Live Now, Pay Later: Benefits, Risks, And How To Choose The Right Plan

Table of Contents

Benefits of Live Now, Pay Later Schemes

Live Now, Pay Later schemes offer several compelling advantages for consumers, particularly those seeking flexible payment options and budget-friendly financing.

Improved Cash Flow Management

One of the primary benefits of BNPL is its ability to improve cash flow management. By spreading the cost of a purchase over several installments, you avoid the burden of a large upfront payment.

- Avoids large upfront costs: Instead of paying a significant amount upfront, you can break down the expense into smaller, more manageable payments.

- Easier budgeting for larger purchases: This makes budgeting for larger purchases, like appliances or furniture, significantly easier.

- Spreads the financial burden: The payment schedule allows for a more gradual repayment, reducing immediate financial strain.

These affordable installments make significant purchases feel more accessible and help you stick to your budget better than paying a lump sum. The flexible payment options offered by various Live Now, Pay Later providers make this a particularly attractive option for those with fluctuating income.

Enhanced Purchasing Power

BNPL services effectively increase your purchasing power, allowing you to access goods and services you might otherwise delay due to financial constraints.

- Access to goods and services sooner: You can obtain the items you need or want immediately, rather than waiting until you've saved enough money.

- Increased purchasing power for big-ticket items: This is particularly useful for big-ticket items, such as electronics or home improvements, which can often represent a substantial financial commitment.

Increased buying power can significantly improve your quality of life, allowing you to acquire necessary items or enjoy experiences sooner. This convenient financing, however, should be managed responsibly to avoid overspending.

Building Credit History (Potentially)

While not guaranteed, some Live Now, Pay Later services report your payment activity to credit bureaus. This can potentially help build your credit history, provided you utilize the service responsibly.

- Responsible use can improve credit score (if reported to credit bureaus): Consistently making on-time payments demonstrates responsible credit use and can positively impact your credit score.

- Check if the provider reports to credit agencies: It's crucial to confirm whether your chosen provider reports to credit bureaus before relying on it for credit building.

This credit building potential is a valuable secondary benefit, but it’s important to remember that this is not a guaranteed outcome. Always check the individual provider’s practices regarding credit reporting.

Risks Associated with Live Now, Pay Later Services

While Live Now, Pay Later offers significant advantages, it's essential to acknowledge the potential risks involved. Ignoring these risks could lead to significant financial hardship.

High Interest Rates and Fees

One major drawback is the potential for high interest rates and substantial fees, particularly if you miss payments.

- Potential for accumulating debt quickly: Missed payments can quickly escalate the total cost of your purchase due to accumulating interest and penalties.

- High APR (Annual Percentage Rate) compared to traditional loans: BNPL interest rates can be considerably higher than those on traditional loans.

- Late payment fees can drastically increase total cost: These fees, combined with interest charges, can dramatically increase your overall spending.

The high-interest loans associated with missed payments can quickly transform a seemingly manageable expense into a significant financial burden.

Impact on Credit Score

Missed payments on your Live Now, Pay Later accounts are typically reported to credit bureaus, which can severely damage your credit score.

- Late payments reported to credit bureaus: This negative mark on your credit report can persist for several years.

- Negative impact on credit rating: A lower credit score can make it harder to secure loans, mortgages, or even rent an apartment in the future.

- Difficulty securing future loans: Lenders view a poor credit history as a significant risk, leading to higher interest rates or loan rejection.

Therefore, responsible credit use and timely payment are paramount when utilizing BNPL services to prevent credit score damage.

Overspending and Debt Traps

The ease and accessibility of Live Now, Pay Later services can easily lead to overspending and the accumulation of unmanageable debt.

- Easy access to credit can lead to impulse buying: The convenience can tempt you to make purchases you wouldn't otherwise afford.

- Difficulty repaying multiple BNPL loans: Juggling payments across multiple providers can become incredibly challenging.

- Potential for financial hardship: Over-indebtedness from excessive use of BNPL services can cause significant financial strain and hardship.

Therefore, mindful spending habits and careful financial planning are crucial to avoid falling into a debt trap. Financial responsibility is key to the safe use of these services.

Choosing the Right Live Now, Pay Later Plan

Selecting the appropriate Live Now, Pay Later plan requires careful consideration and comparison.

Compare Interest Rates and Fees

Before committing to a plan, thoroughly compare interest rates, fees, and repayment terms across different providers.

- Read the fine print carefully: Pay close attention to hidden fees or additional charges.

- Check for hidden fees: Some providers may have additional fees for late payments, early settlements, or other circumstances.

- Compare APRs from multiple providers: This will help you identify the most cost-effective option.

The best BNPL providers are those offering competitive interest rates and transparent fee structures.

Understand Repayment Terms

Ensure you fully understand the repayment schedule and the consequences of missed payments.

- Confirm the repayment period and installment amounts: Clarify the total number of installments and the amount due for each payment.

- Assess your ability to meet the payment schedule: Be realistic about your financial capabilities and choose a plan that aligns with your budget.

- Choose a plan aligned with your financial capabilities: Avoid plans that may put you at risk of missing payments.

Clear understanding of the payment terms is vital to responsible borrowing.

Check for Credit Bureau Reporting

Determine whether the BNPL provider reports your payment activity to credit bureaus.

- Check the provider's privacy policy: This will usually outline their reporting practices.

- Understand how on-time payments will affect your credit: Responsible use can positively impact your credit history if reported.

- Be aware of potential consequences of missed payments: Missed payments can severely damage your credit score.

Credit reporting transparency is crucial for making informed decisions about your credit history impact.

Conclusion

Live Now, Pay Later schemes offer a convenient and potentially beneficial way to manage expenses and access goods, but they also come with risks. High interest rates, late fees, and the potential for overspending can easily lead to significant financial problems. To maximize the benefits and minimize the risks, carefully research different providers, compare their offerings, and choose a plan that perfectly fits your financial circumstances and goals. Find the best Live Now, Pay Later plan for you by prioritizing responsible borrowing practices and making informed decisions about your Live Now, Pay Later options. Remember, responsible use is key to avoiding potential pitfalls and ensuring a positive experience.

Featured Posts

-

Sporgsmalet Om Et Godt Tilbud Anderlechts Dilemma

May 30, 2025

Sporgsmalet Om Et Godt Tilbud Anderlechts Dilemma

May 30, 2025 -

Faktor Faktor Yang Mendorong Harga Murah Kawasaki Z900 Dan Z900 Se Di Indonesia

May 30, 2025

Faktor Faktor Yang Mendorong Harga Murah Kawasaki Z900 Dan Z900 Se Di Indonesia

May 30, 2025 -

Tileoptiko Programma Kyriaki 16 3 Odigos Provolon

May 30, 2025

Tileoptiko Programma Kyriaki 16 3 Odigos Provolon

May 30, 2025 -

El Recuerdo De Agassi Sobre Sus Duelos Con Rios

May 30, 2025

El Recuerdo De Agassi Sobre Sus Duelos Con Rios

May 30, 2025 -

Ruud And Tsitsipas French Open Disappointments Swiateks Continued Success

May 30, 2025

Ruud And Tsitsipas French Open Disappointments Swiateks Continued Success

May 30, 2025

Latest Posts

-

Rosemary And Thyme History Uses And Cultivation

May 31, 2025

Rosemary And Thyme History Uses And Cultivation

May 31, 2025 -

Simple Recipes With Rosemary And Thyme Easy And Delicious Meals

May 31, 2025

Simple Recipes With Rosemary And Thyme Easy And Delicious Meals

May 31, 2025 -

Creating The Good Life A Journey Of Self Discovery

May 31, 2025

Creating The Good Life A Journey Of Self Discovery

May 31, 2025 -

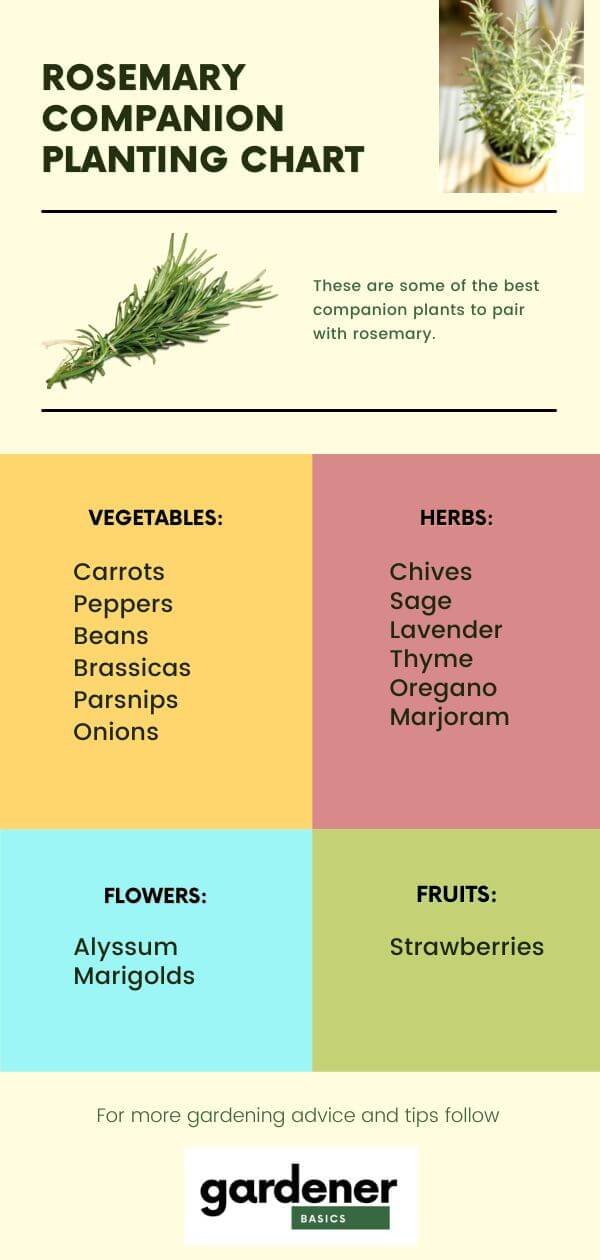

Rosemary And Thyme Companion Planting For A Thriving Garden

May 31, 2025

Rosemary And Thyme Companion Planting For A Thriving Garden

May 31, 2025 -

The Good Life Prioritizing Your Values For A Fulfilling Life

May 31, 2025

The Good Life Prioritizing Your Values For A Fulfilling Life

May 31, 2025