Is Wedbush's Bullish Apple Stance Justified After Price Target Cut?

Table of Contents

Wedbush's Initial Bullish Case for Apple

Before the price target reduction, Wedbush presented a compelling case for Apple's continued growth, fueling a positive Apple stock forecast. Their bullish prediction hinged on several key factors:

- Strong iPhone Sales: Wedbush consistently highlighted the robust sales figures for iPhones, predicting continued strong demand despite economic uncertainty. This was a core pillar supporting their initial Apple price prediction.

- Services Revenue Growth: The significant and expanding revenue stream from Apple's services ecosystem, including Apple Music, iCloud, and Apple TV+, was another key argument. The potential for further expansion in this segment was seen as a significant driver of Apple's overall valuation.

- Expansion into New Markets: Wedbush projected increased market penetration in emerging economies, presenting a significant opportunity for growth. This geographic expansion, contributing to Apple stock's growth potential, was a vital component of their analysis.

- AR/VR Headset Potential: The anticipated launch of Apple's much-rumored AR/VR headset was viewed as a potential game-changer, capable of propelling significant Apple stock price increases. This represented a significant long-term growth catalyst in their Apple price prediction model.

This initial Wedbush Apple analysis painted a picture of sustained, robust growth for Apple, underpinning their initially high price target.

The Price Target Cut: Reasons and Implications

Despite the initial positive Apple stock forecast, Wedbush recently lowered its price target. This adjustment was attributed to several factors:

- Macroeconomic Headwinds: The global economic slowdown, impacting consumer spending and impacting Apple's sales, played a significant role in the revised outlook. This concern directly affected the Apple stock price and investor sentiment.

- Potential Supply Chain Issues: Concerns regarding potential disruptions in Apple's global supply chain, capable of impacting production and sales, contributed to the price target reduction.

- Competitor Actions: Increased competition in the smartphone market and other sectors, putting pressure on Apple's market share and affecting its Apple valuation, were also cited as contributing factors.

The market reacted negatively to the price target cut, resulting in a temporary dip in Apple's share price. Investor sentiment, initially driven by Wedbush’s bullish Apple analysis, experienced a shift, highlighting the impact of such announcements on the Apple stock price.

Assessing the Continued Bullish Stance

Even with the reduced price target, Wedbush maintains a bullish outlook on Apple. However, their revised prediction differs significantly from the initial Apple stock forecast.

- Revised Growth Projections: While still positive, the revised growth projections are more conservative, reflecting the macroeconomic headwinds and competitive pressures. This indicates a shift in their Apple stock outlook.

- Adjusted Valuation: The new price target reflects a lower valuation for Apple, acknowledging the challenges posed by the factors outlined above. However, they still project positive Apple financial performance.

- Long-Term Potential: Wedbush remains convinced of Apple's long-term potential, particularly in its services sector and with the expected launch of new products. This underlies their continued investment in Apple.

The validity of Wedbush's continued bullishness hinges on whether these adjusted predictions accurately account for the evolving market dynamics and Apple’s ability to navigate the current challenges.

Alternative Perspectives and Market Sentiment

It's crucial to consider alternative perspectives on Apple's stock price. While Wedbush maintains a bullish stance, not all analysts share this view.

- Differing Analyst Ratings: Some analysts hold a more cautious outlook, citing the same macroeconomic concerns and competitive pressures highlighted by Wedbush's price target adjustment.

- Varied Stock Predictions: The range of Apple stock predictions from various analysts highlights the uncertainty surrounding the company’s future performance. This underlines the complexity of assessing Apple's future.

- Overall Market Sentiment: Overall market sentiment plays a crucial role in influencing Apple's share price. While the recent price target cut affected investor sentiment, the overall long-term outlook for Apple remains largely positive, reflected in many Apple analyst ratings.

Conclusion

Wedbush's revised Apple price target, while still bullish, reflects a more cautious approach than their initial prediction. The macroeconomic environment, potential supply chain issues, and competitive pressures all contribute to the debate surrounding the validity of their continued optimism. While their belief in Apple's long-term potential remains, the near-term outlook seems less certain.

Further your understanding of the Wedbush Apple price target and make your own informed investment decision. Thorough research, considering multiple perspectives and understanding the evolving market dynamics, is crucial before making any investment in Apple stock. Remember to carefully weigh the arguments for and against the continued bullish stance on Apple, considering the adjusted "Wedbush Apple price target" and the broader market sentiment.

Featured Posts

-

Ecb Faiz Indirimi Avrupa Borsalarinda Karisik Reaksiyonlar

May 24, 2025

Ecb Faiz Indirimi Avrupa Borsalarinda Karisik Reaksiyonlar

May 24, 2025 -

Dax Climbs Further Frankfurt Equities Market Update

May 24, 2025

Dax Climbs Further Frankfurt Equities Market Update

May 24, 2025 -

Le Francais Selon Mathieu Avanzi Plus Qu Une Langue Scolaire

May 24, 2025

Le Francais Selon Mathieu Avanzi Plus Qu Une Langue Scolaire

May 24, 2025 -

Serious M6 Crash Causes Major Traffic Disruption

May 24, 2025

Serious M6 Crash Causes Major Traffic Disruption

May 24, 2025 -

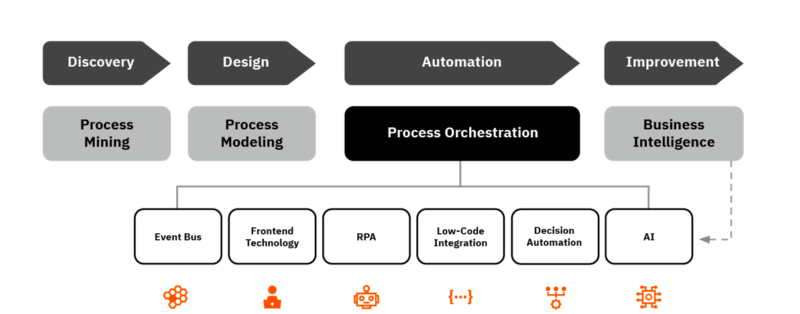

Camunda Con 2025 Optimizing Ai And Automation With Process Orchestration In Amsterdam

May 24, 2025

Camunda Con 2025 Optimizing Ai And Automation With Process Orchestration In Amsterdam

May 24, 2025

Latest Posts

-

Space Crystals And The Future Of Pharmaceutical Innovation

May 24, 2025

Space Crystals And The Future Of Pharmaceutical Innovation

May 24, 2025 -

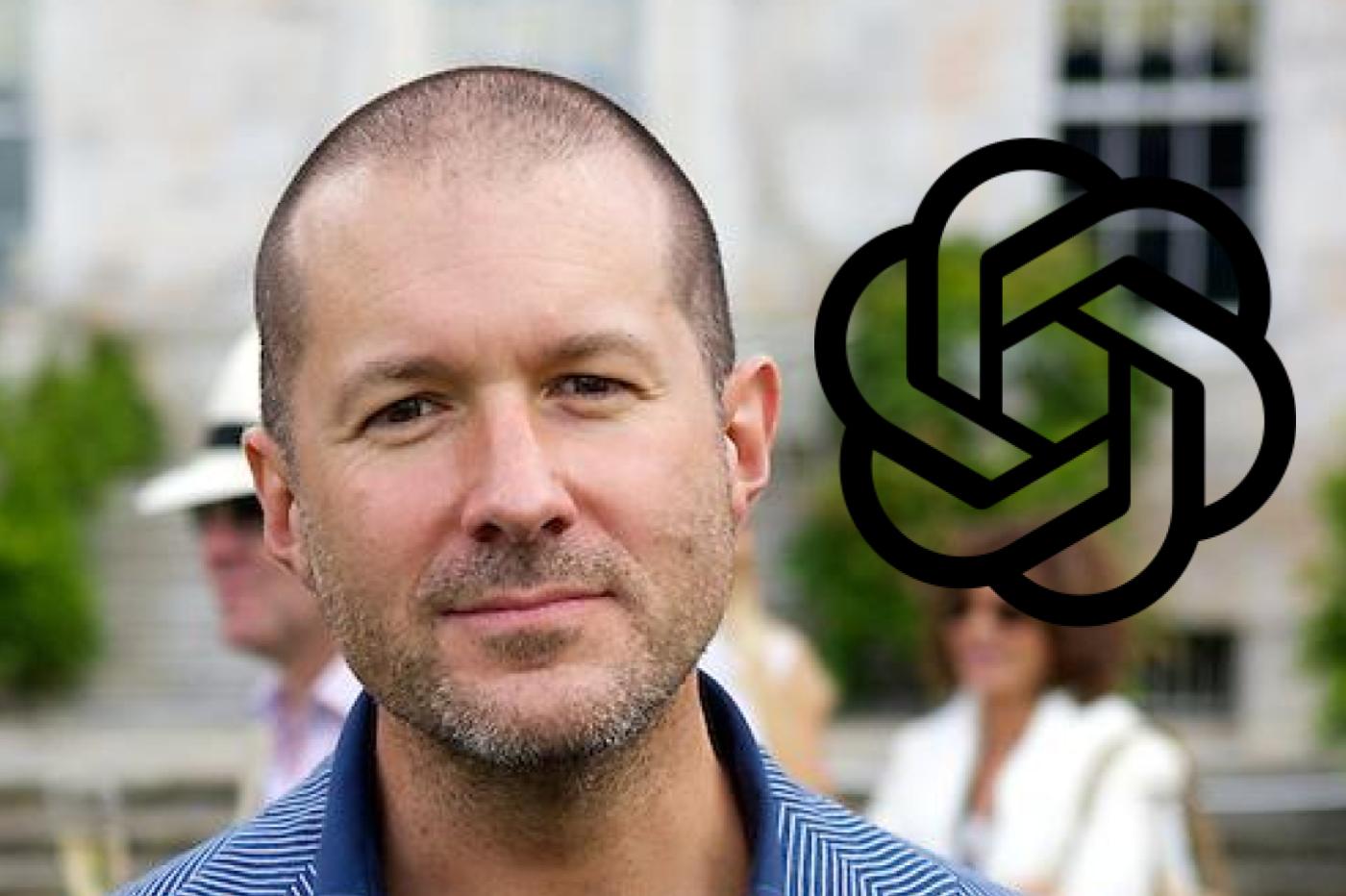

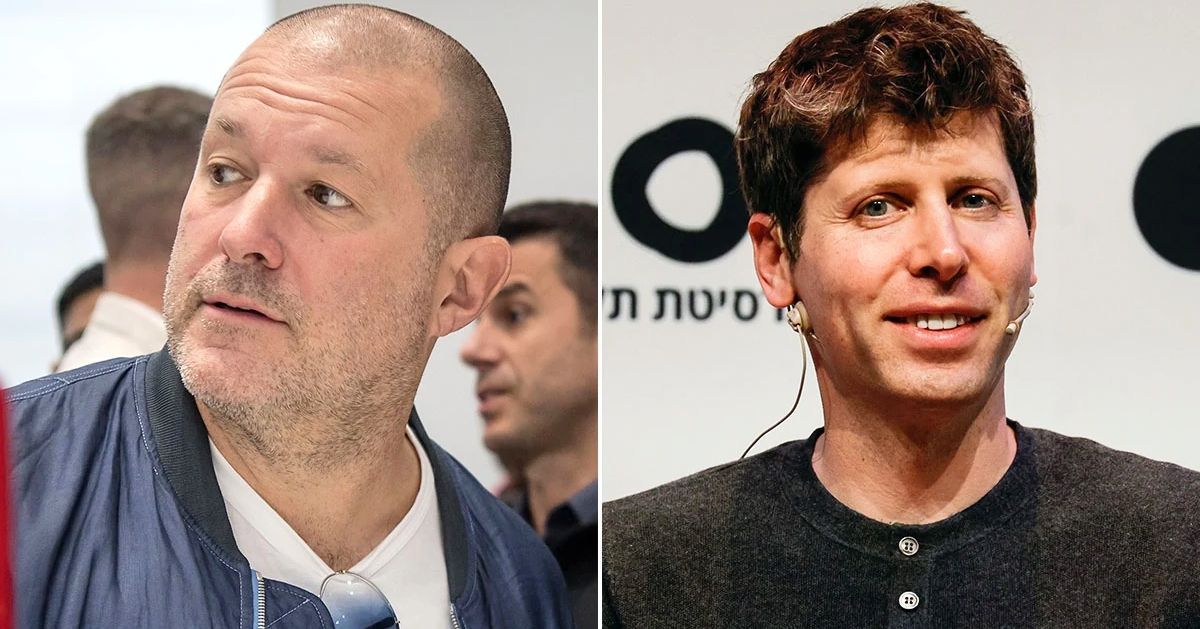

The Future Of Ai Open Ai And Jony Ives Collaboration

May 24, 2025

The Future Of Ai Open Ai And Jony Ives Collaboration

May 24, 2025 -

Harnessing Space Crystals For Enhanced Drug Development

May 24, 2025

Harnessing Space Crystals For Enhanced Drug Development

May 24, 2025 -

Rumor Mill Open Ai And Jony Ives Ai Hardware Company

May 24, 2025

Rumor Mill Open Ai And Jony Ives Ai Hardware Company

May 24, 2025 -

Free Speech And Ai Examining The Case Of Character Ai

May 24, 2025

Free Speech And Ai Examining The Case Of Character Ai

May 24, 2025