U.S. Federal Reserve Holds Steady: Inflation Pressures And Rate Decisions

Table of Contents

Inflationary Pressures: A Persistent Challenge

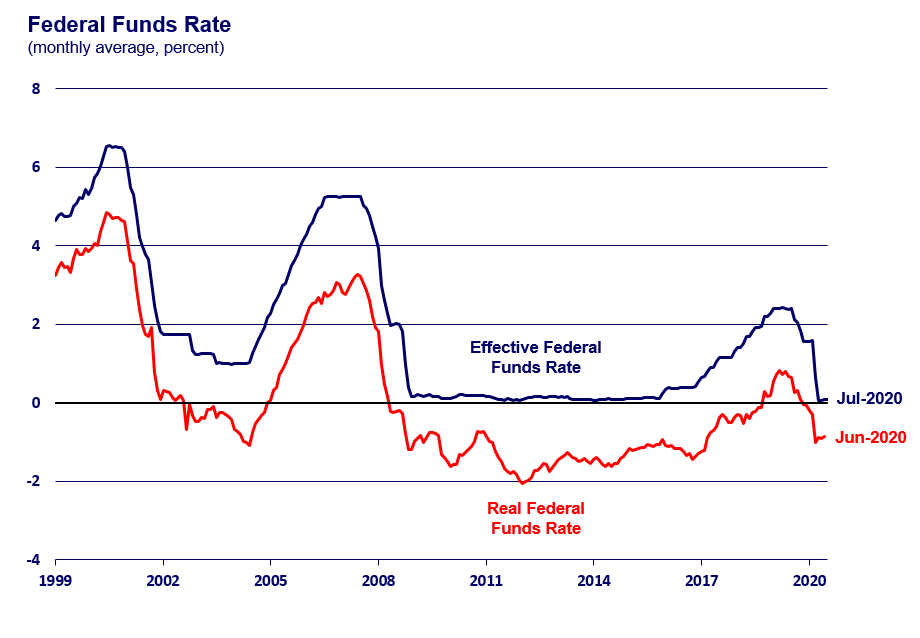

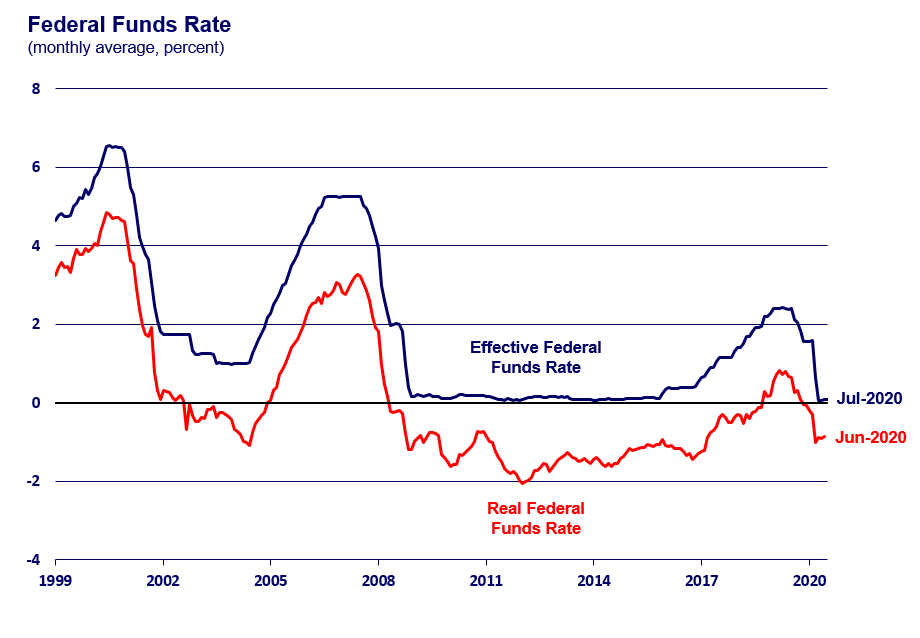

Inflation remains a significant concern for the Federal Reserve, influencing their interest rate decisions. Understanding the current inflationary landscape is crucial to interpreting the Fed's actions.

CPI and PCE Data Analysis

The latest Consumer Price Index (CPI) and Personal Consumption Expenditures (PCE) data provide crucial insights into inflation trends. Recent reports show:

- A slight decrease in the headline inflation rate, but still elevated compared to the Fed's target.

- Persistent increases in the prices of essential goods, such as food and energy.

- A moderation in the rate of increase for certain goods, suggesting potential easing of inflationary pressures.

- Core inflation (excluding food and energy) remains stubbornly high, indicating underlying inflationary pressures.

Impact of Supply Chain Disruptions

Lingering supply chain disruptions continue to fuel inflation. Bottlenecks in various sectors contribute to higher prices for consumers.

- Global shipping delays continue to impact the cost of imported goods.

- Microchip shortages persist, impacting the prices of electronics and automobiles.

- Labor shortages in certain industries contribute to increased production costs.

- Government policies aimed at easing supply chain bottlenecks are showing some positive effects, but the full impact remains to be seen.

Wage Growth and its Inflationary Effects

Robust wage growth contributes to inflationary pressures by increasing production costs for businesses, leading to higher prices for consumers.

- Wage growth in certain sectors outpaces productivity growth, contributing to inflationary pressures.

- The Federal Reserve closely monitors wage growth data to assess its impact on inflation expectations.

- There is ongoing debate on the potential for a wage-price spiral – a self-reinforcing cycle of rising wages and prices.

The Federal Reserve's Rationale for Holding Steady

The Fed's decision to hold interest rates reflects a complex balancing act between supporting economic growth and controlling inflation.

Balancing Economic Growth and Inflation Control

The Fed operates under a dual mandate: achieving maximum employment and price stability. Raising interest rates too aggressively risks triggering a recession, while doing too little risks allowing inflation to become entrenched.

- The Fed aims to achieve a "soft landing"—slowing economic growth enough to curb inflation without causing a recession.

- Maintaining stable economic growth is crucial for minimizing job losses and supporting consumer spending.

Data Dependence and Future Outlook

The Fed's approach is described as "data dependent," meaning future interest rate decisions will be based on incoming economic data. Key indicators include:

- The unemployment rate: A significant rise could signal weakening economic activity and potentially necessitate a pause or rate cut.

- GDP growth: Stronger-than-expected growth might warrant further interest rate increases to curb inflation.

- Inflation expectations: If inflation expectations remain elevated, the Fed may be compelled to take further action.

The current projection suggests potential for further rate hikes, but the timing and magnitude remain uncertain.

Communication Strategy and Market Reaction

The Fed's communication plays a significant role in guiding market expectations. Their recent statements and press conference emphasized the data-dependent nature of future decisions.

- The market initially reacted positively to the hold, with some relief that a more aggressive rate hike was avoided.

- However, uncertainty remains regarding future policy, leading to some volatility in stock and bond markets.

Long-Term Implications and Potential Scenarios

The Fed's decision to hold steady will have significant long-term implications for the U.S. economy and financial markets.

Impact on Economic Growth

The decision to hold rates steady aims to avoid a sharp slowdown in economic growth while addressing inflationary concerns. Potential scenarios include:

- A gradual cooling of the economy, leading to a softer landing with moderate inflation and minimal job losses.

- A more persistent period of elevated inflation, potentially requiring further interest rate increases in the future.

- A recession if inflation proves more persistent than anticipated and requires more aggressive rate hikes to control.

Impact on the Stock Market and Investments

The Fed's decision influences investor sentiment and market performance.

- The initial market reaction was positive, reflecting relief over the absence of a more aggressive rate hike.

- However, uncertainty about future policy could lead to increased market volatility.

- Investors are adjusting their portfolios based on anticipated changes in interest rates and economic growth.

Conclusion: Understanding the U.S. Federal Reserve's Steady Hand on Interest Rates

The U.S. Federal Reserve's decision to hold interest rates steady reflects a careful assessment of current inflationary pressures and the delicate balance between economic growth and price stability. The rationale behind this decision is rooted in the analysis of various economic indicators, including CPI, PCE, wage growth, and supply chain conditions. The long-term implications for the economy and financial markets remain uncertain, but the Fed's data-dependent approach suggests a willingness to adjust policy as new information becomes available. Staying informed about future Federal Reserve interest rate decisions and their impact on your investments is crucial. Follow our blog for the latest updates on interest rates and inflation, and consult with a financial advisor to develop a strategy that aligns with your financial goals.

Featured Posts

-

Trump Tariffs Weigh On Infineon Ifx Lower Than Expected Sales Guidance

May 10, 2025

Trump Tariffs Weigh On Infineon Ifx Lower Than Expected Sales Guidance

May 10, 2025 -

Upcoming Young Thug Album Uy Scuti Release Date Speculation

May 10, 2025

Upcoming Young Thug Album Uy Scuti Release Date Speculation

May 10, 2025 -

Potential Us Debt Crisis August Deadline And Treasurys Warning

May 10, 2025

Potential Us Debt Crisis August Deadline And Treasurys Warning

May 10, 2025 -

Indonesias Falling Reserves Analyzing The Impact Of Rupiah Weakness

May 10, 2025

Indonesias Falling Reserves Analyzing The Impact Of Rupiah Weakness

May 10, 2025 -

Strictly Come Dancing Wynne Evans Career Update

May 10, 2025

Strictly Come Dancing Wynne Evans Career Update

May 10, 2025