JBS Abandoning Banco Master Assets Acquisition Bid: JBSS3 Implications

Table of Contents

Reasons Behind JBS's Withdrawal of the Banco Master Bid

Several factors likely contributed to JBS's decision to walk away from the Banco Master acquisition. Understanding these factors is crucial to assessing the long-term implications for JBSS3.

Valuation Discrepancies

A major sticking point may have been the valuation of Banco Master's assets. Significant disagreements on the fair market value often derail large acquisitions.

- Differing assessments of future profitability: JBS and Banco Master may have held vastly different views on the future earning potential of the assets. JBS's due diligence might have revealed lower-than-expected profitability projections.

- Disagreement on debt levels: The level of existing debt within Banco Master's portfolio might have been a point of contention. JBS may have found the debt burden too high to justify the acquisition price.

- Initial proposed bid price vs. final offer: While specific figures may not be publicly available immediately, a considerable gap between the initial bid and JBS's final offer (if one was made) suggests substantial valuation differences. Analyzing these discrepancies provides insight into the breakdown of negotiations.

Regulatory Hurdles

Navigating the regulatory landscape is a critical aspect of any major acquisition. Stricter regulatory scrutiny or unexpected delays might have forced JBS to reconsider the deal.

- Antitrust concerns: Merger regulators might have raised concerns about potential monopolistic practices resulting from the acquisition, leading to lengthy investigations and potential roadblocks.

- Lengthy approval processes: The time required to secure regulatory approvals could have stretched the timeline beyond JBS's tolerance, especially in a volatile market.

- Relevant regulatory bodies involved: Identifying the specific regulatory bodies involved (e.g., antitrust authorities in relevant jurisdictions) helps understand the nature and extent of the regulatory challenges faced by JBS.

Shifting Market Conditions

The broader economic climate plays a vital role in influencing investment decisions. Unfavorable market conditions might have made the Banco Master acquisition less appealing to JBS.

- Rising interest rates: Increasing interest rates can make borrowing more expensive, impacting the overall cost of the acquisition and potentially making the deal less financially attractive.

- Economic downturn: A looming or ongoing economic downturn can decrease investor confidence and make businesses more risk-averse, leading to a reassessment of investment strategies.

- Increased competition: The emergence of competing bids or alternative investment opportunities could have influenced JBS's decision to withdraw.

Impact of the Abandoned Bid on JBSS3 and JBS's Stock Price

The abandonment of the Banco Master bid has immediate and long-term consequences for JBSS3 and JBS's overall performance.

Short-Term Market Reactions

The news of JBS's withdrawal likely caused immediate fluctuations in JBSS3.

- Stock price fluctuations following the announcement: Analyzing the immediate stock price movement following the announcement reveals investor sentiment and the market's assessment of the decision. A sharp decline suggests negative market reaction, while a minimal change indicates limited impact.

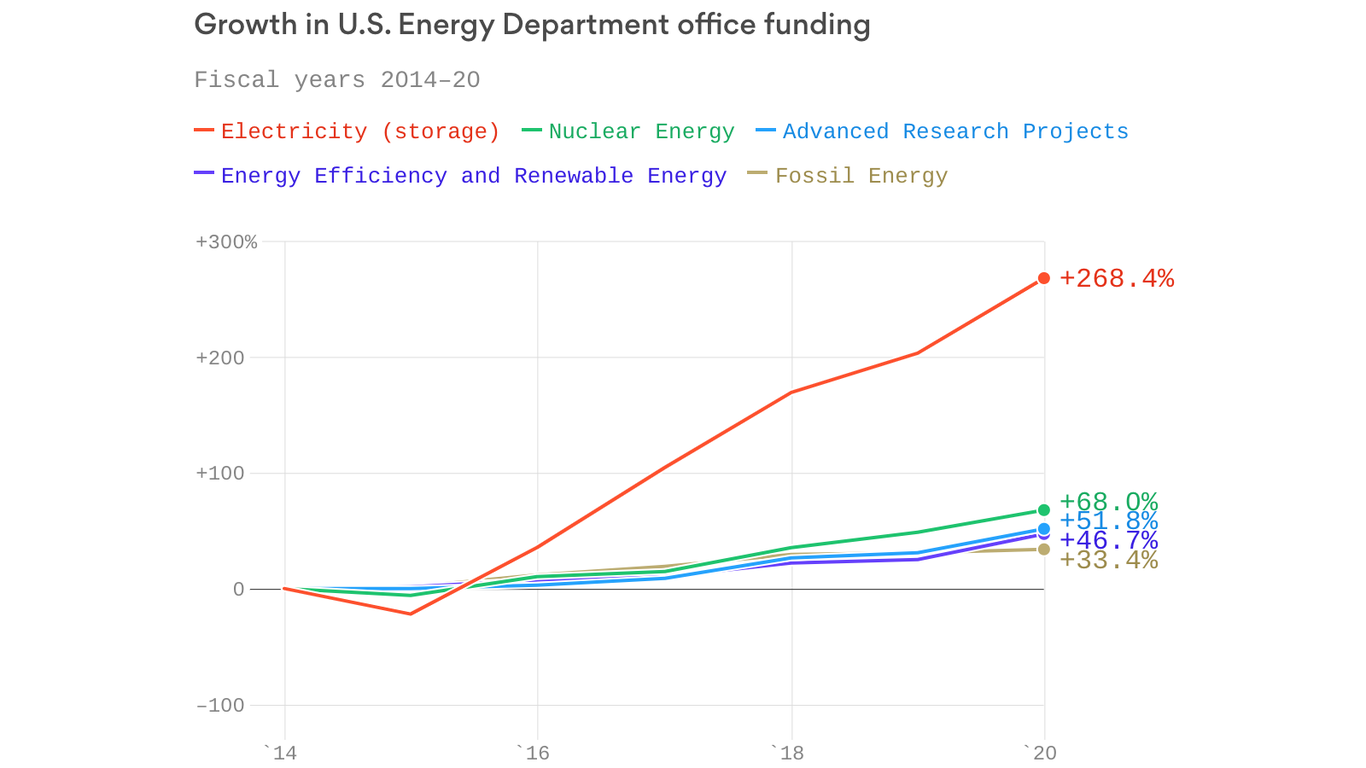

- Charts and graphs illustrating stock price movements: Visual representations of stock price changes offer a clear picture of the market's response to the news.

Long-Term Implications for JBS's Growth Strategy

This decision significantly impacts JBS's growth strategy and future direction.

- Potential alternative investment opportunities: JBS might now focus on exploring alternative acquisition targets or internal expansion opportunities.

- Impact on JBS's diversification strategy: The withdrawal could cause JBS to readjust its diversification strategy, possibly leading to a focus on different sectors or geographic regions.

Investor Sentiment and Confidence

Investor confidence in JBS may have been affected by this decision.

- Effects on investor confidence and future investments: The abandonment of the Banco Master bid could erode investor confidence, especially if the decision is perceived as a sign of poor strategic planning.

- Analyst reports and ratings adjustments: Tracking changes in analyst ratings and reports provides valuable insights into the market's assessment of the long-term implications of the decision for JBS.

Alternative Strategies and Future Outlook for JBS

With the Banco Master deal off the table, JBS needs to outline alternative strategies.

Potential Acquisition Targets

JBS might now shift its focus toward other potential acquisitions.

- Potential sectors or companies JBS might consider acquiring: Identifying potential target sectors allows for speculation on JBS's future direction. This could include companies in related food processing sectors or complementary businesses.

Focus on Organic Growth

JBS may now prioritize internal growth initiatives.

- Examples of organic growth initiatives: This could involve expanding existing facilities, developing new product lines, or enhancing operational efficiency.

Debt Management

The abandoned bid affects JBS's financial planning, particularly its debt management strategy.

- Implications for future debt reduction or refinancing: The withdrawal frees up financial resources that could be used for debt reduction or other strategic investments.

Conclusion: Analyzing the JBS Banco Master Deal and its Future Implications for JBSS3

JBS's decision to abandon its bid for Banco Master's assets stems from a confluence of factors, including valuation discrepancies, regulatory hurdles, and shifting market conditions. This decision has short-term implications for JBSS3, reflected in stock price fluctuations, and long-term implications for JBS's overall growth strategy and investor confidence. The company's future trajectory will depend on its ability to adapt and successfully implement alternative strategies, whether through acquisitions in other sectors, a focus on organic growth, or strategic debt management. Stay updated on the evolving situation with JBS and the implications for JBSS3 by following reputable financial news sources and JBS's official announcements. Understanding the "JBS abandoning Banco Master assets acquisition bid" situation is key to navigating the investment landscape surrounding this significant player in the global food industry.

Featured Posts

-

Republican Tax Bill Delayed Disagreement Over Medicaid And Clean Energy Funding

May 18, 2025

Republican Tax Bill Delayed Disagreement Over Medicaid And Clean Energy Funding

May 18, 2025 -

Bof As Reassurance Why Stretched Stock Market Valuations Shouldnt Worry Investors

May 18, 2025

Bof As Reassurance Why Stretched Stock Market Valuations Shouldnt Worry Investors

May 18, 2025 -

Doom The Dark Ages Why It Appeals To Both Casual And Hardcore Gamers

May 18, 2025

Doom The Dark Ages Why It Appeals To Both Casual And Hardcore Gamers

May 18, 2025 -

Snl Controversy Audience Profanity During Ego Nwodim Sketch

May 18, 2025

Snl Controversy Audience Profanity During Ego Nwodim Sketch

May 18, 2025 -

Vuurwerkverbod Toch Nog Een Op De Zes Nederlanders Die Doorgaat Met Kopen

May 18, 2025

Vuurwerkverbod Toch Nog Een Op De Zes Nederlanders Die Doorgaat Met Kopen

May 18, 2025

Latest Posts

-

Following Breakup Claims Kanye West And Bianca Censori Enjoy Dinner In Spain

May 18, 2025

Following Breakup Claims Kanye West And Bianca Censori Enjoy Dinner In Spain

May 18, 2025 -

Pokhorony Po Uestovski Vdokhnovenie Ot Pashi Tekhnikom I Zaveschanie Kane

May 18, 2025

Pokhorony Po Uestovski Vdokhnovenie Ot Pashi Tekhnikom I Zaveschanie Kane

May 18, 2025 -

Kanye West Bianca Censori Dinner Date Defies Breakup Reports In Spain

May 18, 2025

Kanye West Bianca Censori Dinner Date Defies Breakup Reports In Spain

May 18, 2025 -

Instruktsiya Kane Uesta K Sobstvennym Pokhoronam Vdokhnovenie Ot Pashi Tekhnikom

May 18, 2025

Instruktsiya Kane Uesta K Sobstvennym Pokhoronam Vdokhnovenie Ot Pashi Tekhnikom

May 18, 2025 -

Leslie Jones And Ope Partners A New Partnership

May 18, 2025

Leslie Jones And Ope Partners A New Partnership

May 18, 2025