Market Rally: Sensex, Nifty Close Higher; UltraTech Cement's Decline

Table of Contents

Sensex and Nifty's Strong Performance

Factors Contributing to the Market Rally

Several positive factors contributed to today's impressive market rally. Positive economic indicators played a significant role, boosting investor confidence.

- Strong GDP Growth Forecasts: Recent reports predict robust GDP growth for the next fiscal year, fueling optimism amongst investors. This positive outlook encourages increased investment and contributes to higher stock valuations.

- Improved Investor Sentiment: A general improvement in investor sentiment, driven by positive global cues and domestic economic stability, led to increased buying activity.

- Significant FII Inflows: Foreign Institutional Investors (FIIs) continued their bullish stance, injecting substantial capital into the Indian markets. This inflow of foreign investment provided a significant boost to the market's upward trajectory.

- Sector-Specific Growth: The IT, banking, and FMCG sectors were particularly strong performers, driving the overall market rally. These sectors showed significant gains, contributing substantially to the Sensex and Nifty's positive performance.

This combination of positive economic indicators, improved investor sentiment, and significant FII inflows created a potent cocktail for a strong market rally. You can find more details in today's reports from the [Link to relevant news source 1] and [Link to relevant news source 2].

Technical Analysis of the Rally

From a technical perspective, several indicators support today's uptrend.

- Moving Averages: Both the 50-day and 200-day moving averages are trending upwards, signaling a strong bullish momentum.

- RSI (Relative Strength Index): The RSI indicates that the market is not currently overbought, suggesting the rally may have further room to run. While not a definitive predictor, it adds to the positive technical picture.

- Chart Patterns: The market's movement suggests a continuation of the existing uptrend, although potential resistance levels around the 66,500 mark for the Sensex should be watched.

UltraTech Cement's Unexpected Decline

Reasons Behind UltraTech Cement's Fall

Despite the overall market rally, UltraTech Cement experienced a significant decline. Several factors might have contributed to this unexpected drop:

- Profit Booking: Some analysts suggest that the decline might be attributed to profit-booking by investors who had previously accumulated significant holdings in the stock.

- Sector-Specific Headwinds: Concerns about softening demand in the cement sector or increased input costs could have weighed on the stock's performance.

- Lack of Positive Catalysts: Absence of significant positive announcements or developments related to the company could have led to selling pressure.

- Trading Volume: Analyzing the volume of UltraTech Cement shares traded today can provide further insight into the reasons behind the decline. A high trading volume might indicate significant selling pressure.

Analyzing UltraTech Cement's Future Prospects

While today's decline is concerning, the long-term outlook for UltraTech Cement remains a subject of debate among analysts. Several factors will shape its future performance:

- Demand Recovery: The recovery of the construction sector and infrastructure development will be key to UltraTech Cement's future growth.

- Input Cost Management: The company's ability to effectively manage rising input costs will influence its profitability.

- Competitive Landscape: The intensity of competition within the cement sector will also impact UltraTech Cement's market share and pricing power.

Overall Market Sentiment and Future Predictions

Investor Sentiment and Market Volatility

The overall market sentiment is currently positive, buoyed by the Sensex and Nifty's strong performance. However, the decline in UltraTech Cement highlights the inherent volatility of the market. Investors should remain cautious and monitor potential risks such as inflation, geopolitical uncertainties, and global economic slowdown.

Expert Opinions and Predictions (Optional)

[Include quotes from market analysts, if available, and cite their sources.]

Conclusion: Understanding the Market Rally and UltraTech Cement's Dip

Today's market witnessed a significant rally, with the Sensex and Nifty closing higher, driven by positive economic indicators, improved investor sentiment, and strong FII inflows. However, UltraTech Cement's decline serves as a reminder of the individual stock risks within a broader positive market trend. Understanding both the macro and micro factors influencing market movements is crucial for successful investment strategies. Stay informed about future market rallies and individual stock analyses by subscribing to our newsletter!

Featured Posts

-

Anchor Brewing Companys Closure What Happened

May 09, 2025

Anchor Brewing Companys Closure What Happened

May 09, 2025 -

Despite Trade Wars This Cryptocurrency Could Still Win

May 09, 2025

Despite Trade Wars This Cryptocurrency Could Still Win

May 09, 2025 -

Jeanine Pirro Vs Aoc A Breakdown Of The Fact Check

May 09, 2025

Jeanine Pirro Vs Aoc A Breakdown Of The Fact Check

May 09, 2025 -

Is High Potential Back Tonight Season 2 Renewal And Episode Count

May 09, 2025

Is High Potential Back Tonight Season 2 Renewal And Episode Count

May 09, 2025 -

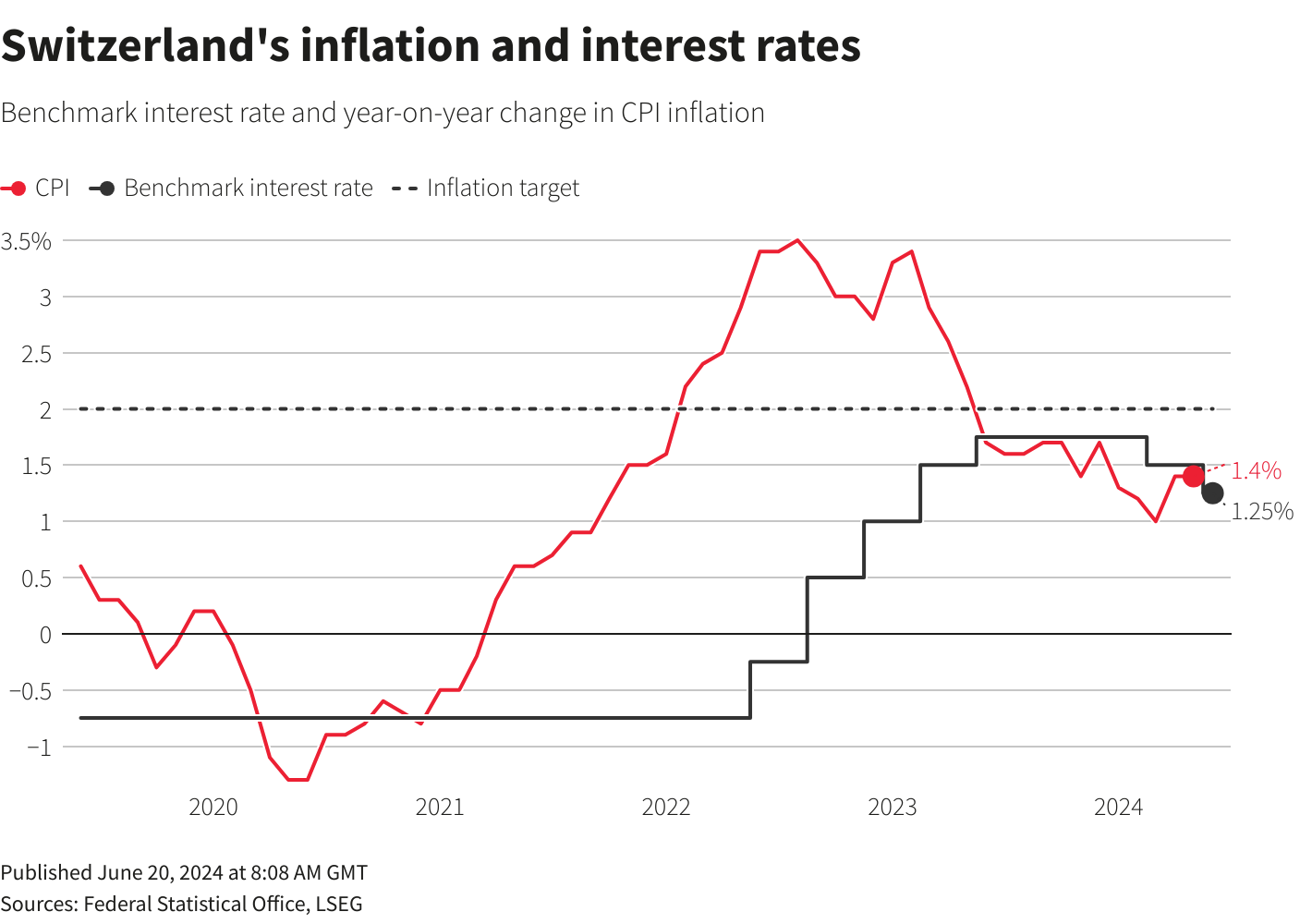

Why The Fed Lags Behind On Interest Rate Cuts A Deep Dive

May 09, 2025

Why The Fed Lags Behind On Interest Rate Cuts A Deep Dive

May 09, 2025