Is Now The Right Time To Buy XRP (Ripple) – A Sub-$3 Evaluation

Table of Contents

The SEC Lawsuit and its Impact on XRP Price

The SEC lawsuit against Ripple Labs is a dominant factor influencing XRP's price. Understanding the complexities of this case is crucial for any potential investor considering buying XRP.

Understanding the SEC's Claims

The SEC alleges that Ripple conducted an unregistered securities offering by selling XRP to the public. They claim XRP is a security, not a currency, because investors purchased it with the expectation of profit based on Ripple's efforts.

- SEC Allegations: The SEC claims Ripple's sales of XRP constituted an unregistered securities offering, violating federal securities laws.

- Ripple's Defense: Ripple argues that XRP is a currency, not a security, and that its sales were not subject to SEC registration requirements. They point to XRP's decentralized nature and widespread use in cross-border payments.

- Potential Outcomes: The outcome of the lawsuit could significantly impact XRP's price. A ruling in favor of the SEC could lead to a substantial price drop, while a victory for Ripple could trigger a significant price surge. The uncertainty surrounding the case contributes to XRP's price volatility.

XRP's Technological Advancements and Utility

Despite the legal uncertainty, XRP's underlying technology and utility continue to evolve. RippleNet, Ripple's payment solution, is gaining traction globally.

RippleNet and its Growing Adoption

RippleNet is a real-time gross settlement system (RTGS) designed for cross-border payments. It offers faster, cheaper, and more transparent transactions compared to traditional banking systems.

- Key Partnerships: Ripple has partnered with numerous financial institutions globally, including major banks and payment providers.

- Successful Use Cases: RippleNet is already facilitating cross-border payments for various businesses, demonstrating its real-world applications.

- Future Growth: The potential for further expansion of RippleNet into new markets and integrations with other financial technologies is substantial, potentially boosting XRP's demand and price. This underlying utility is independent of the SEC case.

Market Sentiment and Current Trading Volume

Analyzing the current market sentiment towards XRP and the overall cryptocurrency market is crucial.

Analyzing Current Market Trends

The cryptocurrency market is inherently volatile, and XRP's price is subject to significant fluctuations. Current market trends, news events, and overall investor confidence all influence XRP's performance.

- Trading Volume and Volatility: Observe XRP's trading volume to gauge current market interest. High trading volume often indicates significant activity and potential for price movement. Volatility is to be expected, but understanding the drivers behind it can aid in investment strategy.

- Catalysts for Price Changes: Positive news, regulatory developments (both positive and negative), and broader cryptocurrency market trends can significantly impact XRP's price.

- Influence of Whales: The actions of large investors (“whales”) can dramatically influence XRP’s short-term price movements. It's important to understand this influence, although it is difficult to predict.

Risk Assessment and Potential Returns

Investing in XRP involves significant risk, primarily due to the ongoing SEC lawsuit and inherent volatility in the cryptocurrency market.

Weighing the Risks and Rewards of Investing in XRP

Before buying XRP, it's crucial to weigh the potential rewards against the considerable risks.

- Potential Scenarios: Consider various scenarios for XRP's future price, ranging from substantial gains to significant losses. A realistic assessment is vital.

- Diversification: Diversifying your cryptocurrency portfolio is crucial to mitigate risk. Don't put all your eggs in one basket.

- Risk Management: Develop a sound investment strategy and only invest an amount you're comfortable losing. Set stop-loss orders to limit potential losses.

Conclusion

The decision of whether to buy XRP at its current sub-$3 price is complex. The SEC lawsuit presents significant uncertainty, but XRP’s technology and potential adoption offer counterbalancing factors. Market sentiment and trading volume should also be closely monitored.

Final Verdict (Neutral): There's no simple answer. A thorough understanding of the risks and potential rewards is vital before investing in XRP. This analysis highlights key aspects, but further research is essential.

Call to Action: Continue your research on XRP and Ripple, carefully assess your own risk tolerance, and make informed decisions about investing in XRP or sub-$3 XRP based on your individual circumstances. Remember that this is not financial advice.

Featured Posts

-

Premier Bebe De L Annee Gagnez Votre Poids En Chocolat En Normandie

May 01, 2025

Premier Bebe De L Annee Gagnez Votre Poids En Chocolat En Normandie

May 01, 2025 -

Dragons Den A Guide To Success

May 01, 2025

Dragons Den A Guide To Success

May 01, 2025 -

Wkrns Nikki Burdine Departs After Seven Years As Morning Anchor

May 01, 2025

Wkrns Nikki Burdine Departs After Seven Years As Morning Anchor

May 01, 2025 -

Nrc Announces Suspension Of Warri Itakpe Rail Operations Following Engine Failure

May 01, 2025

Nrc Announces Suspension Of Warri Itakpe Rail Operations Following Engine Failure

May 01, 2025 -

Remembering Priscilla Pointer Dalla Star Passes Away At 100

May 01, 2025

Remembering Priscilla Pointer Dalla Star Passes Away At 100

May 01, 2025

Latest Posts

-

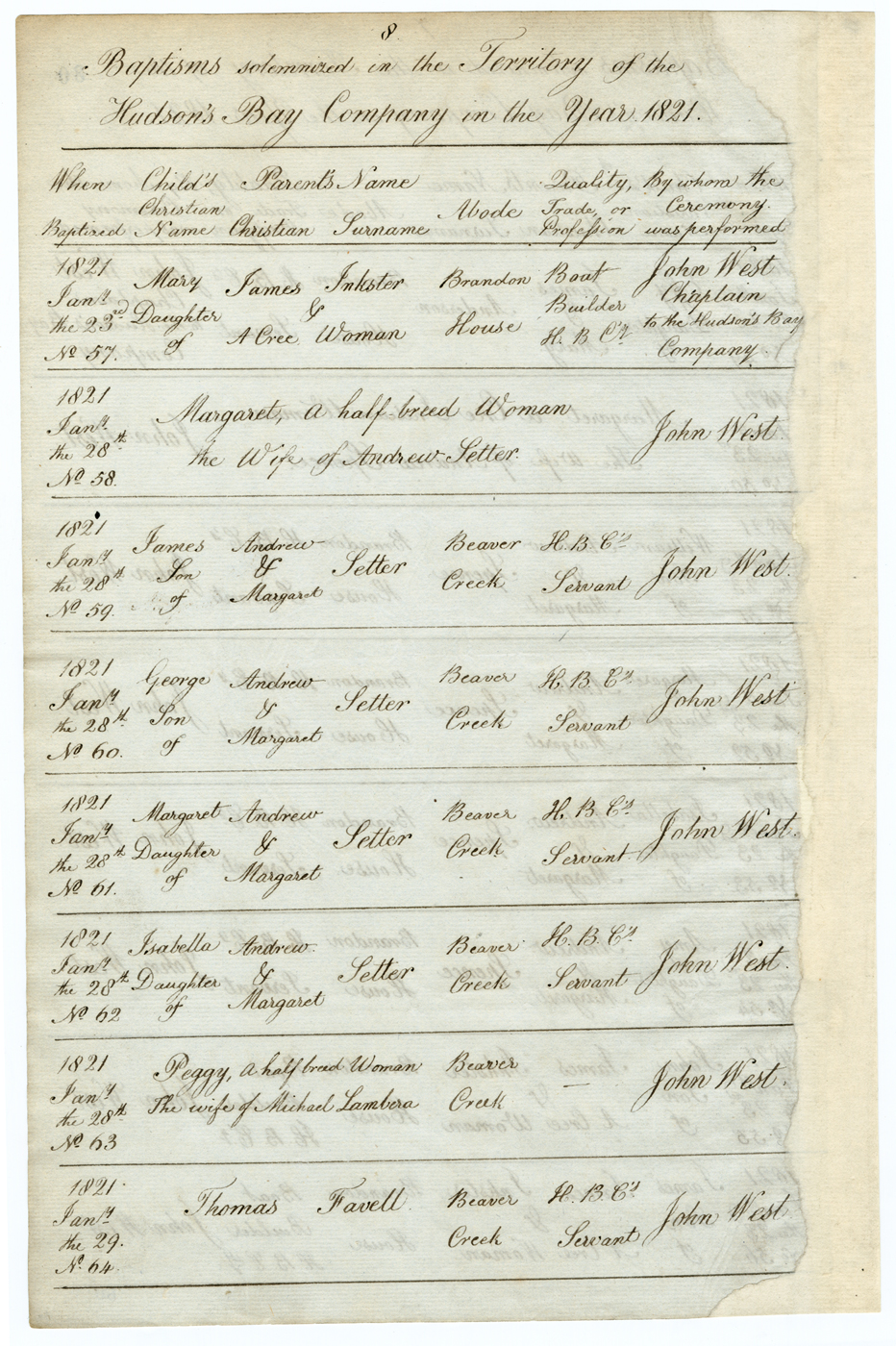

Hudsons Bay And Manitoba Uniting Historical Artifacts

May 01, 2025

Hudsons Bay And Manitoba Uniting Historical Artifacts

May 01, 2025 -

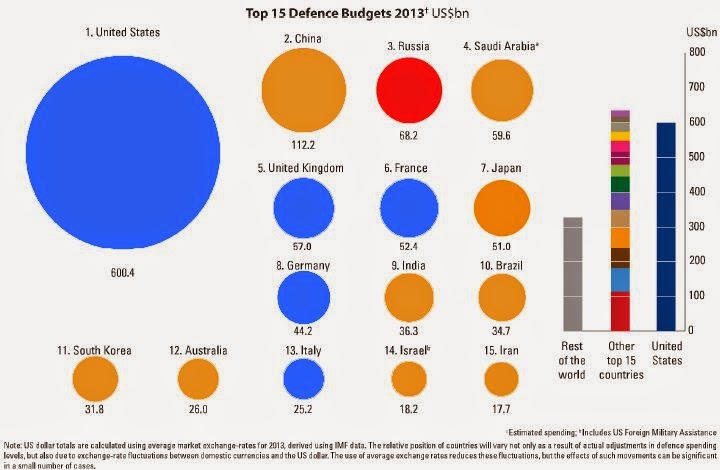

The Ukraine Wars Effect On Global Military Spending Europes Increased Defense Budgets

May 01, 2025

The Ukraine Wars Effect On Global Military Spending Europes Increased Defense Budgets

May 01, 2025 -

Preserving History Hudsons Bay Artifacts And Manitobas Heritage

May 01, 2025

Preserving History Hudsons Bay Artifacts And Manitobas Heritage

May 01, 2025 -

Canadian Dollar Forecast Minority Governments Impact

May 01, 2025

Canadian Dollar Forecast Minority Governments Impact

May 01, 2025 -

Increased Global Defense Budgets Europe Leads The Way In Countering Russia

May 01, 2025

Increased Global Defense Budgets Europe Leads The Way In Countering Russia

May 01, 2025