Is XRP A Commodity? SEC Classification And The Ongoing Debate

Table of Contents

The SEC's Stance on XRP and its Implications

The Securities and Exchange Commission (SEC) has taken a firm stance against Ripple Labs, arguing that XRP is an unregistered security. Their argument centers around the Howey Test, a legal framework used to determine whether an investment contract constitutes a security. The SEC contends that XRP's distribution and sale to investors involved an expectation of profits derived from the efforts of others (Ripple Labs), fulfilling the criteria of the Howey Test.

- Summary of the SEC's lawsuit against Ripple: The SEC filed a lawsuit against Ripple Labs and two of its executives in December 2020, alleging the sale of unregistered securities.

- Key arguments used by the SEC to define XRP as a security: The SEC highlights XRP's initial distribution, ongoing sales, and Ripple's involvement in its market, arguing that these factors point towards a security classification. They point to the centralized nature of Ripple's early XRP distribution.

- Potential penalties for Ripple Labs and implications for XRP holders: The outcome of the lawsuit could result in significant financial penalties for Ripple Labs and potentially impact XRP's market value and trading status. XRP holders may face losses or restrictions on trading depending on the outcome.

- Analysis of legal precedents used by the SEC: The SEC bases its argument on previous court rulings regarding digital assets, attempting to establish a precedent for classifying similar cryptocurrencies as securities.

The Arguments for XRP as a Commodity

Conversely, strong arguments exist for classifying XRP as a commodity. Proponents emphasize XRP's decentralized nature, its use as a bridge currency for facilitating cross-border payments on the RippleNet network, and its distinct operational characteristics compared to traditional securities.

- Explanation of XRP's decentralized nature and its role in the RippleNet network: While Ripple Labs initially played a significant role in XRP's creation and distribution, arguments exist that XRP's functionality within the RippleNet ecosystem operates independently of Ripple Labs, supporting its decentralized classification.

- Comparison of XRP to other cryptocurrencies considered commodities: Many argue that XRP shares characteristics with other cryptocurrencies like Bitcoin and Ethereum, which are generally considered commodities due to their decentralized nature and utility.

- Arguments based on the functionality and usage of XRP: XRP’s primary function is as a medium of exchange and a tool for facilitating faster and cheaper cross-border transactions; characteristics aligning with the definition of a commodity.

- Expert opinions and legal analyses supporting the commodity classification: Several legal experts and commentators have voiced support for XRP's classification as a commodity, highlighting the limitations of applying the Howey Test to decentralized digital assets.

The Ongoing Legal Battle and its Uncertainty

The SEC vs. Ripple lawsuit remains ongoing, creating significant uncertainty in the XRP market. The outcome will have profound implications for XRP's price, trading status, and the broader cryptocurrency regulatory landscape.

- Updates on the ongoing legal proceedings: The case has seen numerous developments, including filings, expert witness testimony, and ongoing legal arguments.

- Potential outcomes of the lawsuit and their effects on XRP's price and future: A ruling in favor of the SEC could significantly depress XRP's price and potentially lead to delisting from exchanges. A ruling in favor of Ripple could bolster XRP's value and solidify its position in the market.

- Analysis of expert opinions and market predictions: Market analysts offer varying predictions, reflecting the inherent uncertainty surrounding the case's outcome.

- The role of judicial precedent in shaping the outcome: The judge's decision will likely set a significant precedent, shaping the future regulation of cryptocurrencies.

The RippleNet Ecosystem and its Influence on Classification

RippleNet, Ripple's payment network, plays a central role in the XRP classification debate. While some argue RippleNet's centralized nature lends weight to the SEC's security classification, others argue it doesn't fundamentally alter XRP's underlying characteristics as a decentralized digital asset.

- Detailed description of RippleNet and its functionality: RippleNet enables banks and financial institutions to send and receive cross-border payments using XRP.

- Arguments suggesting RippleNet might imply a security classification: Some argue that RippleNet's centralized control over the network and its promotion of XRP for use within the network might suggest a security classification for XRP.

- Arguments suggesting RippleNet doesn't affect XRP's commodity status: Counterarguments highlight that XRP’s use within RippleNet is optional; banks and financial institutions are not required to use it, and its use case extends beyond RippleNet.

Navigating the Uncertain Future of XRP Classification

The debate surrounding XRP classification remains unresolved. The SEC's arguments against Ripple Labs highlight the challenges of applying traditional securities laws to innovative digital assets. Conversely, the arguments for XRP as a commodity emphasize its decentralized aspects and operational characteristics. The ongoing legal battle underscores the need for clarity and consistency in cryptocurrency regulation. Understanding the nuances of this debate is crucial for investors. Stay informed about the XRP commodity classification debate and conduct thorough research before investing in cryptocurrencies. Further reading on legal updates related to the SEC's position on cryptocurrencies and the evolving regulatory landscape is highly recommended. Making informed decisions about your investments, especially in the volatile cryptocurrency market, is key.

Featured Posts

-

Kolejna Tragedia Na Przejezdzie Piecioosobowa Rodzina Nie Zyje A Sprawa Pozostaje Nierozwiazana

May 07, 2025

Kolejna Tragedia Na Przejezdzie Piecioosobowa Rodzina Nie Zyje A Sprawa Pozostaje Nierozwiazana

May 07, 2025 -

Ovechkins Take Watching The 4 Nations Face Off Without Russia

May 07, 2025

Ovechkins Take Watching The 4 Nations Face Off Without Russia

May 07, 2025 -

The John Wick 5 Question What Keanu Reeves Said And What It Means

May 07, 2025

The John Wick 5 Question What Keanu Reeves Said And What It Means

May 07, 2025 -

Teawn Laram Wimbratwr Ljdhb Almzyd Mn Alsyah Ila Albrazyl

May 07, 2025

Teawn Laram Wimbratwr Ljdhb Almzyd Mn Alsyah Ila Albrazyl

May 07, 2025 -

Check The Latest Lotto Plus 1 And Lotto Plus 2 Results

May 07, 2025

Check The Latest Lotto Plus 1 And Lotto Plus 2 Results

May 07, 2025

Latest Posts

-

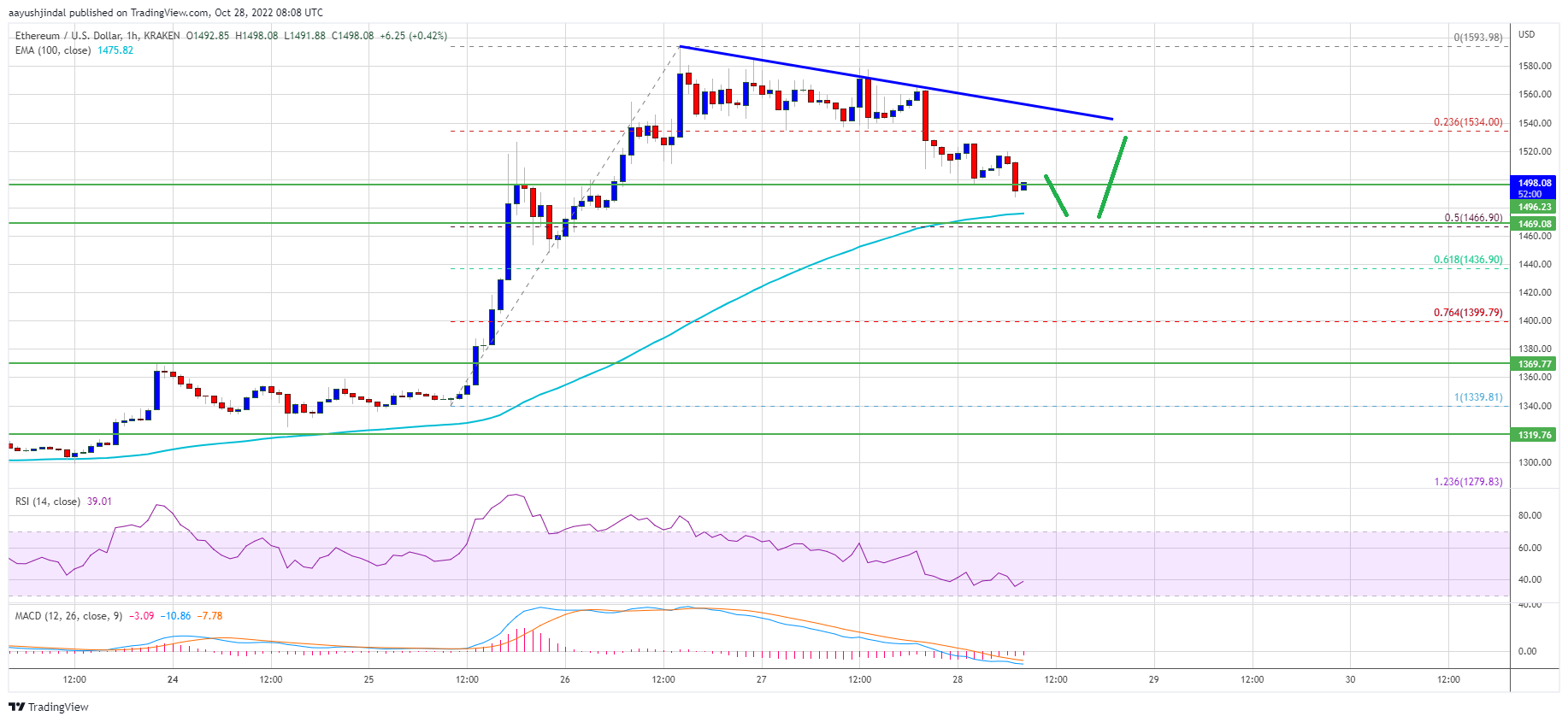

Is 1 500 The Next Ethereum Price Target Crucial Support Level Under Scrutiny

May 08, 2025

Is 1 500 The Next Ethereum Price Target Crucial Support Level Under Scrutiny

May 08, 2025 -

Ethereum Price Breakout Is 2 000 The Next Target

May 08, 2025

Ethereum Price Breakout Is 2 000 The Next Target

May 08, 2025 -

Ethereum Indicator Signals Potential Buy Opportunity Weekly Chart Analysis

May 08, 2025

Ethereum Indicator Signals Potential Buy Opportunity Weekly Chart Analysis

May 08, 2025 -

Ethereum Price Surges Past Resistance Will It Hit 2 000

May 08, 2025

Ethereum Price Surges Past Resistance Will It Hit 2 000

May 08, 2025 -

Ethereum Price Holds Above Key Support Could A Drop To 1 500 Be Next

May 08, 2025

Ethereum Price Holds Above Key Support Could A Drop To 1 500 Be Next

May 08, 2025