Is An XRP ETF A Good Investment? Analyzing Supply, Demand, And Institutional Interest

Table of Contents

Understanding XRP Supply and Demand Dynamics

Before exploring the potential of an XRP ETF, it's crucial to understand the underlying asset: XRP. XRP is a cryptocurrency designed for fast and efficient cross-border payments, operating on the Ripple network. An ETF (Exchange-Traded Fund) is a security that tracks an underlying asset, in this case, XRP. Understanding the supply and demand dynamics of XRP is key to assessing the potential success of an XRP ETF.

Current XRP Circulation and Distribution

The total supply of XRP is capped at 100 billion tokens. However, a significant portion is held by Ripple Labs, the company behind XRP. This distribution significantly influences the market.

- Ripple Holdings: A substantial percentage of XRP is held by Ripple, influencing market supply.

- Exchange Holdings: A considerable amount of XRP resides on various cryptocurrency exchanges, affecting liquidity and price volatility.

- Long-Term Holders: The percentage held by long-term investors indicates confidence in the asset and potential resistance to price drops.

The existing supply and its distribution heavily influence XRP's price volatility. A sudden release of a large amount of XRP into the market could depress prices, impacting the value of an XRP ETF. Conversely, sustained demand in the face of limited supply could push prices higher.

Analyzing Demand Factors for XRP

Demand for XRP is driven by several factors, all of which would impact the potential success of an XRP ETF:

- Adoption by Payment Providers: Increasing adoption by payment providers utilizing Ripple's technology for cross-border transactions increases demand.

- Cross-Border Payments: The core utility of XRP in facilitating swift and cost-effective international payments directly fuels demand.

- Regulatory Developments: Positive regulatory developments surrounding XRP could significantly boost investor confidence and demand.

- General Crypto Market Sentiment: Overall market sentiment towards cryptocurrencies plays a crucial role in influencing XRP's price and, consequently, the value of an XRP ETF.

Recent partnerships and integrations of Ripple's technology with financial institutions could further increase demand, potentially driving up the price of an XRP ETF.

Supply and Demand Interaction and its Impact on XRP ETF Price

The interplay of supply and demand will be the primary determinant of an XRP ETF's price. High demand coupled with limited supply will likely result in a higher price, while the opposite scenario could lead to lower prices. A well-structured XRP ETF could potentially mitigate some of this volatility through mechanisms built into the fund itself, but it’s impossible to eliminate the inherent risks associated with the underlying asset.

Institutional Interest in XRP and Potential ETF Listings

Institutional adoption is a significant indicator of an asset's long-term viability and can significantly influence the success of an XRP ETF.

Current Institutional Holdings of XRP

While precise figures are difficult to obtain, several reports suggest a growing number of institutional investors are holding XRP.

- Institutional Investors: Although specific names are often undisclosed due to confidentiality agreements, reports suggest a slow but steady increase in institutional ownership.

- Impact of Increased Adoption: Increased institutional adoption generally leads to greater price stability and potentially higher valuations for an XRP ETF.

The lack of complete transparency regarding institutional holdings of XRP makes a definitive assessment challenging but the trend seems positive for future growth.

Regulatory Landscape and its Impact on ETF Approval

The regulatory environment surrounding XRP is arguably the biggest hurdle to an XRP ETF's approval.

- SEC Rulings and Ripple's Legal Battles: The ongoing legal battles between Ripple and the SEC significantly impact investor confidence and the likelihood of ETF approval. A positive resolution could pave the way for ETF listings.

- Influence on Investor Confidence: Regulatory clarity is crucial for attracting institutional investment and fostering confidence in an XRP ETF. Uncertainty can deter investors and suppress price.

Comparison with other Crypto ETFs

Existing Bitcoin and Ethereum ETFs have shown considerable success, attracting significant institutional investment. However, an XRP ETF would offer a distinct investment proposition, potentially benefiting from Ripple's focus on cross-border payments. The competitive landscape and the unique features of XRP need to be considered when evaluating its potential.

Assessing the Risks and Potential Rewards of an XRP ETF

Investing in an XRP ETF, like any cryptocurrency investment, involves substantial risks and potential rewards.

Volatility and Market Risk

The cryptocurrency market is inherently volatile. XRP's price can fluctuate significantly in short periods, posing considerable risk to ETF investors.

- High Risk, High Reward: Cryptocurrency investments are characterized by high risk and potentially high rewards. Careful risk management is crucial.

- Diversification Strategies: Diversifying investments can help mitigate the risk associated with XRP price volatility.

Regulatory Risk and Legal Uncertainties

The ongoing legal uncertainties surrounding XRP and its regulatory status represent significant risks.

- Negative Regulatory Decisions: Negative regulatory decisions could significantly impact XRP's price and the value of any associated ETF.

Potential for Growth and Returns

Despite the risks, XRP holds the potential for substantial long-term growth. Its utility in cross-border payments, coupled with increased adoption, could drive price appreciation.

- Bull Market Scenario: In a bull market, XRP and an XRP ETF could experience significant price appreciation.

- Bear Market Scenario: Bear markets, however, pose significant downside risk.

Conclusion: Should You Invest in an XRP ETF?

The potential of an XRP ETF hinges on several factors: the resolution of Ripple's legal battles, broader regulatory clarity, and the sustained growth of XRP's utility in the payments sector. While an XRP ETF offers potential high returns, it also carries significant risks. The volatility of the cryptocurrency market and ongoing regulatory uncertainties could result in substantial losses. Therefore, before you carefully consider an XRP ETF investment, conduct thorough research and assess your risk tolerance. Evaluate the potential of an XRP ETF against your overall investment strategy. Only invest what you can afford to lose. Remember to research the XRP ETF market thoroughly and make informed decisions based on your own financial situation and risk appetite.

Featured Posts

-

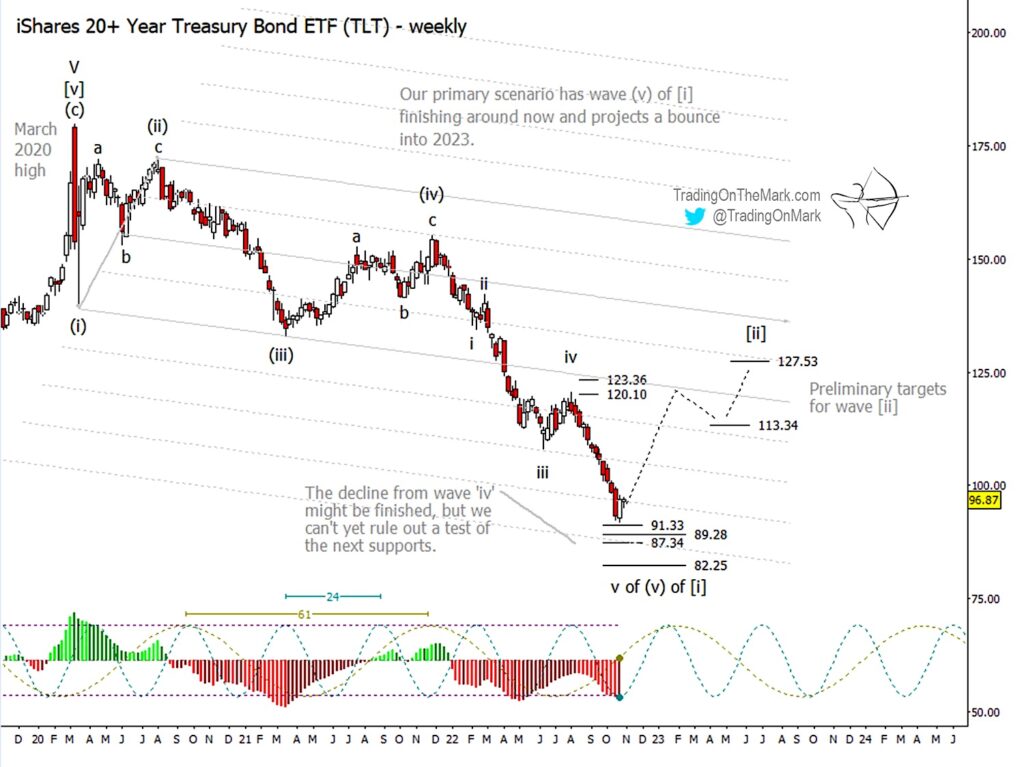

Taiwanese Investors Us Bond Etf Pullback Analyzing The Recent Trend

May 08, 2025

Taiwanese Investors Us Bond Etf Pullback Analyzing The Recent Trend

May 08, 2025 -

Saving Private Ryan Ranking Its 10 Best Characters

May 08, 2025

Saving Private Ryan Ranking Its 10 Best Characters

May 08, 2025 -

Anchor Brewing Companys Closure A Legacy In Beer Comes To An End

May 08, 2025

Anchor Brewing Companys Closure A Legacy In Beer Comes To An End

May 08, 2025 -

Former Okc Thunder Rare Double Performance Records

May 08, 2025

Former Okc Thunder Rare Double Performance Records

May 08, 2025 -

Sony Ps 5 Pro Disassembly Examining The Liquid Metal Cooling Implementation

May 08, 2025

Sony Ps 5 Pro Disassembly Examining The Liquid Metal Cooling Implementation

May 08, 2025