Jeanine Pirro's Stock Market Warning: Ignore For The Next Few Weeks?

Table of Contents

Analyzing Jeanine Pirro's Stock Market Prediction

The specifics of Pirro's warning:

Jeanine Pirro's exact warning requires referencing the specific source where she made her statement (e.g., a television interview, a social media post). For the purpose of this example, let's assume she expressed concern about a potential short-term market correction, citing rising inflation and potential interest rate hikes as contributing factors. She did not specify a particular timeframe beyond suggesting caution in the "coming weeks." The absence of specific sector warnings makes independent analysis crucial.

- Key Points: Pirro expressed concern about market volatility due to inflation and potential interest rate increases.

- Source: [Insert source here - e.g., "During a recent segment on Fox News," or "In a post on her social media account,"].

- Specific Sectors/Stocks: [Insert details here, or state "No specific sectors or stocks were mentioned."]

Analyzing the context, Pirro's warning seems rooted in generally accepted economic concerns. Rising inflation and the possibility of further interest rate hikes by the Federal Reserve are indeed factors that can impact stock market performance. However, the lack of specifics makes it difficult to assess the direct applicability of her warning to individual portfolios.

Evaluating the Validity of Pirro's Claims

Expert opinions on market trends:

While Pirro's concerns about inflation and interest rates are valid, several financial experts offer differing perspectives. Some analysts agree that increased volatility is likely, but disagree on the severity or duration of any potential downturn. Others point to positive economic indicators that could mitigate the impact of these concerns.

- Divergent Viewpoints: [Cite specific examples of analysts with opposing views and their reasoning. For instance: "Economist John Smith predicts a mild correction, citing strong corporate earnings. Conversely, Jane Doe, Chief Investment Strategist at XYZ Investments, anticipates a more significant downturn based on recent consumer spending data."]

- Data Points: [Insert links to relevant articles/reports from sources such as the Wall Street Journal, Bloomberg, or the Financial Times, providing specific data points like inflation rates, GDP growth, and interest rate forecasts.]

- Market Situation: The current market situation is characterized by [describe the current situation - e.g., high inflation, rising interest rates, geopolitical uncertainty, etc.]. This creates uncertainty and necessitates a cautious approach to investment decisions.

Strategies for Navigating Market Uncertainty

Risk Management Techniques:

Navigating market uncertainty requires a robust risk management strategy. This is not about predicting the market, but preparing for different scenarios.

- Diversification: Spread investments across various asset classes (stocks, bonds, real estate, etc.) to mitigate losses in any single area. A diversified portfolio is less vulnerable to single-sector downturns.

- Long-Term Approach: Focus on long-term investment goals rather than short-term market fluctuations. Market corrections are a normal part of the investment cycle. A long-term perspective allows for weathering short-term volatility.

- Financial Advisor: Consider consulting a qualified financial advisor who can help you create a personalized investment strategy aligned with your risk tolerance and financial objectives.

The Importance of Independent Research

Reliable Sources for Market Information:

Relying solely on any single source, even a respected figure like Jeanine Pirro, is risky.

- Reputable Sources: Consult multiple, reliable sources for market information. This includes reputable financial news websites (e.g., Bloomberg, Reuters, The Wall Street Journal), economic research firms, and government data sources.

- Financial Advisor: A financial advisor can provide personalized guidance and help you interpret complex market data.

- Bias Awareness: Be mindful of potential biases in any source you consult. Consider the source’s potential motivations and perspectives.

Conclusion:

Jeanine Pirro's stock market warning highlights the ever-present uncertainty in the market. While her concerns about inflation and interest rates are valid, the lack of specificity and the existence of differing expert opinions underscore the importance of independent research. Don't ignore the potential implications of Jeanine Pirro's stock market warning, but don't panic either. Conduct thorough research, diversify your investments, and consider consulting a financial advisor to make informed decisions that align with your risk tolerance and long-term financial goals. Learn more about navigating market volatility and protecting your investments by [link to a relevant resource, such as a financial planning website].

Featured Posts

-

Local News Coverage Celebrating Anchorages Thriving Arts Community

May 09, 2025

Local News Coverage Celebrating Anchorages Thriving Arts Community

May 09, 2025 -

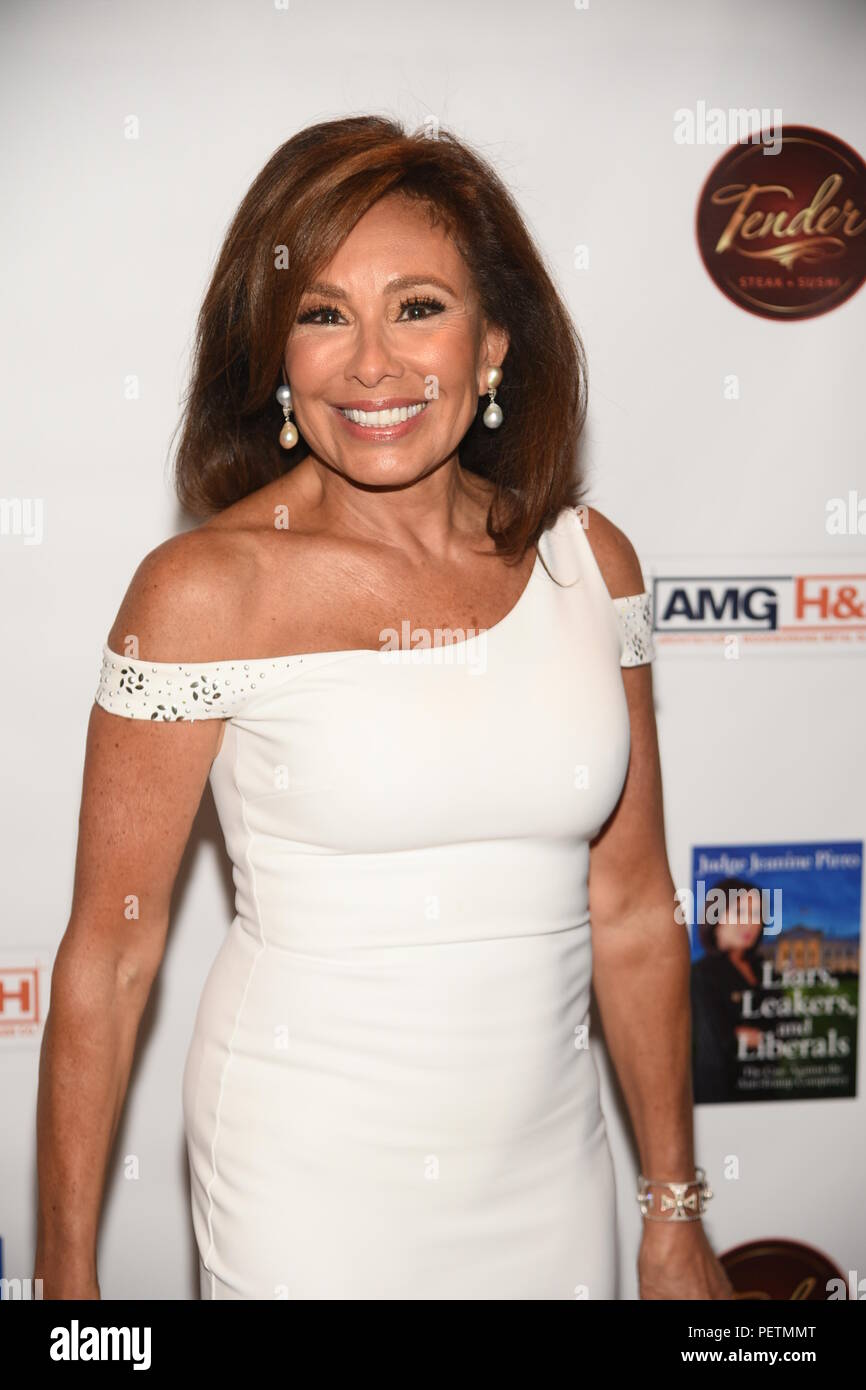

Palantir Stock Before May 5th Is It A Smart Investment

May 09, 2025

Palantir Stock Before May 5th Is It A Smart Investment

May 09, 2025 -

Greenlands Autonomy Under Pressure Examining Trumps Impact On Its Relationship With Denmark

May 09, 2025

Greenlands Autonomy Under Pressure Examining Trumps Impact On Its Relationship With Denmark

May 09, 2025 -

Home Office Intensifies Asylum Restrictions Focus On Three Nations

May 09, 2025

Home Office Intensifies Asylum Restrictions Focus On Three Nations

May 09, 2025 -

High Stock Market Valuations Bof As Analysis And Investor Reassurance

May 09, 2025

High Stock Market Valuations Bof As Analysis And Investor Reassurance

May 09, 2025