ING's 2024 Annual Report: Key Highlights From Form 20-F Filing

Table of Contents

ING's 2024 Form 20-F filing is a crucial document for investors, analysts, and stakeholders seeking a comprehensive understanding of the company's financial performance and strategic direction. This article provides a concise overview of the key highlights from ING's 2024 annual report (Form 20-F), focusing on the most significant financial highlights and key performance indicators (KPIs). We will delve into ING's financial performance, segment-specific results, risk factors, outlook, and shareholder returns, offering valuable insights for investment analysis.

2. Main Points:

H2: Financial Performance Overview: Revenue, Net Profit, and Key Metrics

ING's 2024 financial performance showcased [Insert overall positive or negative statement about performance, e.g., "solid growth across key metrics," or "challenges in certain areas but overall resilience"]. The Form 20-F reveals [Insert specific numbers for revenue and net profit, e.g., "a total revenue of €X billion and a net profit of €Y billion"]. This represents a [Insert percentage change compared to previous year, e.g., "10% increase in revenue" and/or "5% decrease in net profit"] compared to 2023.

Analyzing key financial metrics provides further context:

- Revenue Growth: [Insert specific percentage and explanation for the change in revenue]

- Net Profit Margin: [Insert specific percentage and explanation for change in net profit margin]

- Return on Equity (ROE): [Insert specific percentage and explanation of ROE. Highlight comparison to industry benchmarks if possible]

- Earnings Per Share (EPS): [Insert specific number and explanation of the change in EPS]

H2: Segment-Specific Performance: A Deep Dive into ING's Business Units

ING operates across several key business segments, each contributing differently to overall financial performance. Let's examine the performance of each:

- Wholesale Banking: [Summarize the performance of the Wholesale Banking segment, including specific examples from the 20-F. e.g., "Experienced strong growth in transaction banking, driven by increased activity in [specific market]". Mention specific numbers if possible.]

- Retail Banking: [Summarize the performance of Retail Banking. e.g., "Showed steady growth in customer deposits and mortgage lending, although competition remained intense." Mention specific numbers if possible.]

- Investment Management: [Summarize Investment Management performance. e.g., "Assets under management saw [growth/decline] due to [specific market factors]." Mention specific numbers if possible.]

H2: Risk Factors and Outlook: Assessing Future Challenges and Opportunities

ING's 20-F filing identifies several key risk factors that could impact future performance. These include:

- Geopolitical Uncertainty: [Explain the impact of geopolitical factors mentioned in the report.]

- Regulatory Changes: [Discuss any regulatory changes mentioned and their potential impact.]

- Cybersecurity Threats: [Explain the cybersecurity risks identified in the report and how ING is addressing them.]

- Economic Downturn: [Discuss the potential impact of an economic downturn on ING's business.]

Despite these challenges, ING's outlook remains [Insert positive or cautious outlook from the report, e.g., "positive, driven by strong growth prospects in [specific areas]" or "cautiously optimistic, anticipating potential headwinds in the near term"]. Opportunities exist in areas such as sustainable finance and digitalization.

H2: Dividend and Shareholder Return: Insights for Investors

ING's dividend policy and shareholder returns are crucial aspects for investors. The 2024 Form 20-F reveals:

- Dividend per Share: [Insert the dividend per share amount and any percentage changes compared to the previous year.]

- Dividend Payout Ratio: [Insert the payout ratio and explain its significance.]

- Share Buyback Program: [Discuss any share buyback programs and their impact on shareholder returns.]

This information is essential for investors evaluating ING's attractiveness as an investment opportunity.

3. Conclusion: Key Takeaways from ING's 2024 Form 20-F Filing and a Call to Action

ING's 2024 Form 20-F filing reveals a [positive or negative summary] financial performance with [mention key highlights, e.g., "strong revenue growth in key segments," or "challenges in profitability, requiring strategic adjustments"]. The report also highlights key risk factors and opportunities shaping ING's future prospects. Understanding these aspects is critical for investment analysis. For a complete understanding of ING's financial performance and strategic direction, download and review the full 2024 Form 20-F filing. Stay informed on ING's progress by regularly reviewing future ING annual reports and financial disclosures. Analyzing the ING 2024 report provides valuable insights into the company's performance and future trajectory.

Featured Posts

-

College Boom Towns Go Bust Enrollment Declines Economic Impact

May 21, 2025

College Boom Towns Go Bust Enrollment Declines Economic Impact

May 21, 2025 -

Abn Amro Kamerbrief Certificaten Verkoopstrategieen En Programmas

May 21, 2025

Abn Amro Kamerbrief Certificaten Verkoopstrategieen En Programmas

May 21, 2025 -

Trump Irish Pm And Jd Vance Hilarious White House Moments

May 21, 2025

Trump Irish Pm And Jd Vance Hilarious White House Moments

May 21, 2025 -

Mulhouse Le Noumatrouff Et L Esprit Hellfest

May 21, 2025

Mulhouse Le Noumatrouff Et L Esprit Hellfest

May 21, 2025 -

Descubre 5 Podcasts Imprescindibles De Misterio Suspenso Y Terror

May 21, 2025

Descubre 5 Podcasts Imprescindibles De Misterio Suspenso Y Terror

May 21, 2025

Latest Posts

-

Data Breach Costs T Mobile 16 Million Three Year Security Lapse Results In Fine

May 21, 2025

Data Breach Costs T Mobile 16 Million Three Year Security Lapse Results In Fine

May 21, 2025 -

16 Million Penalty For T Mobile Three Years Of Unreported Data Breaches

May 21, 2025

16 Million Penalty For T Mobile Three Years Of Unreported Data Breaches

May 21, 2025 -

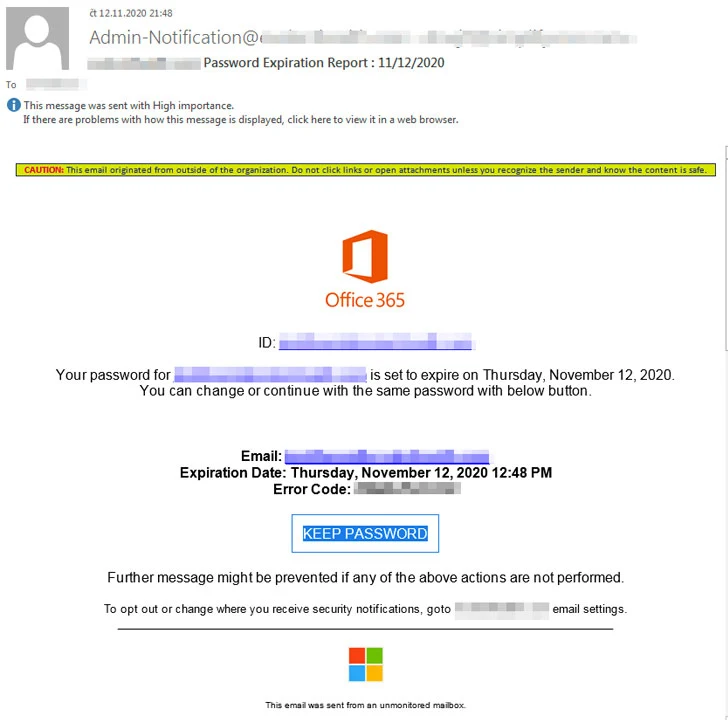

Hacker Makes Millions Targeting Executive Office365 Accounts

May 21, 2025

Hacker Makes Millions Targeting Executive Office365 Accounts

May 21, 2025 -

Unlocking Podcast Potential Ais Role In Transforming Repetitive Documents

May 21, 2025

Unlocking Podcast Potential Ais Role In Transforming Repetitive Documents

May 21, 2025 -

Federal Investigation Millions Stolen Through Compromised Office365 Accounts

May 21, 2025

Federal Investigation Millions Stolen Through Compromised Office365 Accounts

May 21, 2025