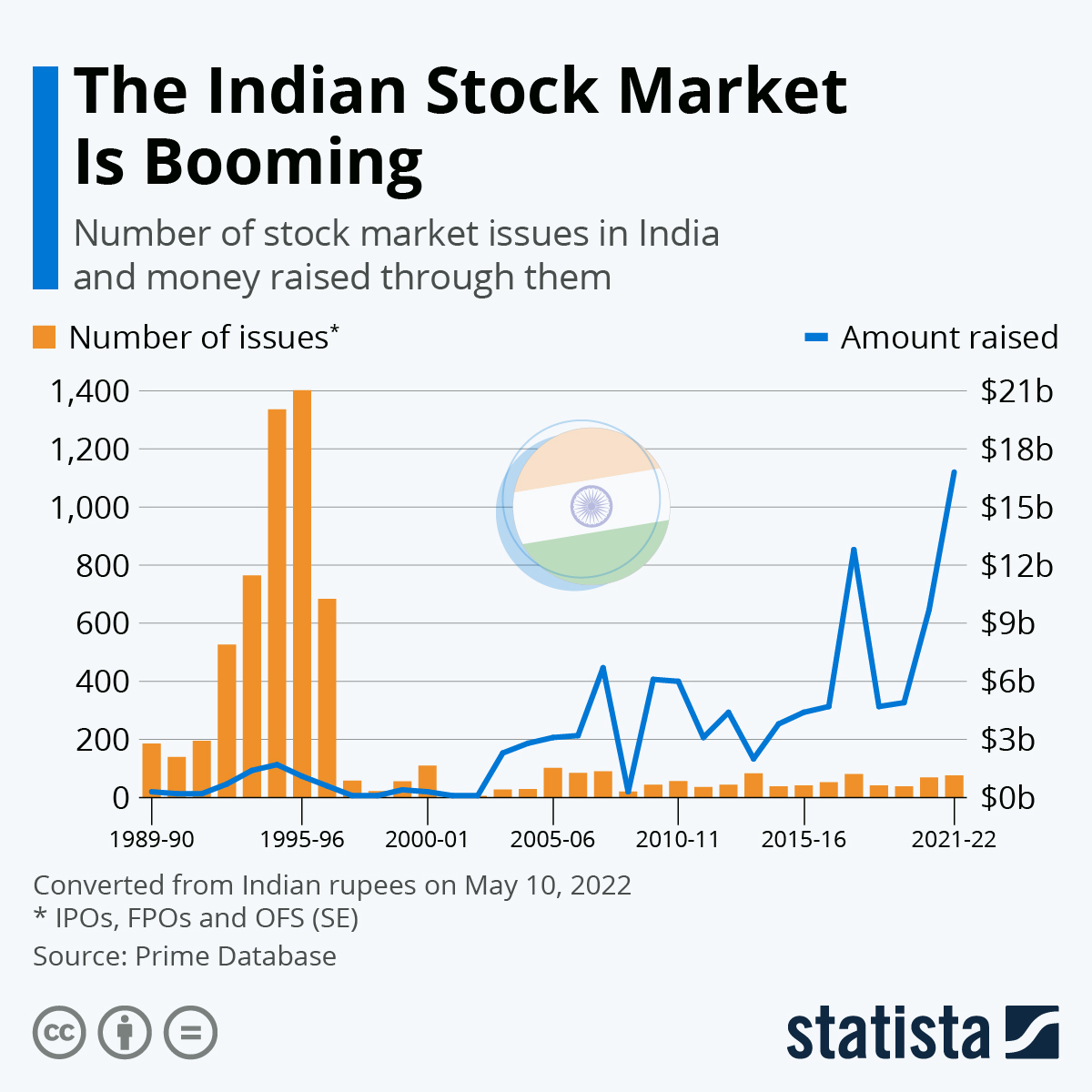

Indian Stock Market: Understanding The Current Bullish Momentum

Table of Contents

Key Factors Driving the Bullish Momentum

Several key factors contribute to the current bullish momentum in the Indian stock market. Analyzing these drivers is essential for understanding the market's trajectory and potential for future growth.

Economic Growth and Positive Macroeconomic Indicators

India's robust economic growth is a primary driver of the bullish trend. Positive macroeconomic indicators paint a promising picture for investors.

- Strong GDP growth projections: The Indian economy is projected to maintain a healthy GDP growth rate, exceeding many global economies. This signifies strong underlying economic fundamentals.

- Rising consumer spending: Increased consumer spending demonstrates a healthy domestic economy and fuels demand for goods and services, positively impacting corporate earnings.

- Improving infrastructure: Government initiatives focused on infrastructure development are boosting economic activity and attracting further investment. The "Make in India" initiative, for example, is creating a favorable environment for domestic manufacturing and job creation.

- Positive global economic outlook (impact on Indian markets): While global uncertainties exist, a relatively positive global economic outlook generally benefits emerging markets like India, attracting foreign investment.

The combination of these factors fosters investor confidence and fuels the bullish sentiment in the Indian stock market. These strong economic fundamentals are reflected in various key economic indicators which consistently show upward trends, thus supporting the bullish momentum.

Foreign Institutional Investor (FII) Inflows

Significant Foreign Institutional Investor (FII) inflows have been a major contributor to the Indian stock market's bullish momentum.

- Increased FII investments in Indian equities: FIIs have been consistently investing heavily in Indian equities, injecting significant liquidity into the market.

- Reasons behind increased interest: Attractive valuations relative to other emerging markets and the strong growth potential of the Indian economy are major draws for FII investments. Furthermore, the ongoing reforms and government policies are improving the ease of doing business in India.

- Impact of global investment strategies: Global investment strategies are increasingly favoring emerging markets, with India being a key beneficiary due to its growth potential and relatively favorable risk-reward profile.

The consistent inflow of FII capital provides strong support to the market and contributes significantly to the bullish sentiment. This capital influx helps sustain the upward trend and creates a positive feedback loop, attracting even more investment.

Strong Corporate Earnings and Profitability

Improved corporate earnings and profitability across various sectors are another significant factor bolstering the bullish momentum.

- Improved performance by several listed companies: Numerous Indian companies are reporting strong earnings growth, demonstrating the resilience and growth potential of the Indian corporate sector.

- Sector-wise analysis of earnings growth: While some sectors may outperform others, overall corporate earnings are showing a positive trajectory, indicating a healthy economic environment. The IT and pharmaceutical sectors, for instance, have exhibited particularly strong growth.

- Impact of government policies on corporate profitability: Supportive government policies, such as tax reforms and deregulation, are improving the business environment and positively impacting corporate profitability.

The strong earnings performance of Indian companies reinforces investor confidence and fuels further investment, contributing significantly to the ongoing bullish trend in the Indian stock market. This improved profitability is a sustainable indicator of market health and future potential.

Sector-Specific Performance and Investment Opportunities

While the overall market exhibits bullish momentum, certain sectors are outperforming others, presenting specific investment opportunities.

High-Growth Sectors

Several sectors are driving the bullish trend, offering attractive investment prospects.

- Identify top-performing sectors (e.g., IT, pharmaceuticals, financials): The IT sector, driven by global demand for software and IT services, continues to be a strong performer. The pharmaceuticals sector benefits from both domestic and international growth. The financial sector benefits from the increasing financial inclusion in India.

- Reasons for their growth: Each of these sectors benefits from specific tailwinds. The IT sector is fueled by global digital transformation, pharmaceuticals benefit from growing healthcare needs, and the financial sector thrives on increasing economic activity.

- Potential risks and rewards: While these sectors present significant growth potential, investors should conduct thorough due diligence to assess the specific risks and rewards associated with each investment.

Identifying and capitalizing on the growth potential of specific high-performing sectors is crucial for maximizing returns in the current bullish market.

Emerging Investment Themes

Beyond established sectors, several emerging themes offer long-term investment potential.

- Discuss emerging trends like renewable energy, electric vehicles, digitalization, etc.: India's commitment to renewable energy, its rapidly expanding electric vehicle market, and its push towards digitalization are creating exciting investment opportunities.

- Analyze the long-term investment potential of emerging sectors: These sectors, while potentially more volatile in the short term, offer significant growth prospects over the long term, aligning with global trends and India's development goals.

Investing in these emerging themes can provide diversification and exposure to high-growth areas of the Indian economy.

Potential Risks and Challenges

While the Indian stock market's bullish momentum is encouraging, it's essential to acknowledge potential risks and challenges.

Inflationary Pressures

Rising inflation poses a potential threat to the market's upward trajectory.

- Discuss the impact of inflation on the stock market: High inflation can erode corporate profits, increase interest rates, and ultimately dampen investor sentiment.

- Potential measures to control inflation: The Reserve Bank of India (RBI) employs various monetary policy tools to manage inflation. These measures, however, can have implications for economic growth and market valuations.

- How it affects investor confidence: Persistent high inflation can erode investor confidence, leading to market volatility and potential corrections.

Monitoring inflation rates and the RBI's response is crucial for navigating the potential risks associated with inflationary pressures.

Global Geopolitical Uncertainty

Global events can significantly impact the Indian stock market.

- Discuss the impact of global events on the Indian stock market: Geopolitical instability, global economic slowdowns, or major international conflicts can negatively impact investor sentiment and lead to capital outflows from emerging markets like India.

- Potential risks stemming from international conflicts or economic downturns: These events can trigger market corrections and increase volatility.

Staying informed about global events and their potential impact on the Indian stock market is essential for risk management.

Valuation Concerns

Assessing market valuations is critical to understanding the sustainability of the bullish momentum.

- Discuss whether current valuations are sustainable: High valuations can make the market vulnerable to corrections if growth expectations are not met. Analyzing price-to-earnings ratios and other valuation metrics helps determine whether the market is fairly valued or overvalued.

- Potential for market correction: While the bullish trend is likely to continue, it's important to anticipate the possibility of market corrections. These are normal occurrences in any market and should be considered part of the investment landscape.

A cautious approach, coupled with a long-term perspective, is essential to mitigate risks associated with potential market corrections.

Conclusion

The Indian stock market's current bullish momentum is driven by a confluence of positive factors, including robust economic growth, significant FII inflows, and strong corporate earnings. However, investors must remain vigilant and acknowledge potential risks such as inflationary pressures and global geopolitical uncertainties. Understanding the nuances of this bullish momentum is crucial for making informed investment decisions. Conduct thorough research and seek professional advice before investing. Stay informed about the latest trends and analysis to effectively navigate the opportunities and challenges presented by the Indian stock market's bullish momentum. Remember to diversify your portfolio and carefully consider your risk tolerance before investing in Indian equities.

Featured Posts

-

The Zuckerberg Trump Dynamic Implications For Facebook And Beyond

Apr 24, 2025

The Zuckerberg Trump Dynamic Implications For Facebook And Beyond

Apr 24, 2025 -

Independence Concerns Lead To 60 Minutes Executive Producers Resignation

Apr 24, 2025

Independence Concerns Lead To 60 Minutes Executive Producers Resignation

Apr 24, 2025 -

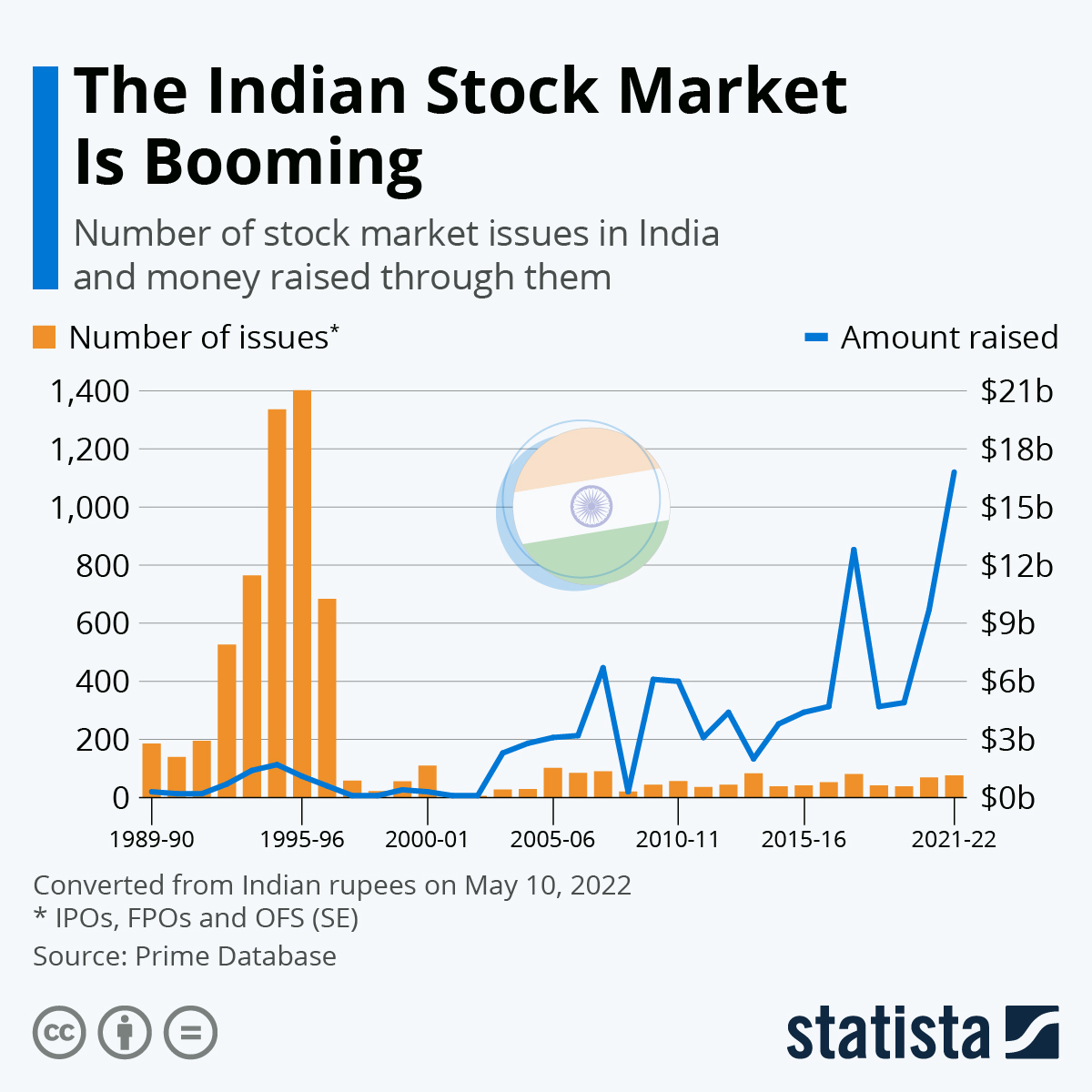

Ftc Challenges Microsoft Activision Merger A Legal Battle Ahead

Apr 24, 2025

Ftc Challenges Microsoft Activision Merger A Legal Battle Ahead

Apr 24, 2025 -

The Bold And The Beautiful April 16 A Recap Of Liam Hope And Bridgets Storylines

Apr 24, 2025

The Bold And The Beautiful April 16 A Recap Of Liam Hope And Bridgets Storylines

Apr 24, 2025 -

Cassidy Hutchinson Jan 6 Testimony And Upcoming Memoir

Apr 24, 2025

Cassidy Hutchinson Jan 6 Testimony And Upcoming Memoir

Apr 24, 2025