Is This XRP's Big Moment? ETF Approvals, SEC Developments, And Market Impact

Table of Contents

The Ripple-SEC Lawsuit: A Looming Shadow or a Catalyst for Growth?

The Ripple-SEC lawsuit has cast a long shadow over XRP, creating significant uncertainty for investors. This legal battle, initiated in December 2020, centers on the SEC's claim that XRP is an unregistered security. The outcome will significantly impact XRP's future.

The Current State of the Lawsuit:

The lawsuit has progressed through various stages, including motion filings, expert witness testimonies, and extensive legal arguments. Recent developments have seen both sides presenting their cases, with judges weighing the evidence. For up-to-date information, refer to reputable news sources covering the case, such as [insert link to relevant news article 1] and [insert link to relevant news article 2].

- Potential outcomes of the lawsuit: A favorable ruling for Ripple could lead to a significant surge in XRP's price, as it would remove the regulatory uncertainty. A settlement, while potentially less dramatic, could still provide a boost. Conversely, an unfavorable ruling could lead to a substantial drop in price and further regulatory hurdles.

- Expert opinions and legal predictions: Legal experts offer varying opinions on the likely outcome, with some predicting a favorable ruling for Ripple based on the arguments presented, and others expressing caution due to the complexities of the case. Analyzing these differing perspectives is crucial for informed decision-making.

- Potential for appeal: Regardless of the outcome, either party has the right to appeal the decision, prolonging the uncertainty and potentially impacting XRP's price in the short term.

The Impact of ETF Approvals on XRP's Market Position

The approval of an XRP exchange-traded fund (ETF) could be a game-changer. ETFs provide a regulated and accessible way for institutional and retail investors to gain exposure to XRP.

Understanding the Potential of XRP ETFs:

An ETF is a type of investment fund that trades on stock exchanges, offering diversified exposure to underlying assets. Approval of an XRP ETF would significantly increase its liquidity and accessibility, attracting institutional investors who currently face hurdles in directly investing in cryptocurrencies.

- Increased institutional investment: Institutional investors, such as pension funds and hedge funds, often require regulated investment vehicles like ETFs before allocating significant capital to cryptocurrencies. ETF approval could unlock substantial institutional investment in XRP, driving up demand and price.

- Boosting market confidence and adoption: ETF approval would signal a degree of regulatory acceptance, boosting investor confidence and potentially leading to broader mainstream adoption of XRP.

- Comparison with other cryptocurrencies: The potential trajectory of an XRP ETF can be compared to the experience of Bitcoin and Ethereum ETFs. Analyzing these precedents can provide insights into the potential market impact.

Market Sentiment and Price Analysis: Gauging XRP's Current Trajectory

XRP's price is influenced by a complex interplay of factors, including overall market sentiment, Bitcoin's performance, and news related to the Ripple-SEC lawsuit and potential ETF approvals.

Analyzing Current Market Trends:

Currently, the cryptocurrency market is experiencing [describe the current market trend - bull, bear, sideways]. This overall sentiment significantly impacts XRP's price. Bitcoin's performance, as the dominant cryptocurrency, often correlates with the price movements of altcoins like XRP.

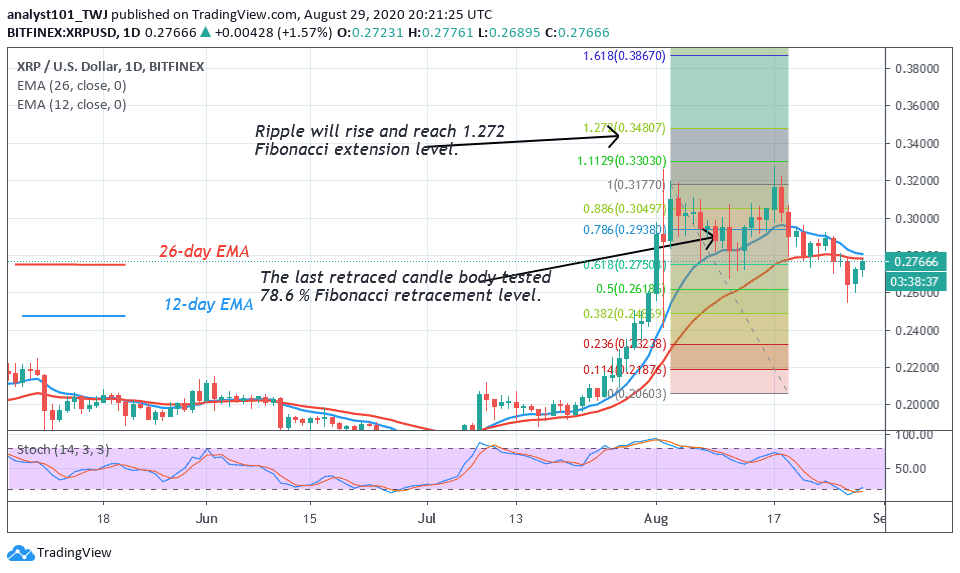

- Technical analysis of XRP's price charts: Technical analysis of XRP's trading volume and price charts can reveal potential support and resistance levels, indicating possible future price movements. [Link to a reputable chart analysis resource]

- Factors contributing to price volatility: News related to the lawsuit, regulatory announcements, and overall market sentiment are major drivers of XRP's price volatility.

- Short-term and long-term price predictions: Predicting cryptocurrency prices is inherently speculative. While some analysts offer forecasts, it's crucial to remember that these are not guarantees, and any investment decisions should be based on thorough research and risk tolerance.

The Regulatory Landscape and its Effect on XRP's Future

The regulatory environment plays a crucial role in shaping XRP's future. Different jurisdictions have varying approaches to regulating cryptocurrencies, creating complexities for investors and businesses operating in the space.

Navigating the Regulatory Maze:

The regulatory landscape for cryptocurrencies is constantly evolving. Clarity regarding XRP's status as a security or a commodity is crucial for its long-term viability.

- Different regulatory approaches: The US, for example, takes a more stringent approach compared to some other countries, influencing how XRP is treated and traded within those jurisdictions.

- Impact of regulatory clarity: Regulatory clarity, or lack thereof, significantly affects investor confidence. Clearer regulations can attract institutional investment and foster growth, while uncertainty can deter participation.

- Potential future regulatory developments: Future regulatory developments, including potential changes to SEC guidelines or the emergence of new global regulations, will have a substantial impact on XRP's market position.

Conclusion

The future of XRP is inextricably linked to the outcome of the Ripple-SEC lawsuit and the potential for ETF approval. While the current situation is marked by uncertainty, it also presents significant opportunities. Careful monitoring of market trends and regulatory developments is crucial for investors considering exposure to XRP. Stay informed about the latest developments surrounding the XRP landscape to make informed investment decisions. Remember to conduct thorough research and consider your own risk tolerance before investing in any cryptocurrency, including XRP.

Featured Posts

-

Video Shows Chaos After Car Crashes Into Afterschool Program Killing Four Children

May 01, 2025

Video Shows Chaos After Car Crashes Into Afterschool Program Killing Four Children

May 01, 2025 -

Household Plastic Chemicals A Studys Implications For Cardiovascular Health

May 01, 2025

Household Plastic Chemicals A Studys Implications For Cardiovascular Health

May 01, 2025 -

Southern Cruises 2025 New Ships And Itineraries

May 01, 2025

Southern Cruises 2025 New Ships And Itineraries

May 01, 2025 -

Kogi Train Malfunction Leaves Passengers Stranded

May 01, 2025

Kogi Train Malfunction Leaves Passengers Stranded

May 01, 2025 -

Is Xrp Ripple A Buy Under 3 A Detailed Investment Analysis

May 01, 2025

Is Xrp Ripple A Buy Under 3 A Detailed Investment Analysis

May 01, 2025

Latest Posts

-

Danh Gia Rui Ro Dau Tu Cong Ty Tung Bi Nghi Van Lua Dao Nen Hay Khong Nen Dau Tu

May 01, 2025

Danh Gia Rui Ro Dau Tu Cong Ty Tung Bi Nghi Van Lua Dao Nen Hay Khong Nen Dau Tu

May 01, 2025 -

Bao Ve Von Dau Tu Cach Thuc Danh Gia Rui Ro Khi Gop Von Vao Doanh Nghiep

May 01, 2025

Bao Ve Von Dau Tu Cach Thuc Danh Gia Rui Ro Khi Gop Von Vao Doanh Nghiep

May 01, 2025 -

Nghi Van Lua Dao Huong Dan Can Trong Khi Dau Tu Vao Cong Ty Co Lich Su Dang Ngo

May 01, 2025

Nghi Van Lua Dao Huong Dan Can Trong Khi Dau Tu Vao Cong Ty Co Lich Su Dang Ngo

May 01, 2025 -

Dau Tu Gop Von Nhan Biet Va Tranh Rui Ro Voi Cac Cong Ty Co Tien Su Lua Dao

May 01, 2025

Dau Tu Gop Von Nhan Biet Va Tranh Rui Ro Voi Cac Cong Ty Co Tien Su Lua Dao

May 01, 2025 -

Can Trong Khi Dau Tu Nhung Rui Ro Tiem An Khi Gop Von Vao Cong Ty Tung Bi Nghi Van Lua Dao

May 01, 2025

Can Trong Khi Dau Tu Nhung Rui Ro Tiem An Khi Gop Von Vao Cong Ty Tung Bi Nghi Van Lua Dao

May 01, 2025