Investing In Amundi MSCI World II UCITS ETF Dist: NAV Considerations

Table of Contents

Understanding Amundi MSCI World II UCITS ETF Dist and its NAV

The Amundi MSCI World II UCITS ETF Dist is designed to track the performance of the MSCI World Index, offering investors broad exposure to a large-cap global equity market. Its investment objective is to replicate the performance of this index, providing diversification across numerous countries and sectors. A key feature is its distribution policy; it pays out dividends, a factor significantly impacting its NAV.

Net Asset Value (NAV) represents the value of an ETF's underlying assets per share. For the Amundi MSCI World II UCITS ETF Dist, the NAV reflects the total value of all the constituent securities held in the ETF, divided by the number of outstanding shares. Understanding this value is paramount because it represents the intrinsic worth of each share.

The Amundi MSCI World II UCITS ETF Dist's NAV is calculated daily, typically at the close of market trading. This calculation considers the closing prices of all the securities in the ETF's portfolio, taking into account currency exchange rates for non-Euro denominated assets.

- Daily NAV Calculation and Publication Timing: The NAV is usually calculated and published at the end of each trading day.

- Where to Find NAV Information: You can typically find the daily NAV on the Amundi ETF website, major financial news websites, and through your brokerage platform.

- Factors Influencing Daily NAV Fluctuations: The daily NAV is subject to fluctuations due to changes in the market value of the underlying securities, currency exchange rate movements, and dividend payments.

Utilizing NAV for Investment Decisions

Tracking the Amundi MSCI World II UCITS ETF NAV over time allows you to monitor its performance. By comparing the current NAV to its historical data, you can gauge its growth trajectory. This historical analysis is essential for assessing the ETF's potential for future growth and for making informed buy or sell decisions.

Analyzing the NAV helps in evaluating the ETF’s growth potential compared to its benchmark index (MSCI World Index). A rising NAV suggests positive performance, indicating growth in the underlying assets.

While less frequent with liquid ETFs like this one, comparing the NAV to the ETF's market price can reveal potential arbitrage opportunities. However, these instances are rare for actively traded ETFs.

- Using Charts and Graphs: Visualizing NAV trends using charts and graphs simplifies the analysis of performance over time.

- Comparing NAV to Benchmark Indices: Comparing the NAV performance to the MSCI World Index allows you to assess how effectively the ETF tracks its benchmark.

- Considering NAV Alongside Expense Ratios: Remember to consider other factors like expense ratios and management fees alongside NAV when making investment decisions.

NAV and Dividend Distributions

Dividend distributions from the Amundi MSCI World II UCITS ETF Dist directly affect its NAV. When a dividend is paid, the NAV decreases by the amount of the dividend per share, as the ETF's underlying assets are reduced.

The ex-dividend date is crucial. This is the date on which the stock trades without the dividend. Buying the ETF before the ex-dividend date entitles you to the dividend; buying after means you miss it. This impacts the NAV because the value reduces on the ex-dividend date reflecting the payout.

Reinvesting dividends back into the ETF can significantly enhance long-term NAV growth through compounding. This strategy contributes to higher returns over time.

- Understanding Dividend Yield: The dividend yield is the annual dividend payment relative to the NAV, providing an indication of the ETF's income potential.

- Tax Implications: Remember to factor in the tax implications of dividend distributions in your investment strategy.

- Dividend Reinvestment Strategies: Decide how you want to manage dividend payouts – reinvestment or receiving cash.

Risks and Considerations

Investing in the Amundi MSCI World II UCITS ETF Dist, like any investment, carries inherent risks. Market risk and volatility are primary concerns. The value of the ETF, and therefore its NAV, can fluctuate significantly due to market conditions.

For non-Euro investors, currency fluctuations can also influence the NAV. Changes in exchange rates between the Euro and your local currency will impact the value of your investment.

It is crucial to conduct thorough research and consult a financial advisor before making any investment decision. Never invest more than you can afford to lose.

- Market Risk and Volatility: Understand that market downturns can lead to significant NAV reductions.

- Currency Risk: Non-Euro investors should be aware of the potential impact of currency fluctuations on their investment.

- Expense Ratio: The expense ratio impacts long-term returns; be sure to factor this cost into your calculations.

Conclusion

Understanding and effectively utilizing the Amundi MSCI World II UCITS ETF NAV is essential for making informed investment decisions. We've explored how the NAV is calculated, its role in performance tracking, the impact of dividend distributions, and potential risks. Remember to monitor the Amundi MSCI World II UCITS ETF NAV regularly to track performance and stay informed about its fluctuations. To make truly informed investment decisions, use Amundi MSCI World II UCITS ETF NAV data alongside other key metrics and consider consulting a financial advisor before investing.

Featured Posts

-

Qfzt Daks Almanya Ila 24 Alf Nqtt Bfdl Atfaqyt Altjart Byn Alsyn Walwlayat Almthdt

May 25, 2025

Qfzt Daks Almanya Ila 24 Alf Nqtt Bfdl Atfaqyt Altjart Byn Alsyn Walwlayat Almthdt

May 25, 2025 -

New Album Her In Deep Matt Maltese Talks Intimacy And Personal Growth

May 25, 2025

New Album Her In Deep Matt Maltese Talks Intimacy And Personal Growth

May 25, 2025 -

Dow Jones Grinds Higher Following Positive Pmi Report

May 25, 2025

Dow Jones Grinds Higher Following Positive Pmi Report

May 25, 2025 -

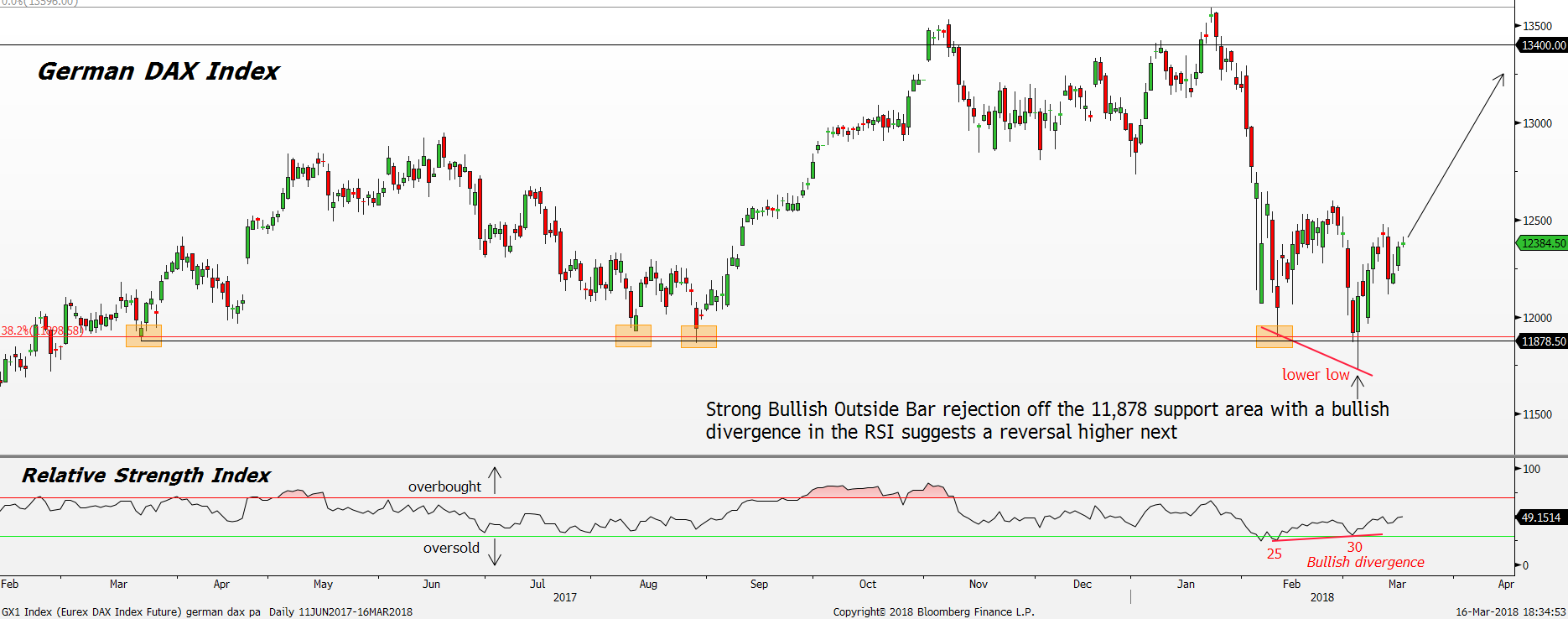

Dax Surge Will A Wall Street Rebound Dampen German Market Gains

May 25, 2025

Dax Surge Will A Wall Street Rebound Dampen German Market Gains

May 25, 2025 -

Kuda Propali Pobediteli Evrovideniya Za Poslednie 10 Let

May 25, 2025

Kuda Propali Pobediteli Evrovideniya Za Poslednie 10 Let

May 25, 2025

Latest Posts

-

Punished For Seeking Change Understanding The Consequences

May 25, 2025

Punished For Seeking Change Understanding The Consequences

May 25, 2025 -

Brazils Brb Challenges Banking Giants Banco Master Acquisition Details

May 25, 2025

Brazils Brb Challenges Banking Giants Banco Master Acquisition Details

May 25, 2025 -

Law Enforcement Cracks Down On Gun Trafficking 18 Brazilian Nationals Arrested In Massachusetts

May 25, 2025

Law Enforcement Cracks Down On Gun Trafficking 18 Brazilian Nationals Arrested In Massachusetts

May 25, 2025 -

Brb Acquires Banco Master Reshaping Brazils Competitive Banking Landscape

May 25, 2025

Brb Acquires Banco Master Reshaping Brazils Competitive Banking Landscape

May 25, 2025 -

Over 100 Firearms Seized In Massachusetts As 18 Brazilian Nationals Face Gun Trafficking Charges

May 25, 2025

Over 100 Firearms Seized In Massachusetts As 18 Brazilian Nationals Face Gun Trafficking Charges

May 25, 2025