Is XRP (Ripple) A Buy Under $3? A Detailed Investment Analysis

Table of Contents

Briefly, Ripple is a fintech company focused on facilitating cross-border payments for banks and financial institutions. XRP is the native cryptocurrency of Ripple's network, RippleNet, designed to expedite these transactions. Its speed and low transaction costs are key selling points. This analysis will determine whether the current price presents a viable entry point for investors considering the complexities of the situation.

Ripple's Legal Battle with the SEC and its Impact on XRP Price

The ongoing legal tussle between Ripple and the Securities and Exchange Commission (SEC) casts a long shadow over XRP's price. Understanding the lawsuit's potential outcomes is crucial for any investment decision.

The SEC Lawsuit and its Potential Outcomes

The SEC alleges that Ripple sold XRP as an unregistered security, violating federal law. The outcome of this case could significantly impact XRP's price.

- Favorable Outcome for Ripple: A court victory could see XRP regain investor confidence, potentially driving a price surge. The market might interpret this as validation of XRP's legitimacy.

- Unfavorable Outcome for Ripple: A ruling against Ripple could result in a significant price drop, as investors might lose confidence and sell off their XRP holdings. The consequences could be severe, impacting XRP's long-term prospects.

Expert opinions are divided. Some analysts predict a significant price rally upon a favorable ruling, while others warn of continued uncertainty even with a positive outcome. The market's reaction will depend largely on the specifics of the court's decision and subsequent regulatory clarity.

Market Sentiment and Investor Confidence

The SEC lawsuit has undeniably impacted investor sentiment. Negative media coverage and the uncertainty surrounding the case have fueled fear, uncertainty, and doubt (FUD), depressing XRP's price. This highlights the crucial role of public perception and media narratives in shaping market dynamics for cryptocurrencies like XRP. The lack of regulatory clarity creates volatility.

XRP's Technological Advantages and Use Cases

Despite the legal challenges, XRP boasts considerable technological advantages and growing adoption.

RippleNet and its Global Adoption

RippleNet is a real-time gross settlement system (RTGS) that facilitates faster and cheaper international payments for financial institutions. Its increasing adoption by banks and payment providers worldwide is a positive sign for XRP's future.

- Key Features: Speed, low transaction costs, security, and scalability.

- Benefits for Banks: Reduced operational costs, improved efficiency, and enhanced customer experience.

The expansion of RippleNet and the increasing number of partnerships could lead to greater demand for XRP, potentially driving its price upwards. Successful integrations into existing financial infrastructures are pivotal in determining future growth.

XRP's Utility Beyond RippleNet

XRP's utility extends beyond RippleNet. Potential applications include:

- Cross-border payments: Facilitating quick and affordable transfers across borders.

- Decentralized Finance (DeFi): Emerging uses within the DeFi ecosystem are being explored.

- Other Applications: Exploring new possibilities in blockchain-based solutions.

These diverse applications could broaden XRP's appeal and boost its long-term value proposition, making it more than just a payment facilitator.

Market Analysis and Price Predictions

Analyzing XRP's price requires a dual approach: technical and fundamental analysis.

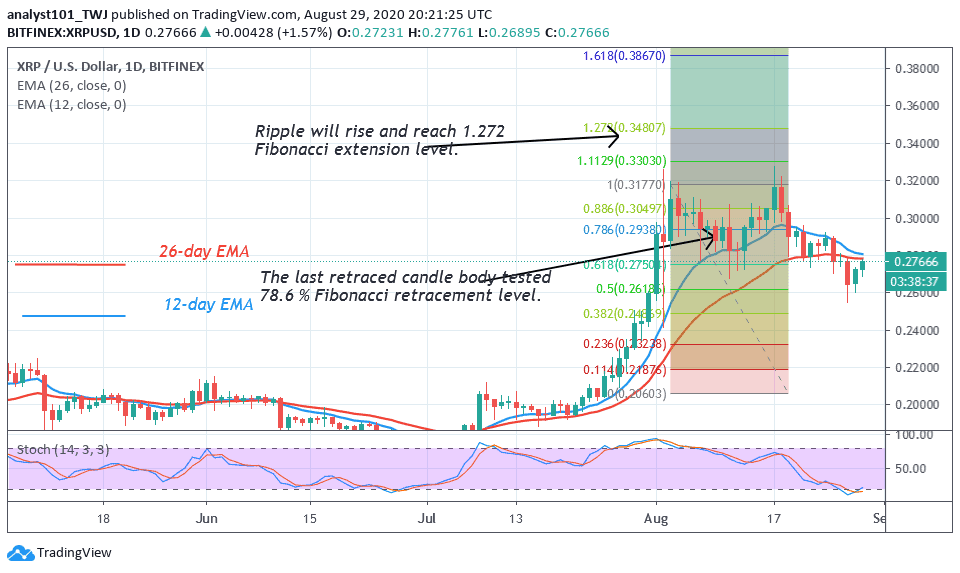

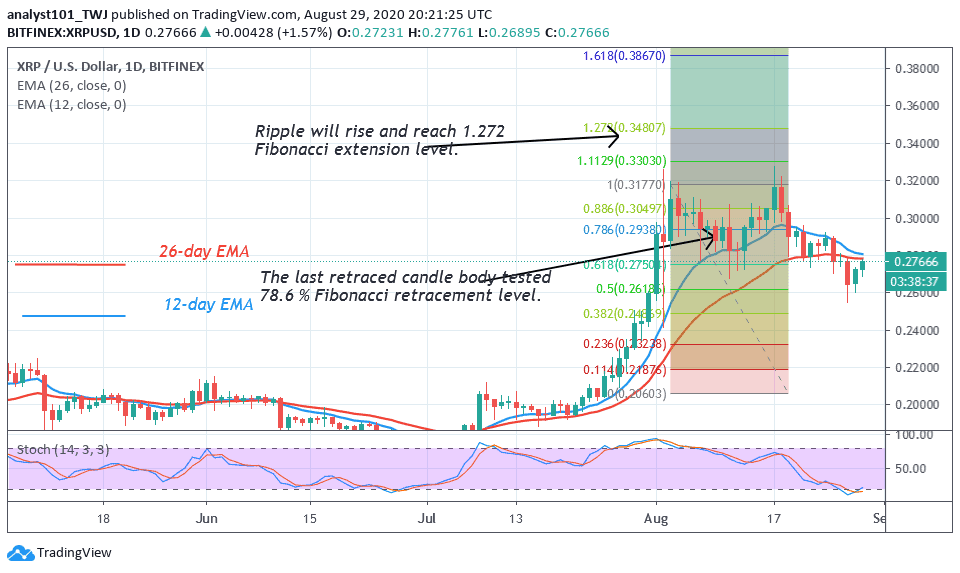

Technical Analysis of XRP

Technical indicators, such as moving averages, Relative Strength Index (RSI), and Moving Average Convergence Divergence (MACD), can offer insights into XRP's potential price movements. Support and resistance levels identify key price points where buying and selling pressure are expected to be strongest. While technical analysis can suggest potential price targets, it’s not foolproof. Charts illustrating these indicators would provide a more visual representation.

Fundamental Analysis of XRP

Fundamental analysis considers broader factors, including:

- Market Capitalization: XRP's market cap relative to other cryptocurrencies provides a benchmark for its value.

- Circulating Supply: The total number of XRP in circulation influences its price.

- Adoption Rate: Growth in RippleNet usage and other applications is a key driver of long-term value.

These factors, alongside global economic conditions and the overall cryptocurrency market sentiment, influence XRP's long-term growth potential. Comparing XRP's fundamentals to other cryptocurrencies in the same space is crucial.

Risks Associated with Investing in XRP

Investing in XRP, like any cryptocurrency, carries significant risks.

Regulatory Uncertainty

The SEC lawsuit highlights the regulatory uncertainty surrounding XRP. Further regulatory scrutiny could lead to additional price drops and prolonged market instability. Understanding these legal risks is paramount before investing.

Market Volatility

The cryptocurrency market is inherently volatile. XRP's price can experience substantial fluctuations, potentially resulting in significant losses. Effective risk management strategies are crucial for navigating this volatility. Diversification across different asset classes is a key mitigation technique.

Conclusion: Should You Buy XRP Under $3?

The decision of whether to buy XRP under $3 is complex. While XRP possesses technological advantages and a growing ecosystem, the ongoing legal battle with the SEC introduces considerable uncertainty. The potential for significant price movements, both positive and negative, is undeniable.

This analysis highlights both the promising aspects of XRP's technology and the substantial risks associated with its legal and market uncertainties. A favorable outcome in the SEC lawsuit could unlock significant price appreciation, but an unfavorable outcome could lead to substantial losses. Therefore, a cautious approach is advised.

Call to action: Ultimately, the decision of whether to buy XRP under $3 is a personal one. However, by carefully considering the factors outlined in this analysis, including the legal risks, technological potential, and market volatility, you can make a more informed decision about your XRP investment strategy. Thorough due diligence and understanding your own risk tolerance are critical before investing in XRP or any other cryptocurrency.

Featured Posts

-

Kya Shh Rg Hmyshh Zyr Khnjr Rhe Gy Ayksprys Ardw Ka Jwab

May 01, 2025

Kya Shh Rg Hmyshh Zyr Khnjr Rhe Gy Ayksprys Ardw Ka Jwab

May 01, 2025 -

Navigating The Dragons Den How To Secure Investment

May 01, 2025

Navigating The Dragons Den How To Secure Investment

May 01, 2025 -

Voyage A Velo Trois Jeunes Du Bocage Ornais Relevent Un Defi De 8000 Km

May 01, 2025

Voyage A Velo Trois Jeunes Du Bocage Ornais Relevent Un Defi De 8000 Km

May 01, 2025 -

Bangladesh Nrc Calls For Action Against Anti Muslim Conspiracies

May 01, 2025

Bangladesh Nrc Calls For Action Against Anti Muslim Conspiracies

May 01, 2025 -

Veteran Actress Priscilla Pointer Dead At 100 Remembering Her Legacy

May 01, 2025

Veteran Actress Priscilla Pointer Dead At 100 Remembering Her Legacy

May 01, 2025

Latest Posts

-

The Trump Factor And Nvidia Assessing Global Risks And Future Implications

May 01, 2025

The Trump Factor And Nvidia Assessing Global Risks And Future Implications

May 01, 2025 -

Beyond China Examining The Wider Geopolitical Challenges Facing Nvidia

May 01, 2025

Beyond China Examining The Wider Geopolitical Challenges Facing Nvidia

May 01, 2025 -

New Us Plant Merck Invests In Domestic Manufacturing Of Key Medicine

May 01, 2025

New Us Plant Merck Invests In Domestic Manufacturing Of Key Medicine

May 01, 2025 -

Stock Market Valuation Concerns Bof A Offers Investors Reassurance

May 01, 2025

Stock Market Valuation Concerns Bof A Offers Investors Reassurance

May 01, 2025 -

Pierre Poilievres Election Loss What Went Wrong

May 01, 2025

Pierre Poilievres Election Loss What Went Wrong

May 01, 2025