Kentucky Storm Damage Assessments: Delays And Reasons Why

Table of Contents

The Complexities of Kentucky Storm Damage Assessment

The assessment process for storm damage in Kentucky involves several key steps, each of which can contribute to delays. It typically begins with filing an insurance claim, followed by an inspection by an insurance adjuster, and concludes with detailed documentation of the damage. However, several factors can significantly prolong this process.

High Volume of Claims After Major Storms

Major storms in Kentucky often result in a surge of insurance claims, overwhelming the system and causing significant delays.

- Increased demand overwhelms adjusters, leading to backlogs: The sheer number of claims filed after a widespread event like a tornado or severe flooding surpasses the capacity of available insurance adjusters, creating substantial backlogs.

- Increased paperwork and administrative tasks: Each claim requires extensive documentation, including photographs, detailed descriptions of damage, and supporting evidence. This paperwork burden intensifies during periods of high claim volume, further slowing down the assessment process.

- Difficulty accessing damaged properties due to widespread devastation: Road closures, downed power lines, and debris fields can make it nearly impossible for adjusters to reach damaged properties promptly, delaying the assessment.

This high volume of storm damage claims directly impacts assessment timelines. Kentucky insurance adjusters are often stretched thin, leading to longer wait times for homeowners and businesses seeking compensation for their losses. Efficient processing of insurance claims becomes a significant challenge.

Difficulties in Accessing Damaged Properties

Accessing damaged properties after a severe storm can present significant logistical hurdles.

- Road closures, debris removal delays: Widespread damage often results in road closures and significant debris removal efforts, delaying adjuster access to damaged properties.

- Safety concerns for adjusters entering damaged areas: Unsafe conditions, including unstable structures, downed power lines, and hazardous materials, pose safety risks for adjusters, necessitating careful planning and potentially delaying inspections.

- Property inaccessibility due to flooding or structural damage: Flooding and significant structural damage may render some properties inaccessible until cleanup and repairs make the area safe for assessment.

Conducting thorough property damage assessment in such hazardous conditions is challenging and significantly contributes to delays in the overall insurance claim process. Accurate hazard assessment is paramount before any detailed damage evaluation can begin.

Determining the Extent of Damage

Accurately assessing the extent of damage is a crucial, yet time-consuming, part of the process.

- Hidden damage requiring specialized inspections (e.g., foundation damage, mold): Surface-level damage may obscure hidden problems like foundation cracks, water damage leading to mold growth, or compromised structural integrity. These require specialized inspections, adding time to the assessment.

- Complex damage requiring engineering expertise: Severe damage may necessitate the involvement of structural engineers or other specialized professionals to determine the extent of repairs and associated costs, prolonging the assessment process.

- Disputes over the cause of damage: Disagreements between homeowners and insurance companies over the cause of the damage can lead to lengthy investigations and delays in settling the claim.

Thorough damage evaluation is essential for fair compensation. This often involves detailed structural damage assessment and careful consideration of all contributing factors, which naturally increases the time required for complete Kentucky storm damage assessments.

Role of Insurance Companies in Kentucky Storm Damage Assessments

Insurance companies play a central role in the assessment process, and their procedures significantly impact timelines.

Insurance Company Procedures and Protocols

Insurance companies have established procedures and protocols that can contribute to delays.

- Strict requirements for documentation: Insurers require comprehensive documentation, including detailed descriptions, photos, and receipts, which can be time-consuming to gather, especially after a major storm.

- Multiple layers of review and approval: Claims often undergo multiple levels of review and approval within the insurance company, further delaying the process.

- Negotiating settlements can be time-consuming: Disputes over the value of the damage or the scope of coverage can lead to protracted negotiations, delaying final settlement.

Clear communication with your insurance company is crucial. Understanding their insurance claim process and being prepared with all necessary documentation can help minimize delays. Knowing how to effectively address potential insurance claim denial is also important. Skillful insurance adjuster negotiation can be vital in achieving a fair settlement.

Understaffing and Resource Constraints within Insurance Companies

Insurance companies may face resource limitations that exacerbate delays.

- Limited number of adjusters available: The number of qualified insurance adjusters may be insufficient to handle the surge in claims after a major storm.

- Backlogs in processing claims: High claim volumes inevitably lead to backlogs in processing, resulting in significant delays for all claimants.

- Increased workloads due to major storm events: The aftermath of a major storm places a tremendous strain on insurance company resources, leading to longer processing times.

Legal and Regulatory Factors Affecting Kentucky Storm Damage Assessments

Legal and regulatory frameworks also play a role in the assessment process.

Building Codes and Regulations

Compliance with building codes and regulations adds another layer of complexity to the assessment.

- Compliance checks increase assessment time: Assessors must ensure that repairs meet all applicable building codes and regulations, adding to the assessment time.

- Strict adherence to regulations by assessors: Assessors are bound by strict adherence to building codes and regulations, which can influence the assessment process and the ultimate cost of repairs.

- Need for specialized expertise for code compliance reviews: Complex repairs may necessitate specialized expertise in building code compliance, potentially delaying the final assessment.

Understanding Kentucky building codes and the relevant legal requirements is important for homeowners. Ensuring building code compliance during repairs streamlines the process and prevents future disputes.

Conclusion

Kentucky storm damage assessments often experience significant delays due to a complex interplay of factors. High claim volumes, access challenges, thorough damage evaluation, insurance company procedures, and legal considerations all contribute to extended timelines. Understanding these reasons can help homeowners and businesses better manage their expectations and navigate the process effectively. If you're facing delays in your Kentucky storm damage assessment, be proactive in communicating with your insurance company and seeking professional assistance when needed. Don't hesitate to seek advice on navigating the complexities of Kentucky storm damage assessments and protecting your interests.

Featured Posts

-

Cancer Drug Setback Akeso Stock Takes A Hit

Apr 29, 2025

Cancer Drug Setback Akeso Stock Takes A Hit

Apr 29, 2025 -

Black Hawk Helicopter Collision Pilot Error Leading To American Airlines Near Miss

Apr 29, 2025

Black Hawk Helicopter Collision Pilot Error Leading To American Airlines Near Miss

Apr 29, 2025 -

Halbmastbeflaggung In Deutschland Trauer Um Den Papst

Apr 29, 2025

Halbmastbeflaggung In Deutschland Trauer Um Den Papst

Apr 29, 2025 -

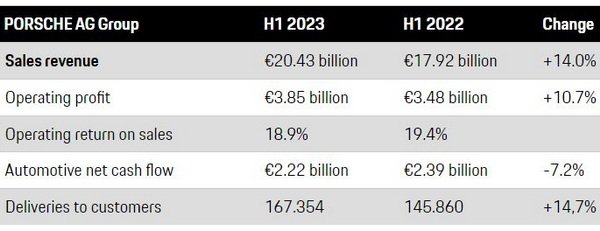

Porsche Ag

Apr 29, 2025

Porsche Ag

Apr 29, 2025 -

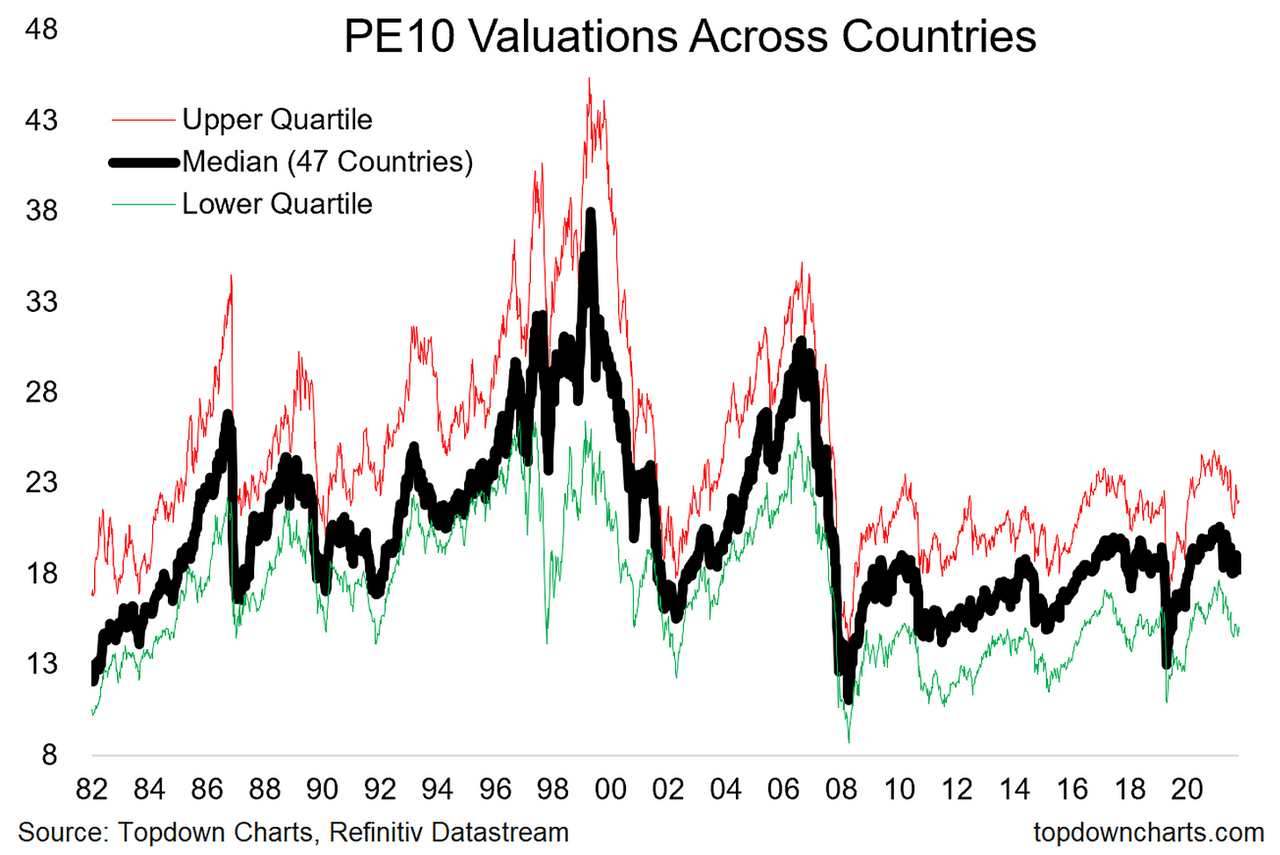

The Bof A Perspective Why Stretched Stock Market Valuations Shouldnt Worry You

Apr 29, 2025

The Bof A Perspective Why Stretched Stock Market Valuations Shouldnt Worry You

Apr 29, 2025