XRP's Uncertain Future: Derivatives Market Hinders Price Recovery

Table of Contents

The Ripple Effect: How the SEC Lawsuit Impacts XRP Derivatives Trading

The SEC lawsuit against Ripple, alleging the unregistered sale of XRP as a security, casts a long shadow over the entire XRP ecosystem. This ongoing legal uncertainty significantly impacts investor confidence and trading volume in XRP derivatives markets. Regulatory ambiguity surrounding XRP's classification creates hesitancy among both individual and institutional investors. The potential outcomes of the lawsuit—ranging from a complete victory for the SEC to a more favorable ruling for Ripple—introduce substantial volatility into the market. This uncertainty makes it challenging for investors to make informed decisions, leading to decreased participation in XRP derivatives trading.

- Decreased trading volume in XRP futures and options: The legal uncertainty discourages traders from entering into long-term positions, leading to a reduction in overall trading activity.

- Increased price volatility due to legal news and developments: Any news related to the lawsuit, whether positive or negative, can trigger significant price swings in both the spot and derivatives markets.

- Hesitation from institutional investors to enter the XRP market: Institutional investors, often risk-averse, are less likely to invest in a cryptocurrency facing such significant regulatory challenges.

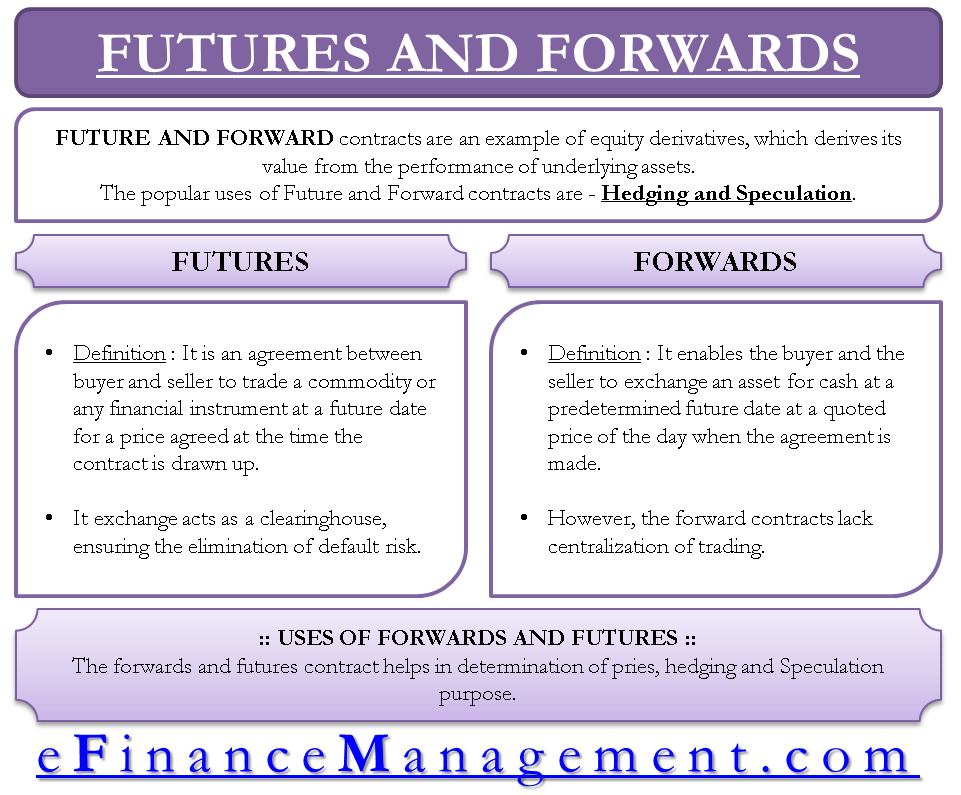

XRP Derivatives Market Mechanics and Their Influence on Price

Understanding the mechanics of XRP derivatives trading is crucial to grasping their impact on the spot price. Futures contracts, options, and other derivatives allow traders to speculate on XRP's price movements without directly owning the cryptocurrency. This opens avenues for short selling, where traders profit from a price decline. The leverage inherent in derivatives trading amplifies both gains and losses, further contributing to price volatility. In a market already affected by regulatory uncertainty, the potential for amplified downward pressure from short selling and leveraged trading is substantial.

- Short selling pressure driving down the spot price: A high volume of short positions can create downward pressure on the spot price of XRP, as traders profit from its decline.

- High leverage amplifying both gains and losses: Leverage magnifies price movements, increasing both the potential for profit and the risk of significant losses.

- Potential for market manipulation through derivatives trading: The use of leverage and sophisticated trading strategies in the derivatives market raises concerns about the potential for manipulation.

Comparing XRP Derivatives Market to Other Cryptocurrencies

To understand the unique challenges faced by XRP, it's helpful to compare its derivatives market to those of other major cryptocurrencies like Bitcoin and Ethereum. Bitcoin and Ethereum benefit from greater market maturity, broader regulatory clarity (relative to XRP), and significantly larger trading volumes in their respective derivatives markets. This difference in liquidity and size impacts price sensitivity. A relatively smaller and less liquid XRP derivatives market makes it more vulnerable to price manipulation and increased volatility compared to its more established counterparts.

- Comparison of trading volumes and open interest: The XRP derivatives market exhibits considerably lower trading volumes and open interest compared to Bitcoin and Ethereum derivatives.

- Analysis of price correlation between spot and derivatives markets: Examining the correlation between the spot price of XRP and its derivatives can reveal insights into market dynamics and potential manipulation.

- Discussion on the impact of market depth and liquidity: The shallower liquidity of the XRP derivatives market makes it more susceptible to sudden price swings.

The Role of Institutional Investors and High-Frequency Trading

The participation of institutional investors and high-frequency trading (HFT) algorithms significantly impacts XRP's price dynamics within the derivatives market. Large institutional trades can trigger considerable price movements, while sophisticated HFT algorithms can exploit inefficiencies and exacerbate volatility. Algorithmic trading, while potentially beneficial in increasing market efficiency under normal conditions, can amplify price swings in a volatile market like XRP's.

- Impact of large trades on price movements: Institutional investors’ sizable positions can create significant price fluctuations.

- Potential for front-running and market manipulation: Sophisticated algorithms can potentially front-run orders and manipulate prices for profit.

- Effect of algorithmic trading strategies on volatility: HFT algorithms can increase market volatility, especially in an already uncertain environment.

Conclusion: Navigating the Uncertain Future of XRP

The XRP price trajectory remains intertwined with the dynamics of its derivatives market and the ongoing SEC lawsuit. The relatively smaller and less liquid XRP derivatives market, combined with the regulatory uncertainty, creates a volatile and unpredictable environment. Short selling, leverage, and the actions of institutional and algorithmic traders all contribute to the price stagnation. While XRP's future remains uncertain, careful consideration of the risks is paramount.

Conduct thorough due diligence and market analysis before investing in XRP. Stay informed about the ongoing legal developments and understand the complexities of its derivatives market. Investing in XRP requires a high degree of risk tolerance given the current situation and the significant impact the derivatives market has on its price. Consider all aspects before making investment decisions in the volatile XRP market.

Featured Posts

-

Rogue The Reluctant X Men Leader

May 08, 2025

Rogue The Reluctant X Men Leader

May 08, 2025 -

Inter Milan Faces Goalkeeping Dilemma After Sommers Thumb Injury

May 08, 2025

Inter Milan Faces Goalkeeping Dilemma After Sommers Thumb Injury

May 08, 2025 -

Japan Trading House Shares Surge Berkshire Hathaways Long Term Investment

May 08, 2025

Japan Trading House Shares Surge Berkshire Hathaways Long Term Investment

May 08, 2025 -

Star Wars Andor Novel Axed Over Artificial Intelligence Fears

May 08, 2025

Star Wars Andor Novel Axed Over Artificial Intelligence Fears

May 08, 2025 -

Jayson Tatums Personal Journey Grooming Confidence And The Essence Of Coaching

May 08, 2025

Jayson Tatums Personal Journey Grooming Confidence And The Essence Of Coaching

May 08, 2025