Is This XRP's Big Moment? ETF Hopes, SEC Changes, And Ripple's Impact

Table of Contents

The Rise of XRP ETFs and Their Potential Impact

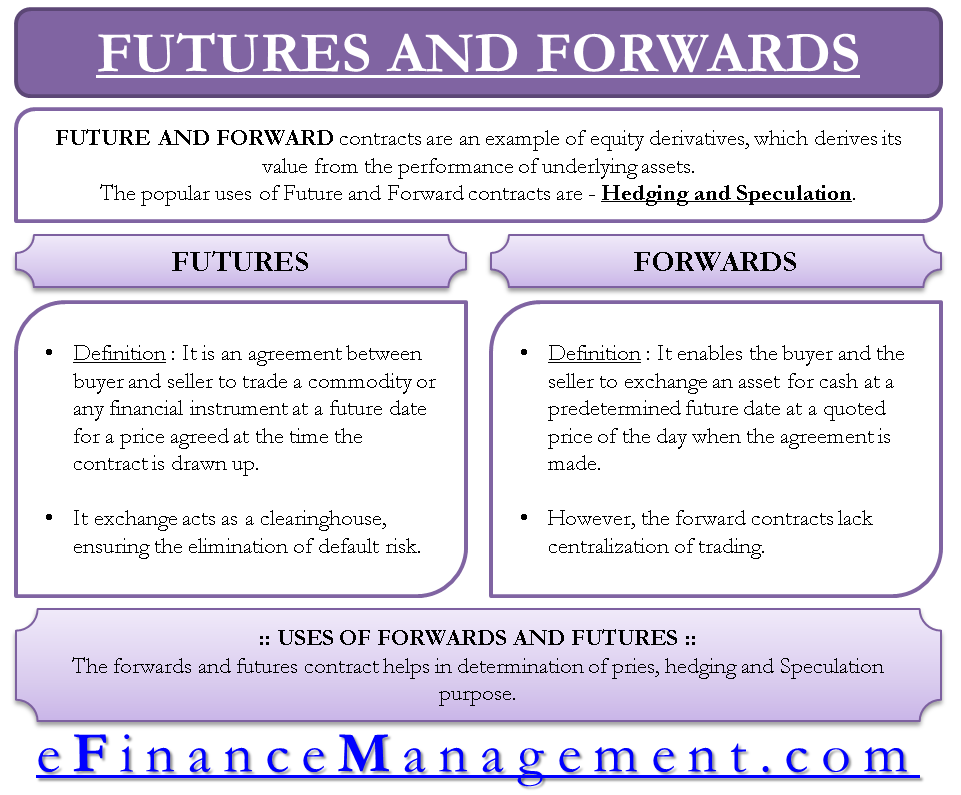

The potential approval of XRP ETFs (Exchange-Traded Funds) is a significant catalyst for the current excitement surrounding XRP. Understanding this potential requires understanding both ETFs and the regulatory hurdles involved.

What are XRP ETFs?

Exchange-Traded Funds are investment funds traded on stock exchanges, much like stocks. An XRP ETF would allow investors to gain exposure to XRP without directly purchasing and holding the cryptocurrency. This offers several advantages:

- Simplified Access: Investing in an XRP ETF is generally simpler than directly buying and securing XRP on a cryptocurrency exchange.

- Diversification: ETFs allow diversification within a portfolio, reducing overall risk compared to investing solely in XRP.

- Regulatory Oversight: ETFs are subject to greater regulatory scrutiny than individual cryptocurrencies, potentially offering investors a degree of comfort.

The Regulatory Landscape for Crypto ETFs

The SEC's stance on crypto ETFs has been a major obstacle for many digital assets. However, recent developments, including the ongoing legal battles and the increasing pressure from institutional investors, suggest a potential shift. The SEC's rejection of numerous Bitcoin ETF applications in the past highlights the regulatory challenges. However, the outcome of the Grayscale lawsuit against the SEC could significantly impact the future of all crypto ETFs, potentially paving the way for XRP ETF approval.

- Increased institutional investment potential: ETF approval would likely attract significant investment from institutional players who are currently hesitant to invest directly in cryptocurrencies.

- Enhanced liquidity for XRP: ETFs typically offer increased liquidity, making it easier to buy and sell XRP.

- Greater mainstream adoption and price appreciation: Increased accessibility through ETFs could drive wider adoption of XRP, potentially leading to price appreciation.

- Potential challenges in SEC approval process: Despite positive signals, the SEC approval process remains unpredictable and could still present significant hurdles.

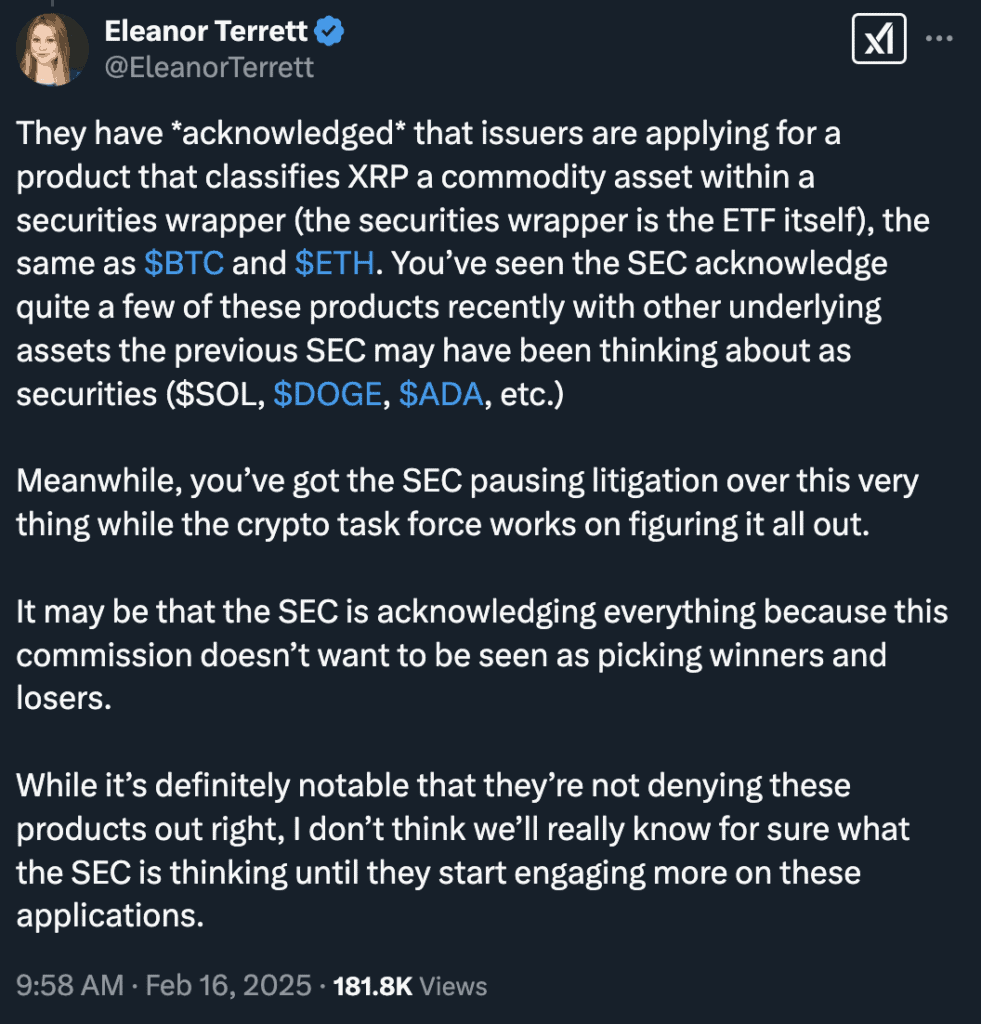

The SEC's Shifting Stance on Crypto Regulation and its Effect on XRP

The SEC's regulatory approach significantly influences XRP's trajectory. The ongoing Ripple case and broader regulatory changes are key factors to consider.

The Ripple Case and its Fallout

The legal battle between Ripple Labs and the SEC over the classification of XRP as a security has been a major source of uncertainty for XRP investors. A favorable ruling for Ripple could significantly boost XRP's price and adoption by clarifying its regulatory status. Conversely, an unfavorable ruling could have a negative impact. The legal arguments, potential settlements, and the overall outcome remain crucial to XRP's future.

Broader Regulatory Changes

Beyond the Ripple case, broader shifts in the SEC's and other regulatory bodies' approach to cryptocurrency regulation will play a crucial role. Increased clarity on the regulatory framework for cryptocurrencies, particularly concerning the classification of digital assets as securities or commodities, is essential for the long-term stability and growth of the market, including XRP's.

- Impact of a potential SEC settlement or court ruling: The outcome of the Ripple case will have a profound impact on XRP's price and investor sentiment.

- Increased clarity on regulatory framework for cryptocurrencies: Clearer regulatory guidelines will reduce uncertainty and potentially attract more institutional investment.

- Potential for increased institutional confidence in XRP: Regulatory clarity could lead to increased institutional adoption and investment in XRP.

- Uncertainty surrounding future regulatory actions: The regulatory landscape remains dynamic, and future actions could still pose significant challenges.

Ripple's Ongoing Innovation and its Influence on XRP's Value

Ripple's continued innovation and expansion of its ecosystem are vital factors contributing to XRP's potential.

Ripple's Technology and Partnerships

Ripple's technology, primarily its RippleNet platform, facilitates cross-border payments, offering a faster and more cost-effective alternative to traditional banking systems. Its strategic partnerships with financial institutions globally are key indicators of its potential for widespread adoption. The development of new features and functionalities within the Ripple ecosystem also enhances its appeal.

Ripple's Ecosystem Growth

The growth of RippleNet and the increasing transaction volume on the XRP Ledger demonstrate the rising demand and utility of XRP. As more financial institutions integrate Ripple's technology, the demand for XRP is likely to increase.

- Increased adoption of RippleNet by financial institutions: Growing adoption strengthens XRP's utility as a bridge currency in cross-border transactions.

- Growth of the XRP Ledger and its transaction volume: Increased transaction volume indicates growing demand and network activity.

- Development of new features and functionalities within Ripple's ecosystem: Continuous innovation enhances the platform's appeal and potential for future growth.

- Potential for increased XRP utility and value: Expanding utility and adoption are likely to drive the value of XRP.

Conclusion

The future of XRP remains uncertain, but the confluence of potential ETF approvals, shifts in SEC regulatory approaches, and Ripple's continued innovation creates a compelling case for increased attention. While risks remain, the potential rewards for XRP investors could be substantial. The current situation presents a pivotal moment, and whether this is truly XRP's big moment will depend on the unfolding of these key factors. Stay informed and continue to research the potential of XRP and its role in the evolving cryptocurrency landscape. Consider diversifying your portfolio and conducting thorough due diligence before investing in any cryptocurrency, including XRP.

Featured Posts

-

Andors Final Season Cast Offers Bts Glimpse Into Rogue One Prequel

May 08, 2025

Andors Final Season Cast Offers Bts Glimpse Into Rogue One Prequel

May 08, 2025 -

Bitcoin Madenciliginin Gelecegi Son Mu Devam Mi

May 08, 2025

Bitcoin Madenciliginin Gelecegi Son Mu Devam Mi

May 08, 2025 -

5 Minute Superman Minecraft Preview From Thailand Theater

May 08, 2025

5 Minute Superman Minecraft Preview From Thailand Theater

May 08, 2025 -

Xrps Uncertain Future Derivatives Market Hinders Price Recovery

May 08, 2025

Xrps Uncertain Future Derivatives Market Hinders Price Recovery

May 08, 2025 -

Tatums Transformation Grooming Confidence And A Meaningful Coaching Reunion With Essence

May 08, 2025

Tatums Transformation Grooming Confidence And A Meaningful Coaching Reunion With Essence

May 08, 2025