Is Palantir's Stock Price Justified? A Deep Dive Into Its Performance And Valuation

Table of Contents

Palantir's Financial Performance: A Detailed Look

Revenue Growth and Profitability

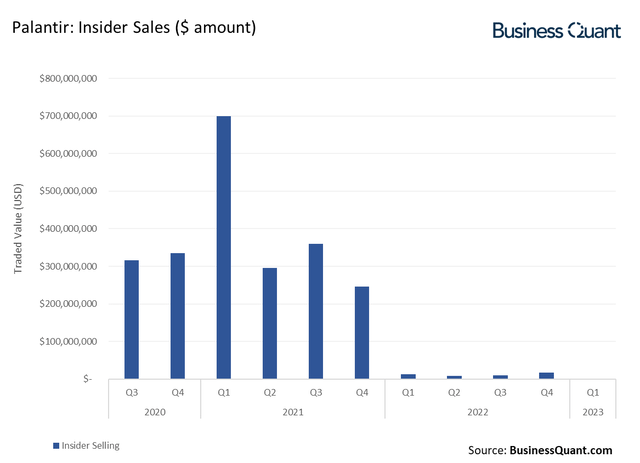

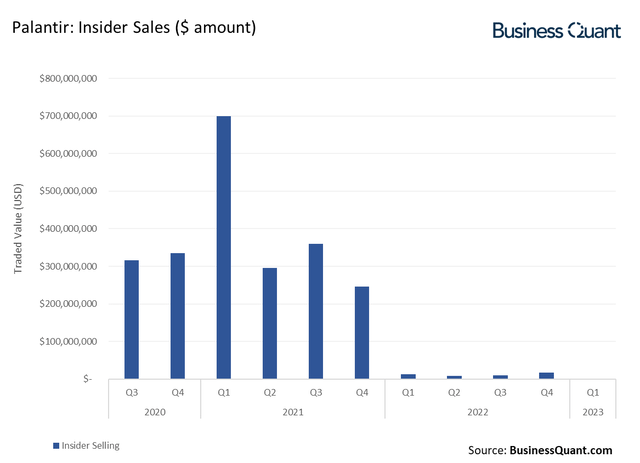

Palantir's revenue growth trajectory has been a subject of much discussion. While the company has shown consistent year-over-year growth, the rate of this growth and its profitability margins need careful scrutiny when evaluating Palantir's stock price.

- Year-over-Year Growth: Examining Palantir's financial reports reveals fluctuations in year-over-year revenue growth. While impressive growth percentages have been reported in certain periods, understanding the underlying drivers of this growth is crucial. Sustained high growth rates are essential for justifying a high stock price.

- Operating Income and Net Income: Analyzing Palantir's operating income and net income helps assess its profitability. While revenue growth is important, profitability demonstrates the company's ability to translate revenue into profit. Comparing these figures to previous years and industry benchmarks provides valuable context.

- Key Financial Ratios: Key financial ratios such as gross margin and operating margin provide insights into Palantir's cost structure and efficiency. Tracking these ratios over time reveals trends in profitability and operational effectiveness, which directly influence Palantir's stock price valuation.

[Insert relevant chart visualizing revenue growth, operating income, and net income over time].

Government vs. Commercial Revenue Streams

A significant aspect of Palantir's business model is its reliance on both government and commercial contracts. Understanding the contribution of each sector is vital for evaluating Palantir's stock price.

- Government Contract Dependence: Palantir's history shows a considerable dependence on government contracts. This dependence introduces risks associated with government budgeting cycles and potential changes in government priorities. High reliance on government contracts can affect the stability and predictability of Palantir's revenue streams.

- Commercial Sector Growth: Palantir's expansion into the commercial sector is crucial for its long-term growth and sustainability. The success of this strategy will directly influence future revenue streams and potentially reduce dependence on government contracts, stabilizing Palantir's stock price.

- Long-Term Contracts: The nature of Palantir's long-term contracts, both government and commercial, provides a degree of revenue predictability. However, potential contract renewal challenges or changes in contract terms can influence future revenue and, consequently, Palantir's stock price.

Valuation Metrics: Is Palantir Overvalued or Undervalued?

Price-to-Earnings Ratio (P/E)

The P/E ratio is a widely used valuation metric. Analyzing Palantir's P/E ratio relative to its competitors and the industry average is crucial for assessing whether its stock price is justified.

- High or Low P/E Ratio: A high P/E ratio often suggests investors expect significant future growth. However, a high P/E ratio can also indicate an overvalued stock. A low P/E ratio might suggest undervaluation or lower growth expectations.

- Influencing Factors: Various factors influence Palantir's P/E ratio, including its growth rate, profitability, risk profile, and market sentiment. Understanding these factors is crucial for proper interpretation.

- Future Growth Potential: The P/E ratio should be considered alongside projections for future growth. If future earnings are expected to significantly increase, a relatively high P/E ratio might be justified.

Other Key Valuation Metrics

A comprehensive valuation requires considering multiple metrics, providing a more holistic view of Palantir's stock price.

- Price-to-Sales (P/S): The P/S ratio compares the market capitalization to revenue, offering another perspective on valuation, especially valuable for companies with high growth but limited current profitability.

- PEG Ratio: The PEG ratio considers both the P/E ratio and the company's growth rate, providing a more refined assessment of valuation.

- Discounted Cash Flow (DCF) Analysis: DCF analysis estimates the intrinsic value of a company based on its projected future cash flows. This method requires making assumptions about future growth and discount rates, making it subject to uncertainty.

Competitive Landscape and Future Outlook

Key Competitors and Market Share

Palantir operates in a competitive big data analytics market. Understanding its competitive landscape and market share is crucial for assessing the sustainability of its growth and the justification for its stock price.

- Competitive Advantages: Palantir's proprietary technology, strong relationships with government agencies, and expertise in data integration provide significant competitive advantages.

- Competitive Disadvantages: The high cost of Palantir's platform and its relative lack of brand recognition in the commercial market could be seen as disadvantages.

- Market Share and Competition Intensity: Assessing Palantir's market share and the intensity of competition from rivals like AWS, Microsoft, and Google will provide insights into its long-term growth potential.

Growth Potential and Future Innovation

Palantir's future growth depends on its ability to innovate and expand into new markets.

- R&D Efforts: Palantir's investment in research and development is crucial for its ability to maintain a competitive edge and develop innovative products.

- New Markets and Technologies: Expansion into new markets and leveraging emerging technologies (like AI and machine learning) will contribute to future growth.

- Risks and Uncertainties: Risks associated with technological disruption, intense competition, and economic downturns could affect Palantir's future prospects and its stock price.

Conclusion

Analyzing Palantir's stock price requires a thorough examination of its financial performance, valuation metrics, and competitive landscape. While Palantir demonstrates consistent revenue growth and has a strong position in the government contracting market, its reliance on government contracts and high valuation metrics raise concerns. The company's success in the commercial sector and its ability to innovate will be key factors determining whether its current stock price is justified in the long run. Ultimately, deciding whether Palantir's stock price is justified requires careful consideration of the factors discussed. Conduct thorough due diligence and consult with a financial advisor before making any investment decisions related to Palantir's stock price.

Featured Posts

-

Third Pregnancy Confirmed Rihanna At The Met Gala

May 07, 2025

Third Pregnancy Confirmed Rihanna At The Met Gala

May 07, 2025 -

Nba Game Recap Cavaliers Rout Bulls By 22 Points

May 07, 2025

Nba Game Recap Cavaliers Rout Bulls By 22 Points

May 07, 2025 -

Todays Mlb Game Tigers Vs Mariners Prediction And Best Betting Picks

May 07, 2025

Todays Mlb Game Tigers Vs Mariners Prediction And Best Betting Picks

May 07, 2025 -

Section 230 And The Sale Of Banned Chemicals On E Bay Legal Implications

May 07, 2025

Section 230 And The Sale Of Banned Chemicals On E Bay Legal Implications

May 07, 2025 -

Salmond Sit Down Aces President Nikki Fargas On Community 2025 Season And More

May 07, 2025

Salmond Sit Down Aces President Nikki Fargas On Community 2025 Season And More

May 07, 2025

Latest Posts

-

Analyzing The Ethereum Weekly Chart Buy Signal And Market Outlook

May 08, 2025

Analyzing The Ethereum Weekly Chart Buy Signal And Market Outlook

May 08, 2025 -

Ethereum Price Holding Above Support But Is A Drop To 1 500 Imminent

May 08, 2025

Ethereum Price Holding Above Support But Is A Drop To 1 500 Imminent

May 08, 2025 -

Ethereums Crucial Support Will The Price Fall To 1 500 A Price Prediction

May 08, 2025

Ethereums Crucial Support Will The Price Fall To 1 500 A Price Prediction

May 08, 2025 -

Ethereum Rebound Imminent Weekly Chart Indicator Suggests Buy

May 08, 2025

Ethereum Rebound Imminent Weekly Chart Indicator Suggests Buy

May 08, 2025 -

Ethereums Price Action Breaking Through Resistance Levels

May 08, 2025

Ethereums Price Action Breaking Through Resistance Levels

May 08, 2025