DAX Climbs Further: Frankfurt Equities Market Update

Table of Contents

DAX Index Performance and Key Drivers

The DAX index has experienced a notable increase, currently standing at [Insert Current DAX Value] – a [Insert Percentage]% rise compared to [Insert Comparison Point, e.g., yesterday's closing, last week's closing]. Several key factors are contributing to this impressive DAX performance:

- Robust German and Eurozone Economic Indicators: Recent data reveals strong growth in key sectors of the German economy, including manufacturing and exports. Positive Eurozone economic indicators also contribute to overall investor confidence, boosting the DAX.

- Strong Corporate Earnings: Major DAX companies have released impressive earnings reports, exceeding expectations in many cases. This positive news reinforces investor belief in the strength and resilience of German businesses. For example, [mention specific company and its positive earnings].

- Global Market Trends and Investor Sentiment: Positive global market trends, alongside a generally optimistic investor sentiment, have played a significant role in driving the DAX's upward trajectory. Reduced global uncertainties contribute to increased investment in the Frankfurt equities market.

- Sector Performance: The automotive sector, a significant component of the DAX, has shown particular strength, along with positive performance in the technology and industrial sectors. This sector-specific growth is contributing to the overall DAX gains.

[Insert relevant chart or graph illustrating DAX performance]

Impact on Individual Stocks

The DAX climb isn't uniform across all stocks. While the overall index is up, individual stock performance varies significantly.

- Top Performers: [Name specific high-performing stocks] have seen significant gains, driven by [mention reasons – e.g., strong earnings reports, new product launches, positive industry news].

- Bottom Performers: Conversely, [Name specific low-performing stocks] have underperformed, possibly due to [mention reasons – e.g., disappointing earnings, sector-specific headwinds, negative industry news]. Understanding these individual stock movements provides a nuanced view of the market's dynamics.

- News Impact: Specific news events impacting individual DAX companies, such as mergers, acquisitions, or regulatory changes, significantly influence their share price and the overall market sentiment.

Analyst Predictions and Future Outlook

Financial analysts offer mixed views on the DAX's future direction. While many remain optimistic about the short-term outlook, predicting continued growth based on current positive economic indicators and corporate performance, others caution about potential risks.

- Short-Term Forecast: Many analysts foresee continued growth for the DAX in the short term, citing the strength of the German economy and positive global trends.

- Long-Term Outlook: The long-term outlook is more uncertain. Potential risks include global economic slowdown, geopolitical instability, and potential inflationary pressures. These factors could impact investor confidence and the DAX's performance.

- Market Risks: Investors need to consider potential market risks, including inflation, interest rate hikes, and global economic uncertainty when formulating their investment strategies.

Trading Strategies and Investment Opportunities

The current upward trend in the DAX presents potential investment opportunities. However, it's crucial to remember that this information is not financial advice. Investors should always conduct thorough research and consider their risk tolerance before making any investment decisions.

- Potential Strategies: Depending on risk tolerance, strategies could include investing in individual DAX stocks or using exchange-traded funds (ETFs) that track the DAX index. Careful risk management is essential.

- Investment Opportunities: The current market conditions suggest opportunities for investors seeking exposure to the German economy, but thorough due diligence and diversification remain vital for a sound investment strategy.

DAX Climbs Further: Your Next Steps in the Frankfurt Equities Market

The DAX's significant rise reflects positive economic indicators, strong corporate earnings, and positive global market sentiment. However, potential risks exist, and staying informed is critical. To make well-informed investment decisions in the Frankfurt equities market and continue tracking the DAX climb, subscribe to our regular market updates, follow reputable market analysis, and consult with a qualified financial advisor. Stay informed about the exciting developments in the Frankfurt equities market and the ongoing DAX performance.

Featured Posts

-

Escape To The Countryside A Comprehensive Guide To Rural Living

May 24, 2025

Escape To The Countryside A Comprehensive Guide To Rural Living

May 24, 2025 -

How To Secure Bbc Big Weekend 2025 Tickets At Sefton Park

May 24, 2025

How To Secure Bbc Big Weekend 2025 Tickets At Sefton Park

May 24, 2025 -

Lego Master Manny Garcia Inspires Students At Veterans Memorial Elementary School

May 24, 2025

Lego Master Manny Garcia Inspires Students At Veterans Memorial Elementary School

May 24, 2025 -

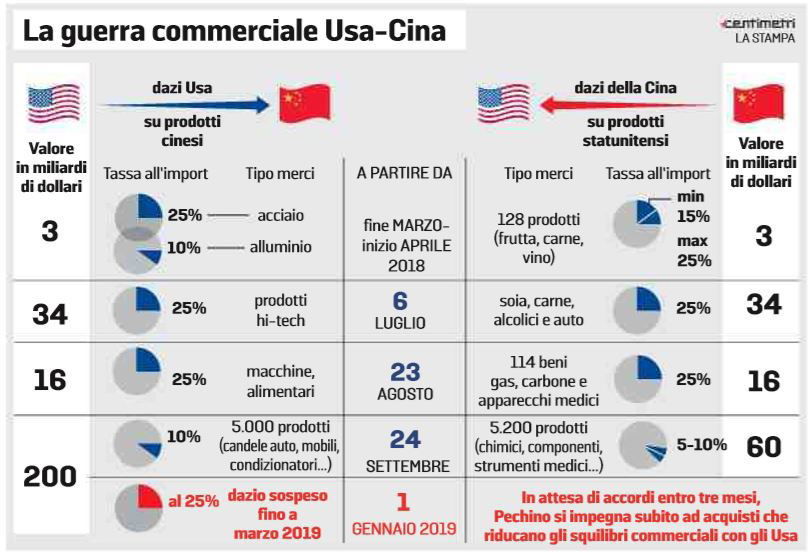

L Impatto Dei Dazi Usa Sui Prezzi Dell Abbigliamento Una Panoramica

May 24, 2025

L Impatto Dei Dazi Usa Sui Prezzi Dell Abbigliamento Una Panoramica

May 24, 2025 -

Muezelerde Araba Sergileme Yoentemleri Porsche 956 Oernegi

May 24, 2025

Muezelerde Araba Sergileme Yoentemleri Porsche 956 Oernegi

May 24, 2025

Latest Posts

-

Buffetts Apple Investment Impact Of Trump Era Tariffs

May 24, 2025

Buffetts Apple Investment Impact Of Trump Era Tariffs

May 24, 2025 -

Apple Stock Suffers Setback Cook Announces 900 Million Tariff Hit

May 24, 2025

Apple Stock Suffers Setback Cook Announces 900 Million Tariff Hit

May 24, 2025 -

Apple Stock Price Prediction Evaluating A 254 Target At Current Levels

May 24, 2025

Apple Stock Price Prediction Evaluating A 254 Target At Current Levels

May 24, 2025 -

Apple Vs Trump Tariffs Will Buffetts Top Tech Stock Crack

May 24, 2025

Apple Vs Trump Tariffs Will Buffetts Top Tech Stock Crack

May 24, 2025 -

Apple Stock Plummets 900 Million Tariff Impact

May 24, 2025

Apple Stock Plummets 900 Million Tariff Impact

May 24, 2025