Is Palantir Stock A Good Investment? A Detailed Evaluation

Table of Contents

Palantir Technologies (PLTR) has captivated investors with its groundbreaking data analytics platforms. Its innovative approach to data integration and analysis has positioned it as a key player in both the government and commercial sectors. But is Palantir stock a good investment? This in-depth analysis dissects the crucial factors shaping Palantir's stock performance, helping you decide if it aligns with your investment strategy. We will explore its business model, financial health, competitive standing, and future prospects to offer a comprehensive evaluation of Palantir as an investment opportunity.

Palantir's Business Model and Revenue Streams

Palantir operates primarily through two platforms: Gotham and Foundry. Palantir Gotham caters to government agencies, providing them with powerful tools for combating terrorism, cybersecurity threats, and other critical challenges. Palantir Foundry, on the other hand, serves commercial clients across various industries, enabling them to leverage their data for better decision-making and operational efficiency.

-

Recurring Revenue Model: A significant portion of Palantir's revenue is generated through its subscription-based model. This recurring revenue stream offers greater predictability and enhances long-term financial stability compared to project-based models. This is a key factor in Palantir valuation.

-

Key Clients and Industry Verticals: Palantir boasts an impressive client roster, including major government agencies and Fortune 500 companies across diverse sectors such as finance, healthcare, and manufacturing.

- Examples include the CIA, FBI, and numerous commercial enterprises.

- This diversification across both public and private sectors mitigates some risks associated with over-reliance on a single industry.

-

Revenue Growth Trajectory: Palantir has shown consistent revenue growth, though profitability remains a key area of focus. Analyzing this trajectory and its sustainability is crucial for evaluating Palantir stock. Continued growth in both Gotham and Foundry will be key indicators of the health of Palantir's business. Keywords: Palantir Gotham, Palantir Foundry, Palantir revenue, Palantir recurring revenue, Palantir clients.

Financial Performance and Valuation

Assessing Palantir's financial performance requires a deep dive into several key metrics:

-

Revenue Growth: While revenue has been increasing, consistent and sustainable growth is essential for long-term investor confidence.

-

Profitability: Palantir's profitability, or lack thereof, is a significant concern for many investors. Analyzing operating margins and net income is crucial.

-

Cash Flow: Examining Palantir's cash flow from operations provides insights into its financial health and ability to fund future growth initiatives.

-

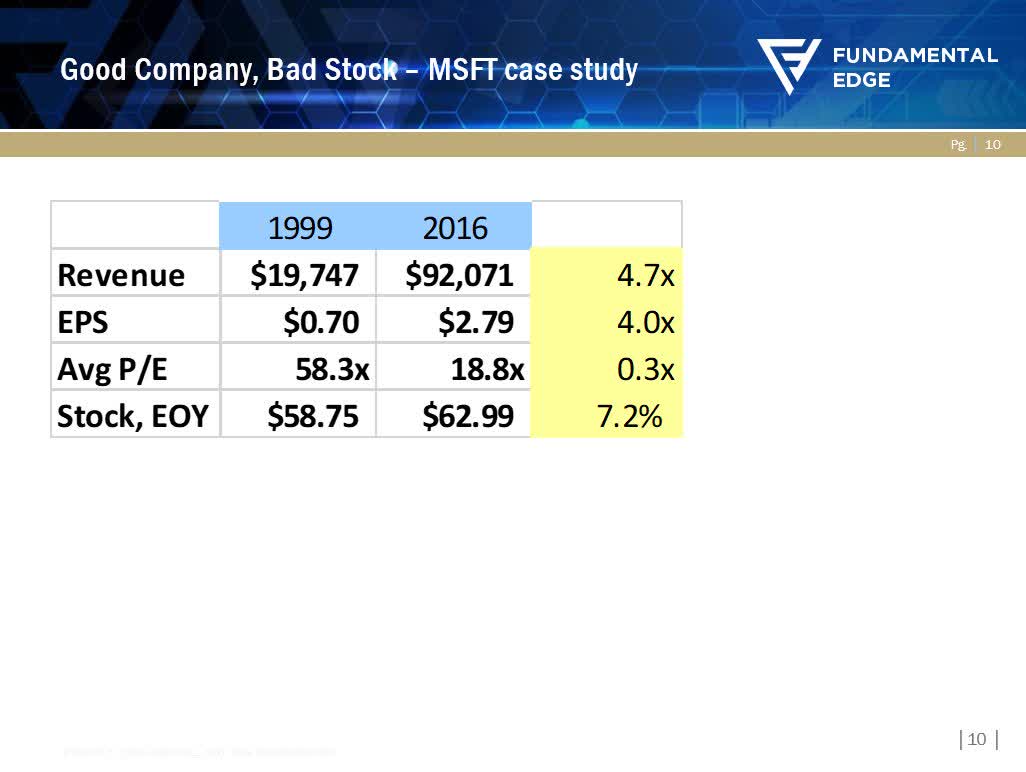

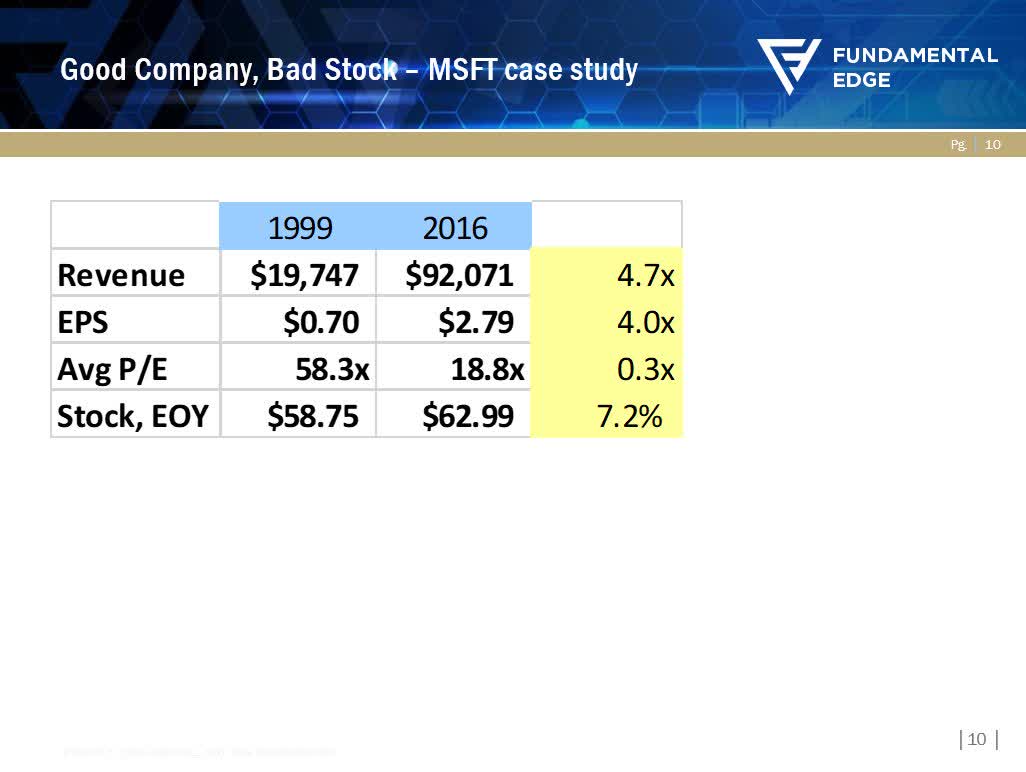

Valuation Metrics: Comparing Palantir's price-to-sales ratio (P/S ratio) and other valuation metrics to its competitors provides a relative assessment of its current valuation.

-

Past Performance and Projected Earnings: Studying historical financial data and analyst projections helps in forecasting future earnings and understanding the potential for stock price appreciation. Keywords: Palantir financials, Palantir valuation, Palantir P/S ratio, Palantir profitability, PLTR earnings.

Competitive Landscape and Market Opportunities

Palantir faces stiff competition in the burgeoning big data analytics market. Key competitors include:

- Databricks: A prominent player in cloud-based data warehousing and analytics.

- Snowflake: Another major cloud data platform known for its scalability and performance.

- Other specialized analytics firms: Several niche players compete with Palantir in specific industry segments.

Palantir's competitive advantages include its strong government relationships (particularly with Gotham), its sophisticated data integration capabilities, and its proven track record in handling complex data challenges. However, its high pricing and the complexity of its platform can be disadvantages. The data analytics market is expanding rapidly, presenting significant growth opportunities for Palantir. However, the competitive landscape necessitates continuous innovation and adaptation. Keywords: Palantir competitors, data analytics market, big data market, Palantir competitive advantage.

Risks and Challenges Facing Palantir

Despite its potential, Palantir faces several risks:

-

Dependence on Government Contracts: A substantial portion of Palantir's revenue stems from government contracts. Changes in government policy or budget cuts could significantly impact its financial performance. This is a major factor influencing PLTR stock.

-

Profitability and Scalability: Achieving consistent profitability and scaling operations effectively remain key challenges.

-

Geopolitical Risks and Regulatory Hurdles: International operations expose Palantir to geopolitical risks and regulatory uncertainties in different countries.

-

Competition: The intensifying competition in the data analytics space poses a constant threat to Palantir's market share. Keywords: Palantir risks, Palantir challenges, Palantir government contracts, PLTR risks.

Future Growth Prospects and Potential for Palantir Stock

Palantir's long-term growth hinges on several factors:

-

Expansion into New Markets: Further penetration into commercial markets and expansion into new geographical regions are vital for sustained growth.

-

Technological Advancements: Continuous investment in research and development (R&D) is crucial to maintain a competitive edge in the rapidly evolving data analytics landscape.

-

Strategic Partnerships: Collaborations with other technology companies can unlock new opportunities and accelerate growth.

While Palantir’s future is promising, investing in PLTR carries risks. A balanced outlook acknowledges both the considerable potential for growth and the inherent challenges. Keywords: Palantir growth prospects, Palantir future, Palantir stock forecast, PLTR future.

Conclusion

This analysis of Palantir Technologies stock has explored numerous factors that influence its investment potential, from its innovative business model and financial performance to the competitive dynamics and associated risks. Palantir offers exciting prospects within the burgeoning data analytics sector, but potential investors must carefully weigh both the substantial upside and the considerable challenges.

Ultimately, whether Palantir stock is a good investment for you hinges on your individual risk tolerance and investment objectives. Conduct exhaustive due diligence and consult with a financial advisor before making any investment decisions concerning Palantir stock (PLTR). Further research into Palantir's financial statements and market position will enhance your understanding of this intriguing company.

Featured Posts

-

Edmonton Oilers Betting Odds And Chances To Win Against The Los Angeles Kings

May 09, 2025

Edmonton Oilers Betting Odds And Chances To Win Against The Los Angeles Kings

May 09, 2025 -

Tham Kich Bao Hanh Tre Em Tien Giang De Xuat Giai Phap Phong Ngua

May 09, 2025

Tham Kich Bao Hanh Tre Em Tien Giang De Xuat Giai Phap Phong Ngua

May 09, 2025 -

5 Must Read Stephen King Books For True Fans

May 09, 2025

5 Must Read Stephen King Books For True Fans

May 09, 2025 -

Bitcoin Vs Micro Strategy Stock Which To Invest In

May 09, 2025

Bitcoin Vs Micro Strategy Stock Which To Invest In

May 09, 2025 -

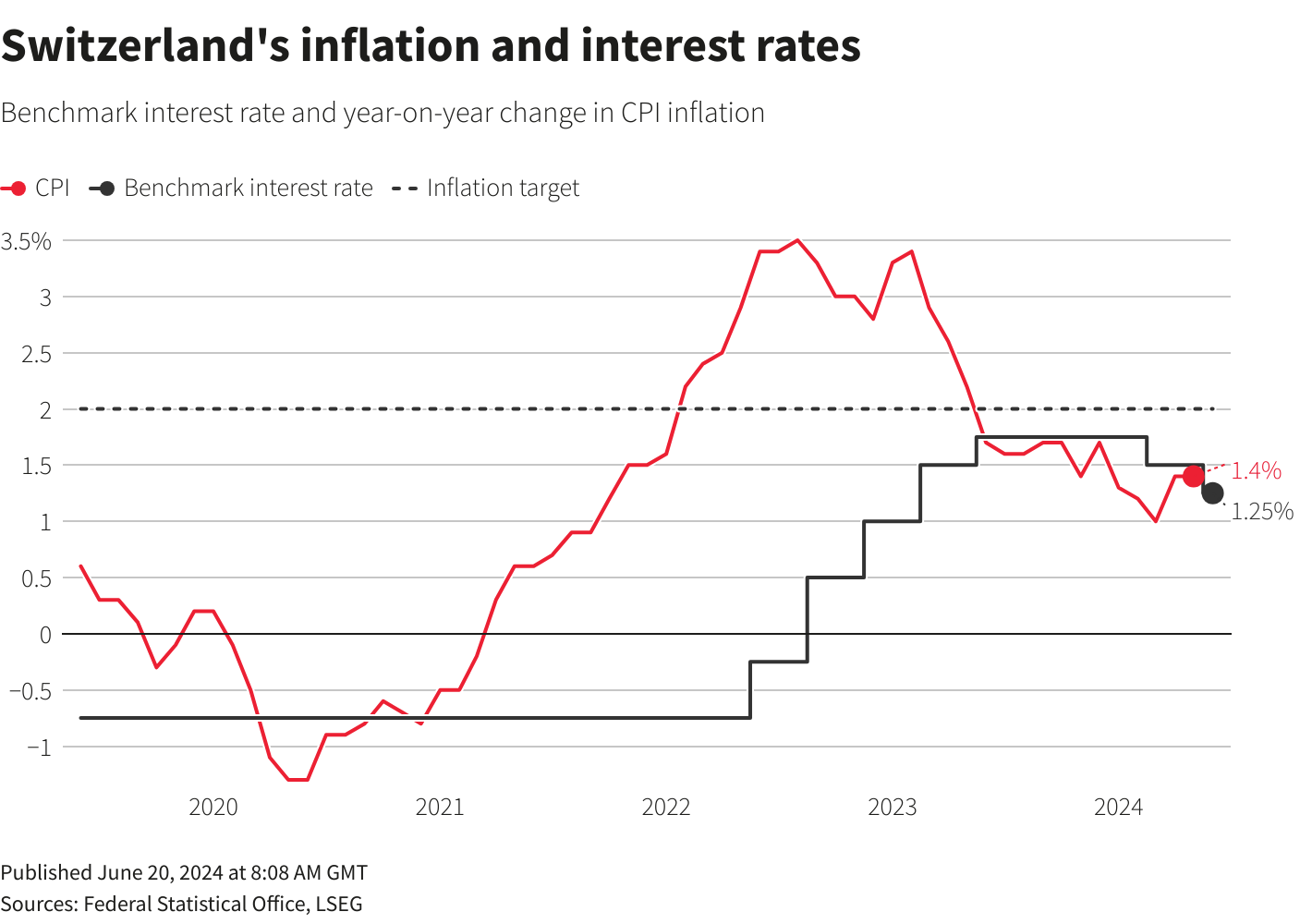

Why The Fed Lags Behind On Interest Rate Cuts A Deep Dive

May 09, 2025

Why The Fed Lags Behind On Interest Rate Cuts A Deep Dive

May 09, 2025