Klarna IPO: $1 Billion Funding And Next Week's Potential Listing

Table of Contents

Klarna's Recent $1 Billion Funding Round

Klarna's recent $1 billion Series G funding round represents a major vote of confidence in the company and the burgeoning Buy Now Pay Later (BNPL) market. This significant capital injection strengthens Klarna's position as a global leader in the fintech sector.

-

Investors and Valuation: While the exact details of participating investors may not be publicly available immediately, the size of the round indicates strong investor interest and likely positions Klarna for a substantial valuation in its upcoming IPO. This funding round significantly boosts Klarna's financial resources.

-

Strategic Implications: This influx of capital will undoubtedly fuel Klarna's ambitious global expansion plans and allow for significant investments in product development and innovation. The funding provides a solid foundation for navigating the competitive BNPL landscape.

-

Use of Funds: Klarna is likely to allocate the funds strategically across several key areas:

- Product Development: Enhancing its existing BNPL platform with new features and functionalities to improve user experience and attract new customers.

- Market Expansion: Expanding its reach into new geographical markets and solidifying its presence in existing ones.

- Potential Acquisitions: Acquiring smaller companies or technologies to bolster its capabilities and competitive advantage within the fintech space. This could involve smaller BNPL providers or companies offering complementary financial services.

Anticipation Surrounding the Klarna IPO

The anticipation surrounding the Klarna IPO is palpable. Investors worldwide are eagerly awaiting the potential stock market debut of this high-growth fintech company.

-

Timing and Venue: While an exact Klarna IPO date remains unconfirmed, next week is widely speculated as a potential timeframe. The likely listing venue is anticipated to be either the Nasdaq Stockholm or a major US exchange like the New York Stock Exchange (NYSE), depending on various factors.

-

Potential Valuation and IPO Price: Klarna's valuation is subject to much discussion, with estimates varying widely based on market conditions and investor sentiment. The IPO price will be determined closer to the listing date, considering various factors such as comparable company valuations and overall market performance.

-

Factors Impacting Success: Several factors could influence the success of the Klarna IPO, including:

- Market Conditions: Overall market volatility and investor appetite for tech stocks can significantly influence investor interest.

- Investor Sentiment: The general sentiment towards the BNPL sector and Klarna's specific business model will play a crucial role in determining the IPO's reception.

- Competition: The competitive landscape within the BNPL industry and the success of Klarna's competitors will be closely monitored.

The Buy Now Pay Later (BNPL) Market and Klarna's Position

The Buy Now Pay Later (BNPL) market is experiencing explosive growth globally. Klarna is at the forefront of this expansion, establishing itself as a major player.

-

Market Growth and Projections: The BNPL market is projected to experience significant expansion in the coming years, driven by increasing consumer adoption and technological advancements. This growth presents a massive opportunity for established players like Klarna.

-

Klarna's Competitive Advantages: Klarna's success is attributed to several key factors:

- Brand Recognition: Klarna has cultivated strong brand recognition and trust amongst consumers.

- User Experience: The company's user-friendly platform and seamless integration with online retailers contribute to its popularity.

- Global Reach: Klarna operates in numerous countries, providing a significant competitive edge.

-

Key Competitors: Klarna faces competition from established players such as Affirm, Afterpay (now a part of Square), and PayPal's BNPL offerings. The competitive landscape is dynamic, and maintaining market share requires constant innovation and adaptation.

Potential Risks and Challenges for the Klarna IPO

While the Klarna IPO presents significant opportunities, investors should be aware of potential risks and challenges.

-

Regulatory Hurdles: The regulatory landscape for BNPL services is evolving rapidly, with increasing scrutiny from regulators globally. Changes in regulations could impact Klarna's operations and profitability.

-

Financial Risks: The BNPL business model inherently carries financial risks, including the potential for increased defaults and credit losses. Effective risk management is crucial for long-term sustainability.

-

Market Volatility and Economic Uncertainty: Economic downturns and market volatility can negatively affect consumer spending and the performance of high-growth tech companies. The IPO's success depends heavily on stable economic conditions.

Conclusion

Klarna's substantial $1 billion funding round significantly boosts its prospects for a highly anticipated IPO, potentially happening next week. The Klarna IPO represents a major event for the fintech industry and the broader BNPL market. While the BNPL market offers immense growth potential, investors should carefully consider the risks associated with this rapidly evolving sector and Klarna's specific position within it. The Klarna Initial Public Offering will be closely watched by investors worldwide.

Call to Action: Stay informed about the latest developments regarding the Klarna IPO and the Klarna stock market debut by following reputable financial news sources. Understanding the intricacies of the Klarna Initial Public Offering is key for anyone interested in investing in this dynamic fintech company and the growing Buy Now Pay Later market.

Featured Posts

-

Did Political Correctness Sink Snow White Examining Disneys Latest Release

May 14, 2025

Did Political Correctness Sink Snow White Examining Disneys Latest Release

May 14, 2025 -

Jake Paul Vs Tommy Fury The Pub Fight Aftermath And Daddy Diss

May 14, 2025

Jake Paul Vs Tommy Fury The Pub Fight Aftermath And Daddy Diss

May 14, 2025 -

Captain America Brave New World 4 K Blu Ray Steelbook Now Available For Pre Order

May 14, 2025

Captain America Brave New World 4 K Blu Ray Steelbook Now Available For Pre Order

May 14, 2025 -

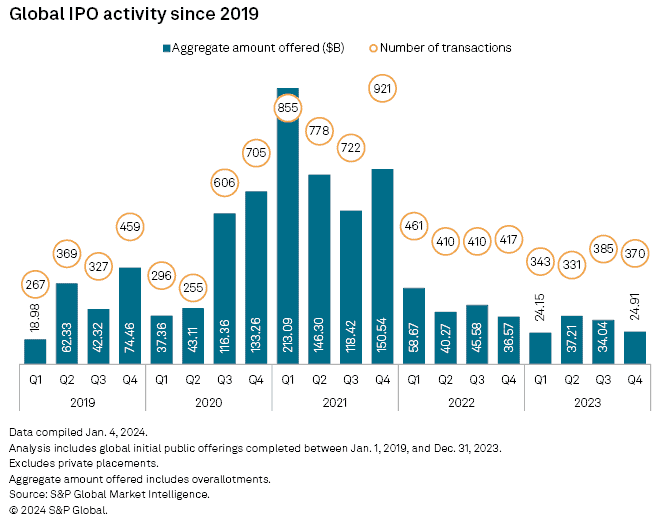

The Impact Of Tariffs On Ipo Activity A Current Market Analysis

May 14, 2025

The Impact Of Tariffs On Ipo Activity A Current Market Analysis

May 14, 2025 -

Portugals Shift On Immigration Increased Expulsions And Their Reasons

May 14, 2025

Portugals Shift On Immigration Increased Expulsions And Their Reasons

May 14, 2025