentiment, and market performance. Any future shifts in global trade relations could significantly impact Euronext Amsterdam.

- Expert Opinions: Many financial analysts forecast continued growth for Euronext Amsterdam, but they also emphasize the importance of monitoring evolving geopolitical factors.

The overall impact on the European economy is likely to be positive if the tariff pause leads to increased trade and investment. However, the long-term effects will depend on various factors, including the broader global economic outlook and the resolution of ongoing trade disputes.

Investment Strategies Following the Euronext Amsterdam Surge

The surge in Euronext Amsterdam stocks presents both opportunities and risks for investors. A cautious yet strategic approach is crucial.

- Investment Opportunities and Risks: While some sectors offer attractive investment opportunities, investors should carefully assess the specific risks associated with each company and sector. Diversification across different sectors and asset classes can mitigate risk.

- Investment Strategies: A diversified portfolio, incorporating risk management techniques like stop-loss orders, is recommended. Careful analysis of individual company performance and financial health is vital.

- Company Research: Thorough research into individual companies listed on Euronext Amsterdam is essential before making any investment decisions.

It's crucial to conduct thorough due diligence before investing in any Euronext Amsterdam stock. Understanding the company's financial performance, future prospects, and the broader market conditions is vital for making informed investment decisions.

Conclusion

The 8% surge in Euronext Amsterdam stocks after the pause of Trump-era tariffs represents a significant development with short-term and long-term implications. While the temporary reprieve provides opportunities, investors must remain cautious and carefully consider potential risks. The future trajectory of Euronext Amsterdam stocks will depend on several factors, including the resolution of trade disputes and broader economic conditions. Understanding these intricacies is key for successful navigation of the Euronext Amsterdam market.

Call to Action: Stay informed about the dynamic situation on Euronext Amsterdam and the impact of future trade policies on European markets. Monitor key stocks and indices closely to make well-informed investment decisions in Euronext Amsterdam opportunities. Conduct thorough research before investing in Euronext Amsterdam stocks.

Featured Posts

-

The Underappreciated Value Of News Corp A Comprehensive Analysis

May 25, 2025

The Underappreciated Value Of News Corp A Comprehensive Analysis

May 25, 2025 -

Amira Al Zuhair Models For Zimmermann In Paris Fashion Week

May 25, 2025

Amira Al Zuhair Models For Zimmermann In Paris Fashion Week

May 25, 2025 -

Wildfire Speculation Analyzing The Market For Los Angeles Wildfire Bets

May 25, 2025

Wildfire Speculation Analyzing The Market For Los Angeles Wildfire Bets

May 25, 2025 -

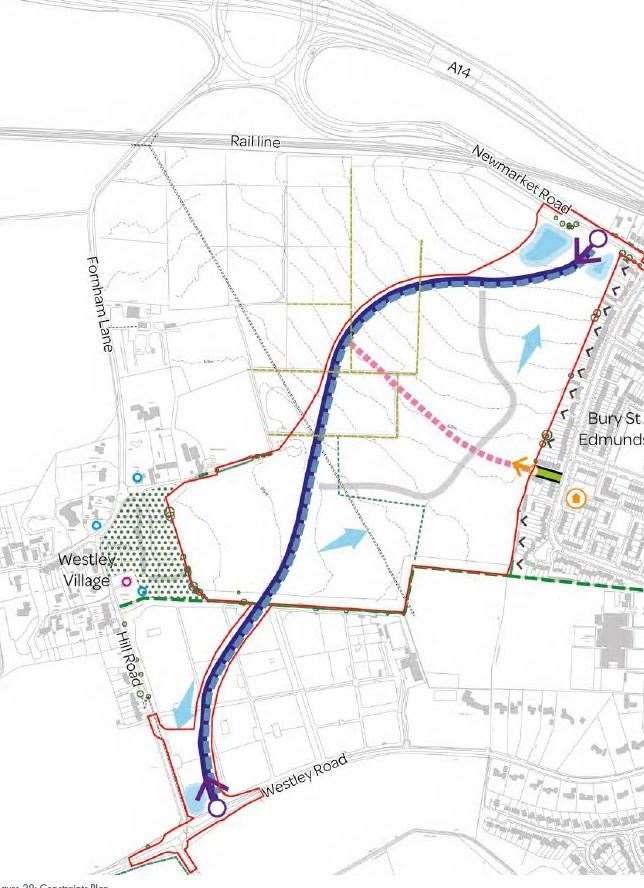

The M62 Relief Road Burys Unrealized Infrastructure Project

May 25, 2025

The M62 Relief Road Burys Unrealized Infrastructure Project

May 25, 2025 -

Apple Stock Wedbushs Long Term Bullish Prediction After Price Target Cut

May 25, 2025

Apple Stock Wedbushs Long Term Bullish Prediction After Price Target Cut

May 25, 2025

Latest Posts

-

New Evidence Implicates Najib Razak In French Submarine Bribery Case

May 25, 2025

New Evidence Implicates Najib Razak In French Submarine Bribery Case

May 25, 2025 -

The Problem With Thames Waters Executive Bonus Structure

May 25, 2025

The Problem With Thames Waters Executive Bonus Structure

May 25, 2025 -

Addressing Stock Market Valuation Worries Insights From Bof A

May 25, 2025

Addressing Stock Market Valuation Worries Insights From Bof A

May 25, 2025 -

Chinas Impact How The Auto Industry Responds To Evolving Market Dynamics

May 25, 2025

Chinas Impact How The Auto Industry Responds To Evolving Market Dynamics

May 25, 2025 -

The Dark Side Of Disaster Exploring The Market For Los Angeles Wildfire Bets

May 25, 2025

The Dark Side Of Disaster Exploring The Market For Los Angeles Wildfire Bets

May 25, 2025