Indian Stock Market Soars: Sensex And Nifty's 1,400 & 23,800+ Point Rally Explained

Table of Contents

Key Factors Driving the Sensex and Nifty Rally

Several interconnected factors have contributed to the recent spectacular performance of the Sensex and Nifty. These can be broadly categorized into global sentiment, robust domestic economic strength, impressive corporate earnings, and a significant influx of foreign investment.

Positive Global Sentiment

The positive global sentiment has played a crucial role in bolstering the Indian stock market. Easing inflation in the US, coupled with positive global growth forecasts, has injected renewed confidence into international markets.

- Easing US Inflation: Lower inflation reduces the pressure on central banks to aggressively raise interest rates, creating a more favorable environment for global investment.

- Positive Global Growth Forecasts: Predictions of continued growth in major economies have encouraged investors to seek higher returns, and emerging markets like India often benefit.

- Strong Earnings Reports: Positive earnings reports from multinational companies have further enhanced global investor sentiment, creating a ripple effect on markets worldwide, including India's. This demonstrates the interconnectedness of the global economy and the impact of positive news on investor confidence.

Keywords: Global economic growth, Inflation, Foreign Institutional Investors (FIIs), global market trends, US inflation, global investment.

Domestic Economic Strength

The Indian economy's inherent strength has also acted as a powerful catalyst for this rally. Robust GDP growth, coupled with increased consumer spending and supportive government policies, has fueled investor confidence.

- Robust GDP Growth: India’s consistently strong GDP growth has showcased the country's economic resilience and potential for future expansion. This attracts both domestic and foreign investment.

- Increased Consumer Spending: A rise in consumer spending indicates a healthy domestic market and fuels demand for goods and services, driving further economic growth.

- Government Initiatives: Government policies focused on infrastructure development, digitalization, and tax reforms have further bolstered investor confidence, creating a positive feedback loop that strengthens the Indian stock market. These initiatives are aimed at long-term sustainable growth.

Keywords: Indian GDP growth, Consumer spending, Government policies, Infrastructure investment, Digital India, Tax reforms.

Strong Corporate Earnings

Impressive corporate earnings across various sectors have been instrumental in driving the Sensex and Nifty rally. The stellar performance of key sectors like IT, banking, and pharmaceuticals has significantly contributed to the overall market surge.

- IT Sector Boom: The IT sector's continued growth, driven by global demand for technology services, has boosted investor confidence.

- Banking Sector Strength: The robust performance of the banking sector reflects a healthy financial system and increased lending activity.

- Pharmaceutical Sector Growth: The pharmaceutical sector's consistent performance further bolsters the overall market strength, showcasing the diversity of the Indian economy.

- Individual Company Contributions: Specific companies within these sectors have reported outstanding earnings, further driving up stock prices and market indices.

Keywords: Corporate earnings, Sectoral performance, Stock market indices, Company performance, IT sector, Banking sector, Pharmaceutical sector.

Increased Foreign Investment

The increased participation of Foreign Institutional Investors (FIIs) has significantly fueled the market rally. FIIs have shown a renewed interest in the Indian stock market due to the positive outlook on India’s long-term growth prospects.

- Increased FII Flows: A significant influx of foreign investment, both FDI and portfolio investment, has injected liquidity into the market, driving up prices.

- Positive Outlook on India: FIIs are increasingly optimistic about India's economic fundamentals and long-term growth potential, leading to sustained investments.

- Global Investment Flows: India's emerging market status and robust growth have attracted global investment flows, further strengthening the market.

Keywords: Foreign Institutional Investors (FIIs), Foreign Direct Investment (FDI), Portfolio investment, Global investment flows, Emerging markets.

Analyzing the Sustainability of the Indian Stock Market Rally

While the recent rally has been impressive, it's crucial to analyze its sustainability and consider potential risks.

Potential Risks and Challenges

Several factors could potentially impact the market's upward trajectory:

- Global Economic Slowdown: A global economic slowdown could negatively impact Indian exports and investor sentiment.

- Geopolitical Instability: Geopolitical tensions and uncertainties could lead to market volatility and decreased investor confidence.

- Inflationary Pressures: Persistent inflationary pressures could erode consumer spending and corporate profits, impacting market performance.

- Sectoral Vulnerabilities: Specific sectors may be more vulnerable to these risks than others, requiring careful analysis.

Keywords: Market volatility, Geopolitical risks, Inflation risks, Economic slowdown, Global recession.

Long-Term Outlook

Despite potential risks, the long-term outlook for the Indian stock market remains positive. The country's young and growing population, increasing consumer base, and ongoing government reforms continue to present significant opportunities for long-term growth. However, investors should adopt a balanced and cautious approach.

Keywords: Long-term investment, Market outlook, Stock market prediction, Investment strategy, Indian economy forecast.

Conclusion: Understanding the Indian Stock Market's Recent Surge and Future Prospects

The recent surge in the Indian stock market, marked by significant gains in the Sensex and Nifty, is attributable to a confluence of factors including a positive global sentiment, robust domestic economic strength, strong corporate earnings, and increased foreign investment. While this rally has been impressive, understanding potential risks such as global economic slowdowns, geopolitical instability, and inflationary pressures is crucial. The long-term outlook for the Indian stock market remains promising, but investors should adopt a well-informed and diversified investment strategy. To capitalize on the opportunities presented by the Indian stock market, it's recommended to learn more about investing in the Indian stock market, understand the Sensex and Nifty indices, and consult with a financial advisor to create a suitable investment strategy tailored to your risk tolerance and financial goals. The Indian stock market offers exciting potential, but thorough research and careful planning are essential for success.

Featured Posts

-

Sensex Today Live Updates 100 Points Higher Nifty Above 17 950

May 10, 2025

Sensex Today Live Updates 100 Points Higher Nifty Above 17 950

May 10, 2025 -

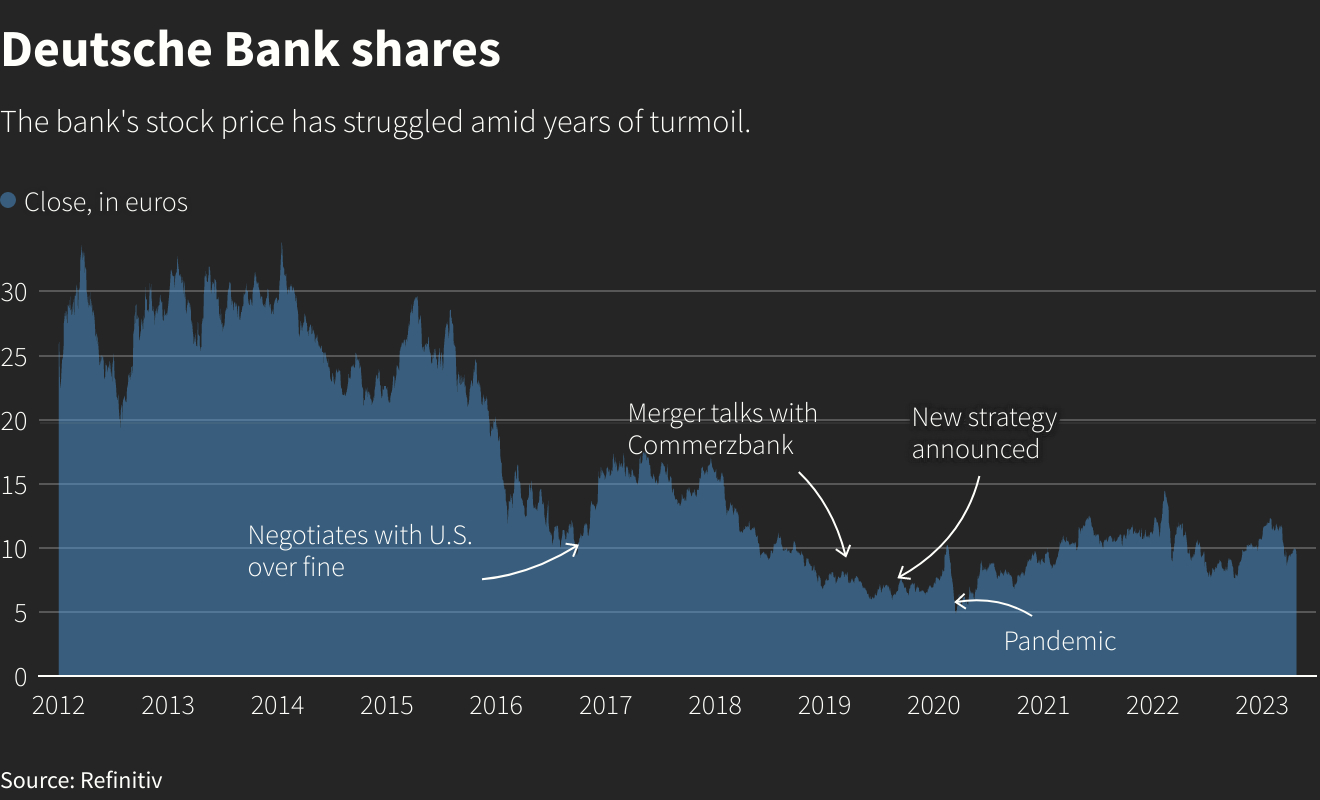

Deutsche Banks New Deals Team Targets Growth In Defense Finance

May 10, 2025

Deutsche Banks New Deals Team Targets Growth In Defense Finance

May 10, 2025 -

Investing In Palantir In 2025 A 40 Growth Potential Analysis

May 10, 2025

Investing In Palantir In 2025 A 40 Growth Potential Analysis

May 10, 2025 -

Palantirs Potential Can It Achieve A Trillion Dollar Market Capitalization By The End Of The Decade

May 10, 2025

Palantirs Potential Can It Achieve A Trillion Dollar Market Capitalization By The End Of The Decade

May 10, 2025 -

To Buy Or Not To Buy Palantir Stock Before May 5th A Data Driven Approach

May 10, 2025

To Buy Or Not To Buy Palantir Stock Before May 5th A Data Driven Approach

May 10, 2025