Is Palantir Stock A Good Buy Before May 5th Earnings Report?

Table of Contents

Palantir's Recent Performance and Future Outlook

Analyzing Q4 2022 and Full-Year Results

Palantir's Q4 2022 and full-year results will heavily influence investor sentiment leading up to May 5th. Analyzing these results requires a close look at key performance indicators (KPIs). We need to examine revenue growth, profitability, and customer acquisition to gauge the company's overall health.

- Revenue Growth: Did Palantir meet or exceed analysts' expectations for revenue growth? A comparison to previous quarters and years is essential. A significant increase in Palantir revenue would be a bullish signal.

- Profitability: Did Palantir achieve profitability, or was it still operating at a loss? Monitoring changes in operating margins and net income provides crucial insights into the company's financial health. Improvements in Palantir profitability would boost investor confidence.

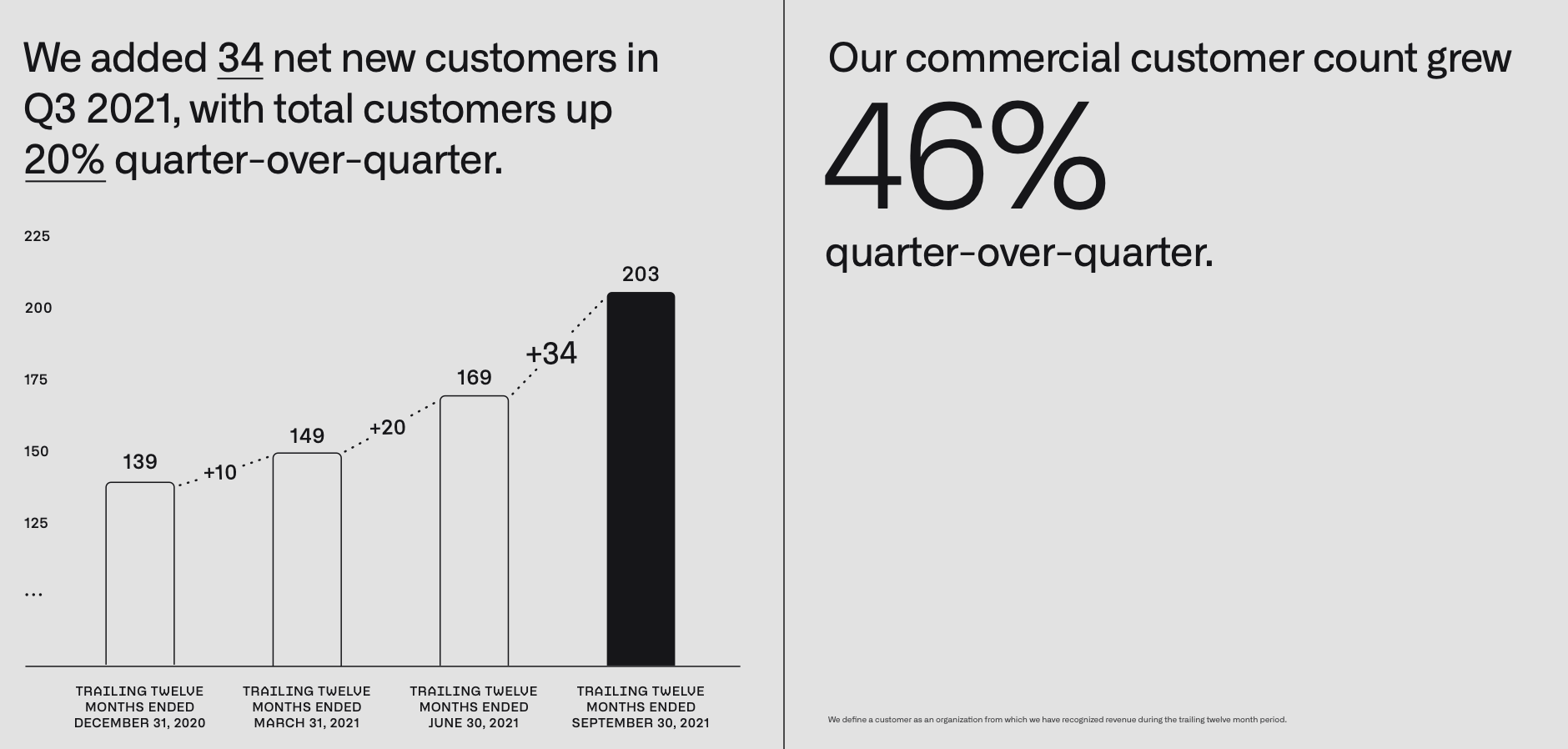

- Customer Acquisition: Did Palantir secure new significant clients in both the government and commercial sectors? Strong customer acquisition indicates healthy future growth potential. The number of new Palantir government contracts and commercial clients will be important metrics.

- Significant Partnerships: Any major partnerships or contract wins announced since the last earnings report should be factored in. These can significantly influence the Palantir stock price. Keywords: Palantir revenue, Palantir profitability, Palantir growth.

Growth Potential in Key Sectors

Palantir operates in two primary sectors: government and commercial. Analyzing the growth potential in each sector is vital for assessing the company's future prospects.

- Government Sector: Palantir enjoys a strong presence in the government sector, providing data analytics solutions to various agencies. Future growth depends on securing new contracts and expanding existing ones. Keywords: Palantir government contracts, data analytics market.

- Commercial Sector: Palantir's expansion into the commercial sector is crucial for long-term growth. Success here relies on attracting and retaining clients across various industries. Keywords: Palantir commercial clients, data analytics market.

- Competitive Advantages: Palantir's proprietary technology and strong data analytics capabilities provide a significant competitive edge. However, competition from established players and new entrants should be considered.

- Challenges: The competitive landscape, potential budget constraints in the government sector, and economic downturns pose challenges to Palantir's growth.

Risks and Uncertainties

Several risks could influence Palantir stock before and after the May 5th earnings report.

- Competition: The data analytics market is highly competitive, with established players and new entrants constantly vying for market share. Increased competition could impact Palantir's revenue growth. Keywords: Palantir competition.

- Geopolitical Factors: Geopolitical instability and international conflicts can affect government spending on data analytics, potentially impacting Palantir's government contracts.

- Economic Slowdown: A global economic slowdown could reduce spending on data analytics solutions by both government and commercial clients. This is a significant risk factor. Keywords: Palantir risk assessment, market volatility.

Valuation and Investment Considerations

Current Stock Price and Valuation Metrics

Understanding Palantir's valuation is critical for any investment decision. Key metrics include the current Palantir stock price, P/E ratio, and Price-to-Sales ratio.

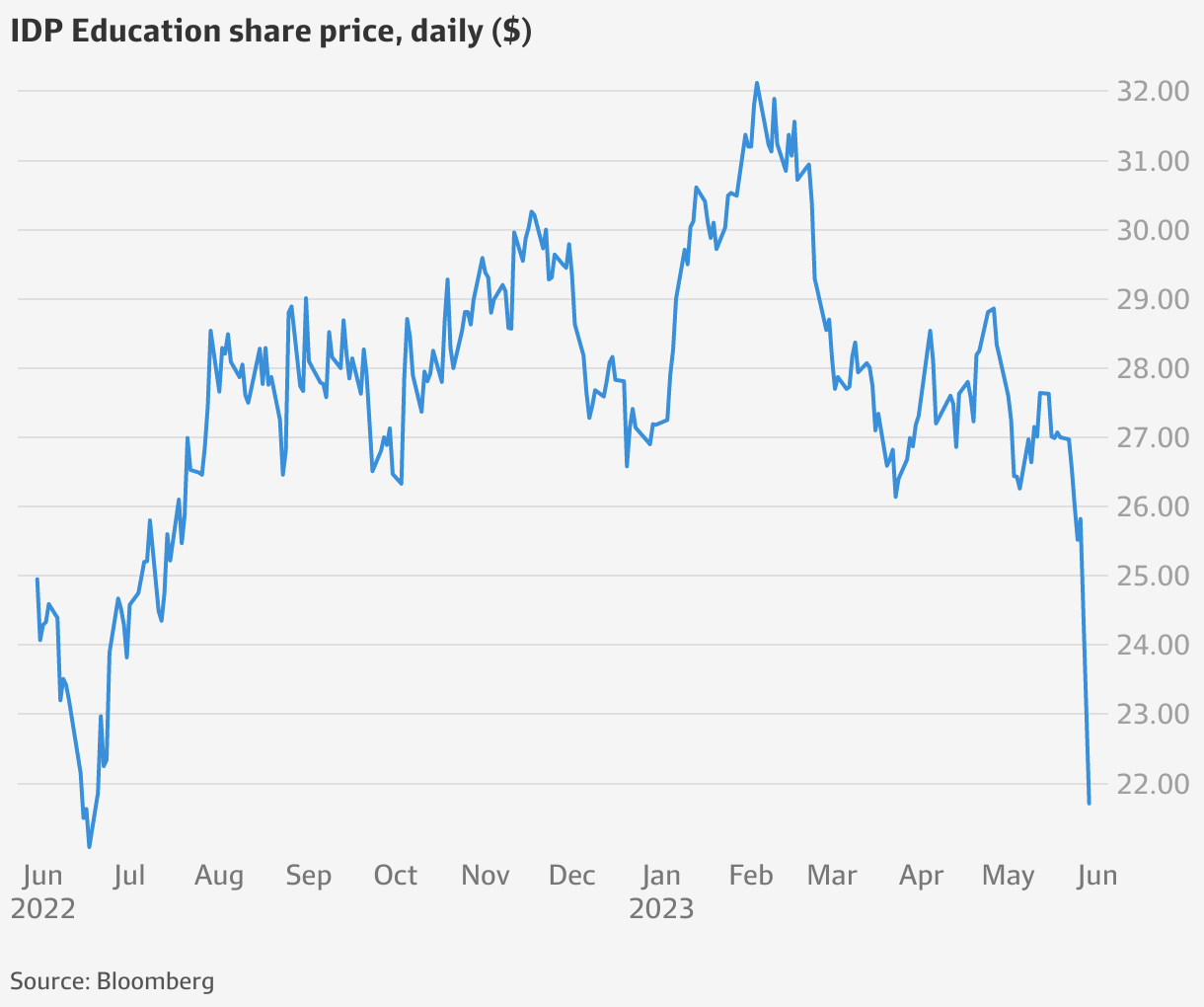

- Palantir Stock Price: The current stock price reflects market sentiment and investor expectations. Analyzing its recent trajectory and comparing it to historical data offers insights. Keywords: Palantir stock price, Palantir valuation.

- Valuation Metrics: Comparing Palantir's P/E ratio and Price-to-Sales ratio to industry peers and historical values helps determine if the stock is overvalued or undervalued. Keywords: P/E ratio, stock valuation.

Analyst Ratings and Predictions

Reviewing analyst ratings and predictions provides a broader perspective on Palantir stock.

- Consensus Estimates: The consensus estimates from financial analysts regarding Palantir's future performance offer valuable insights.

- Price Targets: Analyst price targets provide potential future stock price ranges. However, these should be viewed cautiously. Keywords: Palantir analyst rating, Palantir stock forecast, buy rating, sell rating.

Strategic Implications of the May 5th Earnings Report

Potential Market Reactions

The market's reaction to the May 5th earnings report will depend heavily on the results.

- Positive Surprise: Exceeding expectations could lead to a significant increase in the Palantir stock price.

- Negative Surprise: Falling short of expectations could result in a sharp decline. Keywords: Palantir earnings surprise, market reaction, stock price volatility.

Post-Earnings Trading Strategy

The earnings report will significantly influence investment strategies.

- Buy, Hold, or Sell: Investors may choose to buy, hold, or sell Palantir stock based on the results and their risk tolerance. This section is for informational purposes only and does not constitute financial advice. Keywords: investment strategy, risk management, stock trading.

Conclusion: Is Palantir Stock Right for You Before May 5th?

Whether Palantir stock is a good buy before May 5th depends on individual investment goals, risk tolerance, and a thorough assessment of the information presented above. Remember that the information provided here is for educational purposes only and should not be considered financial advice. Conducting your own thorough research and understanding the inherent risks are crucial before making any investment decisions. Remember to consider your own financial situation and consult with a qualified financial advisor before investing in Palantir stock or any other security. Conduct your own thorough research before deciding if Palantir stock is a good fit for your investment strategy before May 5th.

Featured Posts

-

Felling Of Iconic Sycamore Gap Tree Convictions Secured

May 10, 2025

Felling Of Iconic Sycamore Gap Tree Convictions Secured

May 10, 2025 -

Families Outraged Nhs Staff Viewed Loved Ones A And E Records In Nottingham

May 10, 2025

Families Outraged Nhs Staff Viewed Loved Ones A And E Records In Nottingham

May 10, 2025 -

Hanh Trinh Chuyen Gioi Cua Lynk Lee Nhan Sac Thang Hang Tinh Yeu Tron Ven

May 10, 2025

Hanh Trinh Chuyen Gioi Cua Lynk Lee Nhan Sac Thang Hang Tinh Yeu Tron Ven

May 10, 2025 -

Is A 40 Increase In Palantir Stock Price By 2025 Realistic

May 10, 2025

Is A 40 Increase In Palantir Stock Price By 2025 Realistic

May 10, 2025 -

Trumps Tariffs 174 Billion Wipeout For Top 10 Billionaires

May 10, 2025

Trumps Tariffs 174 Billion Wipeout For Top 10 Billionaires

May 10, 2025