Is Palantir Stock A Buy Right Now? A Comprehensive Analysis

Table of Contents

Palantir Technologies is a data analytics company known for its powerful software platforms, Gotham and Foundry. These platforms are used by government agencies and large corporations to analyze vast amounts of data, uncovering insights and patterns that would otherwise be invisible. While Palantir enjoys a reputation for its work with intelligence agencies, contributing to its somewhat controversial image, its commercial client base is rapidly expanding. This article will dissect its financial performance, competitive landscape, and inherent risks to help you answer the critical question: is Palantir stock a buy right now?

Palantir's Business Model and Revenue Streams

Palantir's revenue streams are primarily derived from two key areas: government contracts and commercial partnerships. Understanding the dynamics of both is crucial to assessing the company's overall financial health.

Government Contracts

Government contracts form a significant portion of Palantir's revenue. These contracts, often with agencies focused on national security and intelligence, provide a degree of stability. However, they also carry inherent risks.

- Stability: Long-term contracts with government agencies ensure a consistent revenue stream, mitigating some of the uncertainty faced by companies relying solely on commercial markets.

- Risks: Government budgets can fluctuate, leading to potential contract cancellations or delays. Geopolitical events can also impact contract renewals and new business opportunities. The specific details of many government contracts are kept confidential, limiting public transparency. Examples of clients include the CIA and various branches of the US military, though specific details regarding those contracts are usually non-public. Future wins and losses in large government contracts can significantly affect short-term stock price.

- Keywords: Palantir government contracts, federal spending, defense spending, government data analytics.

Commercial Partnerships

Palantir's growth in the commercial sector is a key driver of its future potential. The company is increasingly partnering with large corporations across various industries.

- Key Clients: While specific client details are often protected by confidentiality agreements, Palantir serves major players in sectors like finance, healthcare, and manufacturing. These partnerships provide opportunities for increased revenue diversification and less volatility compared to government contracts alone.

- Growth Potential: The commercial market for big data analytics is vast and rapidly expanding, offering significant growth opportunities for Palantir.

- Keywords: Palantir commercial clients, big data analytics, enterprise data solutions, AI-powered solutions.

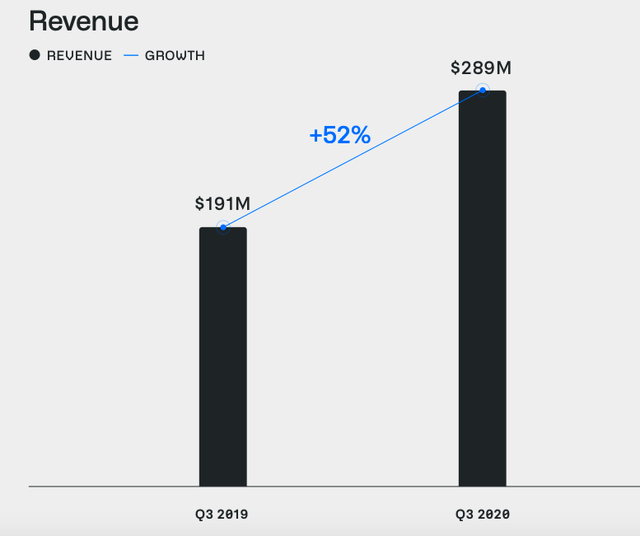

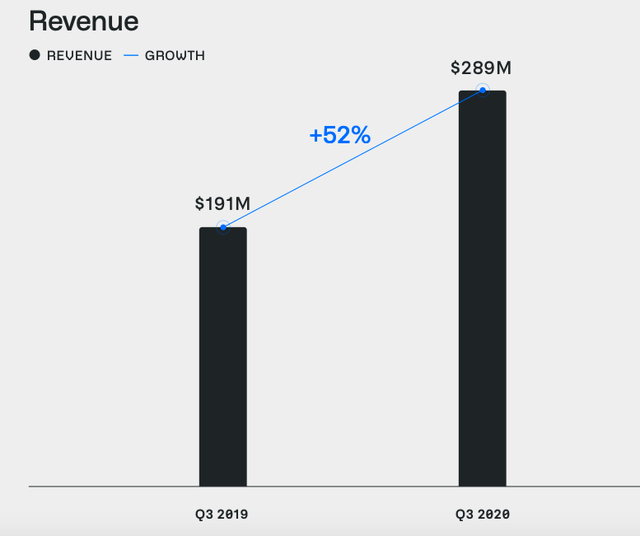

Financial Performance Analysis

A thorough examination of Palantir's financial statements reveals its financial health and potential for future growth.

- Key Metrics: Analyzing Palantir's revenue growth, operating income, net income, and debt levels provides valuable insight into the company's financial performance. Comparing these metrics to competitors, such as IBM or Microsoft's cloud analytics divisions helps gauge Palantir's position within the market.

- Valuation: Key valuation metrics like the Price-to-Earnings (P/E) ratio provide context to the current market valuation of Palantir stock. A high P/E ratio might signal that the stock is overvalued compared to its earnings potential.

- Keywords: Palantir financial statements, Palantir revenue growth, Palantir profitability, Palantir stock valuation.

Competitive Landscape and Market Position

Understanding Palantir's competitive landscape and its position within the broader big data analytics market is essential to evaluating its investment potential.

Key Competitors

Palantir faces stiff competition from established players and emerging tech companies.

- Comparison: Companies like IBM, Microsoft (Azure), AWS, and Google Cloud provide comparable big data and analytics services. Analyzing Palantir's strengths (specialized platform, strong government relationships) and weaknesses (high valuation, dependence on a few large clients) against these competitors is critical.

- Market Share: Assessing Palantir's market share within specific niches helps understand its competitive advantage.

- Keywords: Palantir competitors, data analytics competition, market share analysis.

Market Growth and Future Outlook

The big data analytics market is projected to grow substantially in the coming years.

- Growth Drivers: Increasing data volumes, the rise of cloud computing, and the growing adoption of AI are key factors driving market expansion.

- Palantir's Prospects: Palantir's ability to leverage these trends and capitalize on market opportunities will determine its future growth trajectory.

- Keywords: Big data market growth, data analytics market outlook, Palantir future growth.

Risks and Potential Downsides of Investing in Palantir

While Palantir presents exciting opportunities, several risks and potential downsides warrant consideration before investing.

Dependence on Government Contracts

Palantir's reliance on government contracts exposes it to specific risks.

- Government Spending: Changes in government spending priorities or budget cuts could significantly impact Palantir's revenue. Political shifts and changes in administrations can also affect contract renewals and new business opportunities.

- Geopolitical Risks: Global political instability can create uncertainty and disrupt contract execution.

- Keywords: Palantir government contract risk, political risk, budget cuts.

High Valuation

Palantir's relatively high stock valuation compared to its earnings raises concerns.

- Overvaluation: A high P/E ratio may suggest the stock is currently overvalued compared to its historical performance and future projections. Investors should carefully evaluate the valuation relative to comparable companies.

- Price Correction: There's a possibility of a stock price correction if the market perceives Palantir's valuation as unsustainable.

- Keywords: Palantir stock price, Palantir valuation, overvalued stock.

Competition and Technological Disruption

The data analytics landscape is constantly evolving, and Palantir faces ongoing threats from competition and technological disruption.

- Disruptive Technologies: New technologies could render Palantir's current platforms less competitive in the future. Continuous innovation and adaptability are crucial to maintaining its market position.

- Competitive Pressures: Intense competition from larger players with established market presence could put downward pressure on Palantir's pricing and margins.

- Keywords: Technological disruption, competitive threats, innovation in data analytics.

Conclusion

Our analysis of Palantir's business model, competitive environment, and associated risks paints a complex picture. While Palantir enjoys a strong position in the government sector and a growing presence in the commercial market, its dependence on government contracts, high valuation, and exposure to competitive pressures are important considerations. Whether Palantir stock is a buy, hold, or sell ultimately depends on your individual risk tolerance, investment horizon, and assessment of its long-term growth prospects. Based on the current market conditions and financial performance, a cautious approach might be warranted. However, it certainly has potential for substantial growth.

Therefore, the answer to "Is Palantir stock a buy right now?" remains a nuanced one. Conduct your own thorough research, considering the factors discussed above, before making any investment decisions. Share your thoughts and analysis in the comments below! For further research, consider checking reputable financial news sources and Palantir's investor relations page.

Featured Posts

-

Bayern Munich Vs Inter Milan Champions League Clash Preview And Prediction

May 09, 2025

Bayern Munich Vs Inter Milan Champions League Clash Preview And Prediction

May 09, 2025 -

Air Traffic Controller Safety Warnings Preceded Newark System Failure

May 09, 2025

Air Traffic Controller Safety Warnings Preceded Newark System Failure

May 09, 2025 -

Market Rally Sensex Nifty Close Higher Ultra Tech Cements Decline

May 09, 2025

Market Rally Sensex Nifty Close Higher Ultra Tech Cements Decline

May 09, 2025 -

Suspeita De Perseguicao Mulher Que Se Apresenta Como Madeleine Mc Cann Presa Na Inglaterra

May 09, 2025

Suspeita De Perseguicao Mulher Que Se Apresenta Como Madeleine Mc Cann Presa Na Inglaterra

May 09, 2025 -

Unprecedented Fentanyl Seizure Details From Bondis Press Conference

May 09, 2025

Unprecedented Fentanyl Seizure Details From Bondis Press Conference

May 09, 2025