Liberal Fiscal Irresponsibility: A Threat To Canada's Economic Vision

Table of Contents

Uncontrolled Government Spending: A Major Driver of Debt

The increase in government spending under the current liberal administration is a primary driver of Canada's expanding national debt. This surge isn't simply a matter of increased spending across the board; it's characterized by a lack of fiscal restraint and prioritization, leading to unsustainable levels of deficit financing. Numerous programs and initiatives, while often well-intentioned, lack thorough cost-benefit analyses, resulting in ballooning expenditures.

- Increased social program spending: Expansion of existing social programs and the introduction of new ones, while addressing social needs, have placed significant strain on the federal budget. Data from Statistics Canada [cite source] clearly demonstrates this upward trend.

- Infrastructure projects with questionable cost-benefit analyses: Ambitious infrastructure projects, while vital for long-term growth, often suffer from cost overruns and delays, further exacerbating the deficit. A thorough review of project selection criteria is needed to ensure efficient resource allocation. [cite source]

- Lack of fiscal restraint and prioritization: The absence of a clear and consistent fiscal framework has contributed to the uncontrolled expansion of government spending. Prioritizing essential services and eliminating wasteful expenditure are crucial steps towards fiscal sustainability. [cite source]

This uncontrolled spending directly translates into a widening budget deficit and a rapidly accumulating national debt, jeopardizing Canada's fiscal sustainability. [Include a chart or graph visualizing the growth of the national debt and deficit over the relevant period]. Keywords: Government spending, budget deficit, national debt, fiscal sustainability, program spending, infrastructure spending.

Taxation Policies and Their Impact on Economic Growth

Canada's current taxation policies have significant implications for both businesses and individuals, potentially hindering economic growth. High tax rates, particularly corporate taxes, discourage investment and job creation. This creates a less competitive environment compared to other developed nations, impacting Canada's ability to attract foreign investment and retain domestic businesses.

- High corporate tax rates discouraging investment: Canada's corporate tax rates, compared to those of its international competitors [cite OECD data or similar], may be deterring investments and impacting business expansion plans. This can lead to slower economic growth and reduced job creation.

- Impact of increased personal income taxes on consumer spending: Increased personal income taxes can reduce disposable income, leading to decreased consumer spending, which in turn, dampens economic activity. [Cite relevant economic studies on the impact of taxation on consumer behaviour].

- Inefficient tax collection mechanisms: Inefficiencies in the tax system, including complex regulations and administrative burdens, can lead to lost revenue and compliance difficulties. Streamlining the tax system and improving efficiency could boost government revenue and stimulate the economy.

Keywords: Taxation policy, tax rates, corporate tax, personal income tax, economic growth, investment, job creation.

The Growing National Debt: A Looming Economic Crisis?

Canada's national debt is on a concerning trajectory. The debt-to-GDP ratio is steadily increasing, posing significant risks to the country's economic stability. A high debt-to-GDP ratio reduces the government's ability to respond effectively to economic shocks, such as recessions, and may lead to reduced creditworthiness and higher borrowing costs.

- Current debt-to-GDP ratio and projected increase: [Present the current debt-to-GDP ratio and projections for the coming years, citing reliable sources like the Parliamentary Budget Officer].

- Interest payments on the national debt and their impact on the budget: A larger national debt necessitates higher interest payments, consuming a larger portion of the budget and leaving less for essential services and investments.

- Reduced ability to respond to future economic downturns: A high debt burden limits the government's fiscal capacity to implement counter-cyclical measures during economic downturns, potentially prolonging or worsening such crises.

These factors collectively paint a picture of a looming economic crisis if the current trend persists. Keywords: National debt, debt-to-GDP ratio, sovereign debt, fiscal responsibility, economic crisis, credit rating.

Alternative Fiscal Approaches: A Path to Economic Stability

Adopting alternative fiscal policies is crucial for restoring Canada's economic stability and ensuring sustainable growth. This involves a fundamental shift towards fiscal responsibility, prioritizing spending cuts, tax reforms, and long-term fiscal planning. Examples from other countries, such as [cite examples of countries with successful fiscal consolidation strategies], offer valuable lessons.

- Spending cuts and prioritization: Careful review and prioritization of government spending are paramount. Eliminating wasteful expenditure and focusing on high-impact programs are essential steps.

- Tax reforms to stimulate investment and job creation: Revising tax policies to encourage investment, innovation, and job creation is vital for long-term growth. This could involve lowering corporate tax rates, simplifying regulations, and incentivizing specific sectors.

- Long-term fiscal planning and budgeting: Implementing a comprehensive long-term fiscal plan with realistic budgetary targets and clear accountability mechanisms is essential for achieving fiscal sustainability.

Keywords: Fiscal responsibility, economic stability, fiscal policy reform, sustainable growth, balanced budget, responsible government.

Conclusion: Reining in Liberal Fiscal Irresponsibility for a Stronger Canada

The evidence strongly suggests that liberal fiscal irresponsibility is undermining Canada's economic future. The uncontrolled government spending, detrimental taxation policies, and the rapidly increasing national debt pose significant threats to economic stability and prosperity. A proactive shift towards fiscal responsibility, involving prudent spending, effective tax reforms, and long-term planning, is crucial to secure a stronger Canadian economy for current and future generations.

We urge readers to demand greater fiscal responsibility from their government. Contact your Member of Parliament, engage in informed discussions about Canada's economic future, and advocate for responsible fiscal policy changes. The time for action is now; let's work together to build a more fiscally responsible and economically secure Canada. Keywords: Fiscal responsibility, Canadian economy, economic future, responsible government, fiscal policy reform, sustainable growth.

Featured Posts

-

Revolutionizing Voice Assistant Development Open Ais 2024 Announcement

Apr 24, 2025

Revolutionizing Voice Assistant Development Open Ais 2024 Announcement

Apr 24, 2025 -

35 Unlimited Google Fis Latest Mobile Plan Explained

Apr 24, 2025

35 Unlimited Google Fis Latest Mobile Plan Explained

Apr 24, 2025 -

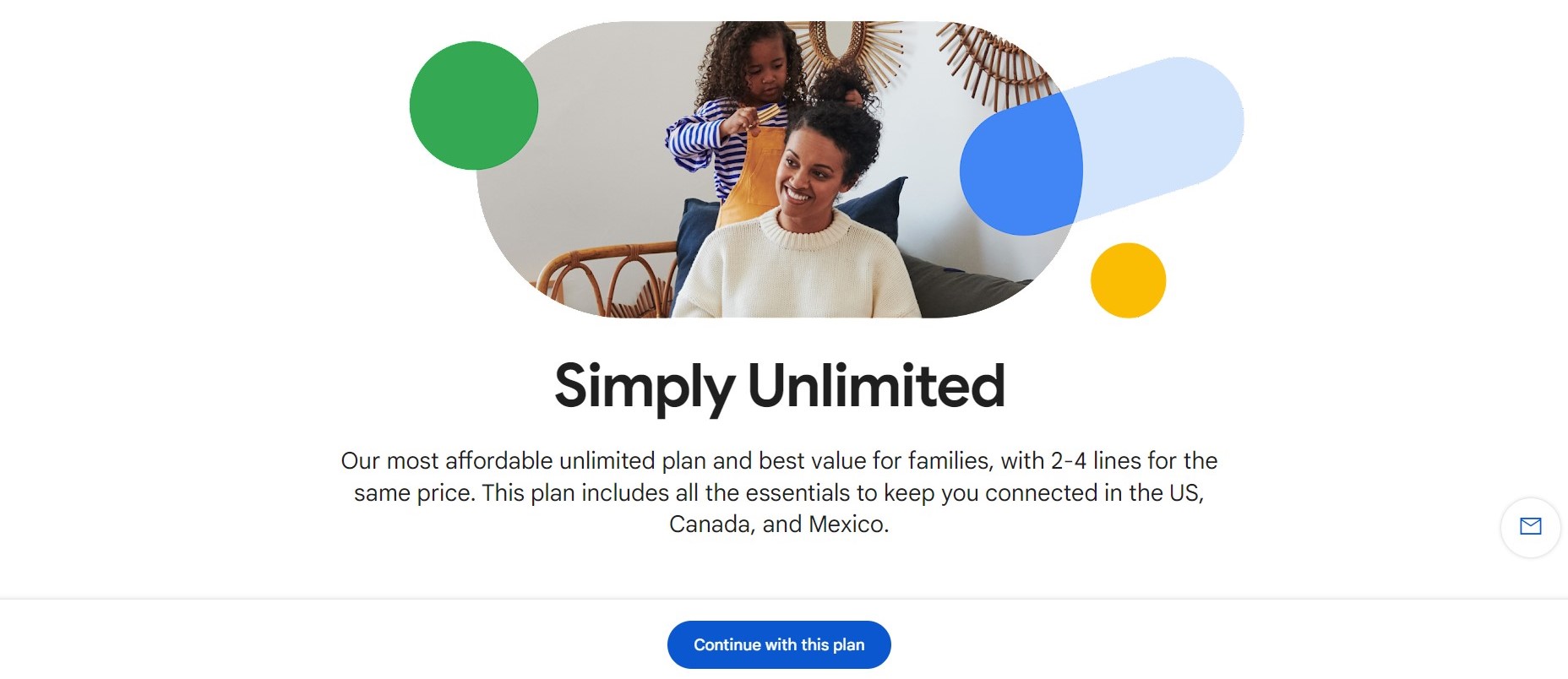

Review 77 Inch Lg C3 Oled Is The Size Right For Me

Apr 24, 2025

Review 77 Inch Lg C3 Oled Is The Size Right For Me

Apr 24, 2025 -

Ted Lassos Revival Brett Goldsteins Resurrected Cat Analogy Explained

Apr 24, 2025

Ted Lassos Revival Brett Goldsteins Resurrected Cat Analogy Explained

Apr 24, 2025 -

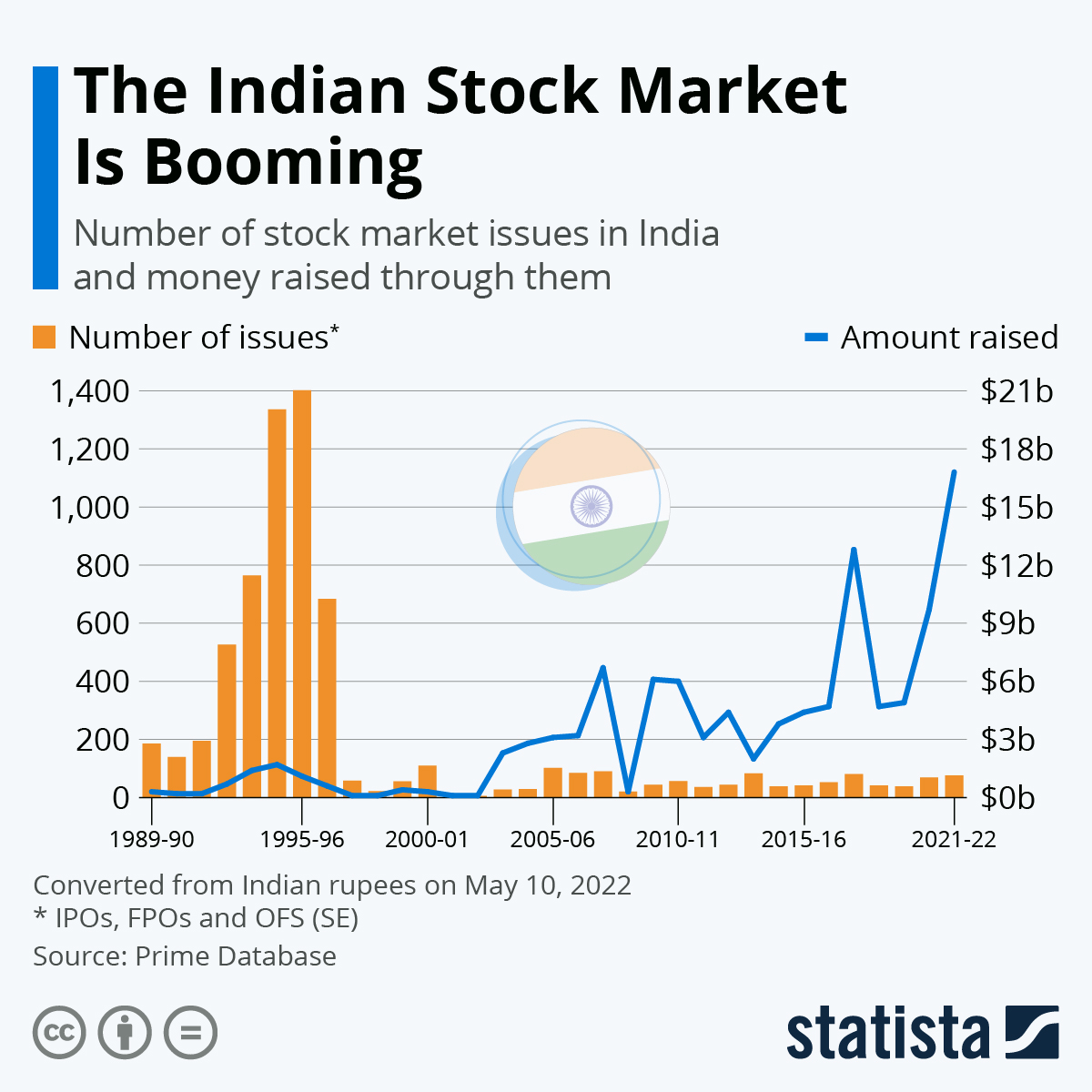

Indian Stock Market Understanding The Current Bullish Momentum

Apr 24, 2025

Indian Stock Market Understanding The Current Bullish Momentum

Apr 24, 2025