Infineon (IFX) Q[Quarter] Sales Guidance: Tariff Uncertainty Creates Headwinds

![Infineon (IFX) Q[Quarter] Sales Guidance: Tariff Uncertainty Creates Headwinds Infineon (IFX) Q[Quarter] Sales Guidance: Tariff Uncertainty Creates Headwinds](https://peoplelikeyourecords.de/image/infineon-ifx-q-quarter-sales-guidance-tariff-uncertainty-creates-headwinds.jpeg)

Table of Contents

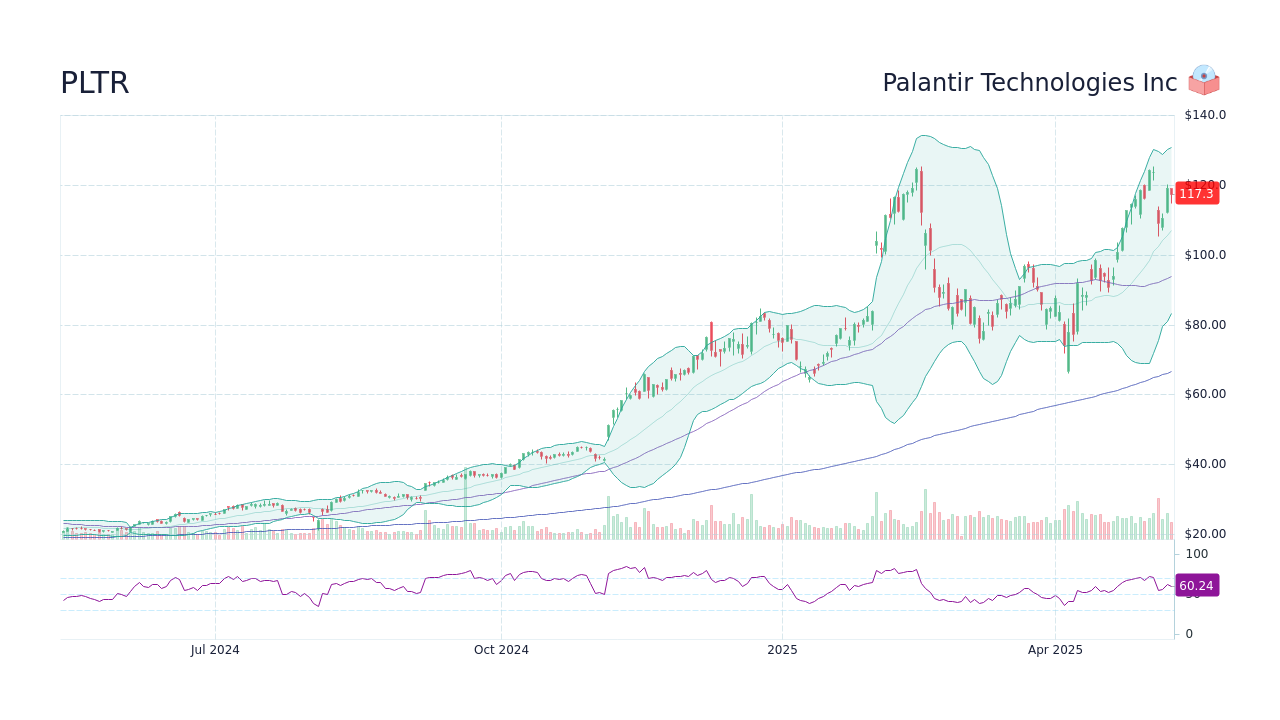

Infineon's Q3 Sales Guidance: The Numbers

Infineon's official sales guidance for Q3 2024 projects revenue between €4.0 and €4.2 billion. This represents a slight decrease compared to Q2 2024's performance and falls slightly below analyst expectations. The following chart visually represents this data and compares it to previous quarters.

[Insert Chart/Graph Here: X-axis = Quarter (Q1 2024, Q2 2024, Q3 2024 Projected), Y-axis = Revenue in Billions of Euros. Include data points and clear labels.]

- Specific revenue projections: €4.0 - €4.2 billion

- Year-over-year growth (or decline) percentage: A projected slight decline compared to Q3 2023. (Insert Specific Percentage based on actual data)

- Breakdown by key product segments: While a precise breakdown wasn't provided in the initial release, previous reports indicate that the Automotive segment remains the largest contributor to revenue, followed by Industrial Power Control and others. (Specify exact percentages if available)

- Changes in operating margin guidance: Infineon’s operating margin guidance is expected to remain within a specific range, (Insert specifics based on the official release), reflecting the pressure from tariff increases and other factors.

Tariff Uncertainty: The Primary Headwind

The primary headwind impacting Infineon's Q3 sales guidance is the ongoing uncertainty surrounding global tariffs. These tariffs, particularly those impacting trade between the US and China, significantly impact Infineon's supply chain and manufacturing costs.

- Specific tariffs impacting Infineon's supply chain: The ongoing trade war has resulted in tariffs on various semiconductor components and materials, affecting Infineon's sourcing and production processes. (Specify examples of affected components if available)

- Impact on raw material costs: Increased tariffs directly translate to higher costs for raw materials, impacting Infineon's production margins.

- Potential price increases for Infineon's products: To offset the increased costs, Infineon may be forced to increase prices for its products, potentially impacting demand.

- Countries/regions experiencing the greatest tariff-related challenges: The US-China trade relationship is the most significant factor, but other regional trade disputes also contribute to the overall uncertainty.

Impact on Key Product Segments

The impact of tariffs is not uniform across Infineon's product lines. Certain segments are more vulnerable than others.

- Automotive segment impact: The automotive industry, a major customer for Infineon, faces pressure from increased chip costs, potentially delaying electric vehicle production and impacting demand.

- Industrial power control segment impact: Increased costs for renewable energy solutions due to tariff-related price hikes in components could lead to reduced demand.

- Other relevant segments and their sensitivities to tariffs: Other segments like power management and sensor solutions are also affected, though to varying degrees, depending on their specific component sourcing and manufacturing locations.

Infineon's Mitigation Strategies

Infineon is implementing several strategies to mitigate the negative impacts of tariff uncertainty.

- Specific actions taken by Infineon to address tariff challenges: These actions may include diversifying its supply chains, exploring alternative sourcing options, negotiating with suppliers, and adjusting pricing strategies.

- Successes and limitations of these strategies: The effectiveness of these measures will depend on the evolution of the global trade situation and the responsiveness of Infineon's supply chain partners.

- Potential future strategies the company might employ: Infineon might further invest in automation, optimize its manufacturing processes, and increase lobbying efforts to address tariff concerns.

Investor Implications and Outlook for Infineon (IFX)

The Q3 sales guidance and the lingering tariff uncertainty impact Infineon's stock price and investor sentiment.

- Potential stock price movements based on the sales guidance: The slightly lower-than-expected guidance could lead to short-term price volatility. (mention analyst predictions if available)

- Investor reactions and analyst ratings: Analyst ratings and investor reactions will heavily depend on the details of the Q3 earnings call and further updates on tariff developments.

- Long-term prospects for Infineon, considering tariff risks and other market factors: Despite the headwinds, Infineon's long-term prospects remain positive, considering its strong position in key growth markets such as automotive and renewable energy. However, tariff uncertainty and potential economic slowdown remain considerable risk factors.

Conclusion:

Infineon's (IFX) Q3 sales guidance clearly indicates that tariff uncertainty is a significant headwind affecting its projected revenue. The impact varies across different product segments, requiring the company to implement effective mitigation strategies. While the situation presents challenges, careful analysis of Infineon's response and the broader market conditions is crucial for investors. Understanding the nuances of this Infineon (IFX) sales guidance and the ongoing impact of tariffs is vital for making informed investment decisions. Stay updated on future Infineon (IFX) sales guidance and market analyses to navigate this evolving landscape effectively.

![Infineon (IFX) Q[Quarter] Sales Guidance: Tariff Uncertainty Creates Headwinds Infineon (IFX) Q[Quarter] Sales Guidance: Tariff Uncertainty Creates Headwinds](https://peoplelikeyourecords.de/image/infineon-ifx-q-quarter-sales-guidance-tariff-uncertainty-creates-headwinds.jpeg)

Featured Posts

-

Palantir Pltr Stock Pre May 5th Investment Outlook

May 10, 2025

Palantir Pltr Stock Pre May 5th Investment Outlook

May 10, 2025 -

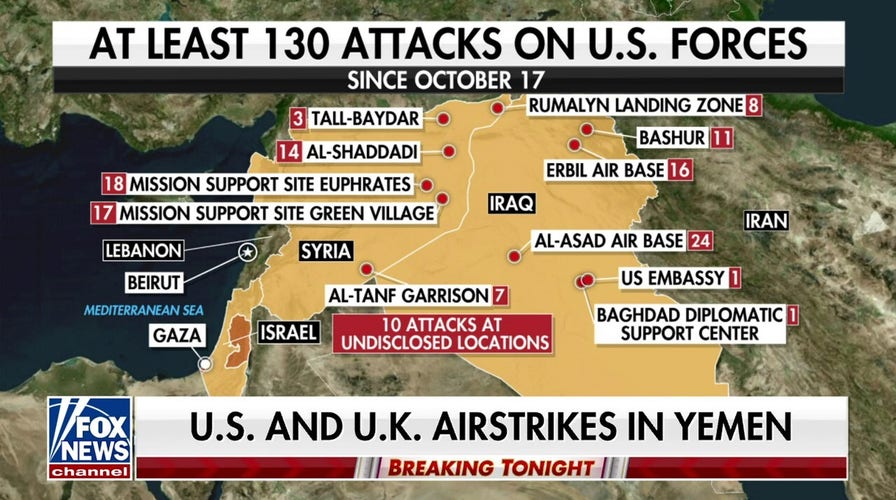

Skepticism Remains Analyzing The Impact Of Trumps Houthi Truce On Shipping

May 10, 2025

Skepticism Remains Analyzing The Impact Of Trumps Houthi Truce On Shipping

May 10, 2025 -

Ovechkins Record In Jeopardy 9 Players With A Shot At The Top

May 10, 2025

Ovechkins Record In Jeopardy 9 Players With A Shot At The Top

May 10, 2025 -

New Look Harry Styles Rocks A 70s Mustache In London

May 10, 2025

New Look Harry Styles Rocks A 70s Mustache In London

May 10, 2025 -

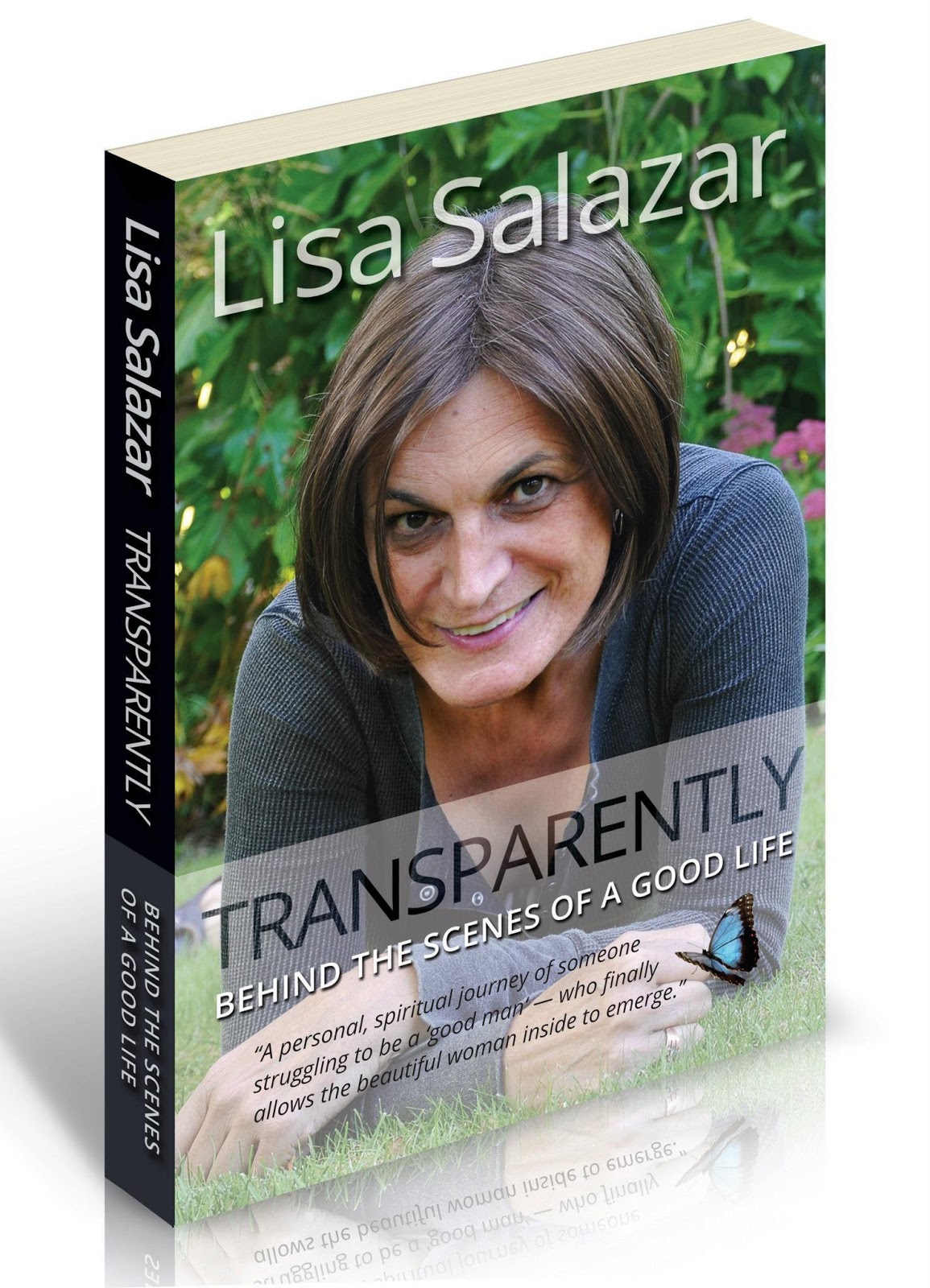

Increased Advocacy For Transgender Equality Featured In The Bangkok Post

May 10, 2025

Increased Advocacy For Transgender Equality Featured In The Bangkok Post

May 10, 2025