Trump's Softer Tone On Fed Boosts US Dollar

Table of Contents

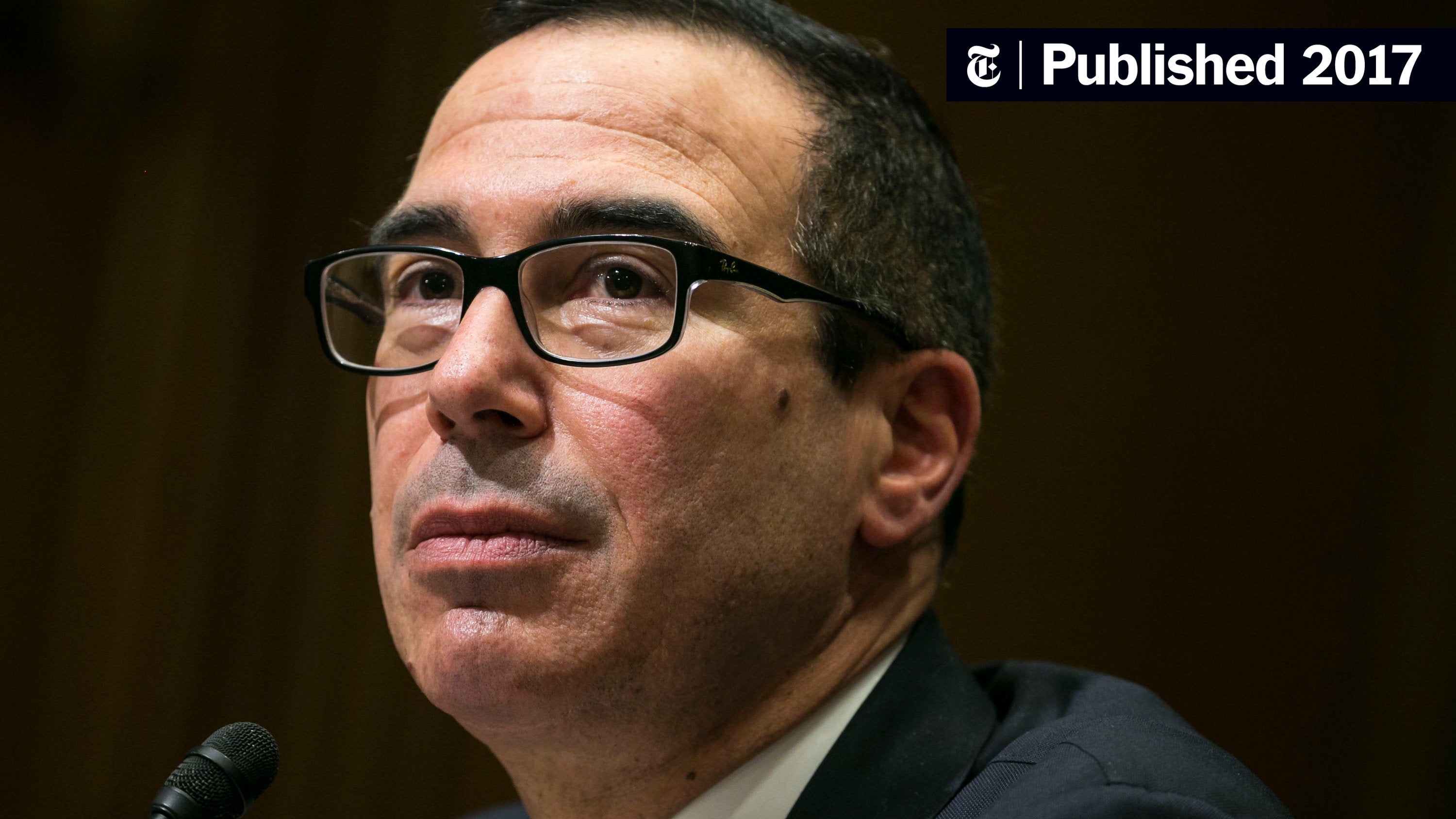

The Impact of Trump's Previous Criticism on the US Dollar

President Trump's past attacks on the Federal Reserve, often criticizing interest rate hikes and accusing the Fed of hindering economic growth, injected considerable uncertainty into the markets. This volatility significantly impacted investor confidence and, consequently, the US dollar's value.

- Market Volatility: Trump's unpredictable pronouncements on monetary policy created a climate of fear and uncertainty, leading to significant fluctuations in the currency markets.

- Currency Fluctuations: The US dollar experienced periods of both appreciation and depreciation as investors reacted to Trump's statements, creating a volatile and unpredictable environment.

- Economic Uncertainty: The constant barrage of criticism undermined confidence in the stability of US economic policy, impacting investor sentiment and negatively affecting the US dollar.

- Investor Confidence: Trump's attacks on the Fed's independence eroded investor confidence in the long-term stability of the US economy, making investors hesitant to hold US dollar assets. Examples include sharp drops in the dollar following particularly critical statements from the President.

Analyzing the Shift in Trump's Rhetoric

Recently, however, a noticeable shift has occurred in Trump's rhetoric regarding the Fed. While he hasn't completely abandoned his criticisms, his tone has become markedly more conciliatory. This change can potentially be attributed to several factors, including the approaching election and shifting economic conditions.

- Presidential Statements: A careful analysis of Trump's recent public comments and tweets reveals a less antagonistic approach towards the Fed Chair and its actions. For example, [insert specific quote from a recent Trump statement regarding the Fed].

- Federal Reserve Policy: The Fed's own policy adjustments, such as [mention specific Fed actions], may have also contributed to a calmer exchange between the President and the central bank.

- Economic Outlook: The evolving economic landscape, including [mention relevant economic indicators], may have influenced Trump to adopt a more measured approach.

- Political Influence: The upcoming election and the need to project an image of economic stability likely played a significant role in the President's shift in tone.

The Correlation Between Trump's Softer Tone and US Dollar Strength

The reduced political uncertainty stemming from Trump's less confrontational stance towards the Fed has directly contributed to increased investor confidence. This increased confidence has, in turn, led to a higher demand for the US dollar, resulting in its recent appreciation.

- Investor Sentiment: The shift in Trump's tone has improved investor sentiment regarding the US economy and its stability, making the US dollar a more attractive investment.

- Currency Appreciation: The reduced uncertainty has boosted the US dollar's value against other major currencies. Data from [mention a reliable source like the Bloomberg Dollar Spot Index] shows a clear correlation between the change in Trump's rhetoric and the rise of the dollar.

- Safe Haven Asset: The US dollar is often considered a safe haven asset during times of global economic uncertainty. The increased confidence following Trump's softened stance reinforced this status, leading to increased demand.

- Economic Growth: The improved investor confidence has also had a positive impact on expectations for future economic growth in the US, further contributing to the strengthening of the US dollar.

Other Factors Contributing to the US Dollar's Rise

While Trump's changed approach towards the Fed has undoubtedly contributed to the US dollar's rise, it's important to acknowledge other factors at play.

- Global Economics: Weakening economies in other parts of the world have made the US dollar a relatively more attractive investment.

- International Trade: Changes in global trade dynamics, including [mention relevant trade agreements or disputes], have influenced the value of the dollar.

- Geopolitical Risk: Increased geopolitical instability in other regions can lead to investors seeking the safety of the US dollar.

- Monetary Policy: The Fed's own monetary policies, independent of Trump's statements, continue to influence the value of the US dollar. These factors should be considered alongside Trump's influence.

Conclusion: Trump's Influence on the US Dollar - A Changing Landscape

In summary, while multiple factors influence the value of the US dollar, President Trump's shift to a softer tone regarding the Federal Reserve has demonstrably contributed to its recent strengthening. This underscores the significant interplay between political rhetoric and currency markets. Understanding this dynamic is crucial for investors and economists alike. The future impact of Trump's approach, especially as the election draws closer and economic conditions evolve, remains to be seen. It is vital to continue monitoring both Trump's Fed policy and related economic indicators to fully grasp the evolving situation. Stay informed about the latest developments by following reputable financial news sources and economic analysis to understand how Trump’s Fed policy continues to impact the US dollar’s value.

Featured Posts

-

77 Inch Lg C3 Oled Why Its My Favorite Tv

Apr 24, 2025

77 Inch Lg C3 Oled Why Its My Favorite Tv

Apr 24, 2025 -

The Dark Side Of Disaster Betting On The Los Angeles Wildfires

Apr 24, 2025

The Dark Side Of Disaster Betting On The Los Angeles Wildfires

Apr 24, 2025 -

Analyzing The Canadian Dollars Performance A Complex Currency Landscape

Apr 24, 2025

Analyzing The Canadian Dollars Performance A Complex Currency Landscape

Apr 24, 2025 -

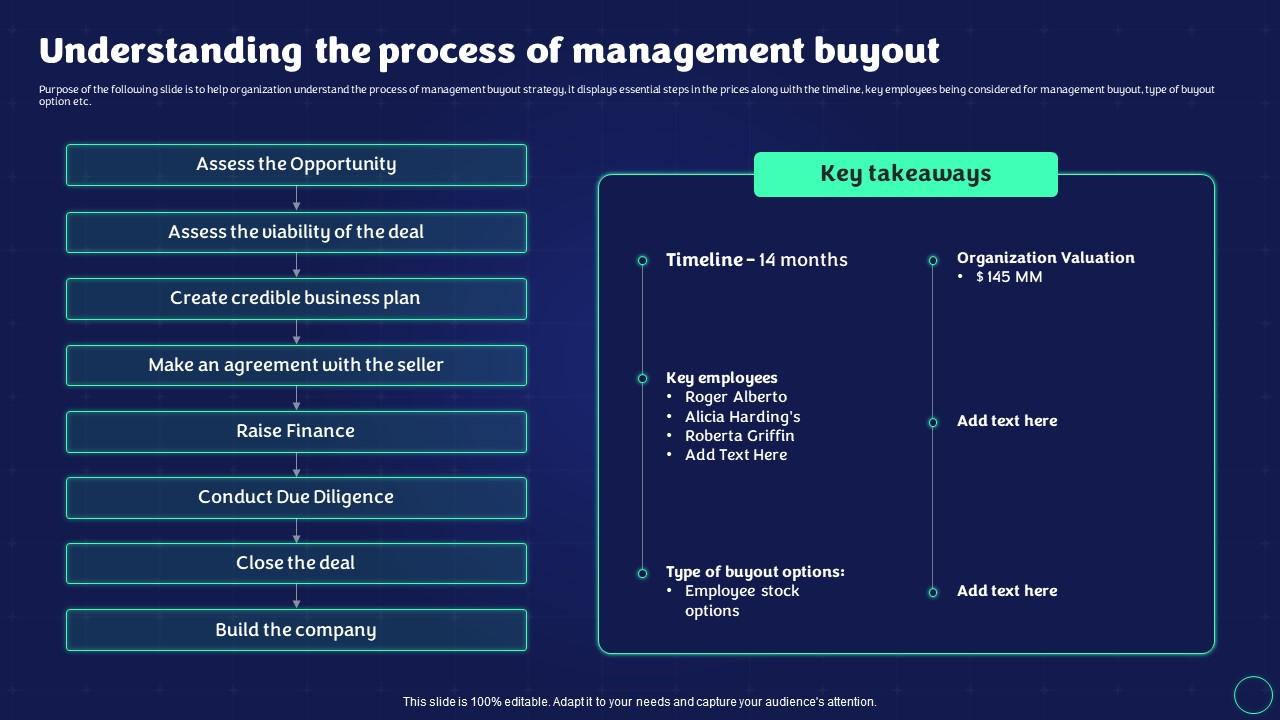

Chip Tester Utac A Chinese Buyout Firms Strategic Decision

Apr 24, 2025

Chip Tester Utac A Chinese Buyout Firms Strategic Decision

Apr 24, 2025 -

Understanding Hegseths Role In Trumps Communication Strategy

Apr 24, 2025

Understanding Hegseths Role In Trumps Communication Strategy

Apr 24, 2025