ING Group Publishes 2024 Financial Results: Form 20-F Analysis

Table of Contents

Key Financial Highlights from the ING Group 20-F Filing

This section examines the key financial highlights presented in ING Group's 2024 Form 20-F filing. We'll analyze revenue, net income, balance sheet strength, and profitability metrics to provide a comprehensive overview of ING's financial performance.

Revenue and Net Income Analysis

ING Group's 2024 financial results showcased [Insert actual data from the 20-F here, e.g., a 10% increase in revenue to €X billion and a 15% rise in net income to €Y billion]. This growth can be attributed to several factors:

- Increased Interest Rates: The rise in interest rates globally positively impacted ING's net interest income.

- Strong Loan Growth: An increase in loan originations across various segments contributed significantly to revenue growth.

- Effective Cost Management: ING's commitment to operational efficiency helped maintain healthy profit margins despite increased expenses in certain areas.

Compared to 2023, ING Group showed [Insert percentage change and comparison to industry benchmarks]. This outperformance relative to industry averages can be attributed to [Explain reasons based on the 20-F]. Revenue streams analysis shows strong performance in [Mention specific segments like retail banking, wholesale banking, or investment management, citing data from the 20-F].

Balance Sheet Strength and Capital Adequacy

ING's balance sheet remains strong, demonstrating robust capital adequacy and liquidity. Key metrics include:

- Common Equity Tier 1 (CET1) Ratio: [Insert data from 20-F]. This comfortably exceeds regulatory requirements and demonstrates a strong capital position.

- Leverage Ratio: [Insert data from 20-F], indicating a healthy level of leverage.

- Liquidity Coverage Ratio (LCR): [Insert data from 20-F], showcasing ample liquidity to withstand potential market shocks.

These ratios highlight ING's resilience and ability to absorb potential losses. Compared to competitors, ING's capital adequacy ratios are [compare to competitors using data]. Potential risks and vulnerabilities include [Mention any identified weaknesses based on the 20-F, such as exposure to specific geographic regions or asset classes].

Profitability and Efficiency Metrics

ING's profitability remained strong in 2024. Key metrics include:

- Return on Equity (ROE): [Insert data from 20-F], reflecting efficient capital utilization.

- Return on Assets (ROA): [Insert data from 20-F], demonstrating profitable asset deployment.

- Cost-to-Income Ratio: [Insert data from 20-F], indicating [improvement/worsening] in operational efficiency.

The improved ROE compared to the previous year is a testament to [Explain the reasons based on the 20-F data]. Areas of strength include [mention specific areas from the 20-F], while areas for potential improvement include [mention areas requiring attention].

Risk Factors and Outlook Discussed in the Form 20-F

The Form 20-F identifies several key risks that could impact ING Group's financial performance.

Identifying Key Risks

ING acknowledges several significant risk factors:

- Geopolitical Instability: Global political uncertainties and conflicts can impact market sentiment and economic activity, affecting ING's operations and investments.

- Economic Downturns: A global recession or significant economic slowdown could increase credit losses and reduce demand for financial services.

- Credit Risk: The risk of borrowers defaulting on loans remains a key concern, particularly in volatile economic conditions.

- Operational Risks: Cybersecurity threats, technological failures, and other operational disruptions could negatively impact ING's business operations.

- Regulatory Changes: Changes in regulatory frameworks can alter the competitive landscape and increase compliance costs.

ING's strategies for mitigating these risks include [mention specific strategies outlined in the 20-F].

Management's Outlook and Guidance

ING's management expresses a [positive/cautiously optimistic/negative] outlook for 2025, citing [mention reasons based on 20-F]. They project [mention projected figures for revenue growth, profitability and capital allocation]. The reasonableness of these projections depends on [discuss underlying assumptions and potential challenges].

Implications for Investors and Next Steps

Understanding the ING Group 2024 financial results is crucial for investors.

Stock Valuation and Investment Strategy

Based on the 20-F data, ING's stock valuation is [discuss the P/E ratio and other valuation multiples, relating them to the 20-F data]. The attractiveness of ING stock depends on [discuss factors affecting attractiveness, such as the risk appetite of the investor]. Further research into [mention areas for further research] is recommended.

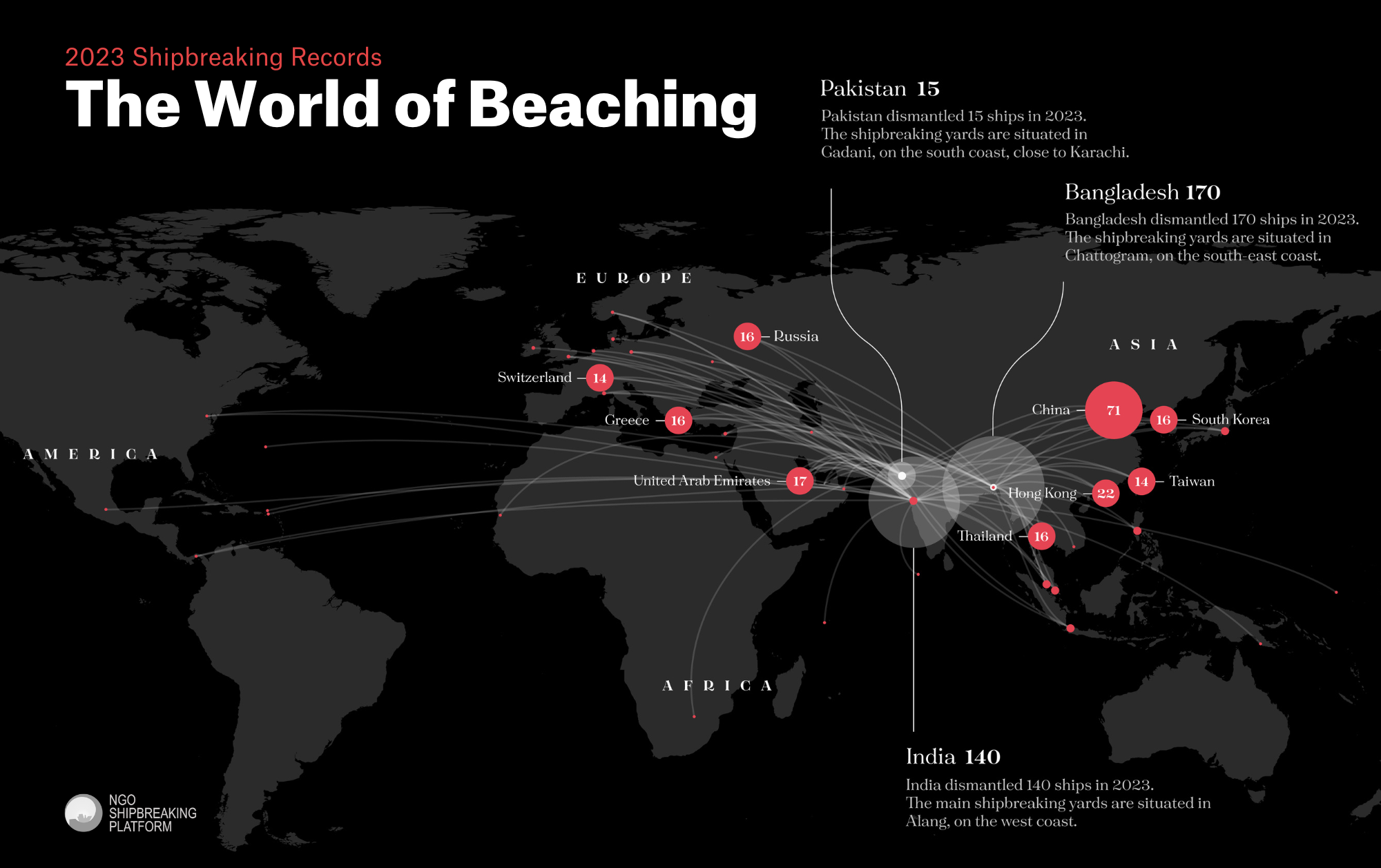

Comparison to Competitor Performance

Compared to its main competitors [mention competitors], ING's performance in 2024 was [compare performance across key metrics]. This suggests [conclude with overall comparison and implications for market positioning].

Conclusion

This analysis of ING Group's 2024 financial results, based on their Form 20-F filing, reveals a [summarize key findings – e.g., strong performance in lending, challenges in certain market segments, positive outlook for future growth]. Investors should carefully consider this information alongside other relevant data before making investment decisions. For a complete understanding, reviewing the full Form 20-F is recommended. A deeper dive into the ING Group's 2024 financial results can further refine your investment strategy. Remember to conduct thorough due diligence before making any investment decisions related to ING Group stock or other financial products.

Featured Posts

-

Vybz Kartel Announces New York City Barclay Center Concert

May 21, 2025

Vybz Kartel Announces New York City Barclay Center Concert

May 21, 2025 -

The Goldbergs A Nostalgic Look Back At 80s Pop Culture

May 21, 2025

The Goldbergs A Nostalgic Look Back At 80s Pop Culture

May 21, 2025 -

First Look Echo Valley Images Preview Sydney Sweeney And Julianne Moore Thriller

May 21, 2025

First Look Echo Valley Images Preview Sydney Sweeney And Julianne Moore Thriller

May 21, 2025 -

Huizenprijzen Nederland Analyse Abn Amro En Kritiek Van Geen Stijl

May 21, 2025

Huizenprijzen Nederland Analyse Abn Amro En Kritiek Van Geen Stijl

May 21, 2025 -

Dexter Resurrection Lithgow And Smits To Reprise Roles

May 21, 2025

Dexter Resurrection Lithgow And Smits To Reprise Roles

May 21, 2025

Latest Posts

-

Data Breach Costs T Mobile 16 Million Three Year Security Lapse Results In Fine

May 21, 2025

Data Breach Costs T Mobile 16 Million Three Year Security Lapse Results In Fine

May 21, 2025 -

16 Million Penalty For T Mobile Three Years Of Unreported Data Breaches

May 21, 2025

16 Million Penalty For T Mobile Three Years Of Unreported Data Breaches

May 21, 2025 -

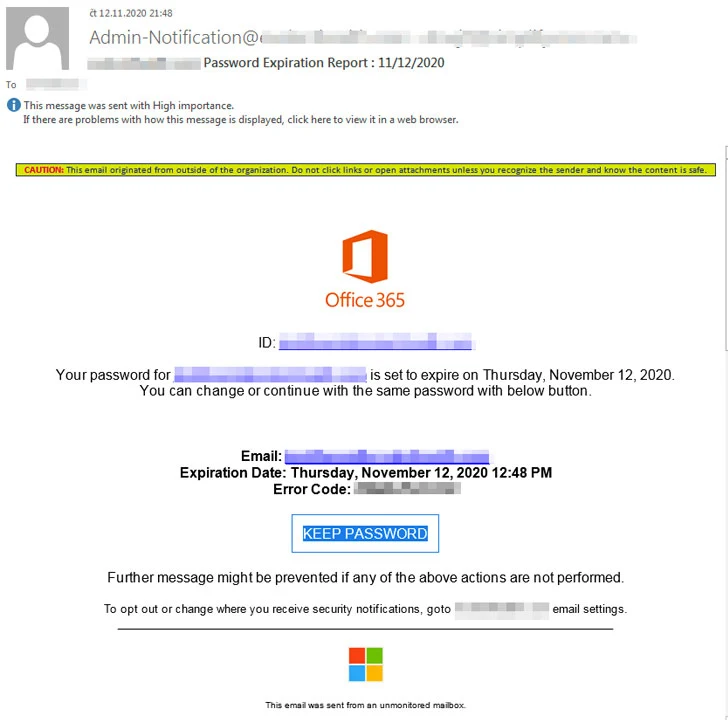

Hacker Makes Millions Targeting Executive Office365 Accounts

May 21, 2025

Hacker Makes Millions Targeting Executive Office365 Accounts

May 21, 2025 -

Unlocking Podcast Potential Ais Role In Transforming Repetitive Documents

May 21, 2025

Unlocking Podcast Potential Ais Role In Transforming Repetitive Documents

May 21, 2025 -

Federal Investigation Millions Stolen Through Compromised Office365 Accounts

May 21, 2025

Federal Investigation Millions Stolen Through Compromised Office365 Accounts

May 21, 2025