Palantir (PLTR) Stock: Pre-May 5th Investment Outlook

Table of Contents

Recent Financial Performance and Key Metrics

Analyzing Palantir's Q4 2022 earnings report and recent financial statements is essential for understanding its current trajectory. Key performance indicators (KPIs) such as revenue growth, profitability, and customer acquisition provide valuable insights into the company's health.

-

Revenue Growth: Examining the revenue growth rate compared to previous quarters and years reveals trends in the company's performance. A sustained high growth rate indicates strong demand for Palantir's products and services. Conversely, a slowing growth rate might warrant closer scrutiny.

-

Profit Margin Analysis: Analyzing profit margins (gross, operating, and net) helps assess the company's efficiency and profitability. Improving margins suggest cost-cutting measures or increased pricing power, while declining margins could indicate operational challenges.

-

Customer Acquisition and Retention: Understanding Palantir's ability to acquire and retain customers is critical. High customer acquisition costs or low retention rates could signal underlying issues. Key contract wins and their potential impact on future revenue should also be considered.

-

Debt Levels and Cash Flow: Reviewing Palantir's debt levels and cash flow provides insights into its financial stability. High debt levels could indicate financial risk, while strong cash flow suggests financial strength and the ability to fund future growth initiatives.

Market Sentiment and Analyst Ratings

Gauging market sentiment towards PLTR stock involves examining recent analyst ratings, price targets, and news coverage. This helps paint a picture of investor confidence and expectations.

-

Analyst Upgrades and Downgrades: Tracking recent analyst upgrades and downgrades offers valuable insights into the overall market view of Palantir. A preponderance of upgrades suggests positive sentiment, while downgrades could indicate growing concerns.

-

Average Price Target: The average price target from leading analysts provides a consensus view on the potential future price of PLTR stock. This serves as a benchmark, although it's essential to remember that price targets are merely estimates.

-

Impact of News and Events: Recent news and events, including press releases, partnerships, and regulatory changes, can significantly influence investor sentiment. Monitoring these factors is crucial for understanding market reaction.

-

Short Interest: High short interest might indicate skepticism among some investors, while low short interest suggests a more optimistic outlook. Significant changes in short interest warrant attention.

Upcoming Catalysts and Potential Risks

Before making any investment decisions, it's vital to consider upcoming catalysts and potential risks that could affect Palantir (PLTR) stock before May 5th.

-

Upcoming Events: Any upcoming earnings calls, investor presentations, or product launches could significantly impact the stock price. Understanding the potential implications of these events is critical.

-

New Partnerships: Potential new partnerships or collaborations with other companies could significantly boost Palantir's growth and market share, positively influencing investor sentiment.

-

Geopolitical Factors: Geopolitical events can influence government spending on defense and intelligence, potentially affecting Palantir's government contracts.

-

Competition: Palantir faces competition in the data analytics and government contracting sectors. Analyzing the competitive landscape helps understand potential challenges.

-

Client Dependence: Palantir's dependence on specific clients or government contracts represents a significant risk. Diversification of its client base is crucial for mitigating this risk.

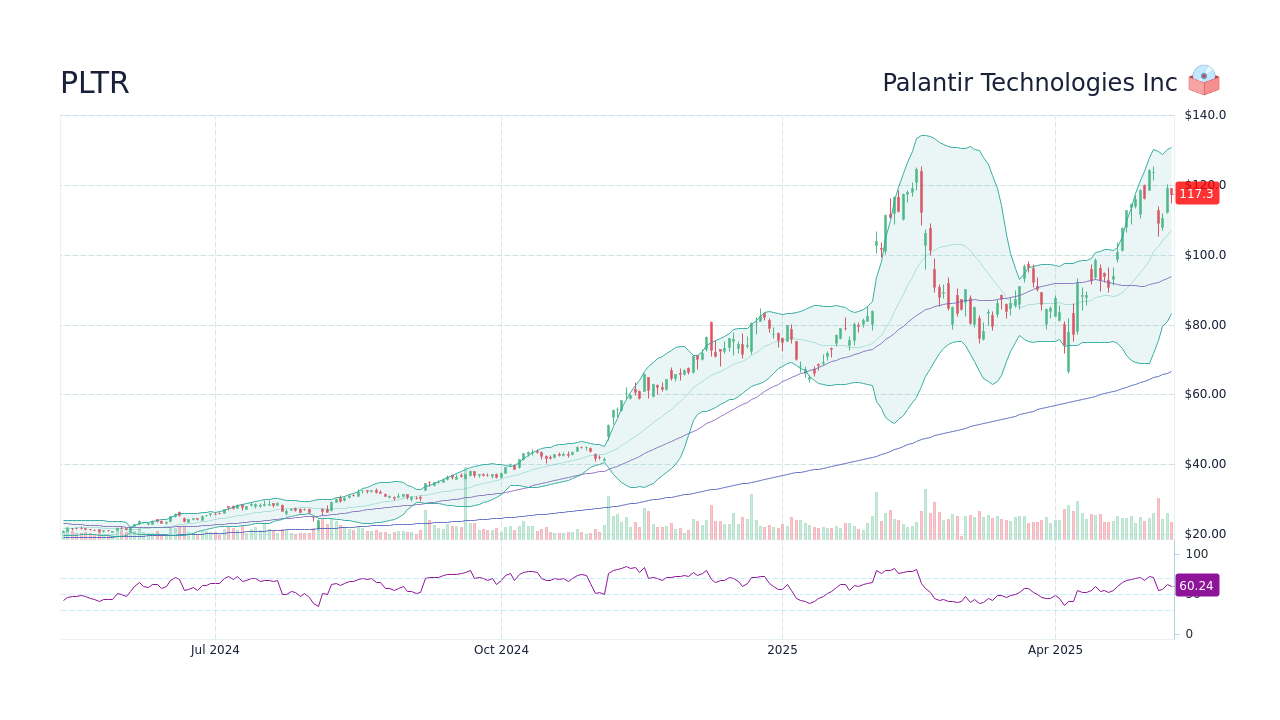

Technical Analysis of PLTR Stock

Technical analysis provides a supplementary perspective on Palantir's stock price movement. However, it should not be the sole basis for investment decisions.

-

Support and Resistance Levels: Identifying key support and resistance levels on the stock chart helps understand potential price turning points.

-

Moving Averages: Analyzing moving averages (e.g., 50-day and 200-day) can help determine the overall trend of the stock price.

-

Relative Strength Index (RSI): The RSI indicator helps assess the stock's momentum and potential overbought or oversold conditions. However, it should be used in conjunction with other indicators.

Remember: Over-reliance on technical analysis alone can be risky. It's essential to combine technical analysis with fundamental analysis and other factors for a comprehensive assessment.

Conclusion

This pre-May 5th analysis of Palantir (PLTR) stock highlights the importance of considering recent financial performance, market sentiment, upcoming catalysts, and potential risks. While Palantir demonstrates growth potential in the data analytics and government contracting sectors, investors must carefully weigh the potential rewards against the risks. Based on this analysis, further due diligence is strongly recommended before making any investment decisions in Palantir (PLTR) stock. Remember, this outlook is only valid before May 5th, and the stock market's inherent volatility means future performance is not guaranteed. Consult with a financial advisor before making any investment decisions related to PLTR stock or any other security.

Featured Posts

-

Should Investors Buy Palantir Stock Ahead Of May 5th Earnings Report

May 10, 2025

Should Investors Buy Palantir Stock Ahead Of May 5th Earnings Report

May 10, 2025 -

Indian Insurers Seek Regulatory Easing On Bond Forwards

May 10, 2025

Indian Insurers Seek Regulatory Easing On Bond Forwards

May 10, 2025 -

Transgender Women And Pregnancy A Community Activists Proposal For Uterine Transplants

May 10, 2025

Transgender Women And Pregnancy A Community Activists Proposal For Uterine Transplants

May 10, 2025 -

Is High Potential Season 1s Most Underrated Character The Ideal Season 2 Target

May 10, 2025

Is High Potential Season 1s Most Underrated Character The Ideal Season 2 Target

May 10, 2025 -

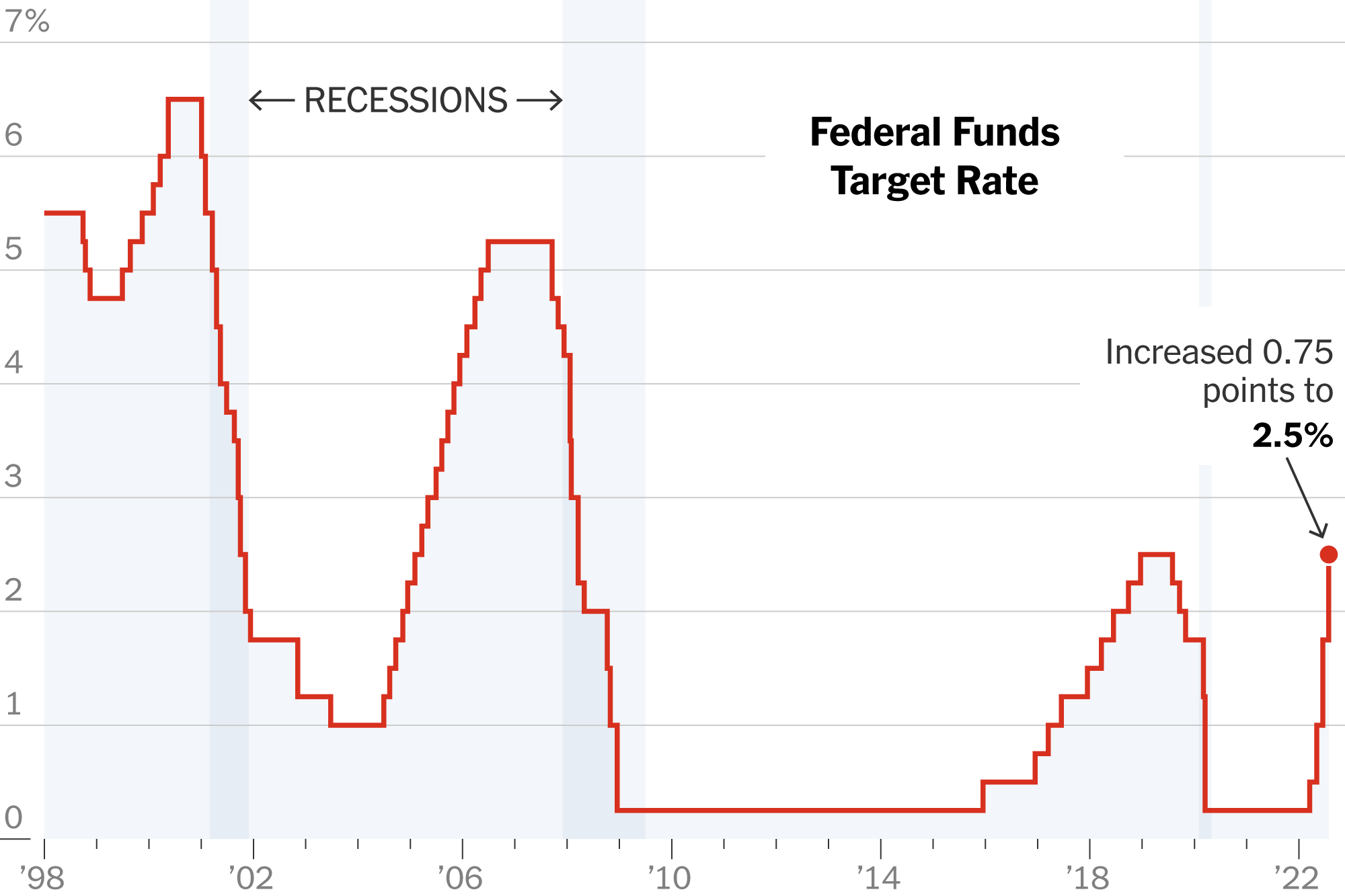

Federal Reserve Rate Decision Holding Steady Amidst Economic Uncertainty

May 10, 2025

Federal Reserve Rate Decision Holding Steady Amidst Economic Uncertainty

May 10, 2025