Live Stock Market Updates: Trump, Tariffs, And The UK Trade Deal

Table of Contents

Trump's Legacy and its Lingering Impact on the Stock Market

The Trump administration left an undeniable mark on the global economic landscape, and its consequences continue to shape live stock market updates. His policies, both in terms of trade and deregulation, had profound and often unpredictable effects on various sectors.

Trade Wars and Tariff Impacts

Trump's trade wars, particularly the tariffs imposed on Chinese goods, significantly impacted global trade and created considerable stock market volatility.

- Technology Sector: Tariffs disrupted supply chains and increased costs for technology companies reliant on components sourced from China, impacting their profitability and share prices.

- Agriculture: The agricultural sector faced retaliatory tariffs from China, leading to decreased exports and impacting farmers' incomes and related stock valuations.

- Market Reactions: Announcements of new tariffs or trade negotiations often caused immediate and sharp fluctuations in stock prices, demonstrating the market's sensitivity to these events. For example, the announcement of tariffs on steel and aluminum in 2018 led to a noticeable dip in the Dow Jones Industrial Average.

Deregulation and its Stock Market Consequences

Trump's administration pursued a policy of deregulation across several sectors, aiming to stimulate economic growth. However, the impact on the stock market was complex and varied.

- Financial Sector: Easing regulations in the financial industry potentially increased short-term profits but also raised concerns about increased risk and future instability. This created uncertainty and impacted investor confidence.

- Energy Sector: Deregulation in the energy sector led to increased oil and gas production, influencing energy company stock prices. However, environmental concerns related to increased emissions also played a role in the market's overall response.

- Data Analysis: Studies examining the impact of specific deregulation initiatives on stock prices are needed to fully understand the long-term consequences of these policies.

The UK Trade Deal: Opportunities and Challenges

The UK's post-Brexit trade deal significantly altered its relationship with the EU and the rest of the world. The consequences for the live stock market are multifaceted.

Post-Brexit Trade Relations

The new trade agreements between the UK and other countries have introduced both opportunities and challenges for UK businesses.

- EU Trade: The new trade relationship with the EU has introduced new customs barriers and complexities, impacting the supply chains of many UK businesses and influencing stock valuations accordingly.

- Global Partnerships: The UK's pursuit of new trade deals with countries outside the EU has the potential to open new markets and boost economic growth, although the long-term effects on the stock market remain to be seen.

- Sector-Specific Impacts: Industries heavily reliant on exports to or imports from the EU (such as automotive manufacturing or agricultural goods) have experienced the most significant shifts in their stock market performance following Brexit.

Global Investment Shifts

The UK's post-Brexit situation has led to shifts in investor sentiment and global investment flows.

- Foreign Direct Investment (FDI): Some investors have expressed concerns about the economic uncertainty following Brexit, potentially leading to decreased FDI in the UK and affecting the performance of related stocks.

- Investor Confidence: The volatility surrounding Brexit has had a noticeable impact on investor confidence, affecting overall market sentiment and stock valuations. Data on investor confidence indices can be correlated to stock market performance to understand this relationship.

- Market Analysis: Ongoing analysis of investment patterns and investor behavior is necessary to properly assess the long-term consequences of the UK trade deal on the global market.

Analyzing Current Live Stock Market Updates and Forecasting Future Trends

Predicting future live stock market updates is challenging, but analyzing current economic indicators and expert opinions provides valuable insights.

Key Indicators and Data Analysis

Several key economic indicators offer clues about the future direction of the market.

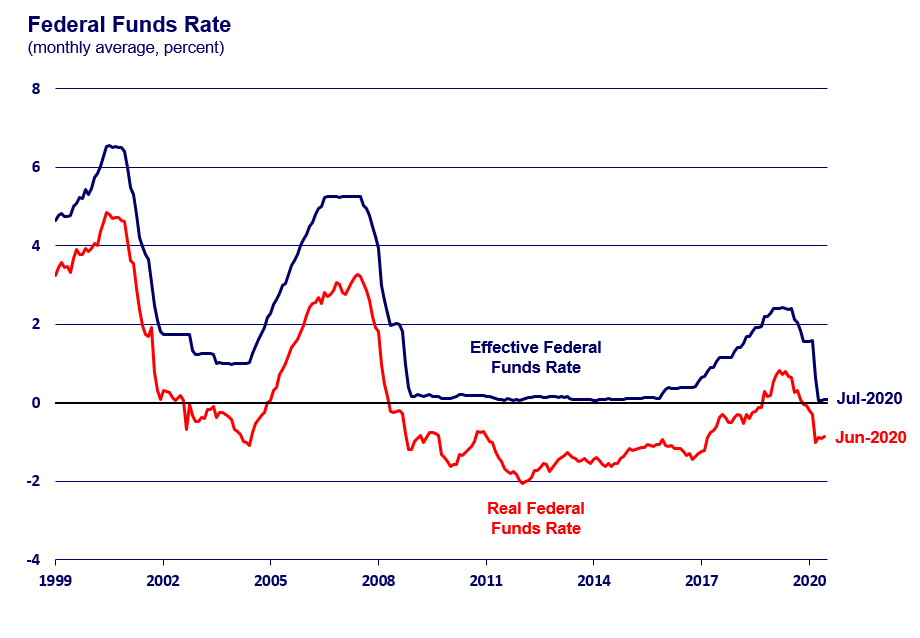

- Inflation: High inflation rates generally lead to increased interest rates, potentially negatively impacting stock valuations. Analyzing inflation data is crucial for accurate market analysis.

- Interest Rates: Changes in interest rates directly impact borrowing costs for businesses and investors. Higher interest rates can slow down economic growth and potentially negatively impact the stock market.

- Unemployment: High unemployment rates generally indicate a weak economy, which can negatively impact stock market performance. Analyzing unemployment figures allows for more informed stock market predictions.

Expert Opinions and Market Sentiment

Experts and analysts offer diverse perspectives on the future direction of the market.

- Leading Economists: Experts frequently weigh in on the impact of global events, providing valuable insights into potential future trends. Tracking these opinions helps understand overall market sentiment.

- Financial Analysts: Financial analysts provide detailed analyses of specific companies and industries, informing investment strategies. Their forecasts influence investor behavior and stock prices.

- Market Sentiment: Overall investor sentiment—optimistic, pessimistic, or neutral—plays a crucial role in determining stock prices. This is particularly true during times of economic uncertainty, highlighting the importance of monitoring this stock market forecast indicator.

Conclusion

The live stock market is profoundly impacted by global political events, trade agreements, and economic indicators. Understanding the lingering effects of Trump's policies, the implications of the UK trade deal, and keeping abreast of current economic data is crucial for effective investment strategies. To make informed decisions, regularly check for the latest live stock market news, including daily stock market updates and real-time stock market updates. Stay informed and navigate the market with confidence.

Featured Posts

-

Harry Styles Snl Impression A Disappointing Reaction

May 10, 2025

Harry Styles Snl Impression A Disappointing Reaction

May 10, 2025 -

Community Activist Advocates For Uterine Transplants To Enable Pregnancy In Transgender Women

May 10, 2025

Community Activist Advocates For Uterine Transplants To Enable Pregnancy In Transgender Women

May 10, 2025 -

U S Federal Reserve Holds Steady Inflation Pressures And Rate Decisions

May 10, 2025

U S Federal Reserve Holds Steady Inflation Pressures And Rate Decisions

May 10, 2025 -

Anchor Brewing Company 127 Years And Counting To Closure

May 10, 2025

Anchor Brewing Company 127 Years And Counting To Closure

May 10, 2025 -

6 Sanrio

May 10, 2025

6 Sanrio

May 10, 2025