LVMH Stock Drops 8.2% Following Missed Q1 Sales Targets

Table of Contents

Q1 Sales Performance Below Expectations

LVMH's Q1 2024 sales figures fell short of both projected targets and the previous year's performance, triggering the substantial stock price drop. While the exact figures require referencing LVMH's official report, a significant deviation from expectations is evident. This percentage difference, representing a substantial loss in revenue, highlights the seriousness of the situation for investors and market analysts.

- Specific sales figures for each major LVMH division: Detailed breakdowns of sales performance for Fashion & Leather Goods, Wines & Spirits, Perfumes & Cosmetics, Watches & Jewelry, and Selective Retailing are crucial for a thorough analysis. Significant underperformance in one or more sectors could explain the overall shortfall.

- Comparison to analyst estimates: Analyzing the discrepancy between actual sales and consensus analyst estimates provides further context for the market's reaction. A larger-than-expected miss is likely to result in a more dramatic stock price decline.

- Year-over-year growth/decline percentages: Comparing Q1 2024 sales to Q1 2023 reveals the extent of the year-on-year growth or decline. A negative year-over-year growth percentage contributes to the negative market sentiment surrounding LVMH stock.

Impact of Geopolitical Factors on LVMH Performance

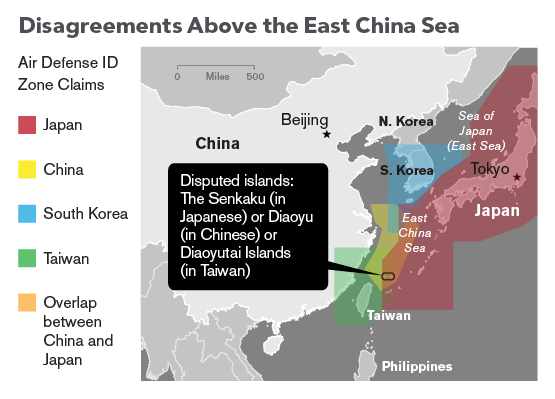

External factors played a significant role in LVMH's Q1 performance. The ongoing war in Ukraine, persistent inflation in many key markets, and lingering supply chain disruptions created a challenging environment for luxury goods sales. These macroeconomic headwinds impacted consumer spending, leading to decreased demand for luxury items across various price points.

- Specific examples of how geopolitical events affected LVMH's sales: The war in Ukraine, for instance, likely impacted sales in the European region and potentially disrupted supply chains for certain materials used in LVMH products. Inflation reduced consumer discretionary spending, impacting demand for luxury goods.

- Impact on specific regions (e.g., Europe, Asia, North America): Different regions may have experienced varying degrees of impact. Some regions might have shown resilience, while others might have been hit harder by the geopolitical turmoil.

- Analysis of consumer behavior changes: Understanding shifts in consumer behavior, such as a move towards more affordable luxury items or a decrease in overall spending, is essential for a comprehensive assessment.

LVMH's Response and Future Outlook

LVMH's official statement regarding the Q1 results is critical in understanding the company's assessment of the situation and its planned response. The statement likely included an explanation of the sales miss, an assessment of the current market conditions, and an outline of any strategic adjustments or cost-cutting measures. Analyst predictions and forecasts for future LVMH stock performance provide valuable insights into the market's sentiment and expectations.

- Key quotes from LVMH's management: Direct quotes from LVMH's management concerning the Q1 performance and their outlook provide valuable insights. These quotes should be carefully analyzed to understand the company's strategic direction.

- Proposed solutions or strategies to improve sales: Identifying the specific strategies LVMH is employing to address the challenges is crucial. These might include marketing campaigns, product diversification, or adjustments to pricing strategies.

- Analyst ratings and price targets: Tracking analyst ratings and price targets for LVMH stock provides an indication of the market’s overall confidence in the company's ability to recover.

- Potential long-term impact on the LVMH brand: The Q1 sales miss could have long-term repercussions for the LVMH brand image and its market positioning, particularly if the challenges persist.

Conclusion

The 8.2% drop in LVMH stock price is primarily attributed to the disappointing Q1 sales performance, which fell significantly short of expectations. Geopolitical factors, including the war in Ukraine, inflation, and supply chain disruptions, heavily influenced consumer spending and demand for luxury goods, contributing significantly to the sales miss. LVMH's response and future strategies will determine its ability to recover and maintain its position in the luxury goods market. Stay updated on LVMH stock and monitor the LVMH stock price for further developments impacting the luxury goods market. Following the future of LVMH stock and its performance is crucial for investors and market analysts alike.

Featured Posts

-

Apple Stock Q2 Earnings Analysis And Future Outlook

May 25, 2025

Apple Stock Q2 Earnings Analysis And Future Outlook

May 25, 2025 -

Kyle Walkers Wife Annie Kilner Seen Out And About After Husbands Night Out

May 25, 2025

Kyle Walkers Wife Annie Kilner Seen Out And About After Husbands Night Out

May 25, 2025 -

Escape To The Country Living Sustainably In The Rural Landscape

May 25, 2025

Escape To The Country Living Sustainably In The Rural Landscape

May 25, 2025 -

Road Closure And Delays On M6 Southbound Due To Serious Crash

May 25, 2025

Road Closure And Delays On M6 Southbound Due To Serious Crash

May 25, 2025 -

Woody Allen Sean Penns Support Amidst Resurfaced Sexual Abuse Allegations

May 25, 2025

Woody Allen Sean Penns Support Amidst Resurfaced Sexual Abuse Allegations

May 25, 2025

Latest Posts

-

Analyzing Trumps Sharp Criticism Of European Trade Practices

May 25, 2025

Analyzing Trumps Sharp Criticism Of European Trade Practices

May 25, 2025 -

Nippon Steels U S Acquisition Trump Administrations Decision And Its Implications

May 25, 2025

Nippon Steels U S Acquisition Trump Administrations Decision And Its Implications

May 25, 2025 -

Trumps Campaign Against Top Law Firms Faces Another Defeat

May 25, 2025

Trumps Campaign Against Top Law Firms Faces Another Defeat

May 25, 2025 -

Will Trumps Pressure Secure A Republican Deal

May 25, 2025

Will Trumps Pressure Secure A Republican Deal

May 25, 2025 -

Trump Vs Europe The Trade Disputes And Their Underlying Causes

May 25, 2025

Trump Vs Europe The Trade Disputes And Their Underlying Causes

May 25, 2025