The Trump Factor And Nvidia: Assessing Global Risks And Future Implications

Table of Contents

The Trump Administration's Impact on the Semiconductor Industry

The Trump administration's economic policies significantly impacted the semiconductor industry, and Nvidia felt the repercussions.

Trade Wars and Tariffs

The trade war with China, characterized by escalating tariffs, directly affected Nvidia's supply chain and manufacturing costs.

- Tariffs on components sourced from China increased the cost of producing Nvidia's graphics processing units (GPUs) and other products.

- Tariffs on finished goods hampered Nvidia's ability to export to China, a crucial market.

This resulted in price increases for Nvidia's products, potentially impacting market share and long-term profitability. The increased costs forced Nvidia to adapt its pricing strategies and potentially explore alternative sourcing options, highlighting the vulnerability of global supply chains to protectionist policies. The long-term effects included a reassessment of global manufacturing strategies and an increased focus on diversification.

Technology Restrictions and Export Controls

The Trump administration implemented stricter export controls on advanced technologies to China, impacting Nvidia's sales of high-performance computing (HPC) products used in artificial intelligence (AI) and other sensitive applications.

- Restrictions were placed on the export of GPUs with specific capabilities to Chinese entities.

- This limited Nvidia's access to a significant portion of the Chinese market, a key growth area for the company.

These restrictions significantly impacted Nvidia's revenue streams and forced the company to navigate complex regulatory landscapes, illustrating the challenges of operating in an environment of heightened geopolitical tension and technology restrictions. Nvidia's response involved adjustments to its product offerings and a renewed focus on markets less impacted by these restrictions.

Focus on Domestic Manufacturing

The Trump administration's emphasis on reshoring semiconductor manufacturing created both opportunities and challenges for Nvidia. While the push for domestic production aimed to reduce reliance on foreign manufacturing, it also presented significant logistical and financial hurdles.

- Nvidia responded by exploring partnerships and potentially investing in domestic manufacturing capabilities, although the scale of such investments remains to be seen.

- This shift, while potentially reducing long-term supply chain vulnerabilities, requires significant capital investment and may lead to increased production costs.

Potential Future Implications under a Trump Presidency (or Similar Policies)

The potential return of Trump-style policies or the emergence of similar protectionist agendas globally presents significant risks and uncertainties for Nvidia.

Renewed Trade Tensions with China

A future escalation of trade tensions with China could severely disrupt Nvidia's supply chains and access to the Chinese market.

- Hypothetical scenarios include the re-imposition or escalation of tariffs on Nvidia products and components.

- This could lead to further price increases, reduced market share, and potentially even sanctions that severely restrict Nvidia's ability to operate in China.

This emphasizes the ongoing need for Nvidia to actively mitigate these risks through diversification and strategic planning.

Further Technology Restrictions and Sanctions

More stringent export controls or sanctions targeting specific technologies relevant to Nvidia's products pose a significant threat.

- Hypothetical scenarios include broadened restrictions on the export of advanced GPUs to other countries beyond China, limiting Nvidia's global market reach.

- Such actions could severely restrict Nvidia's revenue and growth potential, requiring significant adaptation and diversification strategies.

Shifting Geopolitical Alliances

Changes in global alliances and geopolitical realignments could significantly impact Nvidia's global strategy and market access.

- Potential shifts in alliances could create both opportunities and challenges for Nvidia, requiring adaptability and strategic repositioning in different markets.

- Navigating these shifts requires careful monitoring of geopolitical developments and proactive adjustment of business strategies.

Mitigating Risks and Strategies for Nvidia

Nvidia is actively implementing strategies to mitigate the risks associated with geopolitical instability.

Diversification of Supply Chains

Nvidia is diversifying its supply chains to reduce reliance on any single country or region.

- This involves establishing relationships with suppliers in multiple locations, reducing the impact of potential disruptions in any single region.

- This approach enhances resilience and mitigates the risk of supply chain disruptions due to geopolitical events.

Strategic Partnerships and Alliances

Nvidia is forging strategic partnerships and alliances to navigate geopolitical challenges.

- Collaborations with other tech companies and governments can help mitigate risks and facilitate market access in different regions.

- These partnerships provide access to resources and expertise, bolstering Nvidia's ability to navigate the complexities of the global landscape.

Investment in Research and Development

Continuous investment in R&D is crucial for Nvidia to maintain a technological edge and adapt to changing circumstances.

- Developing cutting-edge technologies ensures Nvidia remains competitive regardless of geopolitical shifts.

- Investing in innovative products and technologies helps Nvidia adapt to changing market dynamics and circumvent potential restrictions.

Conclusion: The Trump Factor and Nvidia's Future

The "Trump Factor," encompassing past and potential future protectionist policies, presents both significant risks and opportunities for Nvidia. Understanding the interplay between geopolitical events and Nvidia's global operations is critical. The company's success hinges on its ability to navigate trade wars, technology restrictions, and shifting geopolitical alliances effectively. Its strategies of supply chain diversification, strategic partnerships, and ongoing R&D investment are crucial for mitigating these risks.

To further understand the Trump factor's impact on Nvidia and assess future risks to the company, continued research into the evolving geopolitical landscape is essential. Analyzing the Nvidia-geopolitics connection requires a multi-faceted approach, considering the dynamic nature of international relations and their influence on the tech sector. The increasing interconnectedness of global politics and the technology sector underscores the importance of ongoing monitoring of geopolitical developments for investors and industry professionals alike.

Featured Posts

-

Charity Act Michael Sheen Erases 1 Million In Debt

May 01, 2025

Charity Act Michael Sheen Erases 1 Million In Debt

May 01, 2025 -

Arqam Jwanka Hl Tshyr Ila Azmt Fy Nady Alnsr

May 01, 2025

Arqam Jwanka Hl Tshyr Ila Azmt Fy Nady Alnsr

May 01, 2025 -

Us Navy 60 Million Jet Lost At Sea Aircraft Carrier Incident

May 01, 2025

Us Navy 60 Million Jet Lost At Sea Aircraft Carrier Incident

May 01, 2025 -

Bangladesh Nrcs Demand For Action Against Anti Muslim Violence

May 01, 2025

Bangladesh Nrcs Demand For Action Against Anti Muslim Violence

May 01, 2025 -

Ripple And Sec Settlement Xrps Commodity Classification In The Balance

May 01, 2025

Ripple And Sec Settlement Xrps Commodity Classification In The Balance

May 01, 2025

Latest Posts

-

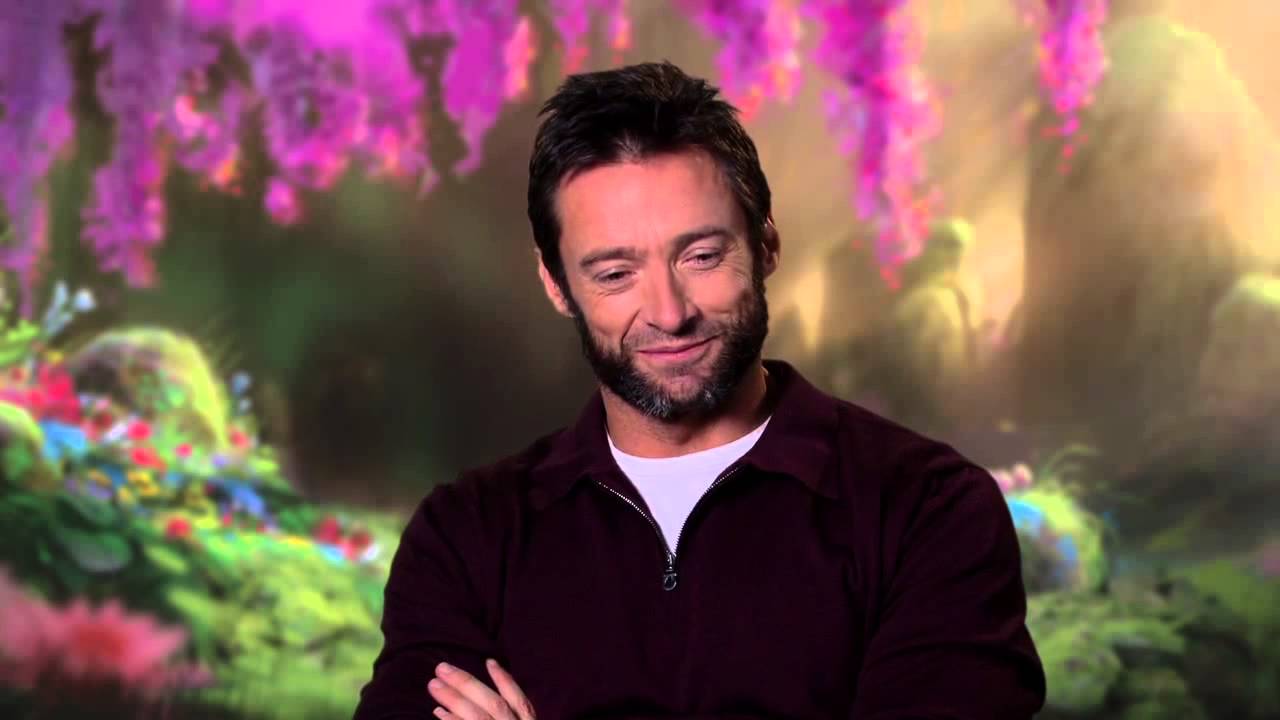

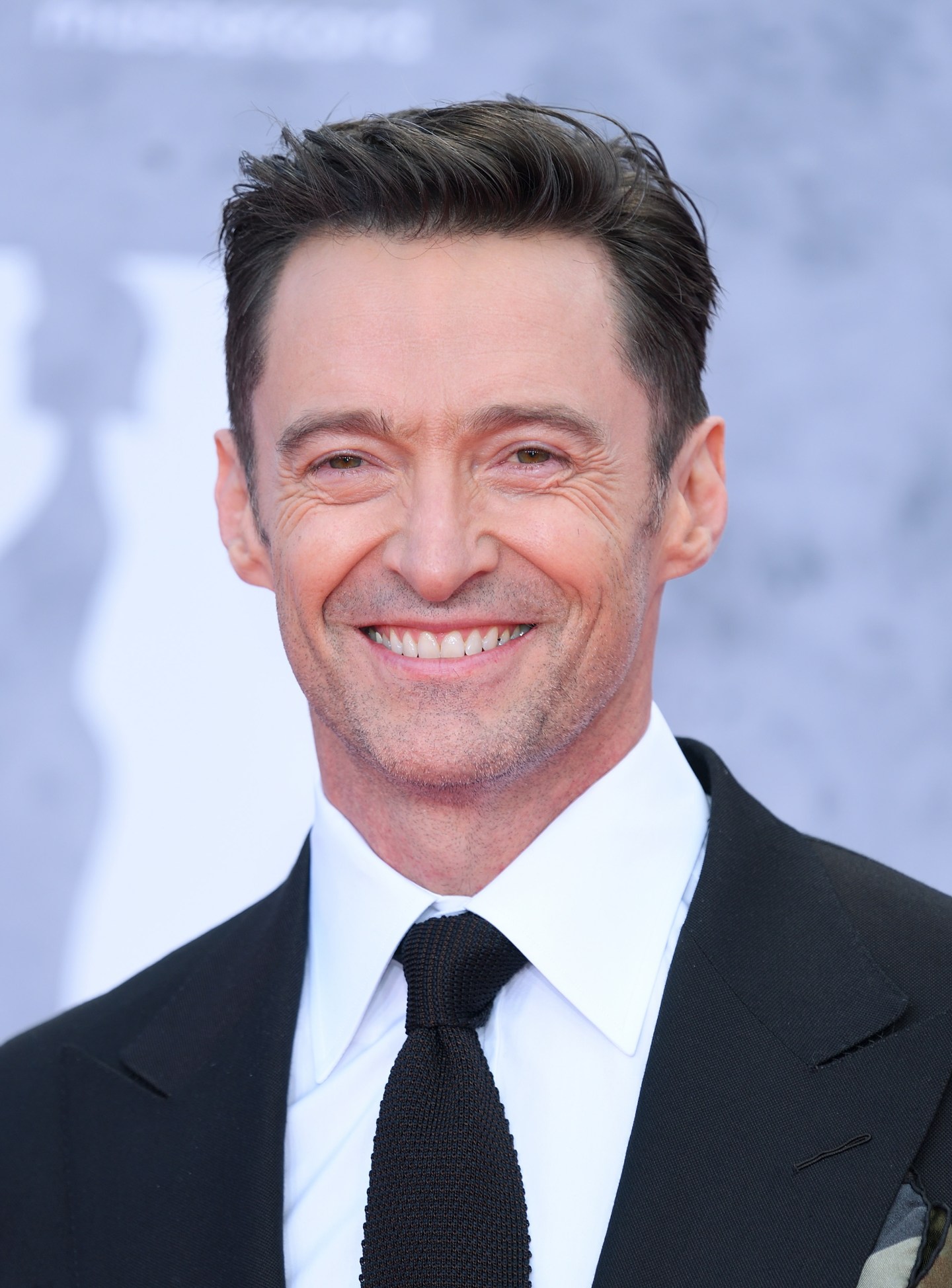

Netflix Top 10 Hugh Jackmans Easter Bunny Movie Makes A Comeback

May 01, 2025

Netflix Top 10 Hugh Jackmans Easter Bunny Movie Makes A Comeback

May 01, 2025 -

13 Years Later Hugh Jackmans Easter Bunny Movie Tops Netflix Global Charts

May 01, 2025

13 Years Later Hugh Jackmans Easter Bunny Movie Tops Netflix Global Charts

May 01, 2025 -

Yankees Early Lead Not Enough Bibee And Guardians Secure Victory

May 01, 2025

Yankees Early Lead Not Enough Bibee And Guardians Secure Victory

May 01, 2025 -

Hugh Jackmans Unexpected Netflix Hit An Easter Bunny Movies 13 Year Journey

May 01, 2025

Hugh Jackmans Unexpected Netflix Hit An Easter Bunny Movies 13 Year Journey

May 01, 2025 -

Cleveland Guardians Win 3 2 Thriller Against New York Yankees Bibees Strong Performance

May 01, 2025

Cleveland Guardians Win 3 2 Thriller Against New York Yankees Bibees Strong Performance

May 01, 2025